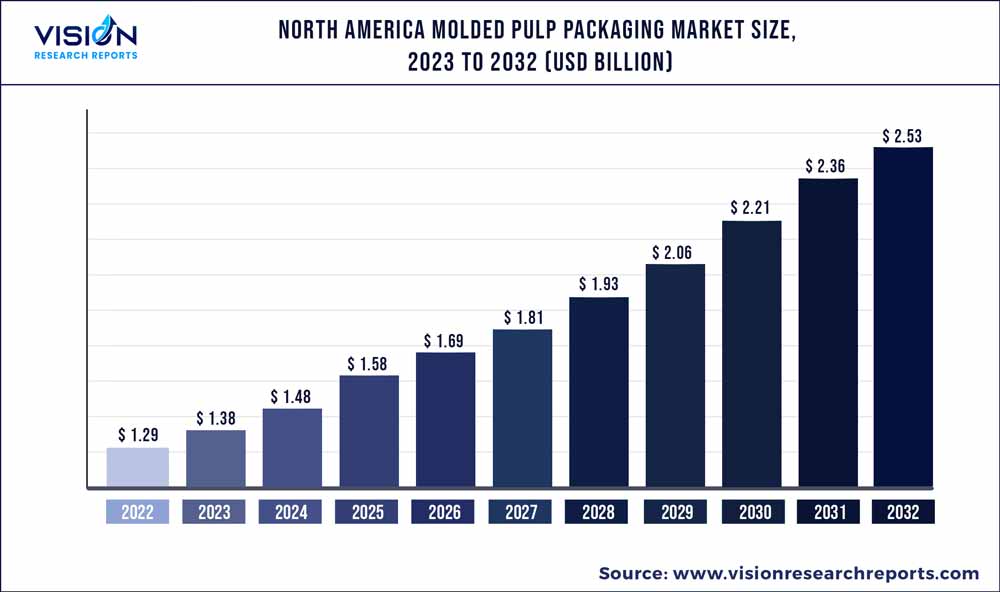

The North America molded pulp packaging market size was estimated at around USD 1.29 billion in 2022 and it is projected to hit around USD 2.53 billion by 2032, growing at a CAGR of 6.95% from 2023 to 2032.

Key Pointers

Report Scope of the North America Molded Pulp Packaging Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.29 billion |

| Revenue Forecast by 2032 | USD 2.53 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.95% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Brødrene Hartmann A/S; Huhtamäki Oyj; UFP Technologies; Thermoform Engineered Quality (Subsidiary of Sonoco Product Company); Genpak, LLC; Eco-Products, Inc; Pro-Pac Packaging Limited; Fabri-Kal; Henry Molded Products, Inc.; Sabert Corporation; Pacific Pulp Molding |

The market is expected to expand at a CAGR of 6.9% from 2023 to 2032. The growing food packaging industry across the region is driving the market of molded packaging products such as trays and clamshells. For instance, eggs and fresh fruits are packed in molded pulp clamshells and trays, which are then sold to food service operators, individual buyers, and restaurants.

The Washington apples from the U.S. are famous and exported globally on a large scale. The fruit preservation technique developed in the U.S. has increased the demand for Red Delicious variety apples from the U.S. Molded pulp trays are used to pack the carton of apples consisting of 45 pieces of apples. These trays provide cushioning and reduce the impact pressure on the fruits. The growing demand for U.S.-based apples is expected to drive the demand for molded pulp trays thus positively impacting the molded pulp packaging market in North America.

In addition, egg consumption is increasing on a yearly basis in the region. Thus, the rising consumption of eggs, owing to the expanding population, associated health benefits, and increasing demand for higher protein intake, is anticipated to drive the demand for molded pulp packaging products, thereby propelling market growth.

Moreover, these molded pulp products.are used to package a variety of medical devices, including test kits, surgical instruments, glucose meters, and others. Increased demand for various medical equipment is anticipated as the rate of chronic illnesses rises, which would benefit the market for molded pulp packaging. Because of the COVID-19 epidemic, which has caused a shortage of medical supplies in the healthcare sector, the need for molded pulp products has increased. Molded pulp solutions are inexpensive compared to the expense of reusing the current utensils and can be discarded easily.

For instance, diabetes is a chronic disease that occurs when the pancreas is unable to produce insulin, which regulates blood sugar. Diabetes is one of the major causes leading to heart attack, kidney failure, and blindness. Thus, rising instances of diabetes are expected to generate high demand for glucose monitors, which, in turn, is anticipated to drive the demand for molded pulp packaging products.

The market is characterized by the presence of key players in the market such as Huhtamaki, Brødrene Hartmann A/S, Thermoform Engineered Quality LLC (Sonoco Products Company), Pro-Pac Packaging Limited,and others with their manufacturing and distribution locations present across the region. These companies are involved in agreements with raw material suppliers and distributors to lower their cost of production, constant supply of raw materials, and gain a competitive edge over other local players. For instance, in June 2022, Huhtamäki Oyj announced its plans to invest USD 100.0 million to expand the production capacity of its molded fiber product manufacturing unit in Indiana, the U.S.

Source Insights

Based on source, the market is segmented into non-wood pulp and wood pulp. The wood pulp segment recorded the largest market share of 85.44% in 2022 in terms of revenue. The demand for ecofriendly packaging along with the presence of several end-users to adopt these forms of packaging has been bolstering the demand for molded wood pulp packaging owing to its 100% degradable properties.

The non-wood pulp segment is expected to expand at a fast CAGR of 8.15% over the forecast period 2023-2032. It is produced using cellulosic of non-wood plant materials such as reeds, cereal straw, sugar cane bagasse, and grasses. With the rising concerns regarding deforestation, the consumer demand for non-wood pulp is anticipated to grow at a faster pace.

Type Insights

Based on type, the market is segmented into thick wall, transfer, thermoformed, and processed. The transfer segment accounted for the largest market share of 57.03% in 2022 in terms of revenue. Transfer molded pulp packaging is gaining momentum in several industries due to its unique properties. For instance, in the food service industry, it adds to the prolonged shelf life of transported food and beverage products owing to its air permeability and hygroscopic properties.

The thermoformed segment is expected to grow at a fast CAGR of 8.35% during the forecast period due to its wide application in the food service industry for trays, plates, cups, and bowls. The rigidity and smooth finish of the packaging make it a better option than plastic packaging. Furthermore, in recent years, molded pulp packaging solutions such as thermoformed are standing as an alternative for thermoformed plastic packaging products.

Product Insights

Based on product, the market is segmented into trays, end caps, bowls & cups, clamshells, plates, and others. The tray segment recorded the largest market share of 41.02% in 2022 in terms of revenue. This is due to a number of problems with plastic trays. For instance, foam and plastic trays are not recommended for use in food service packaging because they have a propensity to distort when food temperatures rise. A significant drawback is that many plastics, with the exception of CPET and PET, cannot be microwaved and are expensive. This is increasing demand for microwaveable molded pulp trays. Molded pulp trays can also be used in conventional and microwave ovens, making them double oven compatible.

The clamshells segment is anticipated to expand at a fast CAGR of 8.27% during the forecast period 2023-2032 owing to the increased demand for retail egg packaging. Eggs are packed either in molded pulp or plastic clamshells. However, the consumer demand for plastic clamshells has been declining in the past few years owing to the increasing demand for molded pulp clamshells. This can be attributed to the convenience, in terms of carrying and disposing, offered by molded pulp clamshells.

Application Insights

Based on application, the market is segmented into food packaging, food service, electronics, healthcare, industrial, and others. The food packaging segment accounted for the largest market share of 48.67% in 2022 in terms of revenue. Molded pulp clamshells and trays are considered the key packaging solutions for vegetables, eggs, and fruits to the low price and cushioning offered. In addition, molded pulp trays offer the extended freshness of the eggs owing to the ventilation provided in the trays.

The electronics segment is expected to expand at a fast CAGR of 8.55% over the forecast period. Molded pulp packaging solutions such as clamshells, trays, and end caps are largely used across the electronic industry for packaging various delicate electronic devices such as computers, printers, hard drives, and others. For instance, Cell phones are delicate electronic devices that require careful handling and protection during transportation. This packaging can be designed to fit the unique shape and size of each cell phone model, providing a secure and snug fit for the device.

North America Molded Pulp Packaging Market Segmentations:

By Source

By Type

By Product

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Molded Pulp Packaging Market

5.1. COVID-19 Landscape: North America Molded Pulp Packaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Molded Pulp Packaging Market, By Source

8.1. North America Molded Pulp Packaging Market, by Source, 2023-2032

8.1.1. Wood pulp

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Non-wood pulp

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Molded Pulp Packaging Market, By Type

9.1. North America Molded Pulp Packaging Market, by Type, 2023-2032

9.1.1. Thick wall

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Transfer

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Thermoformed

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Processed

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Molded Pulp Packaging Market, By Product

10.1. North America Molded Pulp Packaging Market, by Product, 2023-2032

10.1.1. Trays

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. End Caps

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Bowls & Cups

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Clamshells

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Plates

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 11. North America Molded Pulp Packaging Market, By Application

11.1. North America Molded Pulp Packaging Market, by Application, 2023-2032

11.1.1. Food Packaging

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Food Service

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Electronics

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Healthcare

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Industrial

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. North America Molded Pulp Packaging Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Source (2020-2032)

12.1.2. Market Revenue and Forecast, by Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Product (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Brødrene Hartmann A/S

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Huhtamäki Oyj

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. UFP Technologies

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Thermoform Engineered Quality (Subsidiary of Sonoco Product Company)

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Genpak, LLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Eco-Products, Inc

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Pro-Pac Packaging Limited

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Fabri-Kal

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Henry Molded Products, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Sabert Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others