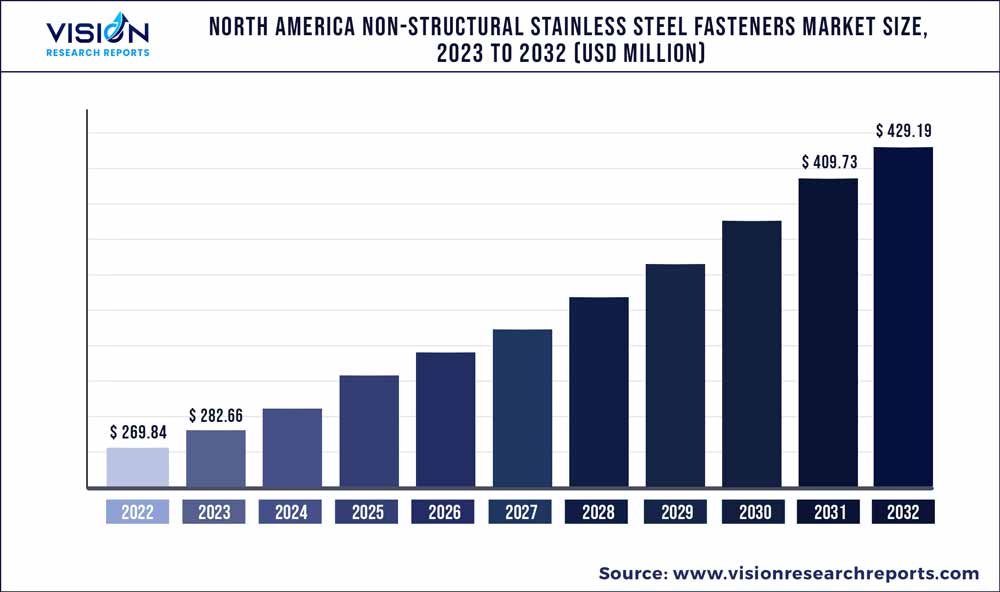

The North America non-structural stainless steel fasteners market was valued at USD 269.84 million in 2022 and it is predicted to surpass around USD 429.19 million by 2032 with a CAGR of 4.75% from 2023 to 2032.

Key Pointers

Report Scope of the North America Non-structural Stainless Steel Fasteners Market

| Report Coverage | Details |

| Market Size in 2022 | USD 269.84 million |

| Revenue Forecast by 2032 | USD 429.19 million |

| Growth rate from 2023 to 2032 | CAGR of 4.75% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Grip-Rite; Associated Fastening Products, Inc.; Simpson Strong-Tie Company, Inc.; Maze Nails; FastenMaster; Starborn Industries, Inc.; KD FASTENERS, INC.; KUIKEN BROTHERS; Camo Fasteners; Eagle Claw Fasteners; The Hillman Group, Inc.; Star Stainless Steel; STANLEY BLACK & DECKER, INC. (Bostitch); Ford Fasteners |

This growth is attributed to the flourishing construction industry in North America as a result of rising disposable incomes and the growing population in the region. With the rise in consumer spending, there has been a growing trend of remodeling homes. This trend is also increased since the pandemic as people started spending more time at home, which has increased the non-structural remodeling activities such as the construction of decks or exterior and interior home renovation through do-it-yourself (DIY) or with the help of professional contractors. This, in turn, is anticipated to increase the demand for non-structural stainless steel fasteners for connecting wood-to-wood products.

The U.S. has been dominating the non-structural stainless steel fastener market in North America in terms of volume owing to the flourishing construction industry in the country. The construction of residential buildings in the U.S. is expected to surge in the coming years owing to deleveraging, along with flat hourly wages and slacked labor markets. These factors are expected to enhance residential construction activities in the country, thereby, influencing the demand for non-structural stainless steel fasteners over the forecast period.

Non-structural stainless-steel fasteners are manufactured using stainless steel. There has been an increase in the demand for steel across the world, primarily from other regions such as Asia Pacific. The surging demand for steel from the automotive, shipbuilding, and consumer goods industries has resulted in companies stocking up on the material, leading to reduced availability of stainless steel in the global market. This ultimately results in fluctuations in the prices of steel, which acts as a restraint to the growth of the non-structural stainless steel fasteners market across North America.

Manufacturers of non-structural stainless steel fasteners in North America use online and offline sales channels for their products. Online sales channels enable users to purchase non-structural stainless steel fasteners either directly from their manufacturers through their web portals or from third-party online distributors, whereas offline sales channels sell non-structural stainless steel fasteners through conventional physical stores.

The leading fastener manufacturers in the market have long-term contracts with producers and contractors. The prices of fasteners fixed by their manufacturers are the result of the purchase volume of non-structural stainless steel fasteners and the duration of contracts. As a result, the prices of fasteners and the profit margins of their manufacturers vary in this market.

Application Insights

Based on application, the North America non-structural stainless steel fasteners market is segmented into decking, siding, trim, and other applications. The decking segment accounted for a significant revenue share in 2022, and it is estimated to grow at the fastest CAGR of 5.33% over the forecast period.

The growth of the decking segment can be attributed to the prevailing trend of expanding and renovating living spaces in the U.S. and Canada. Since the outbreak of the COVID-19 pandemic, people have started spending increased time in their backyards. The high-income population in the region is using garden areas or backyards to extend building structures into trendy dining areas, cooking spaces, and entertainment and relaxation areas, which has surged demand for non-structural stainless steel fasteners for connecting wood-to-wood products.

The trim application segment of the non-structural stainless steel fasteners market in North America is growing at a significant rate over the forecast period. Trim is a decorative non-structure framing that is commonly made from wood, polyurethane, polyvinyl chloride (PVC), and polystyrene and is used for windows, doors, and wall edges. With rising home renovation activities in North America, the use of trims to improve the interior appearance of houses is also increasing. This, in turn, is projected to surge the demand for non-structural stainless steel fasteners for connecting trims to buildings over the forecast period.

The siding application segment accounted for a significant revenue share in 2022. In the U.S. and Canada, most homes are constructed using wooden frames that have sheathed plywood exterior walls. House wraps are installed on exterior plywood walls to protect them. It is followed by the installation of siding over house wraps not only to enhance the aesthetic appeal of houses but also to protect them from water. The increasing utilization of siding in residential and commercial buildings is expected to surge the requirement for bonding components in the coming years. This, in turn, is anticipated to augment the demand for non-structural stainless steel fasteners in North America in the coming years.

North America Non-structural Stainless Steel Fasteners Market Segmentations:

By Application

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on North America Non-structural Stainless Steel Fasteners Market

5.1. COVID-19 Landscape: North America Non-structural Stainless Steel Fasteners Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. North America Non-structural Stainless Steel Fasteners Market, By Application

8.1.North America Non-structural Stainless Steel Fasteners Market, by Application Type, 2023-2032

8.1.1. Decking

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Siding

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Trim

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Other Applications

8.1.4.1.Market Revenue and Forecast (2020-2032)

Chapter 9. North America Non-structural Stainless Steel Fasteners Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2020-2032)

Chapter 10.Company Profiles

10.1. Grip-Rite

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Associated Fastening Products, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Simpson Strong-Tie Company, Inc.

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Maze Nails

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. FastenMaster

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Starborn Industries, Inc.

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. KD FASTENERS, INC.

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. KUIKEN BROTHERS

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Camo Fasteners

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Eagle Claw Fasteners

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others