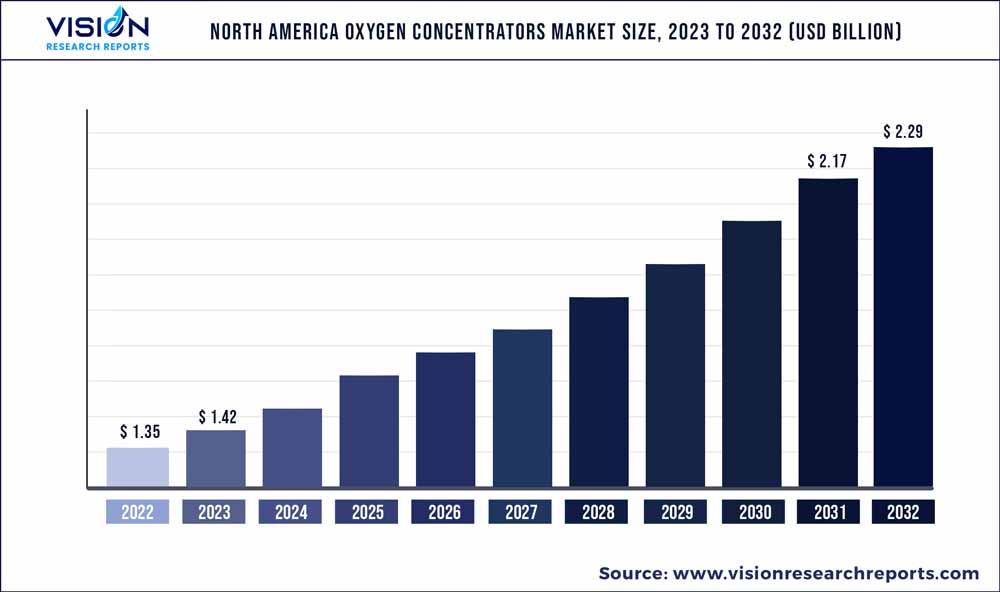

The North America oxygen concentrators market size was estimated at around USD 1.35 billion in 2022 and it is projected to hit around USD 2.29 billion by 2032, growing at a CAGR of 5.43% from 2023 to 2032.

Key Pointers

Report Scope of the North America Oxygen Concentrators Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.35 billion |

| Revenue Forecast by 2032 | USD 2.29 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.43% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Inogen, Inc.; Respironics (a subsidiary of Koninklijke Philips N.V.); Invacare Corporation; Caire Medical (a subsidiary of NGK Spark Plug); DeVilbiss Healthcare (a subsidiary of Drive Medical); O2 Concepts; Nidek Medical Products, Inc |

The increasing prevalence of respiratory conditions, such as COPD, asthma, and sleep apnea, is driving the growth of the respiratory care market. According to a February 2023 article by the American Lung Association, over 34 million Americans suffer from chronic lung diseases including COPD, asthma, chronic bronchitis, and emphysema. In addition, advancements in respiratory technology have played a significant role in fueling market expansion. The COVID-19 pandemic had a limited positive impact on the market, leading to increased demand for advanced and cost-effective devices.

Oxygen therapy became a preferred choice for managing respiratory disorders during the pandemic, providing medical intervention for acute and chronic patient care. The market also benefited from the rising adoption of portable oxygen concentrators, with a significant increase in market penetration in the U.S. from 8% in 2015 to 22% in 2021. Furthermore, favorable reimbursement policies have contributed to the attractiveness of the oxygen concentrators market. These policies provide better reimbursement coverage for portable oxygen concentrators in the U.S. Additionally, healthcare spending in the U.S. and Canada has been increasing, triggering the need for effective diagnosis and treatment of respiratory diseases and driving the demand for oxygen concentrators.

Initiatives by public and private authorities, such as the World Health Organization's distribution of oxygen concentrators and the efforts of associations like the American Lung Association, promote awareness of respiratory diseases. Market players also employ strategies such as acquisitions, collaborations, expansions, and new product launches to extend their product offerings and geographical reach. For instance, React Health's acquisition of Invacare's Respiratory line in February 2023 strengthened its market position, expanded its product portfolio, and enabled them to cater to a wider customer base.

Product Insights

On the basis of the product, the market is segmented into portable oxygen concentrators and fixed oxygen concentrators. The Portable Oxygen Concentrators (POCs) segment dominated the market and accounted for a revenue market share of 54% in 2022. Moreover, the segment is projected to witness the fastest growth rate of 7.3% over the forecast period owing to the increasing need for portable medical oxygen concentrators, especially among mobile patients seeking out-of-home solutions.

Inogen's 10K form for the fiscal year ended December 31, 2021, reveals that approximately 80% of U.S. long-term oxygen therapy users preferred ambulatory oxygen, indicating a strong demand for portable medical oxygen concentrators. On the other hand, the fixed concentrators segment is expected to demonstrate moderate growth. Factors such as a substantial number of long-term patients, the growing elderly population, and the rising demand for these hospital devices contribute to the segment's steady performance.

Technology Insights

On the basis of technology, the market is segmented into continuous flow and pulse flow. The continuous flow segment accounted for the largest revenue share of 62% in the market in 2022. This segment's dominance can be attributed to the increasing prevalence of long-term respiratory disorders, including asthma, COPD, bronchiectasis, and chronic sinusitis. Continuous flow technology is also widely used in residential and military applications, providing a safer alternative to storing oxygen under pressure.

The pulse flow technology segment is expected to experience the fastest CAGR of 5.73% during the forecast period. The growth is driven by the advantages offered by pulse flow technology, including high mobility, lightweight design, and suitability for patients with active lifestyles. Pulse flow technology is particularly beneficial for treating respiratory conditions that require a lower oxygen delivery rate per minute. It is extensively used in portable oxygen concentrators (POCs), which are anticipated to drive the demand for this segment in the coming years.

Application Insights

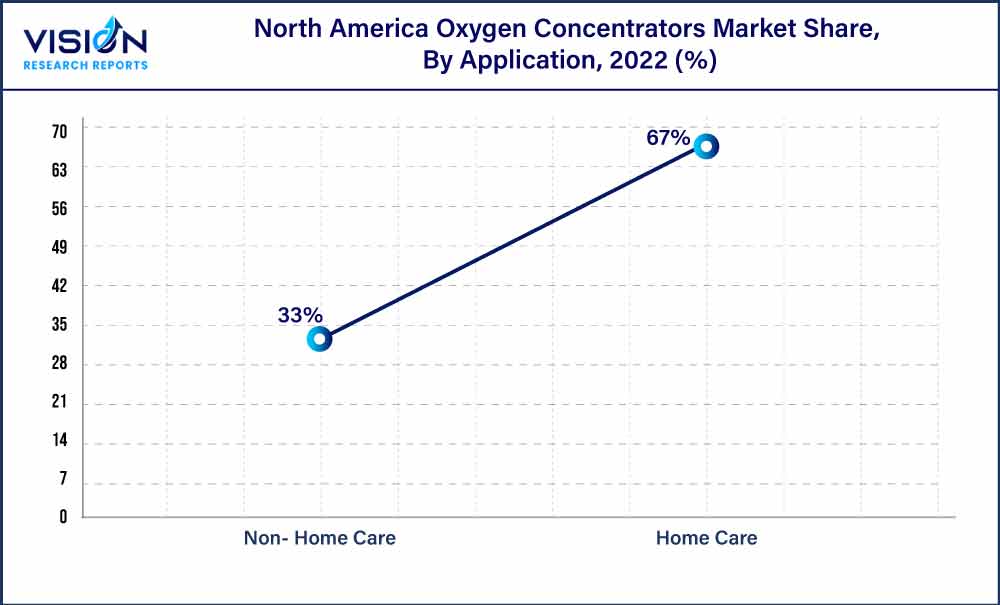

On the basis of application, the market is segmented into home care and non-home care. The home care application segment dominated the market in 2022 and accounted for a significant share of 67% of the overall revenue. The segment is also projected to register the fastest growth rate of 6.3% during the forecast period. The growth of this segment can be attributed to the rising adoption of Long-Term Oxygen Therapy (LTOT) devices in home settings and the availability of a wide range of home oxygen therapy devices (including Liquid Oxygen systems and portable concentrators).

In addition, the shifting preferences of patients towards receiving treatment at home is another key factor contributing to the growth of the home care application segment. On the other hand, the non-homecare segment is expected to exhibit moderate growth over the forecast period, driven by the increased adoption of oxygen therapy in hospitals and clinics. The segment also witnessed growth in 2020 due to the heightened usage of oxygen therapy for hospitalized COVID-19 patients.

North America Oxygen Concentrators Market Segmentations:

By Product

By Technology

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Oxygen Concentrators Market

5.1. COVID-19 Landscape: North America Oxygen Concentrators Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Oxygen Concentrators Market, By Product

8.1. North America Oxygen Concentrators Market, by Product, 2023-2032

8.1.1 Portable Medical Oxygen Concentrators

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Fixed Medical Oxygen Concentrators

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Oxygen Concentrators Market, By Technology

9.1. North America Oxygen Concentrators Market, by Technology, 2023-2032

9.1.1. Continuous Flow

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Pulse Flow

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Oxygen Concentrators Market, By Application

10.1. North America Oxygen Concentrators Market, by Application, 2023-2032

10.1.1. Home Care

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Non- Home Care

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. North America Oxygen Concentrators Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Inogen, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Respironics (a subsidiary of Koninklijke Philips N.V.)

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Invacare Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Caire Medical (a subsidiary of NGK Spark Plug)

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. DeVilbiss Healthcare (a subsidiary of Drive Medical)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. O2 Concepts

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Nidek Medical Products, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others