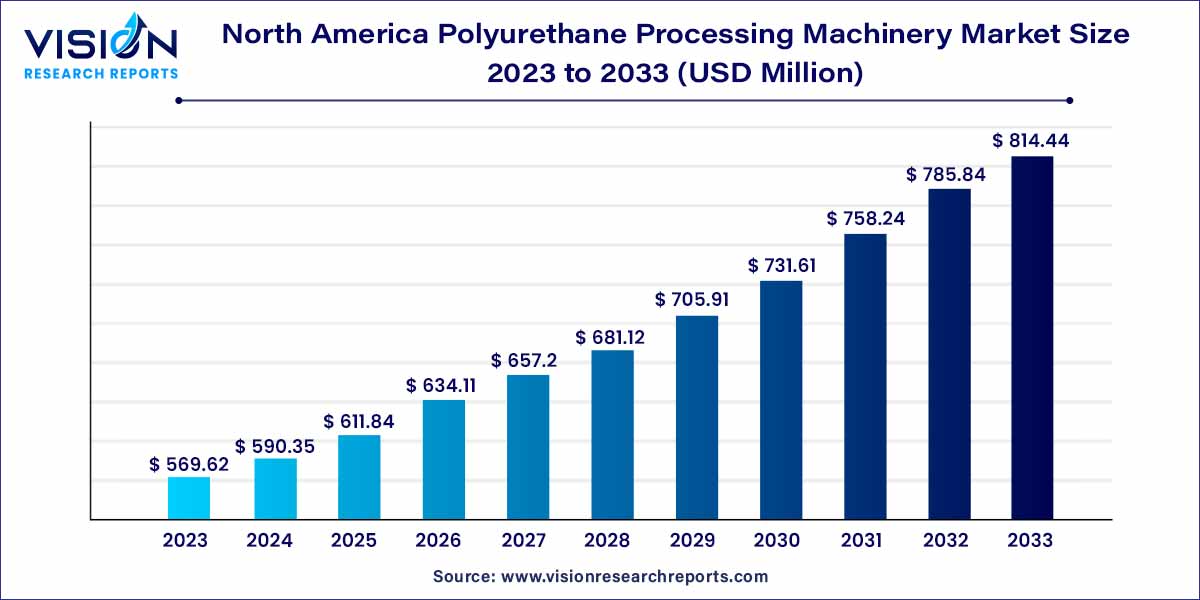

The North America polyurethane processing machinery market size was estimated at around USD 569.62 million in 2023 and it is projected to hit around USD 814.44 million by 2033, growing at a CAGR of 3.64% from 2024 to 2033.

The polyurethane processing machinery market in North America has witnessed significant growth in recent years, driven by various factors such as expanding applications of polyurethane across industries, technological advancements in processing machinery, and increasing demand for energy-efficient solutions. This overview aims to provide insights into the key aspects of the market landscape, including market size, growth trends, major players, and future prospects.

The growth of the North America polyurethane processing machinery market is driven by several key factors. Firstly, the expanding applications of polyurethane across diverse industries such as construction, automotive, furniture, and electronics have created a substantial demand for processing machinery to manufacture polyurethane components and products. Additionally, technological advancements in processing machinery have enhanced efficiency, productivity, and quality, thereby attracting investment from manufacturers seeking to optimize their production processes. Furthermore, the increasing emphasis on sustainability and environmental regulations has propelled the adoption of energy-efficient and eco-friendly processing machinery, driving market growth. Moreover, the growing trend towards customization and innovation in product design has spurred the demand for flexible and adaptable processing equipment capable of meeting evolving industry requirements. Overall, these factors contribute to the robust growth of the North America polyurethane processing machinery market, presenting lucrative opportunities for stakeholders in the industry.

The mixing heads segment dominated the market with the revenue share of 30% in 2023. Mixing heads are responsible for mixing the chemicals supplied by the previous system and later distributing the mixture or blending through various methods such as spraying and closed or open pouring. The rising demand for consumer products is expected to positively influence the growth of the mixing heads segment over the forecast period. Further, the growing product launches are likely to boost the segment’s growth. For instance, in November 2021, Cannon Group introduced the talking head, a high-pressure mixing head fitted with around 30 sensors to track performance.

The foaming equipment segment is expected to witness the highest CAGR over the forecast. The segment’s growth is significantly attributed to the rising market demand for molded components, non-continuous rigid, self-skinning, and cold-curing foam. The applications of different types of foams include decoration, furniture, refrigerators, insulation materials, and various components of automobiles. Further, rising expenditure on furniture and mattresses in North America is anticipated to drive polyurethane foam products. Thus, the demand for foaming equipment is likely to surge over the forecast period.

The high-pressure segment accounted for the largest market revenue share in 2023. The high-pressure polyurethane processing machinery is mainly designed to manufacture PU products by automatically mixing & pouring polyurethane.High-pressure polyurethane processing machinery includes precision metering pumps and high-pressure mix heads for producing PU flexible, rigid, and PU skin foams. These machines provide high-quality foam with uniform cell structure and superior insulation performance.

The low-pressure segment is expected to grow at the fastest CAGR over the forecast period. Low-pressure PU processing machines support applications requiring higher viscosities, smaller quantities, or different viscosity levels among the various chemicals used in a mixture. These devices are also utilized when various chemical streams must be handled before mixing. In addition, the construction sector uses low-pressure PU processing machines to apply foams. Hence, the growing construction and automotive sectors are expected to increase demand for low-pressure PU processing machines over the forecast period.

The construction segment held the largest revenue share in 2023. PU-based binders are used in wood-plastic composites for combining organic materials into particleboard, strawboard, laminated-veneer lumber, long-strand lumber, medium-density fiberboard (MDF), and oriented strand board (OSB). In addition, polyurethane-based composite materials are steadily gaining importance in modern lightweight construction. The PU processing equipment is in significant demand in the construction sector, including civil engineering projects like building construction and interior design. According to the Associated General Contractors, the multifamily houses construction in December 2023 increased by 3.2% compared to November 2023.

The automotive segment is expected to grow at the highest CAGR over the forecast period, owing to the increasing vehicle demand in North America. Further, with the technological advancements, new electric vehicles are continuously being developed and introduced to the market. The number of EV launches is facilitating the demand for polyurethane products. Polyurethane foams are used in various interior components such as headrests, armrests, and seats owing to their cushioning property, which aids in reducing the stress and fatigue associated with driving. Furthermore, polyurethane is used to provide insulation against the noise and heat of the engine.

North America polyurethane processing machinery market was led by the U.S. in 2023 by market revenue share, accounting for 82%. Canada is expected to grow at the highest CAGR over the forecast period. The use of polyurethane is surging in the medical, consumer goods, and construction industries owing to its biocompatibility, robustness, flexibility, and chemical and abrasion resistance characteristics of processed PU products. Thus, the increasing use of polyurethane in North America is expected to fuel the demand for polyurethane processing machinery over the forecast period.

By Product

By Pressure

By Other End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Polyurethane Processing Machinery Market

5.1. COVID-19 Landscape: North America Polyurethane Processing Machinery Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Polyurethane Processing Machinery Market, By Product

8.1. North America Polyurethane Processing Machinery Market, by Product, 2024-2033

8.1.1 Dosing Systems

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mixing Heads

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Metering Equipment

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Foaming Equipment

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Polyurethane Processing Machinery Market, By Pressure

9.1. North America Polyurethane Processing Machinery Market, by Pressure, 2024-2033

9.1.1. High Pressure

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Low Pressure

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Polyurethane Processing Machinery Market, By End-use

10.1. North America Polyurethane Processing Machinery Market, by End-use, 2024-2033

10.1.1. Construction

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Automotive

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Medical

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Consumer Products

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. North America Polyurethane Processing Machinery Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Pressure (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. KraussMaffei.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Hennecke GmbH.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cannon USA, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. FRIMO.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hunter Polyurethane Equipment.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ESCO

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Linden Industries, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. MAX PROCESS EQUIPMENT, LLC

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Polyurethane Machinery Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Graco Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others