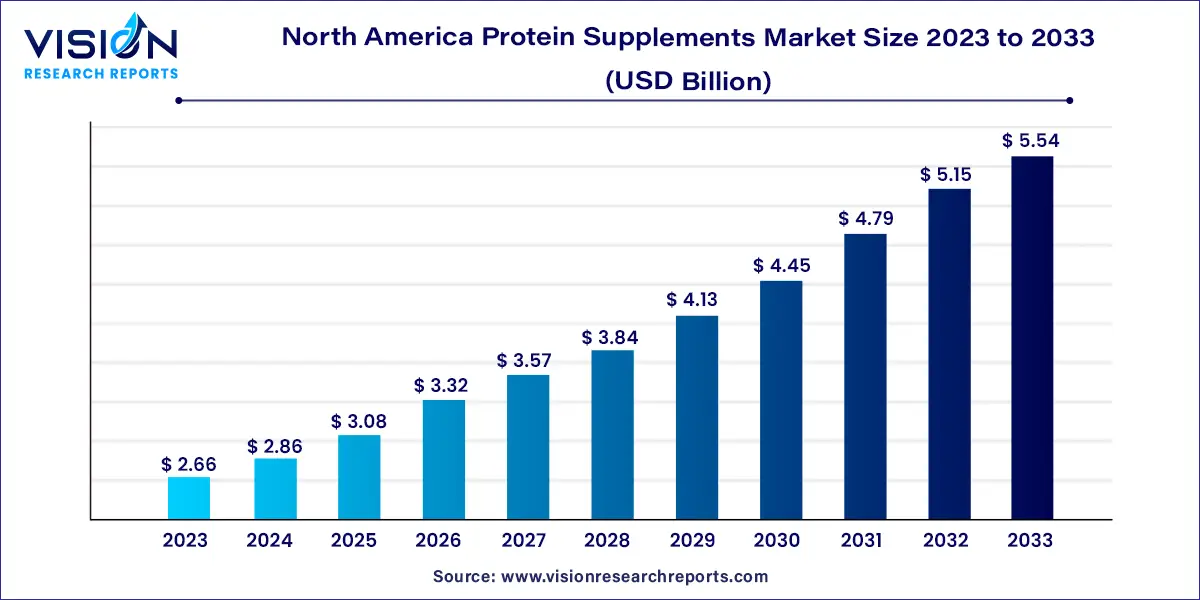

The North America protein supplements market size was estimated at USD 2.66 billion in 2023 and it is expected to surpass around USD 5.54 billion by 2033, poised to grow at a CAGR of 7.62% from 2024 to 2033.

The North America protein supplements market has witnessed significant growth in recent years, driven by a surge in health and fitness consciousness among consumers. This overview aims to delve into the key factors contributing to the market's expansion, providing insights into the current landscape and future trends.

The growth of the North America protein supplements market can be attributed to several key factors. Firstly, a noticeable increase in health awareness has driven consumers to seek protein supplements as a means to support their overall well-being. The expanding fitness culture, marked by the growing prevalence of gym memberships and fitness routines, has further fueled the demand for these supplements, particularly among athletes and fitness enthusiasts. Additionally, the market has witnessed a surge in innovation, with manufacturers introducing diverse product formulations such as plant-based options and convenient ready-to-drink solutions. The booming e-commerce sector has also played a pivotal role, providing consumers with convenient access to a wide range of protein supplements. This combination of health consciousness, fitness trends, product innovation, and accessible distribution channels positions the North America protein supplements market for sustained growth in the foreseeable future.

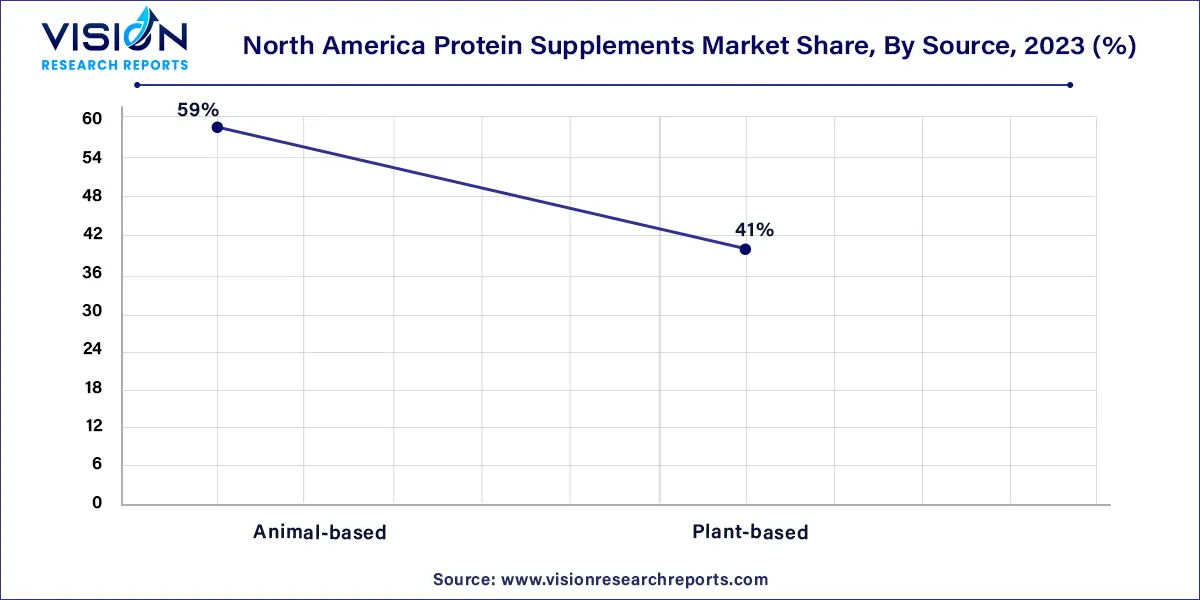

In 2023, animal-based protein supplements held a substantial revenue share of 59%. Recognized for their superior protein quality, animal sources play a crucial role in promoting and maintaining health. With a higher protein concentration, they are preferred for supplement manufacturing. Among these, whey protein stands out as the most popular, driven by its ability to enhance physical performance and reduce fats. This has led to its widespread adoption among fitness enthusiasts, sportspersons, and athletes. Whey protein isolates, concentrates, and hydrolysates are the most marketed forms, with studies highlighting their importance in stimulating bone growth in children, contributing to the segment's growth.

On the other hand, plant-based protein supplements are poised to grow at a CAGR of 9.63% during the forecast period. The shift towards new protein sources is fueled by rising consumer awareness of a healthy lifestyle. Despite the persistent demand for animal-based proteins, many consumers are embracing a vegan diet due to concerns about animal welfare and the environmental impact of the meat industry. Key plant protein sources include soy, wheat, rice, and spirulina. The market for plant protein supplements is expected to benefit from increasing awareness of their nutritional benefits and the growing popularity of clean-label products.

In 2023, protein powder supplements held a significant revenue share of 45%. Derived from various raw materials such as egg, whey, soy, pea, and casein, protein powder supplements have gained popularity due to the rising health consciousness among consumers. The trend of incorporating protein powders into daily diets for purposes like weight management, muscle gain, and overall health and wellness has been a key driver. This demand extends to elite athletes, bodybuilders, and casual exercisers. Notably, plant-based protein powders are also on the rise, fueled by the increasing number of consumers adopting vegan or vegetarian diets.

Furthermore, Ready-to-Drink (RTD) supplements are anticipated to experience a Compound Annual Growth Rate (CAGR) of 9.02% from 2024 to 2033. RTD supplements, pre-formulated protein drinks requiring no additional mixing or preparation, offer a convenient on-the-go solution. These drinks, high in protein content, serve as post-workout drinks, pre-workout boosts, or even meal replacements. The proteins in RTD supplements are swiftly absorbed by the body, facilitating muscle recovery and supporting lean muscle growth. These attributes are expected to propel the growth of this segment throughout the forecast period.

In 2023, the application of supplements in functional food claimed a significant share of 53%. Functional foods are primarily consumed to ensure the intake of essential nutritional constituents for the human body. The rising prevalence of cardiovascular diseases, attributed to sedentary lifestyles and fluctuating dietary patterns, particularly among individuals aged 30 to 40, has heightened consumer awareness regarding the importance of omega-3-based nutraceutical products. This awareness has, in turn, propelled the adoption of such supplements.

The application of supplements in sports nutrition is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 8.92% during the forecast period. This growth is attributed to the increasing demand for sports nutritional supplements aimed at enhancing core strength and endurance among various consumer groups, including athletes, weekend warriors, fitness enthusiasts, and professional athletes. Furthermore, the rising number of individuals engaging in gym activities and the growing demand for sports nutritional supplements to facilitate lean muscle growth, improve performance, aid in weight reduction, and enhance stamina are expected to be key drivers for the growth of this segment.

In 2023, the sales of protein supplements through online stores captured a significant share of 48%. This surge can be attributed to the growing number of internet users and the convenience of accessing numerous brands, catering to the fast-paced consumer lifestyle. The 24/7 availability of products, coupled with the convenience of online shopping and a diverse range of offerings, further propelled the sales of protein supplements through online distribution channels. Customers benefit from features such as price range comparisons and access to numerous brands with customer reviews, reinforcing the appeal of this sales channel.

Concurrently, sales of protein supplements through supermarkets and hypermarkets are forecasted to grow at a Compound Annual Growth Rate (CAGR) of 9.35% from 2024 to 2033. These retail giants conduct comprehensive consumer sentiment analyses to discern preferences for products and brands, allowing them to offer items likely to resonate with customers. Established supermarkets, hypermarkets, and departmental stores in the U.S. have provided a favorable platform for protein supplement manufacturers to distribute their products through these channels. This strategic distribution is expected to contribute to the growth of protein supplement sales in supermarkets and hypermarkets over the coming years.

In 2023, the U.S. protein supplements market held a dominant share of 88%. According to a survey conducted by CFANS Insights, affiliated with the University of Minnesota's College of Food, Agricultural, and Natural Resource Sciences, 80% of U.S. adults currently favor protein sources such as pork, beef, poultry, and fish. However, a noteworthy 31% expressed their intention to increase consumption of plant-based protein over the next five years, signaling a notable trend. Gen Xers emerged as the segment with the highest current preference for plant protein at 26%, surpassing other consumer segments with a 20% preference. Additionally, 44% of Gen Z participants expressed a willingness to pay a premium for plant-based protein options.

Meanwhile, the Canada protein supplements market is poised to grow at a CAGR of 7.02% over the forecast period. Fueled by a well-established health and wellness culture, Canadian consumers are increasingly conscientious about their diet and nutrition. The country has witnessed a significant rise in the number of vegetarians and vegans, aligning with global trends. These factors, coupled with a growing consumer preference for quick and convenient meal solutions, are anticipated to drive the growth of the protein supplements market in Canada in the coming years.

By Source

By Product

By Application

By Distribution Channel

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Protein Supplements Market

5.1. COVID-19 Landscape: North America Protein Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Protein Supplements Market, By Source

8.1. North America Protein Supplements Market, by Source, 2024-2033

8.1.1. Animal-based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Plant-based

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Protein Supplements Market, By Product

9.1. North America Protein Supplements Market, by Product, 2024-2033

9.1.1. Protein Powders

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Protein Bars

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. RTD

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Protein Supplements Market, By Application

10.1. North America Protein Supplements Market, by Application, 2024-2033

10.1.1. Sports Nutrition

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Functional Foods

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. North America Protein Supplements Market, By Distribution Channel

11.1. North America Protein Supplements Market, by Distribution Channel, 2024-2033

11.1.1. Supermarkets

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Online Stores

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. DTC

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. North America Protein Supplements Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Source (2021-2033)

12.1.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. MusclePharm

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Abbott

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. CytoSport, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Quest Nutrition, LLC.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. The Bountiful Company

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. NOW Foods

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Rousselot

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. International Dehydrated Foods, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Jym-Supplement-Science.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Surthrival

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others