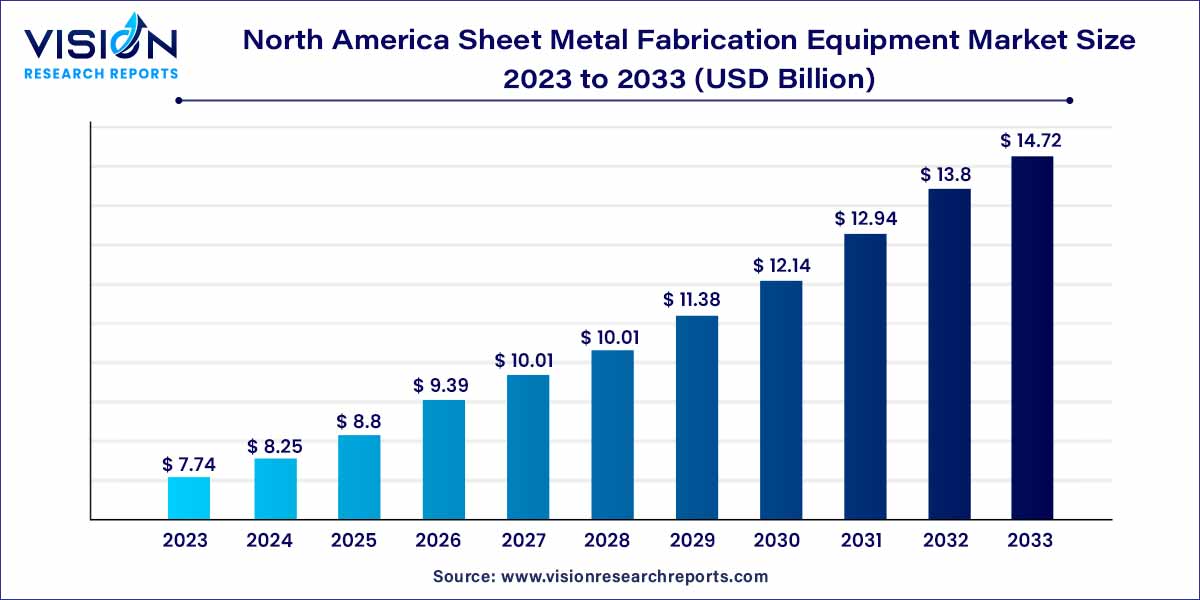

The North America sheet metal fabrication equipment market size was estimated at around USD 7.74 billion in 2023 and it is projected to hit around USD 14.72 billion by 2033, growing at a CAGR of 6.46% from 2024 to 2033. The North America sheet metal fabrication equipment market is driven by the technological developments and growing end-use industries, such as automotive, construction, and aerospace.

The North America sheet metal fabrication equipment market is witnessing robust growth, driven by a combination of technological advancements, increasing demand across various industries, and a burgeoning emphasis on efficient and precise manufacturing processes. This overview delves into key aspects of the market, shedding light on trends, drivers, challenges, and opportunities that shape the landscape of sheet metal fabrication equipment in the region.

The North America sheet metal fabrication equipment market is experiencing robust growth, buoyed by several key factors. Technological advancements have played a pivotal role, with the integration of cutting-edge technologies such as CNC systems, robotics, and automation enhancing the efficiency and precision of fabrication processes. A surge in demand across various industries, including automotive, aerospace, construction, electronics, and energy, contributes significantly to market expansion. The region's growing industrialization and emphasis on sustainable practices further propel the adoption of eco-friendly sheet metal fabrication equipment. Despite challenges such as raw material price volatility and skilled labor shortages, the market benefits from the overarching trend of increased awareness and regulatory focus on environmental sustainability. As the manufacturing sector expands, the North America sheet metal fabrication equipment market remains poised for continuous growth, offering substantial opportunities for stakeholders across the region.

The 'Others' segment, encompassing plate rolls, drilling, polishing, and stamping, emerged as the dominant contributor with a significant revenue share of 21% in 2023. Among these, plate roll machines play a crucial role in sheet metal fabrication, facilitating the bending or rolling of flat metal plates into various curved shapes. Widely employed in metalworking, construction, manufacturing, and diverse industries, these machines are instrumental for shaping intricate cylindrical and conical forms required in construction projects.

Polishing machines within this segment find application in refining sheet metal components and ducts crafted from stainless steel and zinc-coated steel, particularly in the HVAC industry. Plate rolls demonstrate versatility by manufacturing detailed shapes vital for construction purposes.

The cutting segment is poised to exhibit the highest CAGR at 8.05% during the forecast period. Cutting stands as a foundational process in sheet metal fabrication, employing handheld plasma torches and Computer Numerical Control (CNC) cutters to craft dimensional sheet metal parts. These cut components undergo subsequent processes, including polishing and bending, to yield the final product, thus fueling the continual demand for cutting machines.

Furthermore, the cutting-edge integration of Industry 4.0 technologies, such as the Industrial Internet of Things (IIoT) and automation, is optimizing the productivity of sheet metal-cutting machines through real-time data exchange. This facilitates optimal production, aligning with the goals of sheet metal fabricators to enhance production efficiency, minimize downtime, and operate cost-effectively. This concerted effort is expected to positively impact the growth of the sheet metal fabrication equipment market.

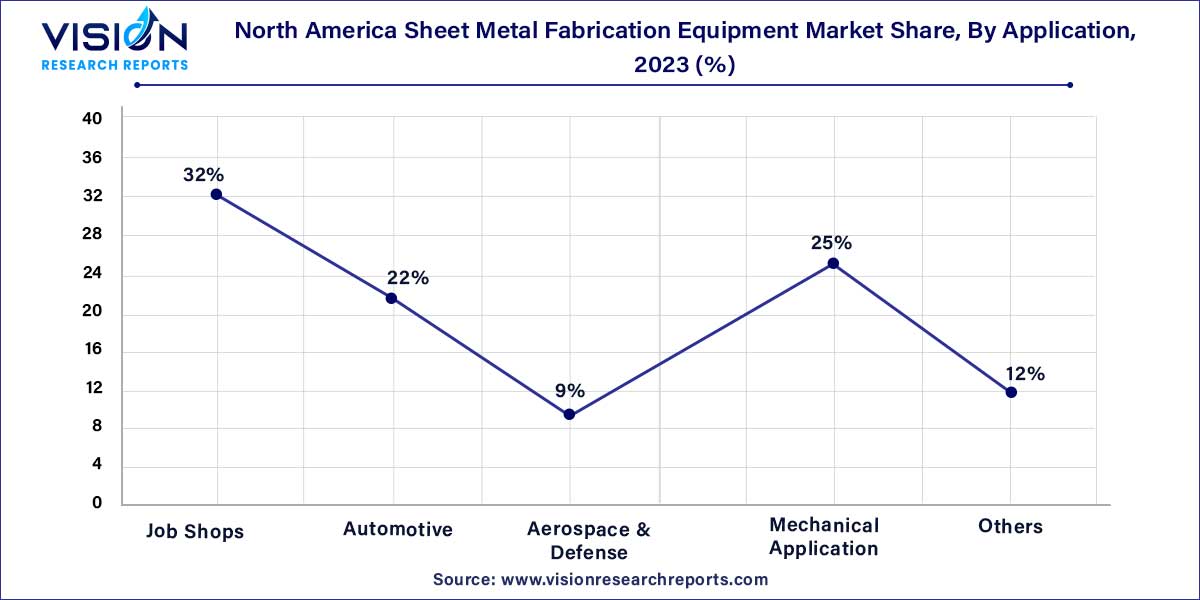

In 2023, the job shops segment took the lead with the highest revenue share at 32%. Job shops, specializing in small-to-medium-sized enterprises, distinguish themselves by focusing on crafting unique, one-of-a-kind products. Their expertise lies in developing items with low manufacturing volume, operating on a made-to-order (MTO) basis. Leveraging various tools and machines, job shops excel in cutting, shaping, and assembling sheet metals to create a diverse range of products.

In North America, job shops are committed to providing distinctive sheet metal fabrication services while embracing environmentally friendly manufacturing practices. Typically, these shops tailor sheet metal components to meet customer requirements, necessitating adaptable machines that reduce power consumption. Consequently, the increasing adoption of power-efficient manufacturing practices is anticipated to drive a heightened demand for environmentally responsible sheet metal fabrication equipment within job shops.

The mechanical application segment is poised to witness the fastest CAGR of 7.53% during the forecast period. Sheet metal fabrication equipment plays a pivotal role in various mechanical applications, manufacturing customized metal components crucial for a wide range of products. The surge in advanced technologies, such as electric vehicles (EVs) and autonomous systems, further fuels the demand for tailored metal components achievable through sheet metal fabrication equipment.

Moreover, the burgeoning development of energy generation and storage solutions, including wind turbines, solar panels, and batteries, necessitates components crafted using sheet metal fabrication equipment. Consequently, the escalating number of energy generation projects in North America is expected to propel the demand for sheet metal fabrication equipment throughout the forecast period.

In 2023, the United States claimed the largest revenue share at 76%, driven by heightened government initiatives focused on public infrastructure development. This investment is particularly vital for the fabrication of structural steel components like beams, columns, and trusses essential in constructing buildings and bridges.

The increasing defense expenditure by the U.S. federal government is poised to bolster the domestic production of naval ships, patrol vehicles, and submarines. The growing preference for mega-ships over older models is expected to positively influence the nation's shipbuilding industry, further contributing to the demand for sheet metal fabrication equipment. These machines play a pivotal role in manufacturing critical components for ships.

Mexico is anticipated to exhibit the fastest CAGR at 7.63%, driven by its capacity to manufacture and export major components crucial in automobile production. Factors such as ease of doing business, geographical proximity, and serving as a supply source for distributors and retailers make Mexico a preferred location for sheet metal component manufacturers. The government's active engagement in infrastructure development, aiming to compete globally with emerging economies, adds to Mexico's appeal.

Positioned as a primary manufacturing center for numerous U.S.-based companies, Mexico leverages its strategic geographical location linking Central and South America with the United States. Additionally, the maquiladora system provides access to shelter services, further boosting the demand for sheet metal fabrication equipment in Mexico throughout the forecast period.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Sheet Metal Fabrication Equipment Market

5.1. COVID-19 Landscape: North America Sheet Metal Fabrication Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Sheet Metal Fabrication Equipment Market, By Type

8.1. North America Sheet Metal Fabrication Equipment Market, by Type, 2024-2033

8.1.1. Cutting

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Shearing

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Punching

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Machining

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Welding

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Bending

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Sheet Metal Fabrication Equipment Market, By Application

9.1. North America Sheet Metal Fabrication Equipment Market, by Application, 2024-2033

9.1.1. Job Shops

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Aerospace & Defense

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Mechanical Application

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Sheet Metal Fabrication Equipment Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. Canada

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Mexico

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Trumpf

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. DMG Mori Co. Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Salvagnini

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. AMADA Co. Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Coherent Corp.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Flow International Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Koike Aronson, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Bystronic Laser AG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Winbro

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Mazak

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others