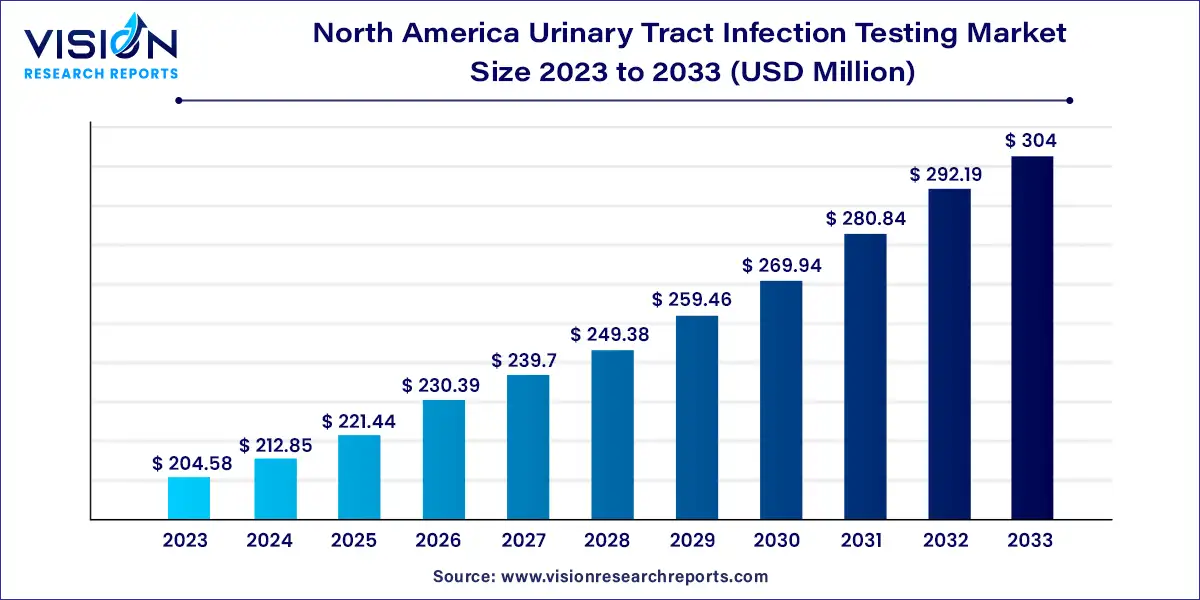

The North America urinary tract infection testing market was surpassed at USD 204.58 million in 2023 and is expected to hit around USD 304 million by 2033, growing at a CAGR of 4.04% from 2024 to 2033.

Urinary tract infections (UTIs) represent a significant healthcare concern in North America, affecting millions of individuals annually. As such, the urinary tract infection testing market in the region plays a crucial role in diagnosis, management, and prevention strategies. This overview aims to provide insights into the key factors shaping the UTI testing market landscape in North America.

The growth of the North America urinary tract infection (UTI) testing market is driven by an increasing prevalence of UTIs in the region is a significant driver, prompting higher demand for diagnostic solutions. Additionally, rising awareness among both healthcare professionals and patients about the importance of early detection and treatment of UTIs is driving market growth. Technological advancements in diagnostic testing methods, such as the development of rapid point-of-care tests and molecular diagnostics, are also contributing to the market's expansion. Furthermore, initiatives aimed at promoting preventive healthcare and reducing healthcare-associated infections are bolstering market demand. Overall, these growth factors underscore the importance of UTI testing in North America's healthcare landscape and its potential for further expansion in the coming years.

| Report Coverage | Details |

| Market Size in 2023 | USD 204.58 million |

| Revenue Forecast by 2033 | USD 304 million |

| Growth rate from 2024 to 2033 | CAGR of 4.04% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The cystitis segment accounted for the largest revenue share of 43% in 2023 in the North America urinary tract infection testing market. Cystitis is a condition where bacteria from the skin or bowel enter the urethra and bladder, leading to irritation and inflammation of the bladder lining, causing a bladder infection. There are two types of cystitis - acute, which occurs suddenly; and interstitial, a chronic and longer-term condition. The growth of the segment is due to the rising incidence & recurrence rate of cystitis, the increased number of product approvals, and the high number of diabetes patients more prone to cystitis.

The pyelonephritis segment is expected to witness the fastest CAGR over the forecast period. This is owing to the increasing cases of pyelonephritis in the region. According to NCBI statistics, each year, there are approximately 250,000 cases of pyelonephritis in the U.S., with a higher occurrence among females. Among women aged between 18 to 49 years, the estimated incidence of pyelonephritis is 28 cases per 10,000 individuals, and around 7% of these cases require hospital admission. Recurrence is less frequent than uncomplicated UTIs, with 9% of females and 5.7% of males experiencing a second episode within a year.

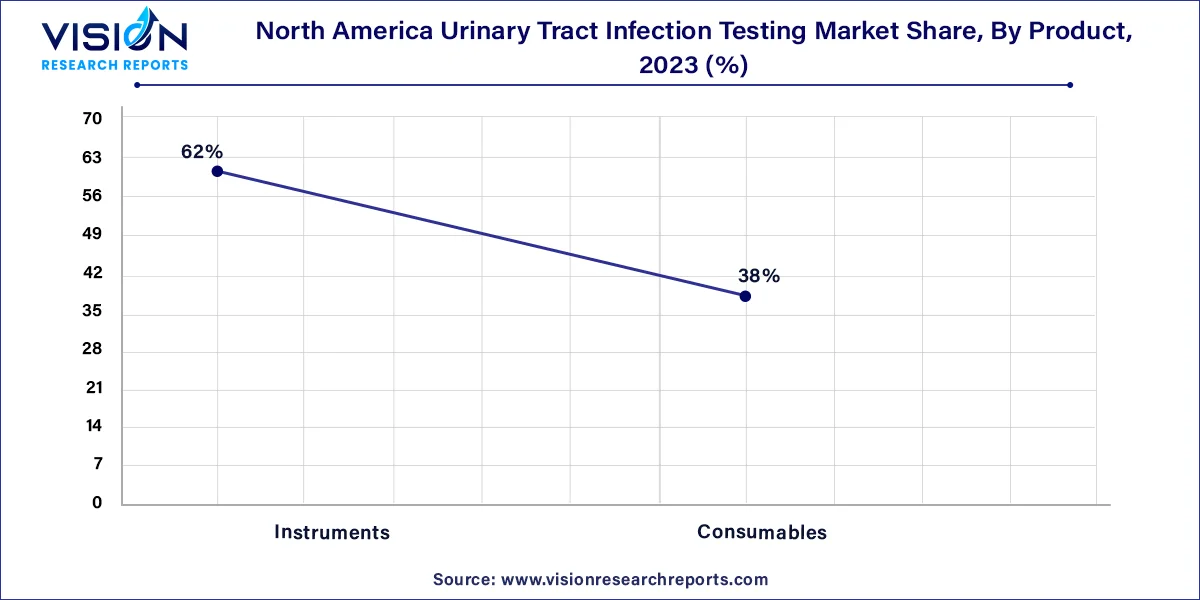

The instruments segment accounted for the largest revenue share of 62% in 2023 and is expected to witness the fastest CAGR over the forecast period. The rising prevalence of UTIs in North America has led to a greater demand for efficient and reliable testing methods. Instruments are crucial in UTI testing as they are essential for accurate and rapid diagnosis. Advanced diagnostic instruments, such as automated urine analyzers and point-of-care testing devices, have gained traction due to their ability to deliver faster and more precise results. These instruments aid in detecting UTIs early, allowing for prompt treatment and improved patient outcomes.

Additionally, ongoing advancements in diagnostic technologies have led to the development of sophisticated instruments with enhanced capabilities. For instance, the increasing adoption of innovative UTI testing instruments, such as the Illumina Urinary Pathogen Infectious Disease/Antimicrobial Resistance (ID/AMR) Panel (UPIP), is revolutionizing the UTI testing market in the region. These advanced instruments offer greater accuracy and sensitivity, attracting healthcare providers and driving market growth.

The reference laboratories segment held the largest revenue share of 28% in 2023. Reference laboratories offer a wide range of comprehensive testing services, including UTI testing, to healthcare providers. These laboratories have advanced instruments and technologies to perform various diagnostic tests with high accuracy and efficiency. Moreover, many reference laboratories have multiple locations and wide geographic coverage, enabling them to serve a large population across different states and regions in North America. In addition, reference labs can handle large volumes of diagnostic tests at an expedited rate and provide better results at comparatively lower prices, which is anticipated to offer economies of scale to service providers.

The urogynecologists segment is expected to witness the fastest CAGR over the forecast period. Urogynecologists primarily focus on women's health concerns, including conditions that affect the urinary tract. Since UTIs are more prevalent in women, urogynecologists encounter and manage UTI cases more frequently than other healthcare specialists. They also perform specific tests to identify the underlying cause of recurrent UTIs and recommend appropriate treatment plans. This comprehensive approach to UTI diagnosis and management may contribute to the growth of UTI testing services within the urogynecology segment.

By Type

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Urinary Tract Infection Testing Market

5.1. COVID-19 Landscape: North America Urinary Tract Infection Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global North America Urinary Tract Infection Testing Market, By Type

8.1. North America Urinary Tract Infection Testing Market, by Type, 2024-2033

8.1.1 Urethritis

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cystitis

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pyelonephritis

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Urinary Tract Infection Testing Market, By Product

9.1. North America Urinary Tract Infection Testing Market, by Product, 2024-2033

9.1.1. Instruments

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Consumables

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Urinary Tract Infection Testing Market, By End-use

10.1. North America Urinary Tract Infection Testing Market, by End-use, 2024-2033

10.1.1. General practitioners

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Urologists

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Urogynecologists

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Hospital Laboratories

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Reference Laboratories

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Hospital Emergency Departments

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Urgent Care

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. North America Urinary Tract Infection Testing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. QIAGEN.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Accelerate Diagnostics, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bio-Rad Laboratories, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. F. Hoffmann-La Roche Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Danaher Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Siemens Healthcare GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Randox Laboratories Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Thermo Fisher Scientific, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. bioMérieux SA.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. T2 Biosystems, Inc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others