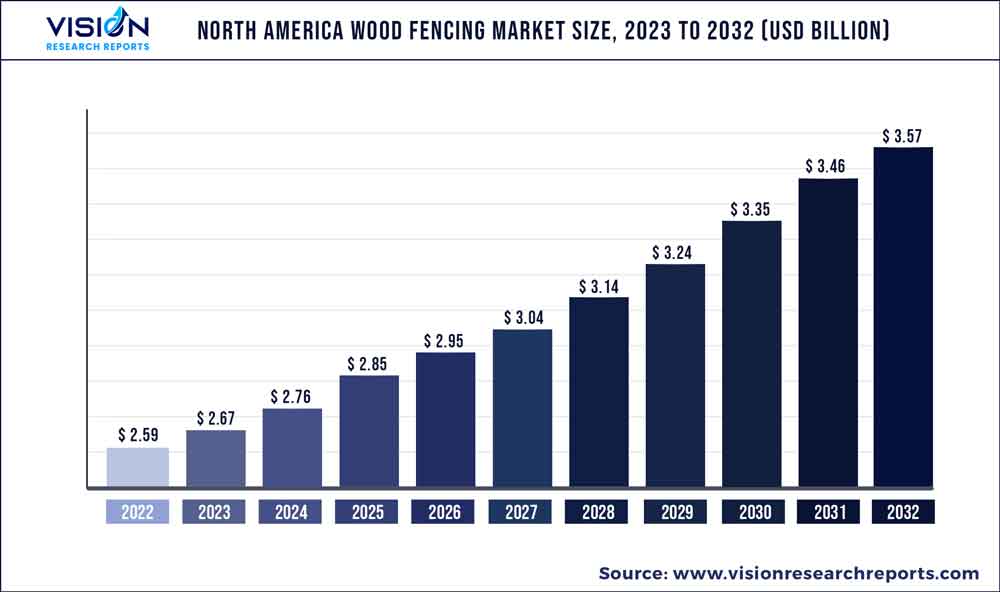

The North America wood fencing market size was estimated at around USD 2.59 billion in 2022 and it is projected to hit around USD 3.57 billion by 2032, growing at a CAGR of 3.27% from 2023 to 2032.

Key Pointers

Report Scope of the North America Wood Fencing Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.59 billion |

| Revenue Forecast by 2032 | USD 3.57 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.27% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Sierra Pacific Industries; Redwood Empire Sawmill; Pine River Group Home, Inc.; L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench; BarretteWood; SPEC Wood Inc., Cedarline Industries; Mendocino Family of Companies |

The surging number of residential and commercial building projects in North America is anticipated to fuel the product demand. In addition, the rising adoption of wood fencing in agricultural applications is a key factor driving the growth of the wood fencing market in North America. Due to the surging disposable income coupled with the developing construction sector, several homeowners in North America are replacing their old fencing may catapult industry growth over the forecast period.

Large and dominant players in North America wood fencing market have adopted the strategies of mergers and acquisitions to retain their market leadership. On a local level, there is intense competition among the market players. Companies actively compete, using various marketing and advertising strategies to increase their market shares in North America. In addition, there is a high potential for market consolidation in the U.S., which is anticipated to lead to intense rivalry in the market in North America.

Most of the North America’s large manufacturers offer their goods directly to consumers via their online portals.To reach a larger consumer base, many of these manufacturers also work with independent online distributors. However, the majority of wood fencing sales are made through offline distribution channels to final consumers through physical distributors and retailers.Through this channel, the products are available to the customer faster, and the customers can analyze and choose from the available options, making an informed decision.

Product Insights

The picket fence product segment led the North America market and accounted for 40.16% of revenue share in 2022. This is due to the high usage of picket fences in safeguarding garden ponds or swimming pools without obstructing any vistas, which is expected to drive the demand for picket fences in North America. Moreover, the rise in residential construction activities and the surge in institutional construction expenditures in North America are expected to fuel the growth of the picket wood fencing industry in North America over the coming years.

The rail and post segment was valued at USD 506.82 million in 2022 and is growing at a significant rate over the forecast period. The demand for rail & post fences is expected to surge in North America owing to their easy installation, cost-effectiveness, durability, and natural look. Furthermore, the easy availability of wood in the region is also surging the demand for wooden rail & post fences in North America.

The vertical board segment accounted for 28.54% of revenue share in 2022. The growth of this segment of the wood fencing market in North America can be attributed to the surged demand for vertical boards in various applications owing to the use of edge-to-edge overlapped or butted vertical planks in them that provide the best possible protection against the wind, as well as offer seclusion.

Species Insights

The cedar species segment accounted for the highest revenue market share of 41.55% in 2022. The use of cedar in wood fencing is growing due to its many benefits; the wood fencing is not chemically treated; its aesthetic appeal and deep tone range enhance the visual appeal of home interiors. Cedar does not need a lot of upkeep for maintaining its look. This is expected to drive the product demand in North America over the forecast period.

The whitewood segment is growing at a significant rate of 2.42% in terms of revenue over the forecast year. Whitewood finds major applications in residential fencing in the form of pickets and boards. Therefore, growth in residential construction is expected to bolster the demand for whitewood fencing in North America over the forecast period.

The redwood segment accounted for the second-largest market in 2022. This is due to long-lasting attributes with minimal or no maintenance. The redwood fence can be utilized in different forms or designs like horizontal or vertical boards and dog-eared or square designs. Redwood can be used to manufacture different fence styles like lattice, picket, board-on-board, and panel.

Installation Insights

The contractor and installers segment dominated the market in 2022 and was valued at USD 1.84 billion. The demand for residential and commercial construction is expected to increase in North America with the improving economic conditions; this would simultaneously bolster the North America wood fencing industry growth over the forecast years.

The Do-It-Yourself (DIY) segment in North America wood fencing is expected to rise significantly over the forecast period, illustrating customers' increasing demand for customized fences. The DIY trend was encouraged by factors such as a rise in house sales and the emergence of home remodeling videos on social media.

Coatings Insights

The stained coatings segment accounted for USD 2.06 billion for the year 2022 in North America. The demand for stained wood fencing is increasing due to its advantages including an attractive and extremely cost-effective alternative to metal or plastic fencing and protection from harsh environmental conditions for a longer time.

The non-stained market is expected to expand at a CAGR of 2.16% in terms of revenue over the forecast period. The wood fences are minimally left unstained before installation, as staining increase the fence life. If the fences are left unstained, the wood can split and crack. This can reduce the lifespan of the fence and thus, the non-stained coating is less preferred compared to stained coating.

Application Insights

The residential application segment accounted for the highest revenue share of 58.92% in 2022. Residential buildings comprise single-family homes, multi-family residential buildings, apartment houses, and community-based residential facilities. A significant emphasis that households lay on security and privacy, as well as rising disposable income, is driving investments in residential fencing. Privacy fences are gaining more popularity in North America making this fence style more relevant for lifestyle comfort and convenience.

The agricultural segment accounted for 26.41% revenue market share in 2022. This is due to the usage of wood fencing in North America to safeguard the farmland from wild animals, thieves, and cattle. In the agricultural sector, fencing includes a much wider range of materials, from conventional old wood materials to new high-tech materials such as wood composite fencing.

Others application segment is expanding at a significant CAGR of 2.4% in terms of revenue in 2022. The high demand for fencing in government premises such as gardens is owing to the usage of highly durable wood to avoid deterioration. Rebounding government premises are also anticipated to drive the demand for wood fencing in other applications.

North America Wood Fencing Market Segmentations:

By Product

By Species

By Installation

By Coating

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Wood Fencing Market

5.1. COVID-19 Landscape: North America Wood Fencing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Wood Fencing Market, By Product

8.1. North America Wood Fencing Market, by Product, 2023-2032

8.1.1. Picket

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Rail & Post

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Vertical Board

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Wood Fencing Market, By Species

9.1. North America Wood Fencing Market, by Species, 2023-2032

9.1.1. Cedar

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Douglas fir

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Redwood

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Whitewood

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Wood Fencing Market, By Installation

10.1. North America Wood Fencing Market, by Installation, 2023-2032

10.1.1. Contractor & Installer

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Do-It-Yourself

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. North America Wood Fencing Market, By Coating

11.1. North America Wood Fencing Market, by Coating, 2023-2032

11.1.1. Stained

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Non-Stained

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. North America Wood Fencing Market, By Application

12.1. North America Wood Fencing Market, by Application, 2023-2032

12.1.1. Residential

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Agricultural

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Others

12.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 13. North America Wood Fencing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.2. Market Revenue and Forecast, by Species (2020-2032)

13.1.3. Market Revenue and Forecast, by Installation (2020-2032)

13.1.4. Market Revenue and Forecast, by Coating (2020-2032)

13.1.5. Market Revenue and Forecast, by Application (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Species (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Installation (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Coating (2020-2032)

13.1.7. Market Revenue and Forecast, by Application (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Species (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Installation (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Coating (2020-2032)

13.1.8.5. Market Revenue and Forecast, by Application (2020-2032)

Chapter 14. Company Profiles

14.1. Sierra Pacific Industries

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Redwood Empire Sawmill

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Pine River Group Home, Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. BarretteWood

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. SPEC Wood Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Cedarline Industries

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Mendocino Family of Companies

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others