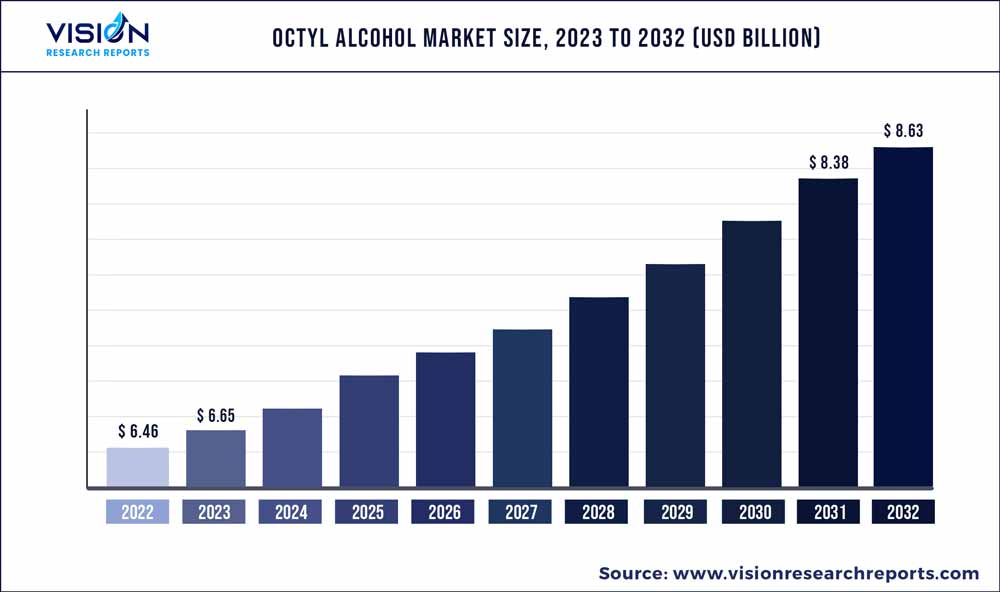

The global octyl alcohol market size was estimated at around USD 6.46 billion in 2022 and it is projected to hit around USD 8.63 billion by 2032, growing at a CAGR of 2.94% from 2023 to 2032. The octyl alcohol market in the United States was accounted for USD 23.9 million in 2022.

Key Pointers

Report Scope of the Octyl Alcohol Market

| Report Coverage | Details |

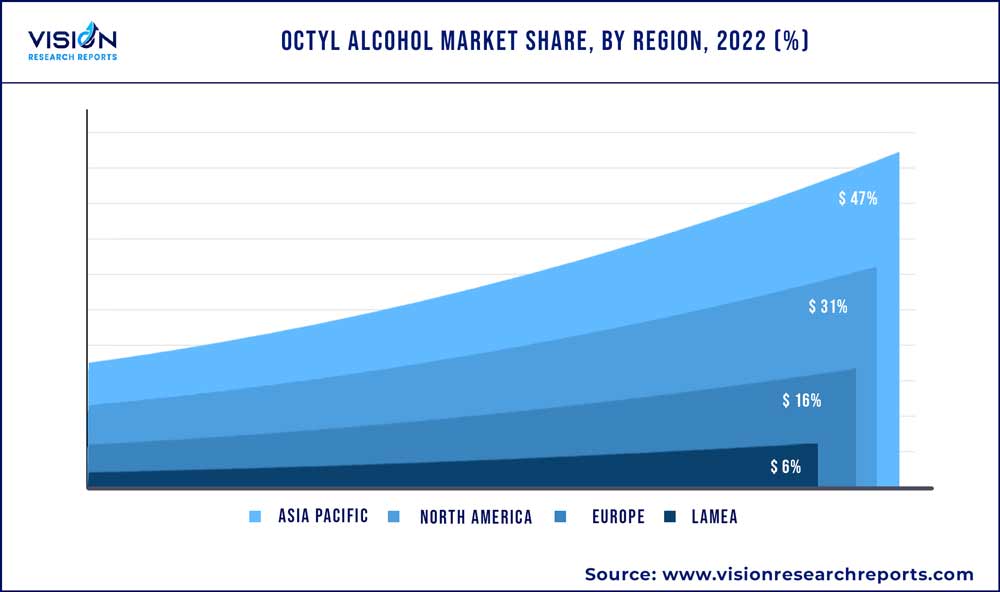

| Revenue Share of Asia Pacific in 2022 | 47% |

| Revenue Forecast by 2032 | USD 8.63 billion |

| Growth Rate from 2023 to 2032 | CAGR of 2.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Sasol; BASF; SABIC; BharatPetroleum; KLK OLEO; The Andhra Petrochemicals Limited; Ecogreen Oleochemicals; Arkema; Axxence Aromatic GmbH; Liaoning Huaxing Group Chemical; SRL |

The growth for the product market is attributed to its use in a variety of industries, including pharmaceuticals, cosmetics, cleaning chemicals, and paint and coatings, among others. One of the primary uses of octyl alcohol is that it can also be used as an intermediate in the production of fragrances, where it is used to produce various esters known for their sweet, fruity, and floral aromas. Additionally, octanol is also used in the pharmaceutical industry as a tool for evaluating the lipophilicity of drugs and other compounds, as well as a solvent in some manufacturing processes. It is also used in the production of various surfactants, which are used in the manufacturing of detergents, shampoos, and other cleaning products.

The U.S. is the largest consumer of the product in North America with a revenue share of over 83.0% in 2022. This is attributed to the growing application industries such as fragrances and flavors, cosmetics, and pharmaceuticals in the country. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), North America accounted for around 49.1% of the total pharmaceutical sales with U.S. accounting for 64.4% of the total sales of new medicines worldwide in 2021. Thus, as a result of growing pharmaceutical and other industries in the U.S. is anticipated to drive the product demand over the forecast period.

Product by Application

2-Ethylhexanol segment is expected to dominate the market with a revenue share of over 95% in 2022. This growth is attributed to the fact that it is used in the production of plasticized PVC in automobiles, as a solvent for surface coatings and inks, as a precursor for making plasticizers such as dioctyl phthalate (DOP), and as a raw material for producing acrylate esters, which are used in manufacturing emulsion paints and surface coatings.

Plasticizers accounted for the major application segment of 2-ethylhexanol with a revenue share of over 53%. This growth is due to growing demand for flexible and durable plastics across a wide range of end-use industries such as automotive, construction, and packaging. Plasticizers are added to polymers to enhance their flexibility, durability, and processability. Additionally, the increasing demand for bio-based and non-phthalate plasticizers due to growing health and environmental concerns is also contributing to the rise in demand for plasticizers.

1-Octanol segment is also anticipated to witness growth over the forecast period. It is a fatty alcohol that is primarily used for the synthesis of esters, which are used in perfumes and flavorings, which further finds application in the food and beverages, and cosmetics industry. Moreover, aside from its use in perfumes and flavorings, 1-octanol has also been used in pharmaceutical products to evaluate their lipophilicity. Thus, all these factors are anticipated to contribute towards the growth of 1-octanol over the forecast period.

Regional Insights

The Asia Pacific region has emerged as the predominant contributor with over 47% revenue share in the octyl alcohol market in 2022. The region's growth can be attributed to the advancing cosmetics, cleaning chemicals, and pharmaceutical industries.

The beauty and personal care industry in China recorded a significant sale of USD 88 billion in 2021, marking a 10% increase compared to the previous year, according to the International Trade Administration. Moreover, according to the National Investment Promotion & Facilitation Agency, the beauty & personal care market in India is the 8th largest in the world, accounting for USD 15 billion, which is further expected to grow at a CAGR of 12% to 16% in the coming years. The advancement of end-use industries in China, India, and Japan will likely drive the demand for octyl alcohol over the forecast period.

North America is another region witnessing growth over the forecast period. According to the Government of Canada, the pharmaceuticals sector is one of the innovative industries in Canada making it the 9th largest pharmaceuticals market worldwide. Additionally, according to the Wisconsin Economic Development Corporation, Mexico is the 2nd largest pharmaceuticals market in North America and 15th largest globally. Thus, the increasing usage of octanol in pharmaceutical is driving the product demand in the region.

Octyl Alcohol Market Segmentations:

By Product By Application

By Regional

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Octyl Alcohol Market

5.1. COVID-19 Landscape: Octyl Alcohol Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Octyl Alcohol Market, By Product By Application

8.1.Octyl Alcohol Market, by Product By Application Type, 2023-2032

8.1.1. 1-Octanol

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. 2-Octanol

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. 2-Ethylhexanol

8.1.3.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Global Octyl Alcohol Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product By Application (2020-2032)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product By Application (2020-2032)

Chapter 10.Company Profiles

10.1. Sasol

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. BASF

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. SABIC

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. BharatPetroleum

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. KLK OLEO

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. The Andhra Petrochemicals Limited

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Ecogreen Oleochemicals

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Arkema

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Axxence Aromatic GmbH

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Liaoning Huaxing Group Chemical

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others