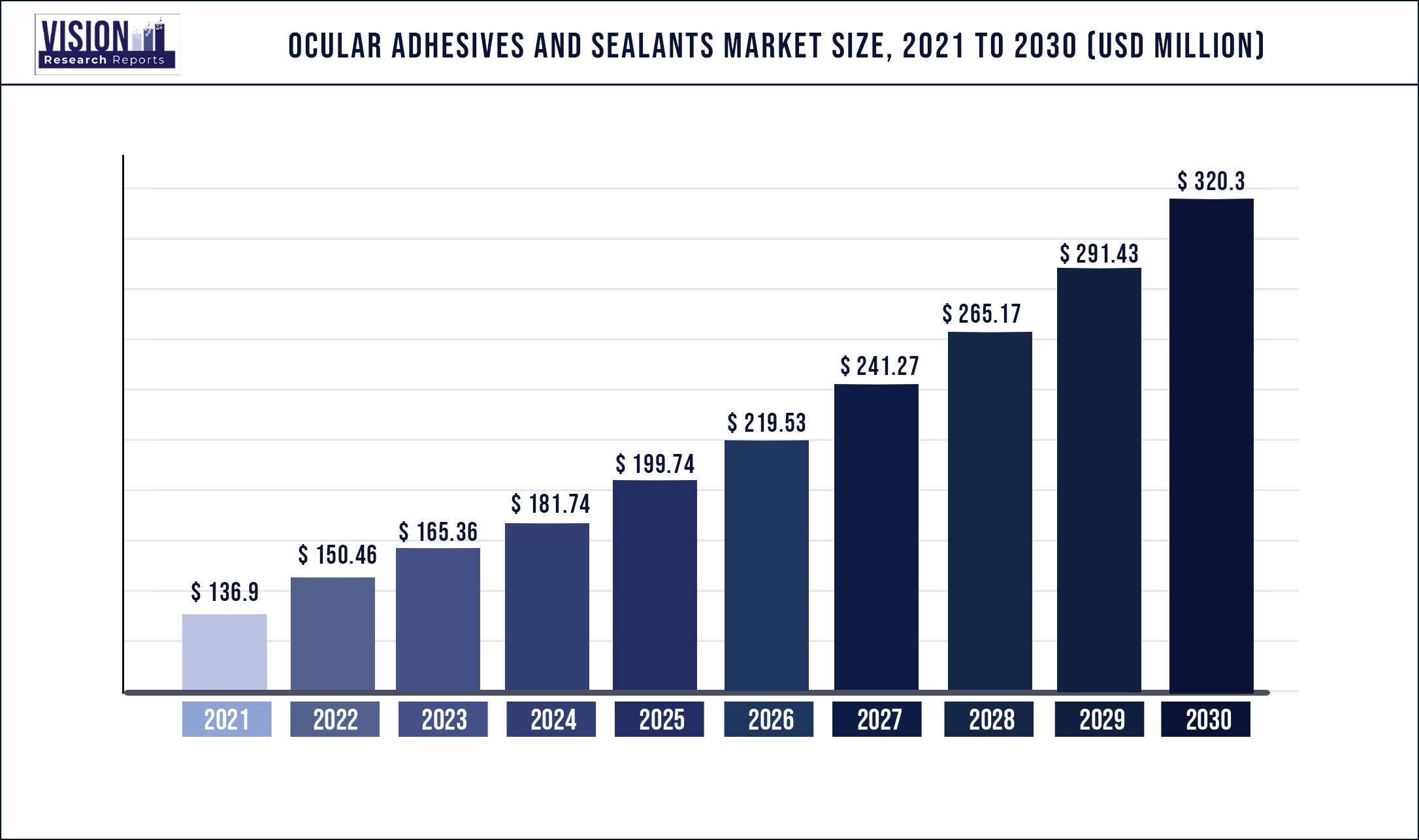

The global ocular adhesives and sealants market size was estimated at around USD 136.9 million in 2021 and it is projected to hit around USD 320.3 million by 2030, growing at a CAGR of 9.9% from 2022 to 2030.

Report Highlights

The market is expanding as a result of the rising ophthalmic surgical procedures and technological advancements. The demand for better surgical treatment is increasing, which is helping the market for ocular sealants grow.

Approximately 2,000 American workers suffer work-related eye injuries each day, according to the National Institute for Occupational Safety and Health (NIOSH). These injuries require medical attention. Approximately 1.3 million Americans over the age of 40 are totally blind, approximately 4.2 Americans over the age of 40 are visually impaired, and more than 150 million Americans require corrective lenses for refractive problems, according to statistics provided by the Centers for Disease Control and Prevention (CDC) and the American Academy of Ophthalmology (AAO). Around 3% of emergency visits to ophthalmic clinics or hospitals are due to high-frequency eye injuries leading to eye damage.

As previously indicated, suturing has a number of disadvantages, including endophthalmitis, tissue damage, and astigmatism. When compared to other wound closure options, suturing is not the best procedure because it also calls for a skilled surgeon. Ocular adhesives, which are intended to address the drawbacks of sutures, are one alternative. Ophthalmic surgeons are preferring suture-less surgery to avoid these issues. Contrary to traditional suturing, the use of adhesive has been demonstrated to reduce the likelihood of post-operative wound infection. Ocular sealants have also improved eye vision, shortened recovery times, and reduced the frequency of enucleation. These ocular sealants are used during wound reconstruction to improve the patient's post-operative state while preserving the wound's integrity. Ocular sealants and adhesives are employed in a variety of indications because each type has distinct advantages and disadvantages.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 136.9 million |

| Revenue Forecast by 2030 | USD 320.3 million |

| Growth rate from 2022 to 2030 | CAGR of 9.9% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, end-use, region |

| Companies Covered | Ocular Therapeutix, Inc.; Reliance Life-Sciences; Baxter; Medtronic PLC; B. Braun Melsungen AG |

Type Insights

The natural segment held the largest revenue share of over 55.1% in 2021. Natural or biological sealants and adhesives are further classified into fibrin, collagen-based, and gelatin-based. Among these, fibrin sealants held the largest revenue share in 2021 owing to their broad applications in medical practice. Fibrin sealants are among the most effective tissue adhesives, which are biocompatible and biodegradable. The fibrin sealants consist of purified, human thrombin, virus-inactivated human fibrinogen, and at times added elements, such as bovine aprotinin and virus-inactivated human factor XIII. The use of fibrin sealants improves the time to hemostasis, lowers blood loss, and reduces complications, all of which have a positive impact on surgical results.

The synthetic segment is classified into urethane-based adhesives, polyethylene glycol adhesives, and cyanoacrylates. The urethane-based adhesives have captured the largest revenue share in 2021. Polyethylene glycol adhesives are expected to expand at a lucrative CAGR during the forecast period. However, factors such as intense inflammatory response when exposed to non-cutaneous surfaces, restricted usage in internal surgeries, higher cost, and the requirement for a skilled workforce are expected to hinder the market growth.

End-use Insights

The ophthalmic clinics segment led the market in 2021 with a revenue share of over 40.06%. This is attributed to the rising cases of ophthalmic surgeries including cataract surgery and refractive surgery in a specialized ophthalmic clinic. The ophthalmic clinics are fully equipped with advanced instruments and have skilled ophthalmologists to carry out an operation, hence people tend to prefer ophthalmic clinics more than hospitals.

The hospitals segment is expected to expand at the fastest CAGR during the forecast period owing to a large number of patient visits and the presence of skilled ophthalmologists. This is due to the increasing number of patients opting for ophthalmic surgeries in hospitals as compared to clinics and specialty eye institutes. The growing incidence of refractive disorders and increasing spending on healthcare infrastructure are factors expected to fuel the growth of the hospitals segment over the forecast period.

Application Insights

The tissue engineering segment held the largest revenue share of over 30.22% in 2021. The market growth is attributed to the rising geriatric population, increasing ophthalmic disorders, and rising inclination towards early disease diagnosis and treatment. Tissue engineering is used for the treatment of various ocular disorders and is mainly used for the anterior segment including the cornea and conjunctiva. Also, it is used in combination with cell therapies for the treatment of retina disorders. Hence, tissue engineering along with biomaterials and medicines is expected to drive the market in the near future.

Moreover, the rising need for surgical procedures to address ocular disorders is expected to fuel market growth. For instance, Lens opacification or cataracts are removed surgically by replacing the lens with artificial intraocular lenses (IOL). According to estimates from the Centers for Disease Control and Prevention (CDC), about 20.5 million Americans aged 40 and older are believed to be affected by cataracts. This number is expected to increase, which, in turn, is increasing the need for cataract removal surgery, which will definitely lead to a higher demand for ophthalmic adhesives and tissues in the near future.

Moreover, rising prevalence of corneal vision loss is expected to fuel the segment growth. For instance, around 10 million people are thought to be affected by corneal vision loss worldwide, and 40,000 corneal transplants are carried out annually in the U.S. alone. This shows the growing demand for ocular adhesives and sealants in corneal surgeries. However, factors such as risk of infection, shortage of corneas, and graft rejection may hamper the growth of the market.

Regional Insights

North America accounted for the largest revenue share of over 35.16% in 2021 owing to factors such as rising prevalence of ocular disorders, presence of well-built infrastructure, availability of skilled ophthalmic surgeons, and presence of key market players. For instance, according to a report published by the American Academy of Ophthalmology in 2022, around 24.4 million Americans of age 40 and older have cataracts. About half of all Americans have cataracts by the age of 75. Over 2.7 million Americans aged 40 and older suffer from glaucoma. Legal blindness affects over 1.3 million Americans aged 40 and older. More than 34 million Americans, or 23.9% of those who are 40 and older, have myopia. 8.4% of Americans aged 40 and older, or close to 14.2 million people, have hyperopia. Injuries to the eyes are thought to occur 2.4 million times annually in the U.S.

Asia Pacific is expected to register the highest CAGR of 8.6% over the forecast period. This can be attributed to the increasing geriatric population and rising healthcare expenditure in this region. It is projected that the considerable shortfall between demand and supply for eye surgical services in nations like India, China, Japan, and other Southeast Asian nations will boost market expansion. Service providers are developing and planning new eye care facilities in these areas due to the significant unmet needs there. For instance, in December 2019, a leading chain of eye hospitals, Dr. Agarwal Eye Hospitals announced that 60 new eye hospitals would be constructed in India and other south Asian nations over the course of the following two to three years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ocular Adhesives And Sealants Market

5.1. COVID-19 Landscape: Ocular Adhesives And Sealants Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ocular Adhesives And Sealants Market, By Type

8.1. Ocular Adhesives And Sealants Market, by Type, 2022-2030

8.1.1 Synthetic

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Natural

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Ocular Adhesives And Sealants Market, By Application

9.1. Ocular Adhesives And Sealants Market, by Application, 2022-2030

9.1.1. Tissue Engineering

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Conjunctival Surgery

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Refractive Surgery

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Vitreo-retinal Surgery

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Corneal Surgery

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Ocular Adhesives And Sealants Market, By End-use

10.1. Ocular Adhesives And Sealants Market, by End-use, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Ophthalmic Clinics

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Ambulatory Surgical Centers

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Ocular Adhesives And Sealants Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Ocular Therapeutix, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Reliance Life-Sciences

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Baxter

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Medtronic PLC

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. B. Braun Melsungen AG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others