The global onychomycosis market size stood at USD 3.91 billion in 2024 and is estimated to reach USD 4.10 billion in 2025. It is projected to hit USD 6.22 billion by 2034, registering a robust CAGR of 4.75% from 2025 to 2034. Growth is driven by the rising prevalence of fungal nail infections in elderly and diabetic populations, increasing awareness of nail health, and higher demand for aesthetic treatments. Advancements in oral and topical antifungals, along with non-invasive options such as laser and photodynamic therapies, are expanding patient choices.

Onychomycosis is a fungal infection that affects the nail matrix, bed or nail plate, impacting both the toenails and fingernails. This condition can result in discoloration, thickening and even crumbling of the nails. The primary goal of treatment is to eliminate the infection, restore the health and appearance of the nails and prevent the fungus from spreading to other nails or the surrounding skin.

With increasing awareness about nail health along with the need for efficient and non-surgical methods of treatment, the demand for effective and advanced options further drives the market. The developments in treatment technologies such as laser therapy or photodynamic therapy are also expanding patient options apart from traditional oral and topical antifungal agents.

The onychomycosis market is primarily driven by the rising global incidence of fungal infections, particularly among the elderly and diabetic populations. These groups are more susceptible to nail infections due to weakened immunity as well as reduced blood circulation. Additionally, increasing awareness of personal hygiene, the growing demand for aesthetic appearance, and the widespread use of public swimming pools and communal showers also contributes to the higher transmission of fungal pathogens.

Another significant growth factor is the advancement in treatment modalities. Pharmaceutical companies are actively investing in the development of novel antifungal agents with improved safety profiles and higher efficacy. The emergence of laser therapy as a non-invasive, painless alternative is gaining traction, especially among patients who prefer treatments without systemic side effects.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.91billion |

| Revenue Forecast by 2034 | USD 6.22 billion |

| Growth rate from 2025 to 2034 | CAGR of 4.75% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Bausch Health, Pfizer, Johnson & Johnson, Novartis, GlaxoSmithKline, Cipla, Dr. Reddy’s Laboratories, Galderma, Moberg Pharma, and Medimetriks Pharmaceuticals. |

Growing Awareness and Increased Healthcare Expenditure

Increased awareness and education regarding onychomycosis are key drivers that are influencing the Onychomycosis Market. Public health campaigns and educational initiatives by healthcare organizations aim to inform individuals about the symptoms, risks and treatment options that are available for fungal nail infections. As awareness about this grows, more and more patients are likely to seek quick medical advice and treatment, thus expanding the market.

Rising healthcare expenditure across various regions is also positively driving the market. Governments and private sectors are increasingly investing in healthcare infrastructure and services, leading to improved access to treatments for onychomycosis. This increase in funding gives access to better diagnostic tools and treatment options, which in turn, enhance patient outcomes. As healthcare systems evolve all over the world, the market is likely to benefit from increased patient engagement and treatment adherence, boosting growth and development.

Treatment Failure and Drug Resistance

The onychomycosis market does face several challenges that could impede efficient disease control and slow down market development. One such challenge is the high rate of treatment failure. Even with the development of antifungal treatments, numerous patients suffer from incomplete removal of the infection, which results in recurrence. The long recovery period that comes with most treatments further makes patient outcomes worse, as fungal nail infections can take months to resolve in spite of regular treatment.

Another challenge is the increasing prevalence of drug-resistant fungal populations. Chronic and widespread use of antifungal agents has now led to diminished drug efficacy and complications in effective treatment. Such aspects make such drugs risky for elderly patients and immune-compromised patients such as diabetic patients or patients who are undergoing chemotherapy.

Increased Interest in Combination Therapy and Non-Invasive Treatments

Physicians are beginning to prescribe combination therapy for effective treatment of fungal infections, opening up new areas of opportunities for the market. Research and development show that an oral antifungal coupled with topical treatment can work simultaneously and internally at the site of the infection, speeding up recovery and reducing the chances of reinfection. This has proved effective as physicians increasingly recommend combination treatment as first-line therapy for patients. Pharmaceutical companies are currently working on new combination therapies and experimenting with improved formulations in order to yield better outcomes.

On the other hand, alternative non-invasive treatments such as laser therapy and photodynamic therapies are also gaining traction. These therapies have proved to be fast, boosting the healing process than compared to classical oral antifungal medications, thus making these very good options for patients with an intolerance to traditional or strong therapy.

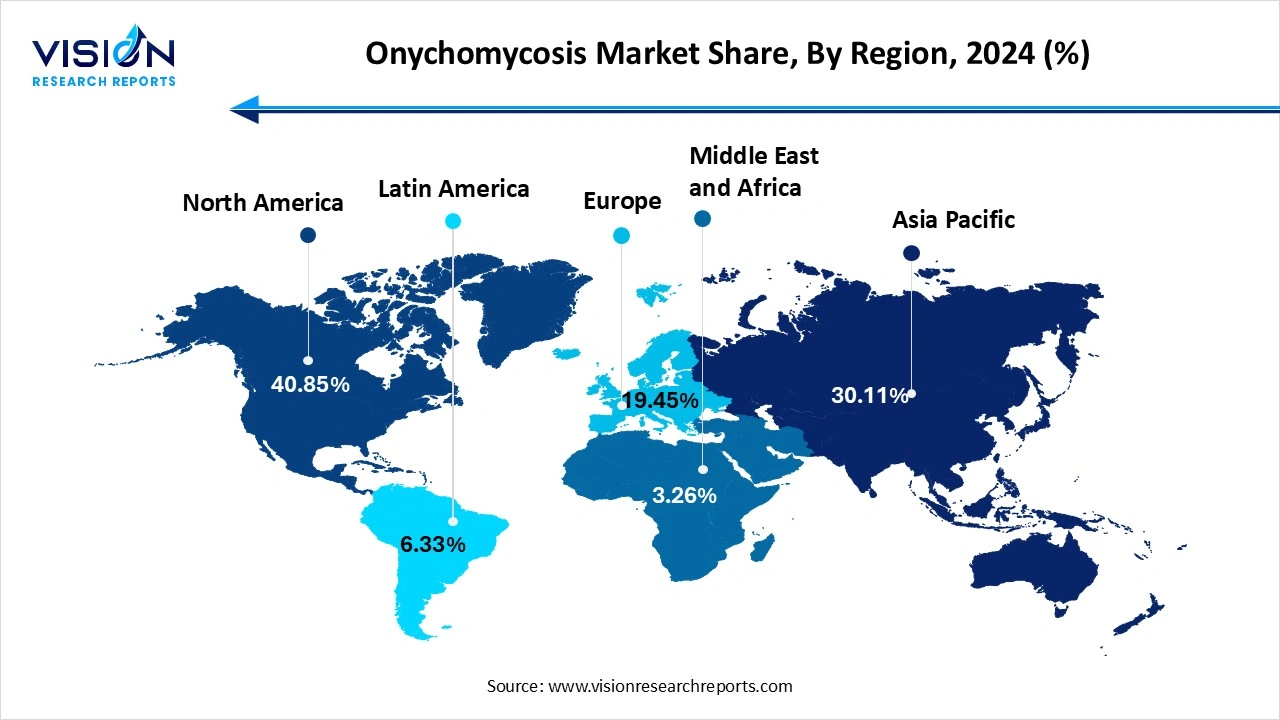

North America dominated the onychomycosis market, accounting for the largest share of 40% in 2024. The high prevalence of fungal infections, greater healthcare awareness, and easy access to advanced treatment options such as laser therapies and combination antifungals have helped position the region as a dominant player. Additionally, the region benefits from a strong healthcare infrastructure, high levels of personal hygiene and widespread use of prescription medications, which contribute to robust market performance in countries like U.S and Canada. The presence of leading pharmaceutical companies and consistent product launches is further driving growth and development in the North American market.

Country Level Analysis

The U.S. led the onychomycosis market in North America in 2024. This dominance is due to its advanced medical research and high adoption of novel therapies. The country’s large diabetic and elderly populations drive the prevalence of nail fungal infections, thus increasing demand for treatments. The country also has access to cutting-edge treatments, including efinaconazole and tavaborole, which helps support market growth. Strong marketing efforts are also being made by companies like Bausch Health to promote awareness and boost product uptake. In addition to that, the region has widespread access to dermatological care and innovative treatment options, such as topical antifungals and laser therapies. All these factors highlight how the country has strategically positioned itself as a key player and competitor in today’s global market.

The Asia Pacific region is expected to witness the fastest growth rate throughout the forecast period. Markets such as China, India, and Japan are witnessing increased demand for affordable antifungal treatments and improved diagnostic accessibility. The tropical climate and high humidity in many parts of Asia also contribute to a higher incidence of fungal infections, further boosting market potential.

Which type segment dominated the market in 2024?

The distal subungual onychomycosis segment led the market, capturing the highest revenue share of 41% in 2024. This type typically occurs when dermatophytes invade the nail bed and the underside of the nail plate, beginning at the distal edge of the nail and progressing proximally. It is most commonly observed in toenails, often linked to trauma, occlusive footwear or poor foot hygiene. The nail may appear thickened, discolored and brittle, with debris accumulating underneath. Due to its frequency and severity, distal subungual onychomycosis drives a substantial portion of treatment demand and has prompted the development of both, systemic and topical antifungal therapies which are tailored for deep penetration.

The white superficial onychomycosis segment is expected to experience the fastest growth rate over the forecast period. In this type, fungal invasion is limited to the superficial layers of the nail plate, resulting in white, chalky spots on the surface. It is generally easier to treat than compared to other forms as the infection does not penetrate that deeply into the nail structure. As awareness grows and diagnostic methods improve, cases of white superficial onychomycosis are being identified more frequently, especially in individuals with compromised immunity or in those who have prolonged exposure to humid environments.

Which treatment held the largest market share?

The topical segment accounted for the highest market share in 2024, contributing 58% of the total revenue. The topical treatment segment holds a significant share in the global onychomycosis market due to its ease of use, minimal systemic side effects, and increasing patient preference for non-invasive therapies. Topical antifungals are often recommended for mild to moderate infections, particularly when the nail matrix is not involved. These treatments are applied directly to the affected nail and surrounding skin, and formulations such as medicated lacquers, creams, and solutions are designed to penetrate the nail plate and target fungal pathogens. With advancements in drug delivery systems, newer topical formulations now offer improved nail penetration and higher efficacy.

The oral segment is anticipated to record the highest CAGR throughout the forecast period. Oral antifungal agents, such as terbinafine and itraconazole, are systemic therapies that work by inhibiting fungal growth from within the body. These medications are typically taken in cycles to minimize side effects while maintaining effectiveness. Oral treatments offer higher cure rates compared to topical options, but they may carry risks of adverse reactions, particularly hepatotoxicity or drug interactions in certain patient groups. As a result, their use often requires monitoring and a prescription from a healthcare professional.

By Type

By Treatment

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Onychomycosis Market

5.1. COVID-19 Landscape: Onychomycosis r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Onychomycosis Market, By Type

8.1. Onychomycosis Market, by Type, 2024-2033

8.1.1. Distal Subungual Onychomycosis

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. White Superficial Onychomycosis

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Proximal Subungual Onychomycosis

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4 Other Types

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Onychomycosis Market, By Treatment

9.1. Onychomycosis Market, by Treatment, 2024-2033

9.1.1. Oral

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Topical

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Treatment (2021-2033)

Chapter 11. Company Profiles

11.1. Bausch Health Companies Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Pfizer Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Novartis AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Johnson & Johnson

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. GlaxoSmithKline plc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Cipla Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Dr. Reddy’s Laboratories Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Galderma S.A.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Moberg Pharma AB

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Medimetriks Pharmaceuticals, Inc.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others