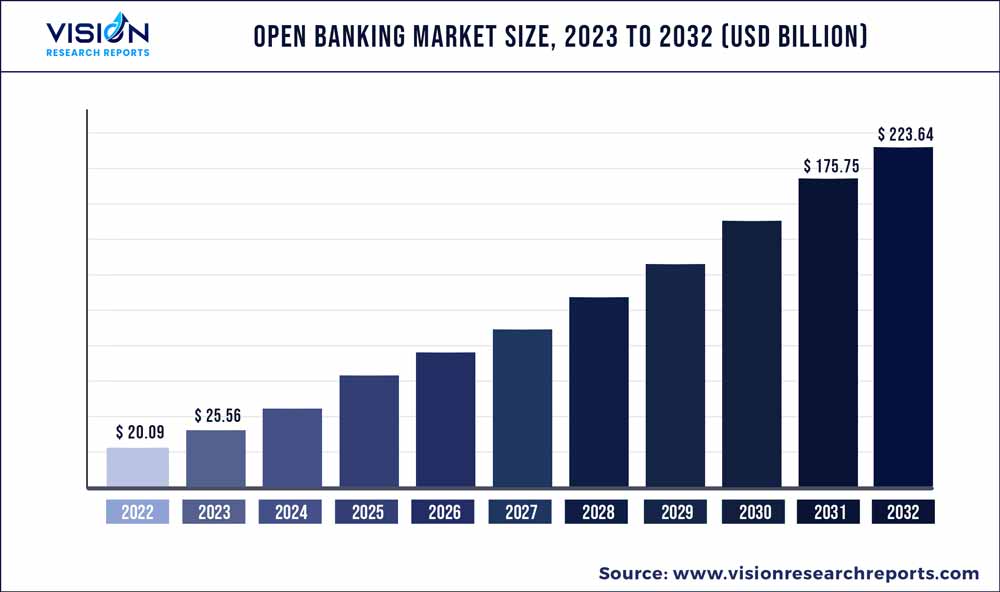

The global open banking market was estimated at USD 20.09 billion in 2022 and it is expected to surpass around USD 223.64 billion by 2032, poised to grow at a CAGR of 27.25% from 2023 to 2032. The open banking market in the United States was accounted for USD 4.5 billion in 2022.

Key Pointers

Report Scope of the Open Banking Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 38% |

| Revenue Forecast by 2032 | USD 223.64 billion |

| Growth Rate from 2023 to 2032 | CAGR of 27.25% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Banco Bilbao Vizcaya Argentaria, S.A.; Crédit Agricole; DemystData, Ltd.; finleap connect; Finastra; FormFree Holdings Corporation; Jack Henry & Associates, Inc.; Mambu.; Mineral Tree, Inc.; NCR Corporation |

The market is expanding due to the growing collaboration partnerships between financial institutions and fintech companies. For instance, in August 2022, FinTech Automation (FTA), a Dallas-based Fintech-as-a-Service platform, announced its partnership with Mastercard. This partnership aimed at developing a network to offer businesses access to technology partners with ease to create and deploy open banking solutions related to lending decision-making and payments at scale. The changing payment ecosystem and the rising adoption of Application Programming Interfaces (APIs), bodes well with the market’s growth.

For instance, according to Visa’s Open Banking Consumer Survey, around 87% of the consumers in the U.S. are using open banking for linking accounts of finance with third parties. However, out of these, only 34% of consumers in the U.S. are aware that these services are enabled by open banking. Furthermore, the growing internet penetration and better broadband connectivity are also anticipated to drive the market’s growth over the forecast period.

The rapid digitization and rising adoption of technologies, including artificial intelligence, machine learning, and big data analytics in the banking industry worldwide, are anticipated to drive the growth of the open banking market. Big data analytics are used in the open banking industry to tailor the services and boost the user experience that is anticipated to attract more customers. Furthermore, the improved security of APIs is another major factor fueling the market's growth. Additionally, the growing e-commerce and online shopping trends worldwide bode well for the growth of the open banking industry.

The growing adoption of open banking has grabbed the attention of venture capital firms driving the investments in open banking market. For instance, in May 2023, Tarabut Gateway, an open banking platform based in MENA, announced that it raised USD 32 million through a Series A funding round led by Pinnacle Capital. With the funding, Tarabut Gateway expanded its footprint across the Kingdom of Saudi Arabia market. Furthermore, the growing strategic initiatives and new product launches by the market players are also expected to fuel the market's growth over the forecast period.

Although the open banking market is anticipated to grow over the forecast period, some of the challenges faced by the market include concerns regarding the growing cyber-attacks and online fraud. Furthermore, as open banking encourages sharing of critical customer information, it also leads to concerns over data security and privacy protection. However, various open banking firms pursue different strategic initiatives to ensure that critical data is shared securely and consensually. Moreover, fintech firms also abided by the regulations drafted by various governments worldwide to govern the terms under which consumers grant access to their data.

Services Insights

The banking & capital markets segment dominated the market in 2022 and accounted for a share of more than 46% of the global revenue. The growing demand for managing finances effectively among millennials is expected to drive the segment’s growth. Shifting the focus of people from traditional investment methods to advanced investment solutions is expected to create lucrative opportunities for the segment. The increasing adoption of advanced AI-enabled platforms that can suggest investment options as per the customer’s need through the integration of algorithms and analytics is expected to propel the segment growth.

The payments segment is anticipated to register the fastest growth over the forecast period. The attributes of the growth are increased internet penetration across the world and a surge in the utilization of various platforms for online payments. Such developments occurred as an opportunity for banks to gain a competitive edge and strengthen their market position by collaborating or partnering with such platform providers. Furthermore, the rise in the launches of payment services by open banking firms also bodes well for the growth of the segment. For instance, in September 2022, PCI Pal, a financial services company, announced the launch of the Pay By Bank open banking solution for contact centers. As a result of this launch, the company enabled merchants to lower the transaction cost, and provide instant refunds along with reduced fraud risk and chargeback cost.

Deployment Insights

In 2022, the on-premise segment dominated the market and registered a share of above 53% of the global revenue. By enabling easy accessibility for customers, the on-premise Open Banking offers a unique method to better serve their needs. Another factor responsible for the segment growth is that the banking and financial companies offer their APIs, which enable third parties and banks to offer cutting-edge services. Additionally, a platform for open banking applications invites users to interact with their financial data in unconventional ways.

The cloud segment is expected to witness the fastest growth over the forecast period. The bank's ability to collect an unprecedented amount of consumer data, analyze it, and provide customized services where they are needed is made possible by cloud deployment services. In addition, cloud technology provides the highest standards of security. Moreover, the cloud enables scalability, flexibility, and real-time processing, which is expected to create new opportunities for segment growth.

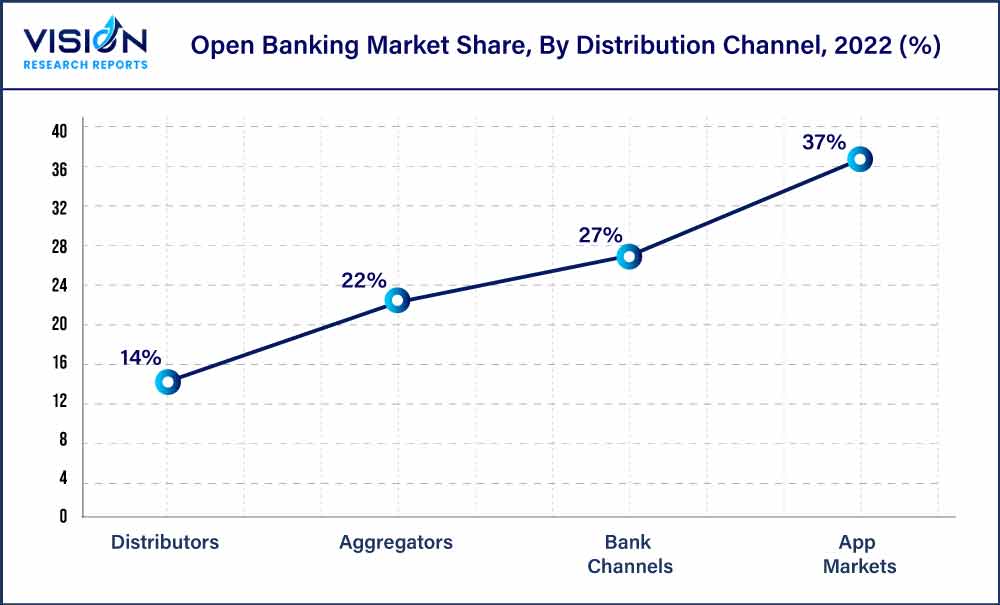

Distribution Channel Insights

The app market segment dominated the market in 2022 and accounted for a share of more than 37% of the global revenue. The dominance can be attributable to the proliferation of smartphones globally. The growing adoption of mobile applications for various purposes such as buying and selling products and services is expected to drive the segment’s growth. Moreover, rising awareness regarding the utilization of banking services through mobile banking also bodes well for the segment’s growth.

The distributor segment is projected to witness the fastest growth over the forecast period. The growth is ascribed to the fact that in a distributor model, banks function purely as service providers or a provider of a product by processing what is eventually sold by a third-party provider. The customer interface is owned in this instance by the third-party provider, which is expected to offer unique opportunities for the segment’s growth. Banks can profit from this by providing funds to third parties under a commission-based business model, allowing customers to obtain services from third parties that a bank would then resell.

Regional Insights

Europe dominated the open banking industry in 2022 and accounted for a share of over 38% of global revenue. The regional market growth can be ascribed to the increasing requirement for improving online payment security in the region. Another aspect promoting market expansion in this region is the government's directives for banking firms to compel the opening of APIs. The presence of numerous prominent players in the region is further expected to fuel the regional market growth.

Asia Pacific is projected to grow at the highest CAGR over the forecast period. The growth of the regional market can be attributed to the growing awareness in countries such as China, India, and Japan, about the benefits offered by open banking systems. The rapid development of digital payment services in the Asia Pacific is also expected to contribute to the growth of the regional market. For instance, in August 2021, an online payment platform Google Pay successfully completed 1 billion transactions in India.

Open Banking Market Segmentations:

By Services

By Deployment

By Distribution Channel

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others