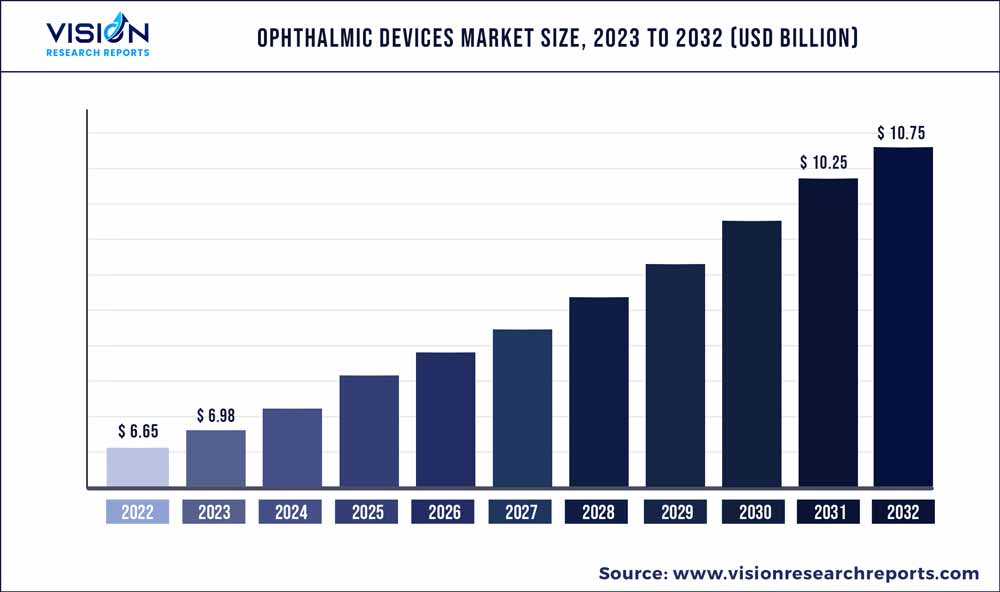

The global ophthalmic devices market was estimated at USD 6.65 billion in 2022 and it is expected to surpass around USD 10.75 billion by 2032, poised to grow at a CAGR of 4.92% from 2023 to 2032. The ophthalmic devices market in the United States was accounted for USD 165.4 million in 2022.

Key Pointers

Report Scope of the Ophthalmic Devices Market

| Report Coverage | Details |

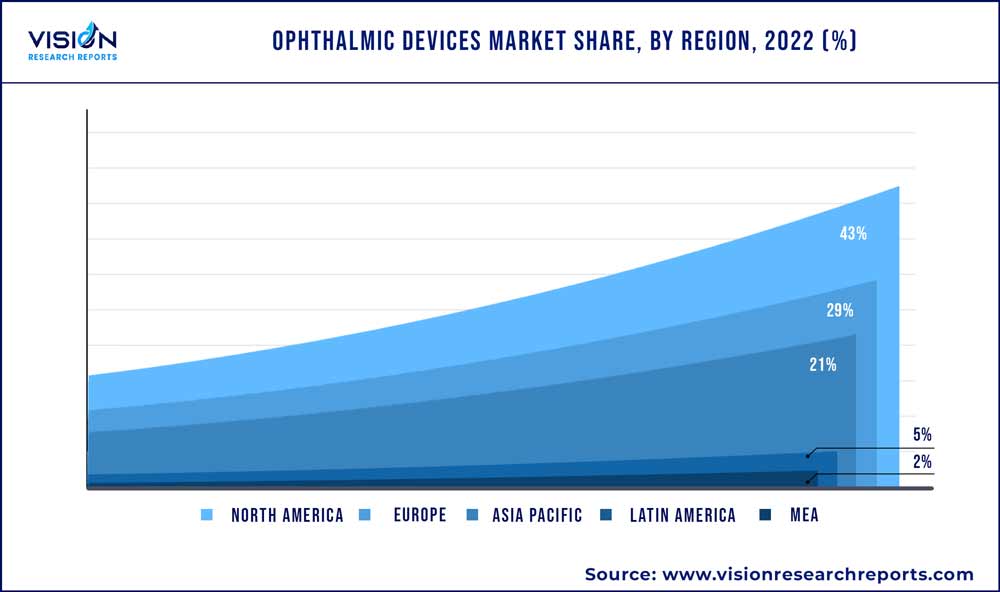

| Revenue Share of North America in 2022 | 43% |

| CAGR of Asia Pacific from 2023 to 2032 | 5.64% |

| Revenue Forecast by 2032 | USD 10.75 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Johnson & Johnson Vision Care; Alcon Vision LLC;Carl Zeiss Meditec AG; Bausch & Lomb Incorporated; Essilor International S.A; Ziemer Ophthalmic Systems Ltd; Nidek Co. Ltd; TOPCON Co.; Haag-Streit Group |

The market growth can be attributed to the rising prevalence of optical disorders such as glaucoma, cataract, diabetic retinopathy, and vitreo retinal disorders, coupled with technological advancements in ophthalmic surgical as well as diagnostic instruments required for these target applications. Improved government initiatives to increase awareness related to visual impairment is further anticipated to widen the base for the market growth.

The growing geriatric population is increasing the demand for ophthalmic devices, as they are more susceptible to age-related ophthalmic disorders. According to the National Institute on Aging (NIA), the geriatric population is expected to reach 72 million by 2030. The increasing prevalence of diabetes and the incidence of diabetes-related blindness are predicted to fuel market growth. According to the World Health Organization, nearly 422 million people worldwide have diabetes, and the majority are living in low- and middle-income countries.

Increased screen time due to the lockdown measures in the COVID-19 pandemic has been associated with the onset and progression of various eye diseases, thus driving the demand for eye examinations. In June 2020, Johnson & Johnson Vision donated USD 320 K to provide eye care to COVID-19 impacted patients. The organization conducted this donation to the Optometry Cares unit of the American Optometric Association (AOA) Foundation and the American Academy of Optometry Foundation (AAOF).

Technological advancements have enabled accurate diagnosis and improved treatment of ophthalmic disorders. Advancements in medications, diagnostic devices, laser technology, and surgical techniques, have enabled improved handling of cataract & macular degeneration, glaucoma, and dry eye disease. Minimally invasive surgeries, such as LASIK surgery, multi-wavelength diabetic retinopathy treatment, ultrasound phacoemulsification, and femtosecond laser surgery are expected to increase the usage of ophthalmic devices. These surgeries are accompanied by better patient outcomes and faster recovery rates.

Many organizations have conducted campaigns and programs to raise awareness for eye health and vision care among the public, optometrists, and ophthalmologists for the diagnosis and treatment of ophthalmic problems. Additionally, several suppliers also offer hands-on training for ophthalmologists and technicians on how to use various ophthalmic equipment through courses, tutorials, and workshops.

Market players are also coming up with advanced products to meet the demand. For instance, in April 2023, Bausch & Lomb announced the launch of ophthalmic viscosurgical devices across the U.S. In March 2023, WaveFront Dynamics Inc. announced the commercial launch of its WaveDyn vision Analyzer. Such initiatives help to increase awareness of eye diseases and the availability of diagnostic equipment.

Product Insights

The optical coherence tomography (OCT) segment dominated the market and accounted for the largest revenue share of more than 24% in 2022 and is also anticipated to exhibit a lucrative CAGR of 5.43% during the forecast period. OCT produces high-resolution cross-sectional and three-dimensional images of biological microstructure and has major application in the diagnosis of diseases such as glaucoma, related Macular Degeneration (AMD), and diabetic eye.

Technological advancements such as the integration of OCT with artificial intelligence (AI) is expected to boost the adoption rate of this device amongst healthcare providers. For instance, in August 2021, Abbott's latest OCT imaging platform, driven by the Ultreon Software, has been approved by the US Food and Drug Administration (FDA). This cutting-edge imaging software combines OCT with artificial intelligence (AI) to give physicians a more complete picture of coronary blood flow and blockages, assisting in decision-making and determining the optimum treatment approach.

The ophthalmoscopes segment is anticipated to witness the fastest growth rate of 5.33% over the forecast period. Ophthalmoscopes are used in the diagnosis of diseases such as CMV retinitis, papilledema, glaucoma, AMD, and diabetic retinopathy. In August 2019, Nidek launched Mirante Scanning Laser Ophthalmoscope. It is a multimodal fundus imaging device, that combines high-resolution SLO (Scanning Laser Ophthalmoscopy) and OCT imaging with ultra-wide field imaging properties. The increasing prevalence and growing demand for accurate and early diagnosis of these diseases are expected to have a positive impact on the market growth.

Application Insights

The cataract segment dominated the market for ophthalmic devices and accounted for the largest revenue share of 42% in 2022 and is expected to witness significant growth during the forecast period. This can be attributed to the high adoption of ophthalmic devices for cataract surgeries. According to the World Health Organization (WHO), cataracts are the leading cause of blindness. Nearly 51% of the total cases of blindness in the world are the result of cataracts.

The refractor disorders segment is anticipated to witness the fastest growth rate over the forecast period. According to the WHO, there are about 2.2 billion people globally who have near or far-distance vision impairment. To treat such disorders and correct refractive errors, ophthalmic devices such as phoropters and retinoscopes are highly preferred. To meet the requirements of the rising patient population, major market players are focused on introducing advanced ophthalmic diagnosis & treatment devices.

End-use Insights

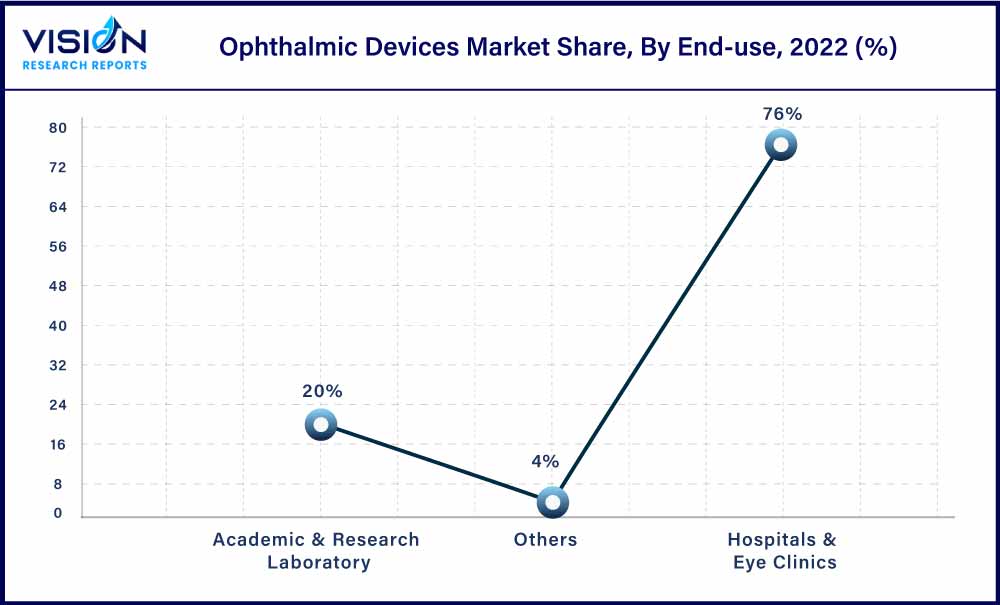

The hospitals & eye clinics segment held the largest share of 76% in the ophthalmic devices market and is expected to continue its dominance over the forecast period. This can be attributed to the increasing adoption of ophthalmic devices in hospitals and low-cost & effective treatment provided in clinics. The increasing mergers and acquisitions between ophthalmic clinics and hospitals are likely to boost the demand for new installations in the coming years.

In October 2021, Dr. Agarwal’s eye facilities merged with Aditya Jyot Eye Hospital, improving the latter’s market footprint within India and across the globe. Moreover, several eye clinics are now coming up with separate diagnostic departments, which in turn, is boosting the adoption of ophthalmic devices. Additionally, the growing number of eye clinics that offer cost-effective treatment is expected to drive the growth of the market during the forecast period.

The market for academic & research laboratories is expected to grow at a significant rate during the forecast period. Academic & research laboratories receive funding for ophthalmic care. For instance, John Hopkins Wilmer Eye Institute, U.S., receives large funding from National Eye Institute to boost ophthalmic research.

Regional Insights

In 2022, North America held a substantial share of 43% of the market. The rapidly growing geriatric population and the rising prevalence of chronic eye conditions because of high stress and unhealthy lifestyles resulting in diabetic retinopathy are considered as high impact rendering drivers for the industry. Additionally, the incorporation of new reimbursement models for ophthalmologic treatment and a stringent regulatory framework aimed at patients’ safety, is expected to drive the demand for ophthalmic devices in this region.

The Asia Pacific market is anticipated to grow at the fastest CAGR of 5.64% over the forecast period owing to the rapidly improving healthcare infrastructure, rising prevalence of eye disorders such as glaucoma, and increasing awareness of patients towards it. The growth can be attributed to the increasing outsourcing activities for ophthalmology devices by key industry players, such as Alcon, Inc. Moreover, the increasing awareness pertaining to advanced corrective vision treatments is a key growth driving factor for emerging economies such as China and India.

Ophthalmic Devices Market Segmentations:

By Product

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ophthalmic Devices Market

5.1. COVID-19 Landscape: Ophthalmic Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ophthalmic Devices Market, By Product

8.1. Ophthalmic Devices Market, by Product, 2023-2032

8.1.1 Optical Coherence Tomography Scanners

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Fundus Cameras

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Perimeters/Visual Field Analysers

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Autorefractors and Keratometers

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Ophthalmic Ultrasound Imaging Systems

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Tonometers

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Slit Lamps

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Phoropters

8.1.8.1. Market Revenue and Forecast (2020-2032)

8.1.9. Wavefront Aberrometers

8.1.9.1. Market Revenue and Forecast (2020-2032)

8.1.10. Optical Biometry Systems

8.1.10.1. Market Revenue and Forecast (2020-2032)

8.1.11. Ophthalmoscopes

8.1.11.1. Market Revenue and Forecast (2020-2032)

8.1.12. Lensmeters

8.1.12.1. Market Revenue and Forecast (2020-2032)

8.1.13. Corneal Topography Systems

8.1.13.1. Market Revenue and Forecast (2020-2032)

8.1.14. Specular Microscopes

8.1.14.1. Market Revenue and Forecast (2020-2032)

8.1.15. Retinoscopes

8.1.15.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Ophthalmic Devices Market, By

9.1. Ophthalmic Devices Market, by Application, 2023-2032

9.1.1. Cataract

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Vitreo Retinal Disorders

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Glaucoma

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Refractor Disorders

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Ophthalmic Devices Market, By End-use

10.1. Ophthalmic Devices Market, by End-use, 2023-2032

10.1.1. Hospitals & Eye Clinics

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Academic & Research Laboratory

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Ophthalmic Devices Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Johnson & Johnson Vision Care

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Alcon Vision LLC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Carl Zeiss Meditec AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Bausch & Lomb Incorporated

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Essilor International S.A

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Ziemer Ophthalmic Systems Ltd

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Nidek Co. Ltd

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. TOPCON Co.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Haag-Streit Group

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others