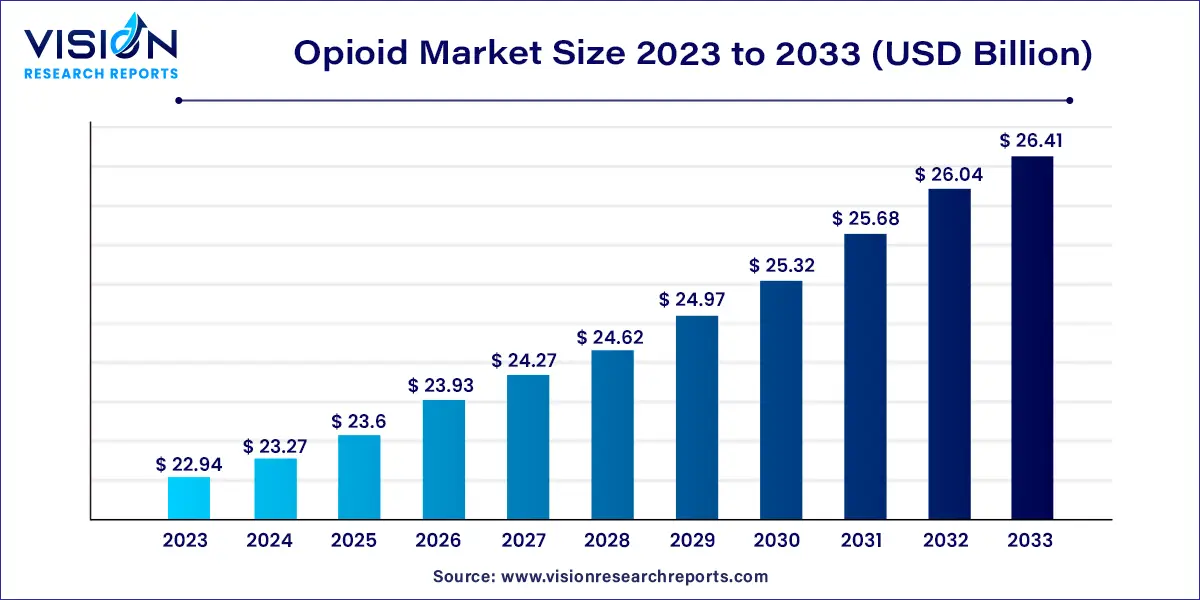

The global opioid market was estimated at USD 22.94 billion in 2023 and it is expected to surpass around USD 26.41 billion by 2033, poised to grow at a CAGR of 1.42% from 2024 to 2033.

The global opioid market stands at a crossroads, representing both immense medical potential and profound societal challenges. Opioids, a class of potent drugs derived from opium, have historically been invaluable in managing pain, especially in cases of severe injury, surgery, or chronic conditions like cancer. However, the market has been marred by a surge in addiction, overdoses, and associated social problems, leading to intense scrutiny and calls for stringent regulation.

The opioid market's growth is underpinned by several key factors. Firstly, the rising prevalence of chronic diseases and surgeries necessitates effective pain management solutions, where opioids play a pivotal role. Additionally, the expanding geriatric population, often plagued by pain-related conditions, contributes significantly to market expansion. Furthermore, ongoing research and development initiatives focusing on the formulation of safer, more controlled opioid medications drive innovation and market growth. The increasing awareness among healthcare professionals about proper opioid administration and patient education also fosters market expansion, ensuring responsible use. Lastly, the market benefits from strategic collaborations between pharmaceutical companies and healthcare providers, enhancing distribution networks and accessibility.

| Report Coverage | Details |

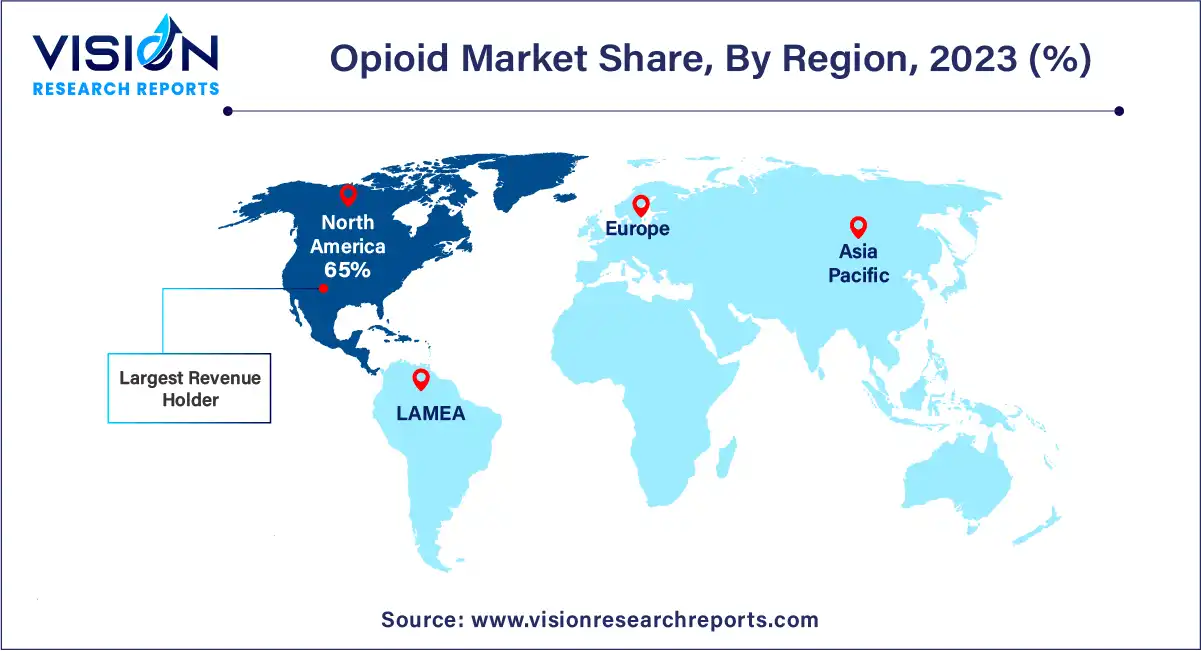

| Revenue Share of North America in 2023 | 65% |

| CAGR of Asia Pacific from 2024 to 2033 | 5.58% |

| Revenue Forecast by 2033 | USD 26.41 billion |

| Growth Rate from 2024 to 2033 | CAGR of 1.42% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The ER/long-acting opioids segment accounted for the largest revenue share of 56% in 2023 and is expected to grow at the fastest CAGR of 1.73% during the forecast period. Long-acting opioids, often in the form of patches or extended-release tablets, provide a controlled and sustained release of the medication over an extended period. This characteristic makes them suitable for chronic pain management, offering patients a more consistent pain relief experience and reducing the frequency of dosing. Such formulations are particularly valuable in conditions requiring continuous pain control, such as cancer or severe back pain, enhancing patient compliance and overall quality of life.

Conversely, Short-Acting Opioids, or Immediate-Release opioids, are designed for rapid pain relief and are often used in acute situations or for breakthrough pain in chronic conditions. They provide quick relief but necessitate more frequent dosing due to their short duration of action. Short-acting opioids are valuable in post-surgical recovery, trauma situations, or during episodes of severe pain. Physicians often prescribe them alongside long-acting opioids to manage sudden, intense pain episodes effectively.

The pain relief segment accounted for the biggest revenue share of 68% in 2023. In pain relief, opioids are indispensable, especially in the management of moderate to severe pain arising from various conditions such as surgery, injury, cancer, and chronic diseases. Opioids act on the body's pain receptors, altering the perception of pain and providing much-needed relief to patients experiencing intense discomfort. Their effectiveness in pain management is unparalleled, making them invaluable tools for healthcare providers striving to enhance their patients' quality of life.

The anesthesia segment is expected to grow at the fastest CAGR of 2.06% during forecast period. Opioids have a vital application in anesthesia, particularly in the induction and maintenance of anesthesia during surgical procedures. By interacting with the central nervous system, opioids produce a state of analgesia, sedation, and euphoria, ensuring that patients do not experience pain or discomfort during surgeries. This is especially crucial in complex and invasive surgeries where the absence of pain perception is vital for both the patient's well-being and the surgical team's precision.

The injectable segment has contributed more than 56% of revenue share in 2023. Injectable opioids are administered directly into the bloodstream, ensuring rapid onset and efficacy. This method is commonly employed in acute medical settings, such as hospitals and emergency rooms, where immediate pain relief is critical. Injectable opioids are invaluable during surgical procedures and in situations where swift pain management is essential, such as trauma cases. Medical professionals can precisely control the dosage, making it an efficient choice for severe pain episodes and post-operative recovery.

The oral segment is expected to register at a CAGR of 2.16% over the forecast period. On the other hand, the oral route of administration involves delivering opioids in the form of tablets, capsules, or liquid solutions. This method offers convenience and flexibility, enabling patients to maintain a consistent pain management routine in the comfort of their homes. Oral opioids are commonly used in treating cancer-related pain, arthritis, and other long-term pain conditions. However, their onset of action is comparatively slower than injectable opioids, making them more suitable for persistent, non-acute pain situations.

The retail pharmacy segment registered more than 59% of revenue share in 2023 and is also expected to grow at the fastest CAGR of 1.73%. Hospital pharmacies, situated within healthcare institutions, are integral in managing acute and severe pain cases. In hospitals, opioids are administered under strict medical supervision, ensuring accurate dosage and immediate response to any adverse reactions. Hospital pharmacists work closely with healthcare providers to prepare and administer opioids as part of pain management protocols, especially in post-surgical recovery, trauma cases, and during cancer treatments. The controlled environment of hospital pharmacies allows for rigorous monitoring, minimizing the risks associated with opioid usage.

Retail pharmacies act as accessible hubs for patients to obtain prescribed opioids for pain management. These pharmacies, both brick-and-mortar establishments and online platforms, are vital for patients with chronic pain conditions. They offer convenience, enabling individuals to pick up their prescriptions and have them filled promptly. Pharmacists in these settings play a pivotal role, providing essential counseling to patients regarding proper usage, potential side effects, and the importance of adherence to prescribed dosages. Retail pharmacies are especially crucial for patients dealing with long-term pain, enabling them to maintain their treatment regimens without the need for frequent hospital visits.

North America held the biggest revenue share of 65% in 2023. In North America, particularly the United States, there has been heightened scrutiny due to the opioid epidemic. The region has witnessed stringent regulations and increased public awareness campaigns to curb opioid misuse and addiction. These initiatives have led to a shift in prescribing practices and an emphasis on alternative pain management methods. In contrast, Europe has implemented diverse strategies across its countries, with some nations adopting harm reduction approaches, including supervised injection sites and opioid substitution therapies.

Asia Pacific is expected to grow at the fastest CAGR of 5.57% during the forecast period. In Asia, the opioid market presents unique challenges and opportunities. While some Asian countries face significant issues related to illicit opioid trade and addiction, others, particularly in the Middle East, have stringent anti-drug policies, resulting in severe penalties for offenders. In recent years, there has been a growing focus on improving access to pain management in these regions, driven by the increasing prevalence of cancer and chronic diseases.

By Product

By Application

By Route of Administration

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Opioid Market

5.1. COVID-19 Landscape: Opioid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Opioid Market, By Product

8.1. Opioid Market, by Product, 2024-2033

8.1.1. IR/Short Acting Opioids

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. ER/Long-Acting Opioids

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Opioid Market, By Application

9.1. Opioid Market, by Application, 2024-2033

9.1.1. Pain relief

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Anesthesia

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cough Suppression

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Diarrhea Suppression

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. De-addiction

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Opioid Market, By Route of Administration

10.1. Opioid Market, by Route of Administration, 2024-2033

10.1.1. Oral

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Injectable

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Opioid Market, By Distribution Channel

11.1. Opioid Market, by Distribution Channel, 2024-2033

11.1.1. Hospital Pharmacy

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Retail Pharmacy

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Opioid Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Purdue Pharma L.P.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Johnson & Johnson Services, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Hikma Pharmaceuticals PLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Pfizer, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. AbbVie Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Sanofi

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Sun Pharmaceutical Industries Ltd

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Grünenthal

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others