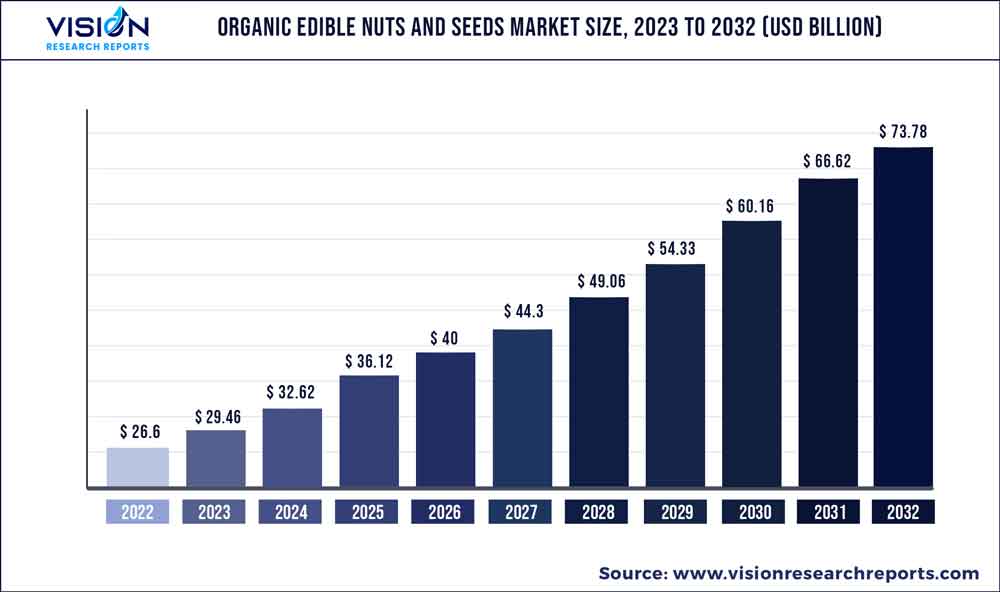

The global organic edible nuts and seeds market was valued at USD 26.6 billion in 2022 and it is predicted to surpass around USD 73.78 billion by 2032 with a CAGR of 10.74% from 2023 to 2032. By product segment, the organic edible nuts and seeds market in the United States was accounted for USD 5.6 billion in 2022.

Key Pointers

Report Scope of the Organic Edible Nuts And Seeds Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 51.75% |

| CAGR of Asia Pacific | 12.42% |

| Revenue Forecast by 2032 | USD 73.78 billion |

| Growth rate from 2023 to 2032 | CAGR of 10.74% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Olam Group; ADM; JIVA ORGANICS; NUTSCO; Big Tree Organic Farms; Left Coast Naturals (Ike Enterprises Inc); Bermar Fruits; U-RAAW!; Cashew Coast; BAUGHER RANCH ORGANICS |

Organic nuts and seeds are cultivated in a certified organic environment, right from the sourcing of raw materials. The nuts are completely free from any artificial additives/ingredients and trace amounts of chemical fertilizers.

Key companies offering organic nuts and nutmeal products include HBS Natural Choice; Tierra Farm; and Sun Organic Farm. Furthermore, due to the increasing internet penetration, the online market for the purchase of such food products has seen rapid growth globally in the last few years. This has attracted a few major retailers, including Amazon; Walmart; and Carrefour, who are capitalizing on increasing e-retailing growth in the online organic edible nuts and seeds industry. Organic edible nuts & seeds are produced in various parts of the world and then supplied to vendors and processors.

For instance, the U.S. is the largest producer of almonds, followed by Spain, Morocco, Turkey, Australia, and Italy. Similarly, Vietnam is the largest producer of cashews in the world, which exported an estimated 450,000 tons of cashew kernels, according to the Vietnam Cashew Association, in November 2020. Various companies export organic certified edible nuts and seeds to distributors and food manufacturers for further applications and to retailers as well. Companies such as SCHLÜTER UND MAACK; MWT Foods; and Olam International Limited have obtained global organic certifications to offer organic edible nuts and seeds across the globe.

In the retail market, various brands offer organic edible nuts & seeds and consumers can choose from a wide range of private-labeled products available in the market. Supermarkets & hypermarkets, grocery stores, and convenience stores, as well as online distribution, are the key retail channels in the organic edible nuts & seeds industry. Among these, supermarkets & hypermarkets account for a large share of the market as they are the most convenient retail channel for consumers.

Moreover, e-commerce has been growing significantly in the industry. To sustain the competition in the market, distributors & retailers are adopting various strategies, including forming alliances with e-commerce retailers to sell products in various countries. This helps them enter new markets and expand their product portfolios and service offerings.

Distribution Channel Insights

The B2B distribution channel is expected to hold a market share of 51.74% of the market in 2022. Aggressive investments by private equity and venture capital firms in B2B payments are creating new growth opportunities for key players in the market. For instance, in January 2022, Rupifi, an India-based B2B payment application provider, raised USD 25 million in a series-A round of funding, led by Tiger Global Management, LLC and Bessemer Venture Partners.

The B2C segment is expected to accelerate at a CAGR of 11.63% during the forecast period. The increasing share of mobile payments in the e-commerce industry is providing momentum to the abovementioned segment. According to a study conducted by SalesForce, in June 2022, mobile consumers account for 60% of the world’s total e-commerce traffic. Furthermore, the increasing adoption of digital wallets across the globe is expected to drive the B2C segment growth over the forecast period.

Regional Insights

The North America dominated the market with a share of over 51.75% in 2022. The growing inclusion of nuts and seeds in people’s diets across North America is expected to drive the market. Additionally, the growing trend to lower fat from one's diet is augmenting the consumption of organic nuts in North America. According to an article published in Deals on Health, in January 2022, organic food sales made up 5.8% of all U.S. food sales. Such data represents a positive outlook for the market in the years to come. Furthermore, production methods and safety aspects continue to influence purchase decisions. Hence, manufacturers remain on guard to label products to attract more consumers.

Asia Pacific is poised to register the fastest CAGR of about 12.42% during the forecast period. Growing concerns about the impact of conventional farming on biodiversity and the environment, as well as the ethical treatment of cattle, are among the key factors driving the shift toward organic foods. National Organic Program (NOP) in China ensures that organic food industry in the country abides by USDA standards and this is leading to an increase in market size and product scope. This has also led to increased prices and taxes on the same. However, the increasing willingness to pay more for premium organic products is likely to drive key manufacturers to launch new products in the market, thereby supporting market growth.

Organic Edible Nuts And Seeds Market Segmentations:

By Product

By Distribution Channel

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others