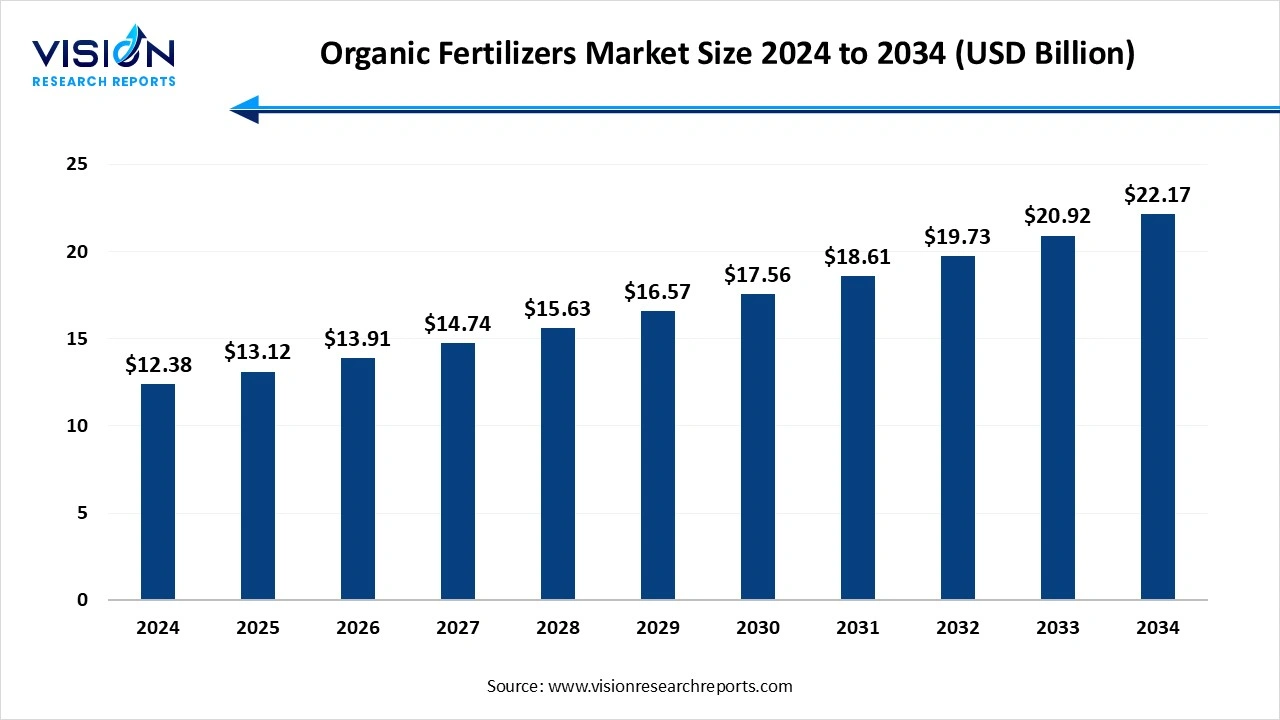

The global organic fertilizers market size evaluated for USD 12.38 billion in 2024, is projected to reach USD 13.12 billion in 2025 and hit USD 22.17 billion by 2034, growing at a CAGR of 6% from 2025 to 2034. The market is driven by rising demand for sustainable farming, health-conscious consumers, supportive government policies, and technological advances in organic fertilizer production. Expansion of organic farming and focus on soil health and crop yield further boost growth.

The global organic fertilizers market is witnessing significant growth, driven by increasing awareness about sustainable agriculture and environmental protection. Rising concerns over soil degradation, chemical residue, and food safety are pushing farmers and agribusinesses to adopt organic fertilizers as a safer and eco-friendly alternative to conventional chemical fertilizers. These fertilizers, derived from natural sources such as compost, manure, and bio-based materials, improve soil fertility and enhance crop yield while maintaining ecological balance.

Additionally, supportive government initiatives, regulatory frameworks promoting organic farming, and growing consumer demand for organic food products are fueling market expansion. The market is also seeing innovation in product formulations, including liquid organic fertilizers and bio-stimulants, catering to diverse crop requirements and improving nutrient efficiency. With increasing investment in sustainable farming practices and rising global demand for organic produce, the organic fertilizers market is poised for robust growth over the coming years.

The organic fertilizers market is experiencing a surge in growth due to several key factors. Firstly, heightened environmental awareness among consumers and farmers alike has driven a shift towards sustainable agricultural practices. Concerns regarding soil degradation, water pollution, and biodiversity loss associated with chemical fertilizers have prompted increased adoption of organic alternatives. Moreover, rising health consciousness among consumers has fueled demand for organically grown produce, further bolstering the market for organic fertilizers. Additionally, supportive government policies and subsidies aimed at promoting organic farming practices have provided a conducive environment for market growth. These factors combined are propelling the organic fertilizers market forward, with ample opportunities for expansion and innovation.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.38 billion |

| Revenue Forecast by 2034 | USD 22.17 billion |

| Growth rate from 2025 to 2034 | CAGR of 6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

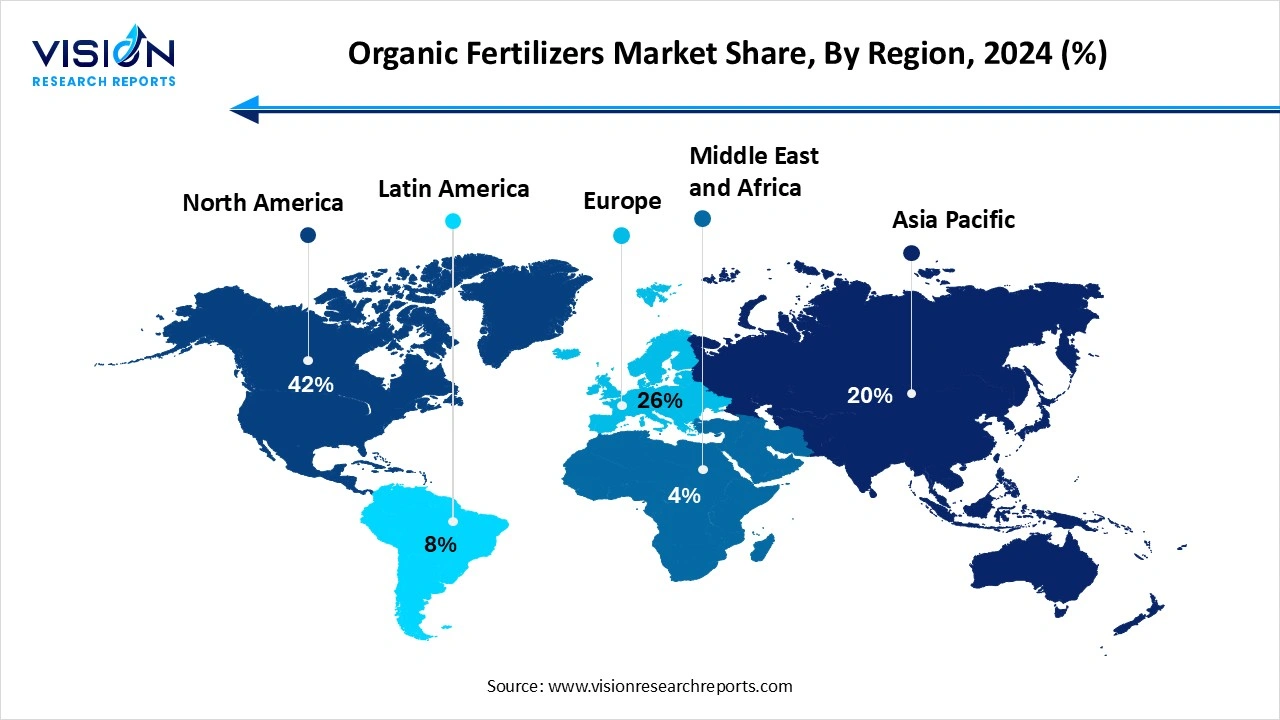

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | PT Pupuk Kalimantan Timur, Lallemand Inc., T Stanes & Company Limited, Madras Fertilizers Limited, Cropmate Fertilizers Sdn Bhd, Midwestern BioAg, Biostar Renewables, LLC, NatureSafe, Biolchim Spa, Rizobacter Argentina S.A., National Fertilizers Limited, Gujarat State Fertilizers & Chemicals Ltd., String Bio, Rashtriya Chemicals & Fertilizers Ltd, Agrinos, Biomax Naturals, and Symborg (Corteva Agriscience). |

In Asia Pacific, the organic fertilizers market emerged as the dominant force in the industry, commanding a significant revenue share of 42% in 2024. This dominance is attributed to the increasing awareness among farmers regarding the benefits of bio-based and organic residue-based fertilizers.

The organic fertilizers market in North America is poised to experience substantial demand for products, driven by growing awareness of the adverse environmental effects associated with chemical fertilizers. The United States Department of Agriculture (USDA) plays a pivotal role in advocating for the adoption of organic fertilizers within the region.

China stands out as the largest manufacturer and consumer of organic fertilizers, supported by the presence of both large-scale and small-scale manufacturers. Furthermore, escalating investments in bio-fertilizers are driving their production within the country. For instance, in August 2023, Biolchim SPA, a prominent organic fertilizer company based in Italy, announced a collaboration with a Chinese company to establish a new manufacturing plant for organic products. This plant is anticipated to commence operations by 2025, further boosting the organic fertilizers market in China

The animal-based product segment held the market's dominance in 2024, accounting for 58% of the revenue share. This was primarily attributed to its rich source of readily available nitrogen. Animal-based products are derived from residues of animal slaughter, such as bone and blood meal, along with animal manure. These products boast high nitrogen content, making them particularly suitable for leafy plants. Examples of animal-based products include milk, urea (urine), and fish emulsion.

On the other hand, mineral-based products serve to enrich the soil with essential nutrients and maintain optimal pH levels conducive to plant growth. Some common mineral-based products include calcium and Epsom salt.

Plant-based products, derived from agricultural residues and by-products, offer another avenue for soil enrichment. Examples include cottonseed meal, cover crop, compost tea, seaweed, kelp, and green manure. These products perform most effectively in soils that are biologically active and regularly nourished with compost, cover crops, and decomposing mulch.

The cereals & grains application segment emerged as the market leader in 2024, capturing the highest revenue share of 44%. This dominance is particularly notable in North America and Asia Pacific, where the cultivation of wheat and corn, especially in countries like China and the U.S., is extensive. Projections from the Organisation for Economic Co-operation and Development (OECD) indicate a substantial increase in global cereal production by 2032, primarily driven by maize and rice cultivation. This anticipated growth is poised to further fuel the demand for the product. The rising consumption of various cereals and grains, including rice, corn, wheat, oats, sorghum, and barley across different regions, also contributes significantly to the demand.

Furthermore, the increasing emphasis on fruit and vegetable cultivation among farmers is anticipated to propel market growth. According to a report by the Ministry of Agriculture & Farmers Welfare of India, fruit and vegetable production in the country reached 108.34 million tons in 2022-23, showing a slight increase from the previous years. This upward trend in fruit and vegetable production, particularly in economies with agriculture-centric sectors, is expected to drive the demand for the product even further.

The dry form segment asserted its dominance in the market in 2024, capturing a substantial revenue share of 69%. This was attributed to several factors, including the long shelf life and ease of storage and transportation offered by dry products. Additionally, dry formulations facilitate gradual nutrient absorption by plants, thereby mitigating the risk of nutrient burn or leaching. Over time, these products also contribute to soil improvement by enhancing its structure and drainage, thanks to their organic matter content.

In contrast, liquid formulations of the product are applied with precision through various methods such as foliar spraying and drip irrigation, supporting the adoption of precision farming techniques. The efficiency and effectiveness of liquid applications are further enhanced through the integration of digital technologies, including precision agriculture tools and data analytics.

While dry products are generally more cost-effective compared to their liquid counterparts, they typically require larger quantities as plants do not absorb them entirely. Despite this difference in application, both forms of the product play vital roles in modern agricultural practices, catering to diverse needs and preferences within the industry.

By Source

By Form

By Crop Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Organic Fertilizers Market

5.1. COVID-19 Landscape: Organic Fertilizers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Organic Fertilizers Market, By Source

8.1. Organic Fertilizers Market, by Source,

8.1.1 Plant

8.1.1.1. Market Revenue and Forecast

8.1.2. Animal

8.1.2.1. Market Revenue and Forecast

8.1.3. Mineral

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Organic Fertilizers Market, By Form

9.1. Organic Fertilizers Market, by Form,

9.1.1. Dry

9.1.1.1. Market Revenue and Forecast

9.1.2. Liquid

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Organic Fertilizers Market, By Crop Type

10.1. Organic Fertilizers Market, by Crop Type,

10.1.1. Cereals & Grains

10.1.1.1. Market Revenue and Forecast

10.1.2. Oilseed & Pulses

10.1.2.1. Market Revenue and Forecast

10.1.3. Fruits & Vegetables

10.1.3.1. Market Revenue and Forecast

10.1.4. Others Crops

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Organic Fertilizers Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Source

11.1.2. Market Revenue and Forecast, by Form

11.1.3. Market Revenue and Forecast, by Crop Type

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Source

11.1.4.2. Market Revenue and Forecast, by Form

11.1.4.3. Market Revenue and Forecast, by Crop Type

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Source

11.1.5.2. Market Revenue and Forecast, by Form

11.1.5.3. Market Revenue and Forecast, by Crop Type

11.2. Europe

11.2.1. Market Revenue and Forecast, by Source

11.2.2. Market Revenue and Forecast, by Form

11.2.3. Market Revenue and Forecast, by Crop Type

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Source

11.2.4.2. Market Revenue and Forecast, by Form

11.2.4.3. Market Revenue and Forecast, by Crop Type

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Source

11.2.5.2. Market Revenue and Forecast, by Form

11.2.5.3. Market Revenue and Forecast, by Crop Type

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Source

11.2.6.2. Market Revenue and Forecast, by Form

11.2.6.3. Market Revenue and Forecast, by Crop Type

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Source

11.2.7.2. Market Revenue and Forecast, by Form

11.2.7.3. Market Revenue and Forecast, by Crop Type

11.3. APAC

11.3.1. Market Revenue and Forecast, by Source

11.3.2. Market Revenue and Forecast, by Form

11.3.3. Market Revenue and Forecast, by Crop Type

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Source

11.3.4.2. Market Revenue and Forecast, by Form

11.3.4.3. Market Revenue and Forecast, by Crop Type

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Source

11.3.5.2. Market Revenue and Forecast, by Form

11.3.5.3. Market Revenue and Forecast, by Crop Type

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Source

11.3.6.2. Market Revenue and Forecast, by Form

11.3.6.3. Market Revenue and Forecast, by Crop Type

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Source

11.3.7.2. Market Revenue and Forecast, by Form

11.3.7.3. Market Revenue and Forecast, by Crop Type

11.4. MEA

11.4.1. Market Revenue and Forecast, by Source

11.4.2. Market Revenue and Forecast, by Form

11.4.3. Market Revenue and Forecast, by Crop Type

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Source

11.4.4.2. Market Revenue and Forecast, by Form

11.4.4.3. Market Revenue and Forecast, by Crop Type

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Source

11.4.5.2. Market Revenue and Forecast, by Form

11.4.5.3. Market Revenue and Forecast, by Crop Type

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Source

11.4.6.2. Market Revenue and Forecast, by Form

11.4.6.3. Market Revenue and Forecast, by Crop Type

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Source

11.4.7.2. Market Revenue and Forecast, by Form

11.4.7.3. Market Revenue and Forecast, by Crop Type

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Source

11.5.2. Market Revenue and Forecast, by Form

11.5.3. Market Revenue and Forecast, by Crop Type

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Source

11.5.4.2. Market Revenue and Forecast, by Form

11.5.4.3. Market Revenue and Forecast, by Crop Type

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Source

11.5.5.2. Market Revenue and Forecast, by Form

11.5.5.3. Market Revenue and Forecast, by Crop Type

Chapter 12. Company Profiles

12.1. PT Pupuk Kalimantan Timur.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Lallemand Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. T Stanes & Company Limited.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Madras Fertilizers Limited.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cropmate Fertilizers Sdn Bhd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Midwestern BioAg

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Biostar Renewables, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. NatureSafe

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Biolchim Spa.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Rizobacter Argentina S.A.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others