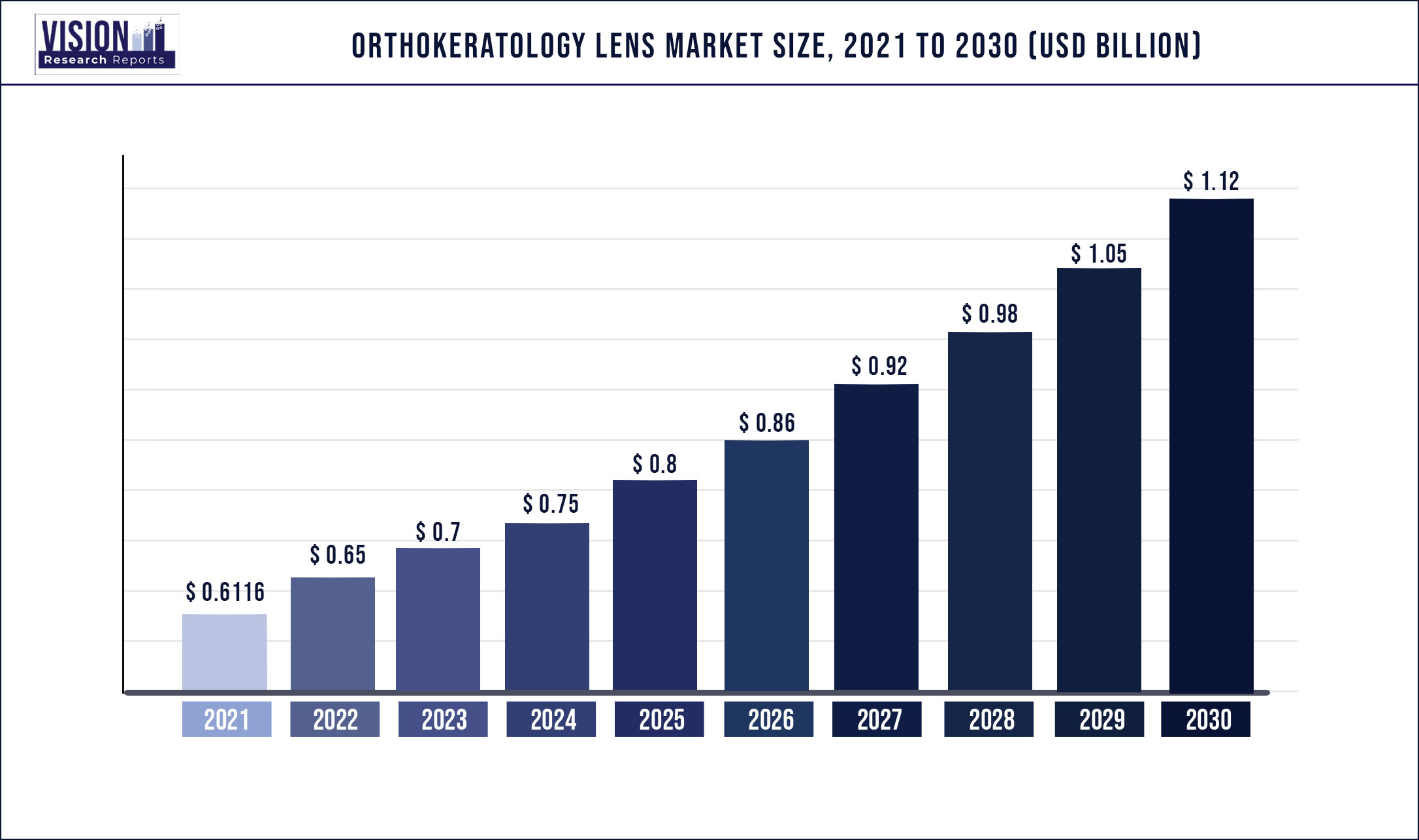

The global orthokeratology lens market size was estimated at around USD 611.6 million in 2021 and it is projected to hit around USD 1.12 billion by 2030, growing at a CAGR of 6.95% from 2022 to 2030.

Report Highlights

Increasing efforts by key manufacturers in the market to launch new products and get regulatory approvals is the key factor driving the market growth. In addition, the ever-growing burden of patients with refractive errors is also majorly contributing to the growth of the market. For instance, according to a recent study published by The International Myopia Institute in 2022, an estimated 30% of the world’s population is myopic and by 2050, almost 50% of the population will be myopic. The outbreak of the COVID-19 pandemic had a negative impact on the market.

The drop in sales of orthokeratology was due to reduced patient visits to the hospitals and clinics to comply with the restrictions and guidelines laid down by the governments to curb the spread of the virus. Moreover, the country-wise lockdowns resulted in the disruption of demand and supply chain, which negatively impacted the market growth. However, with the outbreak of the pandemic, a major shift has been observed where a large number of people are now more prone to develop refractive errors. The shift toward online school and a large number of companies opting for work-from-home is expected to increase the overall screen time of individuals, thereby contributing to the rise in refractive errors. Thus, it can be anticipated that over the forecast years, the market will undergo significant growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 611.6 million |

| Revenue Forecast by 2030 | USD 1.12 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.95% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product type, indication, distributionchannel,region |

| Companies Covered | Bausch & Lomb Inc.; Euclid Systems Corp.; CooperVision; Johnson & Johnson Vision Care, Inc.; Alpha Corporation (Menicon Group); Brighten Optix, Co.; GP Specialists; TruForm Optics, Inc.; Art Optical Contact Lens, Inc.; MiracLens L.L.C. |

Product Type Insights

Based on product types, the global market has been further classified into overnight ortho-K-lens and day-time ortho-K-lens. The overnight ortho-K-lenses product type segment dominated the global market and accounted for the maximum share of more than 94.1%.00 of the overall revenue in 2021. This growth was attributed to the high adoption rates and effectiveness of overnight ortho-K-lens. Overnight ortho-K-lens significantly reduce any discomfort patients may have experienced while using conventional contact lenses. Overnight ortho-K-lens can bring ease of use to those who dislike wearing contact lenses or glasses during the day or contribute and participate in sports.

Thus, various advantages associated with overnight ortho-K-lens are projected to augment the segment growth. Increasing FDA approvals of orthokeratology lenses for the treatment of refractive disorders along with lens design advancements are projected to fuel the market growth. For instance, in May 2021, the U.S. FDA approved the first ortho-k lens for the treatment of myopia. The daytime ortho-K-lens segment held a substantial market share in 2021. As daytime ortho-K-lens are not considered the most comfortable lenses and are normally worn at night. If an individual wears daytime ortho-K-lens, they might have symptoms of dry eye. Thus, side effects associated with these lenses may hamper the market progression.

Indication Insights

On the basis of indications, the global market is segmented into myopia, presbyopia, hypermetropia, astigmatism, and others. Myopia segment held around 40.05% market share in 2021. The rising prevalence of myopia is projected to favor the orthokeratology lenses market in the study period. For instance, according to the Investigative Ophthalmology and Visual Science journal around 1.9 billion people, i.e., nearly 27.08% of the world’s population were suffering from myopia. Myopia can incur significant ocular-related morbidity and substantial healthcare costs. The incidence of myopia is expected to grow even further during the forecast period. Myopia will be one of the leading cause of permanent blindness globally during the forecast period.

Orthokeratology lenses are majorly preferred among children, as the prevalence of myopia is greater in children. Orthokeratology lens helps in slowing down the myopia progression, specifically among youngsters, augmenting the segment growth. As per the WHO, the percentage of people suffering from myopia is expected to reach 52.13% by 2050. The astigmatism segment held a considerable market share in 2021. The increasing prevalence of astigmatism is anticipated to surge the demand for orthokeratology lenses. According to The American Optometric Association, in astigmatism, people prefer corrective eyeglasses to improve their vision rather than surgery. Moreover, each year, 1 in every 3 persons in the U.S. is suffering from astigmatism, which is expected to increase in the near future.

Distribution Channel Insights

Based on distribution channels, the market is segmented into hospitals, ophthalmic clinics, optometry clinics, and others. The hospitals segment accounted for the largest share of around 24.11% in 2021. Investments in orthokeratology lenses are gradually growing in hospitals owing to the rising incidence of eye-related disorders, such as cataracts and glaucoma, which is boosting the market growth. Increasing adoption of orthokeratology lenses in hospitals owing to advanced treatment facilities is estimated to fuel the hospitals' segment growth. However, usage rates of orthokeratology lenses may vary across hospitals across the globe, which may impede market growth. The ophthalmic clinics segment witnessed a significant CAGR during the forecast period.

Ophthalmic clinics are specifically favored by individuals owing to their low costs to patients. The rising number of patients developing vision loss is predicted to boost the demand for ophthalmic clinics. The rising number of ophthalmologists in developing economies is estimated to result in an increased demand for ophthalmic clinics, thereby favoring the segment growth. Moreover, rising accessibility to advanced ophthalmology-associated technologies in ophthalmic clinics in several untapped economies is expected to contribute to segment growth. Increasing competition in ophthalmic clinics is anticipated to fuel the demand for orthokeratology lens over the forecast period. Furthermore, various hospitals are introducing combined ophthalmic centers for several refractive disorders, which is expected to boost the segment growth.

Regional Insights

North America dominated the market in 2021 and accounted for more than 37.55% of the global revenue. Recent progressions in orthokeratology lenses, the launch of overnight ortho-K-lenses coupled with flexibility and choices are some of the factors expected to fuel the market growth. Increasing cases of visual impairment along with the rising adoption of orthokeratology lenses across the U.S. and Canada is estimated to create wide growth opportunities across the U.S. In addition, the local presence of major market players in the U.S., such as CooperVision, Johnson & Johnson Vision, and Bausch & Lomb Inc., is projected to likely enhance the regional growth. The Europe region accounted for the second-highest revenue share and is expected to register a significant CAGR during the forecast period.

The increasing prevalence of ocular disorders, such as myopia and presbyopia, is projected to boost the adoption of orthokeratology lenses among healthcare professionals. Technological advancements along with the increasing number of products receiving CE approval are estimated to foster regional growth. Asia Pacific is predicted to grow at a significant CAGR over the forecast period. Rising healthcare expenditure along with increasing awareness related to eye disorders is anticipated to foster market growth. The growing geriatric population base and increasing adoption of orthokeratology lenses within India and China is anticipated to spur the market. Furthermore, the increasing number of ophthalmic clinics and hospitals within countries of Asia is estimated to accelerate the demand for orthokeratology lenses over the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Orthokeratology Lens Market

5.1. COVID-19 Landscape: Orthokeratology Lens Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Orthokeratology Lens Market, By Product Type

8.1. Orthokeratology Lens Market, by Product Type, 2022-2030

8.1.1 Day-time Ortho-K Lenses

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Overnight Ortho-K Lenses

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Orthokeratology Lens Market, By Indication

9.1. Orthokeratology Lens Market, by Indication, 2022-2030

9.1.1. Myopia

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Presbyopia

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Hypermetropia

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Astigmatism

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Orthokeratology Lens Market, By Distribution Channel

10.1. Orthokeratology Lens Market, by Distribution Channel, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Optometry Clinics

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Ophthalmology Clinics

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Orthokeratology Lens Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Indication (2017-2030)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Indication (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Indication (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Indication (2017-2030)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Indication (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Indication (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Indication (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Indication (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Indication (2017-2030)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Indication (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Indication (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Indication (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Indication (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Indication (2017-2030)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Indication (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Indication (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Indication (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Indication (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Indication (2017-2030)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Indication (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Indication (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

Chapter 12. Company Profiles

12.1. Bausch & Lomb Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Euclid Systems Corp.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CooperVision

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Johnson & Johnson Vision Care, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Alpha Corporation (Menicon Group)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Brighten Optix, Co.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. GP Specialists

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. TruForm Optics, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Art Optical Contact Lens, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. MiracLens L.L.C.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others