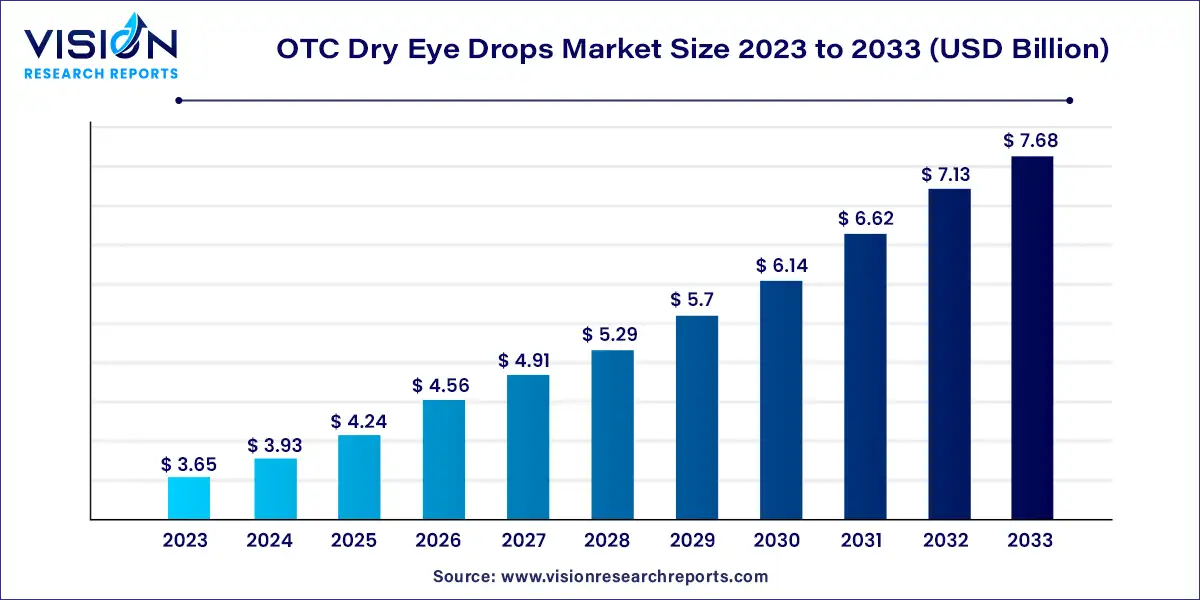

The global OTC dry eye drops market size was estimated at around USD 3.65 billion in 2023 and it is projected to hit around USD 7.68 billion by 2033, growing at a CAGR of 7.72% from 2024 to 2033.

The over-the-counter (OTC) dry eye drops market stands as a pivotal segment within the pharmaceutical industry, catering to the needs of individuals seeking relief from ocular discomfort. This market segment plays a crucial role in providing accessible and convenient solutions for addressing the symptoms of dry eye syndrome. In this overview, we delve into the dynamics, trends, and factors shaping the OTC dry eye drops market landscape.

The growth of the OTC dry eye drops market can be attributed to several key factors. Firstly, the increasing prevalence of dry eye syndrome globally is driving demand for accessible and convenient solutions. Lifestyle changes, prolonged screen time, and environmental factors contribute to the rising incidence of dry eye cases. Additionally, advancements in formulation technologies have led to the development of innovative OTC dry eye drops with enhanced efficacy, further stimulating market growth. Moreover, growing consumer awareness about ocular health and the availability of information through digital platforms are fostering demand for OTC remedies. These factors collectively contribute to the expansion of the OTC dry eye drops market, making it a significant segment within the pharmaceutical industry.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 41% |

| Revenue Forecast by 2033 | USD 7.68 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The generics segment dominated the market and held the largest revenue share of 57% in 2023. The high share of this segment is primarily due to the cost-effectiveness of generic products. These are often more affordable than their brand-name counterparts, making generic products an easier alternative in markets where consumers are price-sensitive and looking for cost-effective options to manage their conditions. Additionally, ease of purchase further boosts segment growth, as generic products are readily available for purchase without a prescription, making them easily accessible to consumers.

The branded segment is anticipated to register a lucrative CAGR over the coming years. Branded products have an established reputation and recognition in the market; thereby, consumers have a higher level of trust and choose products from well-known and reputable brands owing to their history of quality and efficacy. Moreover, branded products have unique formulations and delivery methods protected by patents. This exclusivity can give these brands an edge in the market until generics can replicate or improve upon the patented features, thereby contributing to the overall growth.

The preservative segment dominated the market and held the largest revenue share of 62% in 2023. Dry eye drops with preservatives tend to have a longer shelf life compared to preservative-free alternatives. This longer shelf life can be attractive to both manufacturers and consumers, as it reduces the risk of product expiration and wastage. Furthermore, preservatives prevent bacterial growth in the solution, allowing the product to be stored at room temperature. This convenience in storage makes preservative-containing products more desirable to consumers, thereby contributing to overall growth.

On the other hand, the preservative-free segment is expected to witness the highest CAGR of 8.87% during the forecast period. Preservative-free eye drops are formulated without chemical preservatives, which is a significant advantage for individuals who are sensitive or allergic to preservatives. Moreover, growing awareness about the potential drawbacks of using preservatives in eye drops, such as dryness, discomfort, and allergic reactions, has been increasing. Thus, consumers are becoming more conscious of the ingredients in the products they use and are actively seeking preservative-free options.

The low-viscosity segment dominated the market and held the largest revenue share of 76% in 2023. Ease of application and rapid relief are the major factors that drive segment growth. Low-viscosity eye drops are often easier to wear due to their thin and watery consistency. This makes them more comfortable to use, especially for individuals who may have difficulty with thicker or more viscous formulations. Moreover, low-viscosity eye drops tend to spread quickly across the ocular surface, providing rapid relief to dry and irritated eyes. Additionally, eye drops with low viscosity are better tolerated and easier to use than gel ocular drops or ointments.

On the other hand, the high-viscosity segment is expected to witness the fastest CAGR during the forecast period in the OTC dry eye drops market. High-viscosity eye drops can provide a longer duration of effect compared to low-viscosity eye drops; thus, the longer duration of effects is a major factor that boosts overall growth. Furthermore, high-viscosity eye drops are able to reduce friction, which can otherwise lead to inflammation, and minimize vision blurring, thus improving ocular comfort.

The retail pharmacies segment dominated the market and held the largest revenue share of 41% in 2023. Accessibility and convenience play a crucial role in contributing to the segment growth. Retail pharmacies, including chain pharmacies and independent drugstores, are widespread and easily accessible to consumers. They are often conveniently located in neighbourhoods, shopping centers, and healthcare facilities, making it easy for consumers to purchase OTC products like dry eye drops. Moreover, retail pharmacies offer one-stop shopping for a wide range of healthcare products, including OTC medications, supplements, personal care items, and more. This convenience encourages consumers to buy more products from retail pharmacies, thereby contributing to the growth of the segment.

The online pharmacies segment is expected to witness the highest CAGR of 13.44% during the forecast period. Online pharmacies save consumers’ time by eliminating the need to travel to a physical pharmacy. Thus, the time-saving factor is contributing to the segment’s growth. Moreover, the COVID-19 pandemic further accelerated the adoption of online pharmacies, as consumers sought ways to minimize physical interactions and reduce the risk of exposure to the virus.

North America dominated the market with the largest revenue share of 41% in 2023 due to its large consumer base, advanced healthcare infrastructure, high awareness and education about health products, and a growing aging population with increased dry eye susceptibility. Moreover, the significant presence of pharmaceutical companies focusing on OTC products, higher disposable incomes, a supportive regulatory framework, and a strong retail pharmacy network further propel regional growth.

As per data from the National Health and Wellness Survey conducted in 2022, approximately 6.8% of the U.S. adult population has been diagnosed with dry eye disorder (DED). This has created a huge market opportunity for industry players, and manufacturers have responded by developing and promoting their products at a frequent pace.

The Asia Pacific region is estimated to witness the fastest growth in the market over the forecast period, aided by its large and burgeoning population base, an aging demographic leading to higher dry eye prevalence, and an ever-expanding middle class with increased purchasing power. The market in this region is highly price-sensitive and provides better growth opportunities for generic OTC dry eye drops.

By Type

By Product Type

By Viscosity

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on OTC Dry Eye Drops Market

5.1. COVID-19 Landscape: OTC Dry Eye Drops Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global OTC Dry Eye Drops Market, By Type

8.1. OTC Dry Eye Drops Market, by Type, 2024-2033

8.1.1. Branded

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Generics

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global OTC Dry Eye Drops Market, By Product Type

9.1. OTC Dry Eye Drops Market, by Product Type, 2024-2033

9.1.1. With Preservatives

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Preservatives Free

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global OTC Dry Eye Drops Market, By Viscosity

10.1. OTC Dry Eye Drops Market, by Viscosity, 2024-2033

10.1.1. Low Viscosity

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. High Viscosity

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global OTC Dry Eye Drops Market, By Distribution Channel

11.1. OTC Dry Eye Drops Market, by Distribution Channel, 2024-2033

11.1.1. Drugstores and Supermarkets

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Online Pharmacies

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Retail Pharmacies

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global OTC Dry Eye Drops Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Viscosity (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Rohto Pharmaceutical Co., Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. AbbVie, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Johnson & Johnson Services Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Santen Pharmaceutical Co. Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Novartis AG

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Prestige Consumer Healthcare Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Altaire Pharmaceutical Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Sentiss Pharma Private Limited

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Medicom Healthcare Pvt Ltd

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others