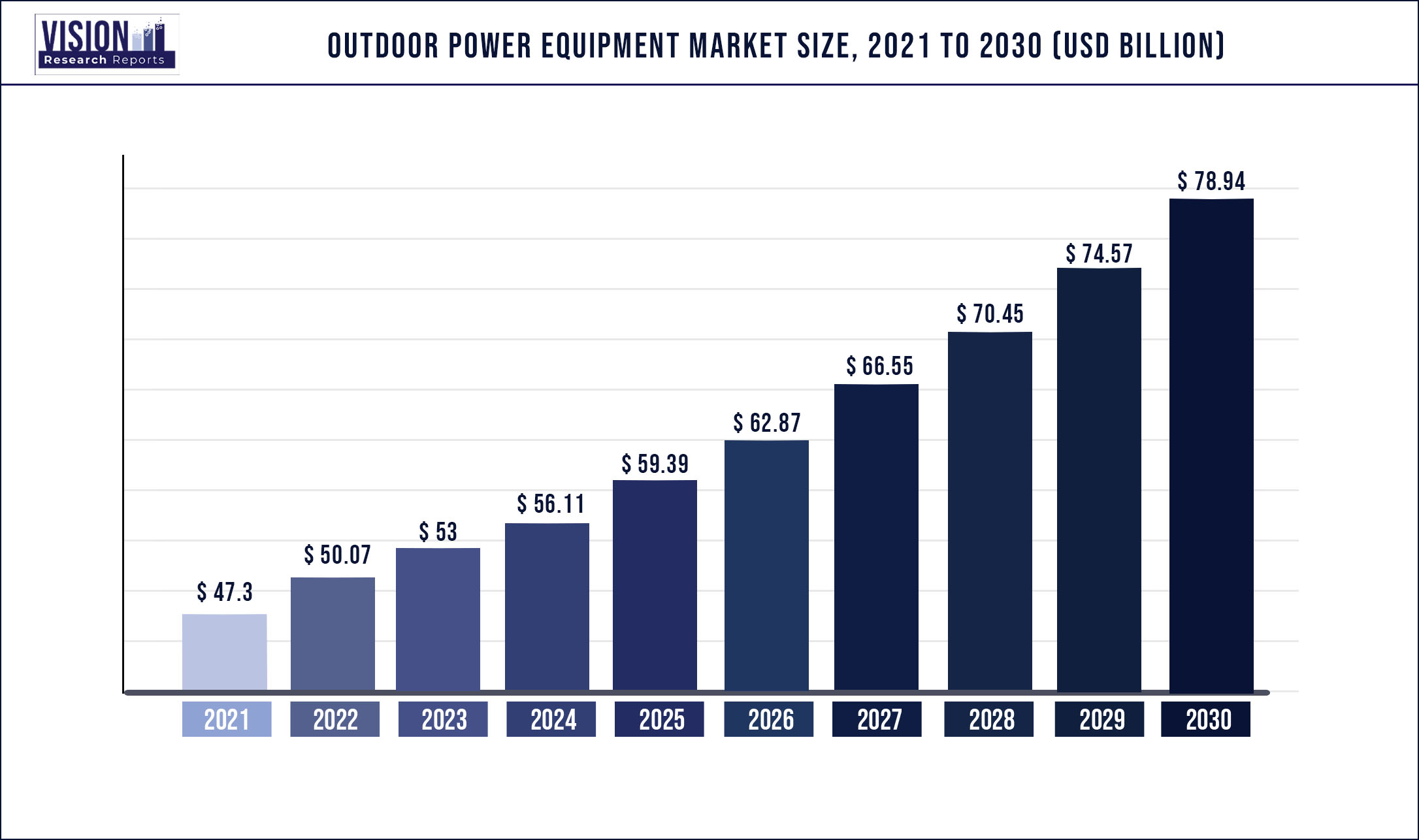

The global outdoor power equipment market was valued at USD 47.3 billion in 2021 and it is predicted to surpass around USD 78.94 billion by 2030 with a CAGR of 5.86% from 2022 to 2030.

Report Highlights

The market growth can be credited to the increasing adoption of outdoor power equipment, using lithium-ion batteries and cordless outdoor power equipment.

For instance, in September 2021, DeWalt, one of the brands of Stanley Black & Decker, announced the launch of a 20V MAX lithium-Ion batteries system to support a variety of outdoor power equipment. Furthermore, government and public places need to be maintained and have an aesthetic appeal, additionally stimulating demand for the lawn mowers. Besides, the growing perception that gardening is a leisure activity is a critical factor in the outdoor power equipment demand.

The rising technological advancements in outdoor power equipment are increasing the inclination of people toward gardening, which is expected to impact growth. For instance, in February 2022, Makita Corporation launched two new Lawn Mowers, XML10CT1 (21" Lawn Mower Kit) and XML11CT1 (21" Self-Propelled Lawn Mower Kit). These two product features 36V (18V X2) LXT power batteries, which signify their capabilities in the cordless lawn and garden market. Furthermore, the rise in residential construction and rising demand for lawn and electric cordless lawn & garden tools in commercial spaces, parks, and sports fields are the factors expected to drive market growth.

Vendors' rising adoption of ergonomic designs enables people to perform activities with less labor and makes their tasks more manageable. It allows people to perform their functions with much less time than non-ergonomic tools. For instance, in November 2021, The Toro Company launched five new gas and battery-based Super Recycler models for the lawn care market. These products are designed with an ergonomic grip, which enables gardeners to have greater cutting convenience, and are developed with additional safety features, to pack within a folded handle.

A considerable increase in the demand for do-it-yourself (DIY) equipment and do-it-for-me (DIFM) services in the commercial and residential segment are expected to drive market growth. The outdoor power equipment market is seasonally affected by end-customer buying patterns, and most outdoor power equipment is sold during the summer and spring seasons. As a result of seasonality in the industry and short-term fluctuations in demand caused by weather patterns, growth in the market is hindered.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 47.3 billion |

| Revenue Forecast by 2030 | USD 78.94 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.86% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Power source, end-use, type, region |

| Companies Covered |

Husqvarna AB; Makita Corp; Honda Motors Co. Ltd; Briggs & Stratton Corp.; MTD Holdings Inc.; Stanley Black and Decker Inc.; Andreas Stihl AG & Company KG; CHERVON (China) Trading Co., Ltd; Techtronic Industries Ltd.; Yamabiko Corporation; Ariens Company; The Toro Company; Andreas Stihl AG & Company KG; Deere & Company; Robert Bosch; AL-KO Kober Group |

Power Source Insights

The power source segment has been segregated into gasoline, battery, and electric corded. The gasoline segment accounted for 57.2% market share in 2021 and is expected to witness a drop in demand because of gas fumes and noise produced. Various government regulations have been enacted to address gasoline-powered sources' environmental issues. For instance, California is expected to implement laws banning gas-powered chainsaws, lawnmowers, and leaf blowers will be in effect as early as 2024.

Meanwhile, the battery power source segment is estimated to expand at a CAGR exceeding 7.4% during the forecast period. The battery-powered source segment is expanding due to the lower shipping costs, lighter than gasoline alternatives, and is more affordably purchased online. Furthermore, various online retailers are adjusting their inventory to optimize new government rules and regulations for developing electric outdoor power equipment products.

End-use Insights

The end-use segment has been segregated into the commercial and residential sectors. The residential segment accounted for more than 49.7% market share in 2021. The growing inclination of residential users towards investing more time in gardening and outdoor is expected to drive demand for outdoor power equipment. Furthermore, the rising sales of DIY outdoor power equipment due to the pandemic are likely to drive the segment growth.

The commercial segment is expected to grow at a CAGR of 5.8% during the forecast period. The rising number of smart cities owing to increasing urbanization is expected to drive segment growth. According to a report published by World Urbanization Prospects in 2019 by the UN Department of Economic and Social Affairs (UN DESA), the current urban population, which is 56.3%, is anticipated to increase to 68.4% in 2050, globally. Furthermore, with the rising number of golf players coupled with a growing number of golf club facilities, demand for the various outdoor power equipments is expected to increase for the commercial segment.

Equipment Insights

The equipment segment has been segregated into a lawn mower, chainsaw, trimmer & edger, blowers, tiller & cultivators, snow throwers, and others. The chainsaw segment is estimated to grow at a CAGR of 7.6% during the forecast period. A chainsaw is a handheld, portable mechanical device mainly used to cut wood and wood-related products. The increasing deforestation rate for various infrastructure activities is expected to drive market growth. Furthermore, the rising demand for interior décors such as wood-based flooring, roofing, panels, and more are augmenting the use of chainsaws in various furniture applications.

The lawn mower segment captured the largest market share and is expected to expand at a CAGR of 6.7% during the forecast period. Several companies are focused on introducing various robotic mowers due to the rising demand for technologically advanced mowers. Furthermore, the latest automated lawn mowers are equipped with GPS tracking and remote controls, making it easier for the user to operate, monitor, and track the mower. In addition, changing consumer behavior in its spending power and aesthetic appeal for their gardening space is also expected to boost the market's growth.

Regional Insights

The North American market accounted for 35.21% share of the overall market in 2021. The regional market’s growth is attributed to North America’s larger geographical area compared to its population, which leads to more gardens and lawns in the region. This led to increased demand for outdoor power equipment in the region. Furthermore, rising investment by the government in infrastructure is expected to drive the region’s growth. For instance, in 2022, the Canadian government provided USD 1.5 billion for the Canada Mortgage and Housing Corporation to expand the rapid housing initiative of building houses.

The Asia Pacific market is expected to register a 6.8% CAGR during the forecast period. The significant growth rate of the region is due to rising disposable income and changing lifestyles in various developing countries such as India and China. Furthermore, increasing annual events such as the Indian Premier League (IPL), World Baseball Classic, Asian Games, and various other sports activities are expected to boost the requirement for outdoor power equipment to enhance sports stadiums and fields.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Outdoor Power Equipment Market

5.1. COVID-19 Landscape: Outdoor Power Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Outdoor Power Equipment Market, By Power

8.1. Outdoor Power Equipment Market, by Power, 2022-2030

8.1.1 Gasoline

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Battery

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Electric Corded

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Outdoor Power Equipment Market, By End-use

9.1. Outdoor Power Equipment Market, by End-use, 2022-2030

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Commercial/ Government

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Outdoor Power Equipment Market, By Type

10.1. Outdoor Power Equipment Market, by Type, 2022-2030

10.1.1. Lawn Mower

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Chainsaw

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Trimmer & Edger

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Blowers

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Tillers & Cultivators

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Snow Throwers

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Outdoor Power Equipment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Power (2017-2030)

11.1.2. Market Revenue and Forecast, by End-use (2017-2030)

11.1.3. Market Revenue and Forecast, by Type (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Power (2017-2030)

11.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Type (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Power (2017-2030)

11.1.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Type (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Power (2017-2030)

11.2.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.3. Market Revenue and Forecast, by Type (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Power (2017-2030)

11.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Type (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Power (2017-2030)

11.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Type (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Power (2017-2030)

11.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Type (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Power (2017-2030)

11.2.7.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Type (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Power (2017-2030)

11.3.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.3. Market Revenue and Forecast, by Type (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Power (2017-2030)

11.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Type (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Power (2017-2030)

11.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Type (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Power (2017-2030)

11.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Type (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Power (2017-2030)

11.3.7.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Type (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Power (2017-2030)

11.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.3. Market Revenue and Forecast, by Type (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Power (2017-2030)

11.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Type (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Power (2017-2030)

11.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Type (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Power (2017-2030)

11.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Type (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Power (2017-2030)

11.4.7.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Type (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Power (2017-2030)

11.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.5.3. Market Revenue and Forecast, by Type (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Power (2017-2030)

11.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Type (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Power (2017-2030)

11.5.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Type (2017-2030)

Chapter 12. Company Profiles

12.1. Husqvarna AB

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Makita Corp

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Honda Motors Co. Ltd

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Briggs & Stratton Corp.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Andreas Stihl AG & Company KG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. MTD Holdings Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Stanley Black and Decker Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Andreas Stihl AG & Company KG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CHERVON (China) Trading Co., Ltd

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Techtronic Industries Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others