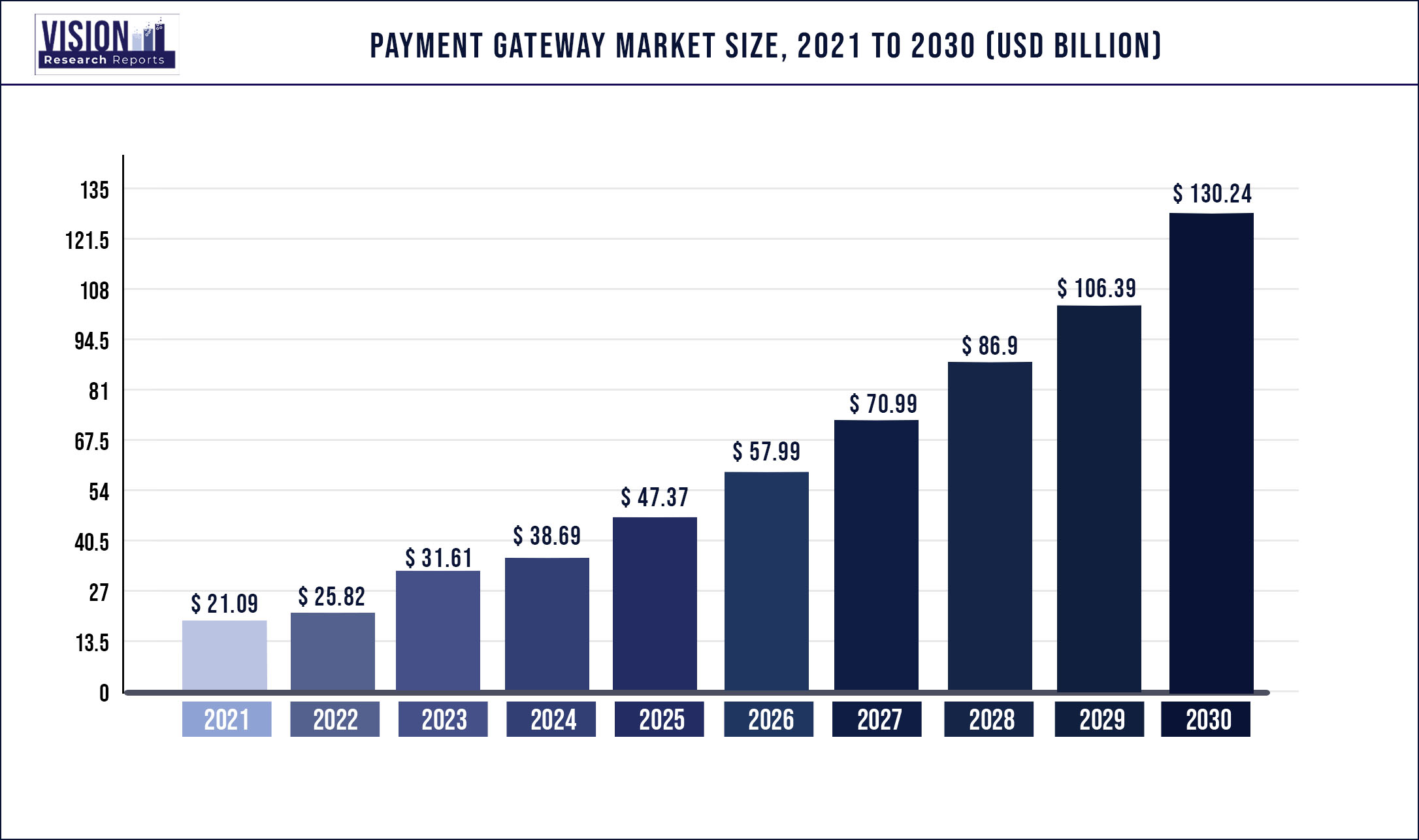

The global payment gateway market size was valued at USD 21.09 billion in 2021, and is predicted to be worth around USD 130.24 billion by 2030, registering a CAGR of 21.1% during the forecast period 2022 to 2030.

Growth Factors

Increase in online transactions, coupled with the advancements in payment methods, such as cash pooling, cashless transactions, and token systems, is expected to fuel the market growth. Moreover, rapidly increasing internet penetration across the globe is anticipated to fuel market growth over the forecast period.

The market growth can be attributed to the increasing demand for mobile-based payments across the globe. Rising e-commerce sales and growing internet penetration globally are other significant factors that are anticipated to contribute to the growth of the market for payment gateway. Additionally, the shift in merchant and consumer preference to digital channels for enabling online money transfers is projected to propel the growth of the market in the forthcoming years.

Companies are increasingly seeking payment gateways that provide secure internet transactions and help prevent credit or debit card scams and other fraudulent activities. Reliable payment gateways encrypt sensitive information such as bank account details and debit or credit numbers to ensure that the information is transferred securely from the customer to the issuing bank.

Report Coverage

| Report Scope | Details |

| Market Size | US$ 130.24 billion by 2030 |

| Growth Rate | CAGR of 21.1% From 2022 to 2030 |

| Largest Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Type, Enterprise Size, End-use |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | Adyen; Amazon Payments Inc.; Authorize.Net; Bitpay; Inc.; Braintree; PayPal Holdings, Inc.; PayU Group; Stripe; Verifone Holdings, Inc.; Wepay, Inc. |

By Type Analysis

The hosted segment dominated the market in 2021 and accounted for more than 57.0% share of the global revenue. The demand for hosted payment gateways is increasing among merchants due to factors such as easy payment setup systems and reduced merchant liability.

These factors ensure that third-party payment service providers handle the entire transaction process and provide enhanced security and data protection. Hosted payment gateways also allow merchants to reduce fraudulent activities and focus on their core offerings.

The non-hosted segment is expected to witness significant growth over the forecast period. Various merchants across the globe prefer a non-hosted payment gateway for their website as they can retain control over the whole checkout process, including the layout and design process while providing a seamless shopping experience to the customers.

By Enterprise Size Analysis

The large enterprise segment dominated the market in 2021 and accounted for more than 56.0% share of the global revenue. Large enterprises tend to have higher customer visits on their website and hence need to deploy effective solutions for their customers during the checkout process.

Payment gateway solutions can ensure a convenient checkout process for customers by supporting various digital payment methods, including net banking and credit or debit cards.

The small and medium enterprises segment is anticipated to register the highest growth over the forecast period. Small & medium enterprises are turning to payment gateways for faster payment processing and offering increased convenience to customers.

By End-use Analysis

The retail and e-commerce segment dominated the market in 2021 and accounted for more than 25.0% share of the global revenue. The segment growth can be attributed to the rising number of online transactions in retail and e-commerce businesses across the globe.

The BFSI segment is expected to witness significant growth over the forecast period. The BFSI sector is widely adopting payment gateway systems as they provide an end-to-end ecosystem for financial services. Financial companies are challenged with complex cash flows where cash is collected from numerous sources and routed to various accounts.

By Regional Analysis

North America dominated the market in 2021 and accounted for more than 36.0% share of the global revenue. The growth can be attributed to technological advancements and the application of payment gateways in flourishing end-use segments such as retail and e-commerce. The presence of prominent players such as Square, PayPal Holdings Inc., Mastercard, BluePay, and Amazon Payments Inc. is also driving the market growth in the region.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The growth can be attributed to several initiatives undertaken by governments to improve the online payment infrastructure in Asia Pacific countries.

Key Players

Adyen

Amazon Payments Inc.

Authorize.Net

Bitpay, Inc.

Braintree

PayPal Holdings, Inc.

PayU Group

Stripe

Verifone Holdings, Inc.

Wepay, Inc.

Market Segmentation

Type

Hosted

Non-hosted

Enterprise Size

Large Enterprises

Small & Medium Enterprises

End-use

BFSI

Media & Entertainment

Retail & E-commerce

Travel & Hospitality

Others

Regional

North America

U.S.

Canada

Europe

Germany

U.K.

Asia Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa

The payment gateway market research report covers definition, classification, product classification, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, the latest dynamic analysis, etc., and also includes major. The study includes drivers and restraints of the global market. It covers the impact of these drivers and restraints on the demand during the forecast period. The report also highlights opportunities in the market at the global level.

The report provides size (in terms of volume and value) of payment gateway market for the base year 2022 and the forecast between 2022 and 2030. Market numbers have been estimated based on form and application. Market size and forecast for each application segment have been provided for the global and regional market.

This report focuses on the global payment gateway market status, future forecast, growth opportunity, key market and key players. The study objectives are to present the payment gateway market development in United States, Europe and China.

It is pertinent to consider that in a volatile global economy, we haven’t just conducted payment gateway market forecasts in terms of CAGR, but also studied the market based on key parameters, including Year-on-Year (Y-o-Y) growth, to comprehend the certainty of the market and to find and present the lucrative opportunities in market.

In terms of production side, this report researches the payment gateway capacity, production, value, ex-factory price, growth rate, market share for major manufacturers, regions (or countries) and type.

In terms of consumption side, this report focuses on the consumption of payment gateway by regions (countries) and application.

Buyers of the report will have access to verified market figures, including global market size in terms of revenue and volume. As part of production analysis, the authors of the report have provided reliable estimations and calculations for global revenue and volume by Type segment of the global payment gateway market. These figures have been provided in terms of both revenue and volume for the period 2019 to 2030. Additionally, the report provides accurate figures for production by region in terms of revenue as well as volume for the same period. The report also includes production capacity statistics for the same period.

With regard to production bases and technologies, the research in this report covers the production time, base distribution, technical parameters, research and development trends, technology sources, and sources of raw materials of major payment gateway market companies.

Regarding the analysis of the industry chain, the research of this report covers the raw materials and equipment of payment gateway market upstream, downstream customers, marketing channels, industry development trends and investment strategy recommendations. The more specific analysis also includes the main application areas of market and consumption, major regions and Consumption, major Chinese producers, distributors, raw material suppliers, equipment providers and their contact information, industry chain relationship analysis.

The research in this report also includes product parameters, production process, cost structure, and data information classified by region, technology and application. Finally, the paper model new project SWOT analysis and investment feasibility study of the case model.

Overall, this is an in-depth research report specifically for the payment gateway industry. The research center uses an objective and fair way to conduct an in-depth analysis of the development trend of the industry, providing support and evidence for customer competition analysis, development planning, and investment decision-making. In the course of operation, the project has received support and assistance from technicians and marketing personnel in various links of the industry chain.

payment gateway market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to payment gateway market.

Prominent players in the market are predicted to face tough competition from the new entrants. However, some of the key players are targeting to acquire the startup companies in order to maintain their dominance in the global market. For a detailed analysis of key companies, their strengths, weaknesses, threats, and opportunities are measured in the report by using industry-standard tools such as the SWOT analysis. Regional coverage of key companies is covered in the report to measure their dominance. Key manufacturers of payment gateway market are focusing on introducing new products to meet the needs of the patrons. The feasibility of new products is also measured by using industry-standard tools.

Key companies are increasing their investments in research and development activities for the discovery of new products. There has also been a rise in the government funding for the introduction of new payment gateway market. These factors have benefited the growth of the global market for payment gateway. Going forward, key companies are predicted to benefit from the new product launches and the adoption of technological advancements. Technical advancements have benefited many industries and the global industry is not an exception.

New product launches and the expansion of already existing business are predicted to benefit the key players in maintaining their dominance in the global market for payment gateway. The global market is segmented on the basis of region, application, end-users and product type. Based on region, the market is divided into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa (MEA).

In this study, the years considered to estimate the market size of payment gateway are as follows:

Reasons to Purchase this Report:

- Market segmentation analysis including qualitative and quantitative research incorporating the impact of economic and policy aspects

- Regional and country level analysis integrating the demand and supply forces that are influencing the growth of the market.

- Market value USD Million and volume Units Million data for each segment and sub-segment

- Competitive landscape involving the market share of major players, along with the new projects and strategies adopted by players in the past five years

- Comprehensive company profiles covering the product offerings, key financial information, recent developments, SWOT analysis, and strategies employed by the major market players

Research Methodology:

In-depth interviews and discussions were conducted with several key market participants and opinion leaders to compile the research report.

This research study involved the extensive usage of both primary and secondary data sources. The research process involved the study of various factors affecting the industry, including the government policy, market environment, competitive landscape, historical data, present trends in the market, technological innovation, upcoming technologies and the technical progress in related industry, and market risks, opportunities, market barriers and challenges. The following illustrative figure shows the market research methodology applied in this report.

The study objectives of this report are:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Payment Gateway Market, By Type

7.1. Payment Gateway Market, by Type, 2021-2030

7.1.1. Hosted

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Non-hosted

7.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Payment Gateway Market, By Enterprise Size

8.1. Payment Gateway Market, by Enterprise Size, 2021-2030

8.1.1. Large Enterprises

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Small & Medium Enterprises

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Payment Gateway Market, By End User

9.1. Payment Gateway Market, by End User, 2021-2030

9.1.1. BFSI

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Media & Entertainment

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Retail & E-commerce

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Travel & Hospitality

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Payment Gateway Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2019-2030)

10.1.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.1.3. Market Revenue and Forecast, by End User (2019-2030)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.1.4.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.1.4.3. Market Revenue and Forecast, by End User (2019-2030)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.1.5.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.1.5.3. Market Revenue and Forecast, by End User (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.2.3. Market Revenue and Forecast, by End User (2019-2030)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.4.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.2.4.3. Market Revenue and Forecast, by End User (2019-2030)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.5.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.2.5.3. Market Revenue and Forecast, by End User (2019-2030)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.6.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.2.6.3. Market Revenue and Forecast, by End User (2019-2030)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.7.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.2.7.3. Market Revenue and Forecast, by End User (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.3.3. Market Revenue and Forecast, by End User (2019-2030)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.4.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.3.4.3. Market Revenue and Forecast, by End User (2019-2030)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.5.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.3.5.3. Market Revenue and Forecast, by End User (2019-2030)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.6.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.3.6.3. Market Revenue and Forecast, by End User (2019-2030)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.7.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.3.7.3. Market Revenue and Forecast, by End User (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.4.3. Market Revenue and Forecast, by End User (2019-2030)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.4.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.4.4.3. Market Revenue and Forecast, by End User (2019-2030)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.5.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.4.5.3. Market Revenue and Forecast, by End User (2019-2030)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.6.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.4.6.3. Market Revenue and Forecast, by End User (2019-2030)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.7.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.4.7.3. Market Revenue and Forecast, by End User (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.5.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.5.3. Market Revenue and Forecast, by End User (2019-2030)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.5.4.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.5.4.3. Market Revenue and Forecast, by End User (2019-2030)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.5.5.2. Market Revenue and Forecast, by Enterprise Size (2019-2030)

10.5.5.3. Market Revenue and Forecast, by End User (2019-2030)

Chapter 11. Company Profiles

11.1. Adyen

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Amazon Payments Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Authorize.Net

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Bitpay, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Braintree

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. PayPal Holdings, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. PayU Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Stripe

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Verifone Holdings, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Wepay, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others