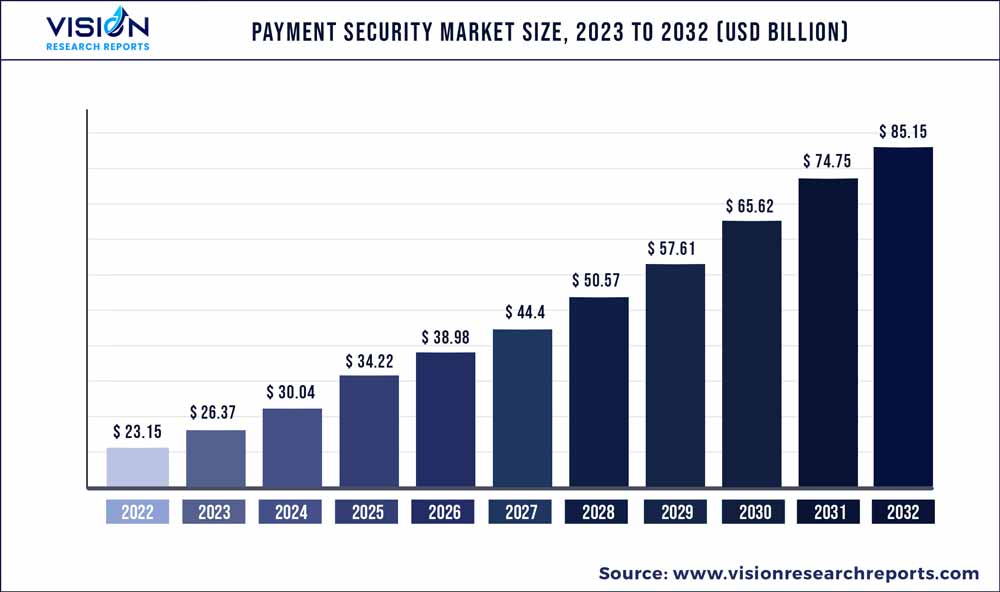

The global payment security market was valued at USD 23.15 billion in 2022 and it is predicted to surpass around USD 85.15 billion by 2032 with a CAGR of 13.91% from 2023 to 2032.

Key Pointers

Report Scope of the Payment Security Market

| Report Coverage | Details |

| Market Size in 2022 | USD 23.15 billion |

| Revenue Forecast by 2032 | USD 85.15 billion |

| Growth rate from 2023 to 2032 | CAGR of 13.91% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Elavon Inc.; Ingenico; Ultimaco Management Gmbh; Shift4 Payment Inc.; Mastercard; Intelligent Payment Solutions Pvt Ltd.; TokenEx, LLC; Paypal Holdings, Inc.; Bluefin Payment Systems; Visa Inc. |

The growth is driven by the need to protect consumer data, comply with regulations, and keep up with the evolving threat landscape. With advancements in technology, cybercriminals are becoming more sophisticated in their attacks. This has driven the development of new and more advanced payment security solutions to keep up with the evolving threat landscape.

Additionally, the rising adoption of smartphones and the growing preference for contactless payments worldwide are expected to drive the market's growth. Mobile payment options are fast and convenient to use. Customers can make payments quickly and easily using their smartphones without needing cash or physical cards. This convenience has made mobile payments an attractive option for consumers.

The rise of fintech has positively affected the payment security market. Fintech companies have invested heavily in developing new and improved payment security trends, such as two-factor authentication, biometric authentication, and tokenization. These trends or payment measures are designed to enhance the security of digital payments and protect against fraud. Additionally, fintech companies have raised awareness about the importance among consumers. As a result, customers are more likely to demand secure payment options and are willing to pay a premium for secure transactions.

Regulatory compliances play a crucial role by establishing standards and requirements that must be met to ensure the confidentiality, integrity, and availability of payment systems and data. Compliance with these regulations helps to prevent fraud, data breaches, and other security incidents that can compromise sensitive financial information and damage the reputation of payment providers and merchants. For instance, Payment Card Industry Data Security Standard (PCI DSS) sets requirements for organizations that process, transmit, or store cardholder data. PCI DSS compliance includes network security, access controls, data encryption, and regular testing and monitoring of payment systems.

Data breaches are becoming more frequent and severe with cybercriminals using increasingly sophisticated methods to steal sensitive information such as payment card data, Personally Identifiable Information (PII), and financial records. This puts individuals and businesses at risk of financial loss, identity theft, and reputational damage. The market must address these concerns to maintain trust in digital payment systems and prevent fraud. One of the main challenges for providers is to keep pace with cybercriminals' constantly evolving tactics and strategies. As these cybercriminals become more sophisticated in their methods, payment security providers must develop more advanced solutions to protect against them. This requires significant investment in research and development to stay ahead of emerging threats, which can be costly.

The COVID-19 pandemic positively impacted the growth of the market. According to the Red Book Statistics from the BIS Committee on Payments and Market Infrastructures (CPMI), the COVID-19 pandemic accelerated payment digitization. Consumers migrated from physical cash to contactless and digital payment instruments. Retailers were increasingly making efforts to use digital payments amid the COVID-19 pandemic. According to a report released by World Bank in November 2021, During the COVID-19 pandemic, the private sector shifted to electronic payments and finance.

Payment Security Market Segmentations:

| By Solution | By Platform | By Organization | By Application |

|

Encryption Tokenization Fraud Detection & Prevention |

Web Based POS Based/Mobile Based |

Small & Medium-Sized Enterprises (SMEs) Large Enterprises |

Retail & E-commerce Travel & Hospitality Healthcare Telecom & IT Education Media & Entertainment Others |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Payment Security Market

5.1. COVID-19 Landscape: Payment Security Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Payment Security Market, By Solution

8.1. Payment Security Market, by Solution, 2023-2032

8.1.1. Encryption

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Tokenization

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Fraud Detection & Prevention

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Payment Security Market, By Platform

9.1. Payment Security Market, by Platform, 2023-2032

9.1.1. Web Based

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. POS Based/Mobile Based

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Payment Security Market, By Organization

10.1. Payment Security Market, by Organization, 2023-2032

10.1.1. Small & Medium-Sized Enterprises (SMEs)

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Large Enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Payment Security Market, By Application

11.1. Payment Security Market, by Application, 2023-2032

11.1.1. Retail & E-commerce

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Travel & Hospitality

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Healthcare

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Telecom & IT

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Education

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Media & Entertainment

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Payment Security Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Solution (2020-2032)

12.1.2. Market Revenue and Forecast, by Platform (2020-2032)

12.1.3. Market Revenue and Forecast, by Organization (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Platform (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Organization (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Platform (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Organization (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.2. Market Revenue and Forecast, by Platform (2020-2032)

12.2.3. Market Revenue and Forecast, by Organization (2020-2032)

12.2.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Platform (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Organization (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Platform (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Organization (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Platform (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Organization (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Platform (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Organization (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.2. Market Revenue and Forecast, by Platform (2020-2032)

12.3.3. Market Revenue and Forecast, by Organization (2020-2032)

12.3.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Platform (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Organization (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Platform (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Organization (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Platform (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Organization (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Platform (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Organization (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.2. Market Revenue and Forecast, by Platform (2020-2032)

12.4.3. Market Revenue and Forecast, by Organization (2020-2032)

12.4.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Platform (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Organization (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Platform (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Organization (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Platform (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Organization (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Platform (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Organization (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.5.2. Market Revenue and Forecast, by Platform (2020-2032)

12.5.3. Market Revenue and Forecast, by Organization (2020-2032)

12.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Platform (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Organization (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Platform (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Organization (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Elavon Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Ingenico

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Ultimaco Management Gmbh

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Shift4 Payment Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Mastercard

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Intelligent Payment Solutions Pvt Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. TokenEx, LLC

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Paypal Holdings, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Bluefin Payment Systems

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Visa Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others