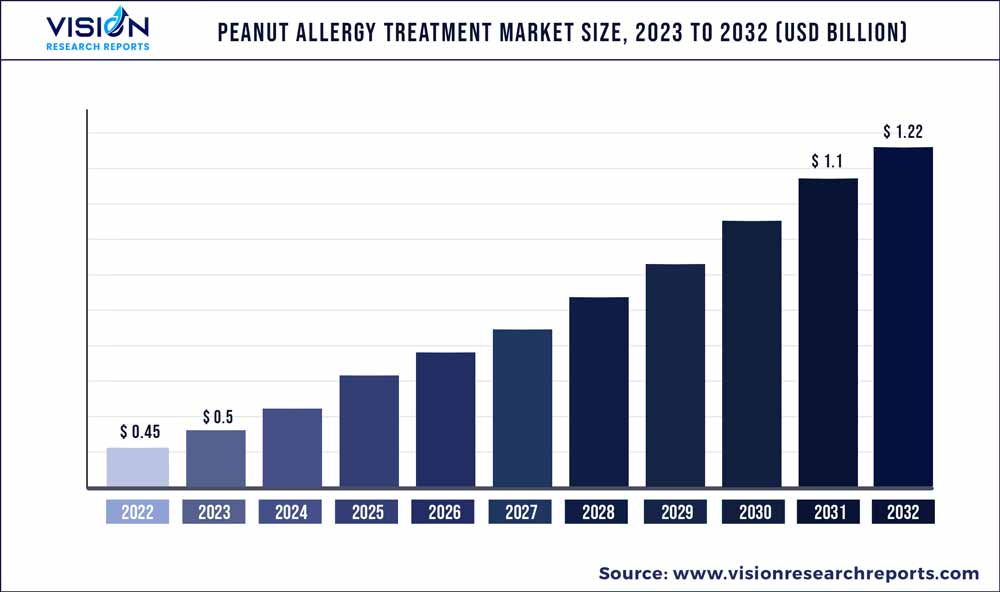

The global peanut allergy treatment market was estimated at USD 0.45 billion in 2022 and it is expected to surpass around USD 1.22 billion by 2032, poised to grow at a CAGR of 10.48% from 2023 to 2032. The peanut allergy treatment market in the United States was accounted for USD 148.6 million in 2022.

Key Pointers

Report Scope of the Peanut Allergy Treatment Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 39% |

| Revenue Forecast by 2032 | USD 1.22 billion |

| Growth Rate from 2023 to 2032 | CAGR of 10.48% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Sanofi; Aimmune Therapeutics Inc.; DBV Technologies; Vedanta Biosciences, Inc.; Alladapt Immunotherapeutics, Inc.; Regeneron Pharmaceuticals Inc.; Aravax Pty Ltd.; Prota Therapeutics; Teva Pharmaceuticals Industries Ltd |

Some of the key factors propelling the market growth include high disease prevalence, robust product pipeline, advancement in drug delivery systems, and strategic initiatives by key market players. Over the past ten years, the prevalence of peanut allergy has increased. For instance, as per the Food Allergy Research & Education in 2022, approximately 32 million Americans have an illness, and 6.1 million of those have a peanut allergy. Along with rising prevalence, the market’s growth is driven by increased spending by private and public organizations on developing novel pharmaceuticals to treat patients.

Furthermore, major players are enhancing their pipeline for peanut allergy by adopting a variety of strategies. For instance, Aravax started its series B round in December 2022 with a USD 20 million investment from prominent Australian healthcare entrepreneurs Tenmile and Brandon Capital. With the help of this financing, Aravax will be able to begin the phase II clinical study of PVX108 in individuals who have an allergic reaction to peanuts. Research and development programs are predicted to advance owing to such funding.

Rising product approvals for the treatment of peanut allergy positively impact the market. For instance, in January 2020, the U.S. FDA (Food and Drug Administration) authorized PALFORZIA [Peanut (Arachis hypogaea) Allergen Powder-dnfp, as reported by Aimmune Therapeutics, Inc. The first immunotherapy medication authorized for people with an allergy to peanuts is PALFORZIA. It is an oral immune therapy intended to lessen allergy responses, including anaphylaxis that can occur from unintended peanut ingestion. People with a verified indication of an allergic reaction to peanuts may use PALFORZIA. Children between the ages of four and 17 may receive the initial dose escalation.

Additionally, rising awareness and initiatives for peanut allergy treatment are anticipated to fuel market expansion throughout the forecast period. For instance, in November 2021, a fund for patients to purchase epinephrine injectables for the management of allergy symptoms in Canada was introduced by the food goods company Kraft Heinz business as part of its "Protection for Peanuts" campaign.

Some therapeutic modalities such as oral immunotherapy, carry a risk of unfavorable effects. The high expenses of manufacturing, regulatory procedures, and clinical studies could put also a cap on the quantity and cost of these medicines. Furthermore, technology developments, such as enhanced diagnostics and personalized medicine strategies, may greatly impact how peanut allergy treatments are delivered in the future. These developments can result in more accurate diagnoses, tailored treatments, and improved patient monitoring, boosting the market growth throughout the projection period.

Drug Class Insights

The epinephrine segment held the major share of the peanut allergy treatment market in 2022 with 48% in terms of global revenue. The standard of care for anaphylaxis treatment has been epinephrine auto-injectors, which are also essential in the management of allergies in emergency situations. Due to the immediate need for the management of life-threatening allergic reactions, the epinephrine section of the peanut allergy treatment market is crucial.

People with known peanut allergies frequently received prescriptions for and carry epinephrine auto-injectors like the EpiPen to treat the signs of an allergic response. Market players are engaged in advancing the products used to treat peanut allergies. For instance, in November 2021, after reviewing durability data, Pfizer and the FDA have been working collaboratively on extending the date of expiration of specific units of EpiPen 0.3 milligram Auto-Injectors and its approved generic equivalent to resolve EpiPen shortfalls.

The immunotherapies segment is expected to grow at the fastest CAGR over the forecast period. As more research is undertaken and regulatory authorizations are obtained, the immunotherapy segment is anticipated to experience substantial growth in the upcoming years. It is crucial to remember that immunotherapies are still being developed and improved, and it could take some time before they are widely used as routine treatment alternatives. Immunotherapy medications can be taken orally or sublingually (under the tongue) as pills.

Route of Administration Insights

The injectable segment dominated the peanut allergy treatment market in 2022 with a revenue share of 63%. Epinephrine serves as the primary medication for treating anaphylaxis. The preferred method of administration is intramuscular (IM) injection, specifically targeting the lateral thigh. While intravenous (IV) administration is an option, it is best suited for inpatient settings where adequate monitoring can be ensured. It is worth noting that antihistamines, corticosteroids, and bronchodilators can be used as supplementary therapies for anaphylaxis management, but they do not address the underlying condition directly. To prevent and treat tissue hypoperfusion, the administration of IV fluids is essential.

The oral route of administration is expected to witness the fastest growth over the forecast period. Oral administration is one of the common methods of administration for several medicines in the market for treating peanut allergies. Oral immunotherapy (OIT) involves exposing allergic patients to progressively higher doses of peanut protein over time. As a result of this exposure, the immune system becomes less sensitive to peanuts and allergic reactions are less severe.

Distribution Channel Insights

The hospital pharmacy segment led the peanut allergy treatment market in 2022 with a share of 57%. Hospital pharmacies are essential for giving patients in a hospital setting access to medications and treatments. Drugs are frequently employed in the therapy of severe allergic responses to peanuts. Hospital pharmacies ensure that these medications are readily available for use in urgent situations by medical personnel. To effectively treat peanut allergies, the hospital pharmacy distribution chain is crucial. They ensure that patients receive the right care and treatment by facilitating the availability and dispensation of drugs required to manage allergies in a hospital setting.

The others segment comprising of online pharmacies is anticipated to be the fastest growing segment during the forecast period. Online pharmacies provide a large selection of pharmaceuticals, including treatments for peanut allergies. These platforms offer a practical way for people to get essential drugs and supplies without going to a physical pharmacy. Distribution methods used by online pharmacies have various benefits. They offer a place where people can learn about and contrast various peanut allergy treatments, peruse consumer feedback, and make well-informed healthcare decisions. Online pharmacies also frequently provide home delivery services, which saves patients' time and effort by bringing their medications right to their door.

Regional Insights

North America accounted for the largest share of 39%. of the peanut allergy treatment market in 2022. Due to the high cases of peanut allergies and the developed healthcare system, North America is a prominent market for the development of treatments for peanut allergies. Due to the region's vast population, growing allergy awareness, high presence of key players, and increased prevalence, it is projected that the North American market for treatments for peanut allergies would be enormous.

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. In recent years, the region has witnessed tremendous expansion in the market for peanut allergy treatments. A prevalent food allergy that has been on the rise globally, especially in the Asia Pacific region, is peanut allergy. As a result, there is an increasing need for therapies and treatments that may effectively control and treat these allergies.

The regional market is witnessing growth as a result of a number of causes. First off, more cases of peanut allergy are being diagnosed as a result of growing public awareness of the ailment and its possible effects. This has led to an increase in the number of patients looking for effective treatment choices.

Moreover, the use of OIT and other therapies has increased in the Asia Pacific region. The development and application of these medicines have been spearheaded by nations like Australia, South Korea, and Japan. A considerable market opportunity for peanut allergy therapies is also presented by the region's large population, particularly in the countries like China and India.

Peanut Allergy Treatment Market Segmentations:

By Drug Class

By Route Of Administration

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Drug Class Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Peanut Allergy Treatment Market

5.1. COVID-19 Landscape: Peanut Allergy Treatment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Peanut Allergy Treatment Market, By Drug Class

8.1. Peanut Allergy Treatment Market, by Drug Class, 2023-2032

8.1.1 Antihistamines

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Epinephrine

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Immunotherapies

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Peanut Allergy Treatment Market, By Route Of Administration

9.1. Peanut Allergy Treatment Market, by Route Of Administration, 2023-2032

9.1.1. Oral

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Injectable

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3 Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Peanut Allergy Treatment Market, By Distribution Channel

10.1. Peanut Allergy Treatment Market, by Distribution Channel, 2023-2032

10.1.1. Hospital Pharmacy

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Retail Pharmacy

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Peanut Allergy Treatment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.1.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.2.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.3.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.4.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.5.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Drug Class (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Route Of Administration (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Sanofi

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Aimmune Therapeutics Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. DBV Technologies

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Vedanta Biosciences, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Alladapt Immunotherapeutics, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Regeneron Pharmaceuticals Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Aravax Pty Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Prota Therapeutics

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Teva Pharmaceuticals Industries Ltd

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others