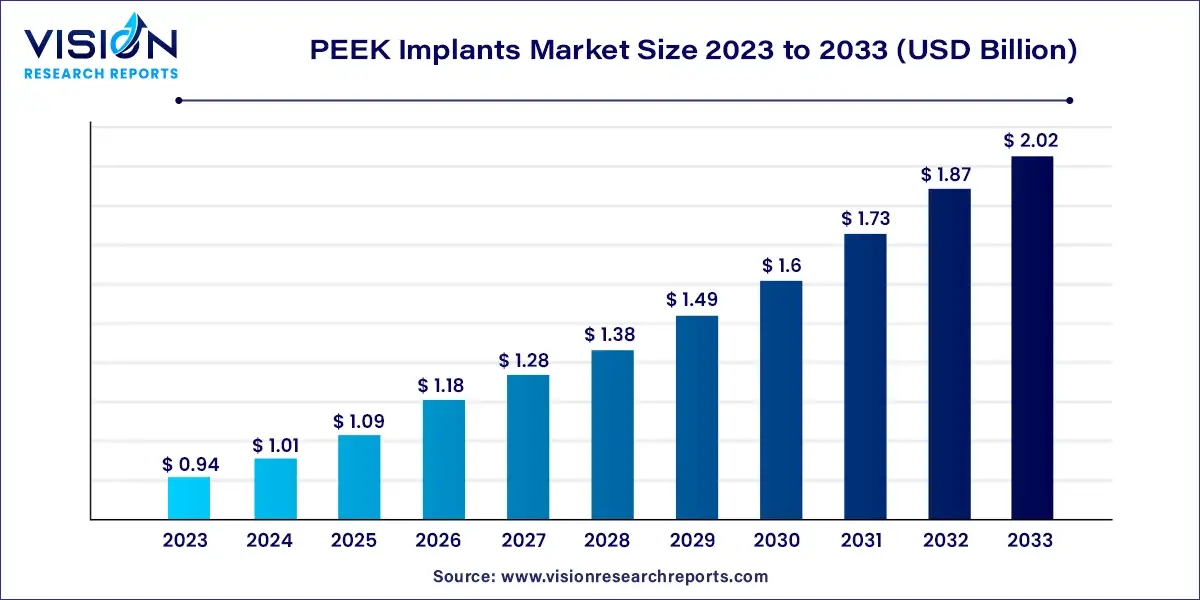

The global PEEK implants market was estimated at USD 0.94 billion in 2023 and it is expected to surpass around USD 2.02 billion by 2033, poised to grow at a CAGR of 7.93% from 2024 to 2033.

Polyetheretherketone (PEEK) implants have emerged as a significant innovation in the field of medical devices, offering a range of advantages over traditional materials such as metal alloys and ceramics. PEEK implants are extensively used in various orthopedic, spinal, and dental surgeries due to their excellent mechanical properties, biocompatibility, and radiolucency.

The growth of the PEEK implants market is driven by the rising incidence of orthopedic and spinal disorders, particularly due to aging populations and sedentary lifestyles, drives the demand for advanced implant solutions. Secondly, continuous advancements in material science have led to the development of PEEK implants with superior properties such as strength, durability, and biocompatibility. Thirdly, the increasing preference for minimally invasive surgical procedures has bolstered the adoption of PEEK implants, thanks to their lightweight nature and ease of implantation. Additionally, ongoing technological innovations in manufacturing techniques and surface modifications have expanded the applications of PEEK implants across various medical specialties.

The spinal implants segment held the largest revenue share of 37% in 2023, primarily driven by the increasing incidence of spinal disorders. The growing prevalence of spinal disorders, fractures, and injuries, coupled with the demand for advanced medical technology and implants, is expected to propel market growth throughout the forecast period. For instance, according to statistics from the World Health Organization (WHO), approximately 250,000 to 500,000 cases of spinal cord injuries (SCI) are reported globally each year, with preventable causes such as falls, automobile accidents, and violence being the primary contributors.

The WHO further estimates that there are 40 to 80 instances of SCI per million adults worldwide annually. However, significant growth is anticipated in the dentistry field within the market. PEEK holds promise as a viable alternative to conventional dental materials in CAD-CAM fixed and detachable dental prostheses. Nevertheless, clinical trials are imperative to assess the long-term performance of PEEK prostheses due to the limited availability of clinical data.

In 2023, the hospitals and clinics segment emerged as the dominant force in the market, commanding a significant revenue share of 65%. Hospitals serve as crucial hubs for delivering a comprehensive array of medical services to communities. With multidisciplinary teams comprising doctors, nurses, therapists, technicians, and support personnel, hospitals ensure a collaborative approach to address patients' medical requirements comprehensively.

On the other hand, specialized clinics prioritize patient-centered care tailored to individuals with specific health conditions. This approach underscores personalized treatment plans, holistic care, and continuous support to optimize patient outcomes. The growth of specialized clinics mirrors the evolving healthcare landscape, propelled by advancements in medical science and technology, and a shift towards patient-centered, value-based care models. These clinics play a pivotal role in catering to diverse healthcare needs and enhancing health outcomes across various medical specialties.

In 2023, the North America PEEK implants market took the lead with the highest revenue share, capturing 42% of the market. The market's robust growth in North America is attributed to the presence of major industry players, a rise in orthopedic disorders, and governmental support for innovative products. Notably, there's a surge in investments in specialized healthcare services, marked by the establishment of new clinics, expansion of existing facilities, and increased focus on research and development endeavors across the region.

Meanwhile, the Europe PEEK implants market secured a share exceeding 28% in 2023, positioning it as the second-largest regional market. The market is poised for further expansion due to factors such as an aging population, the availability of skilled healthcare professionals, and an uptick in trauma and accident cases. Furthermore, injuries remain a significant public health concern across Europe, contributing significantly to the market's growth trajectory.

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others