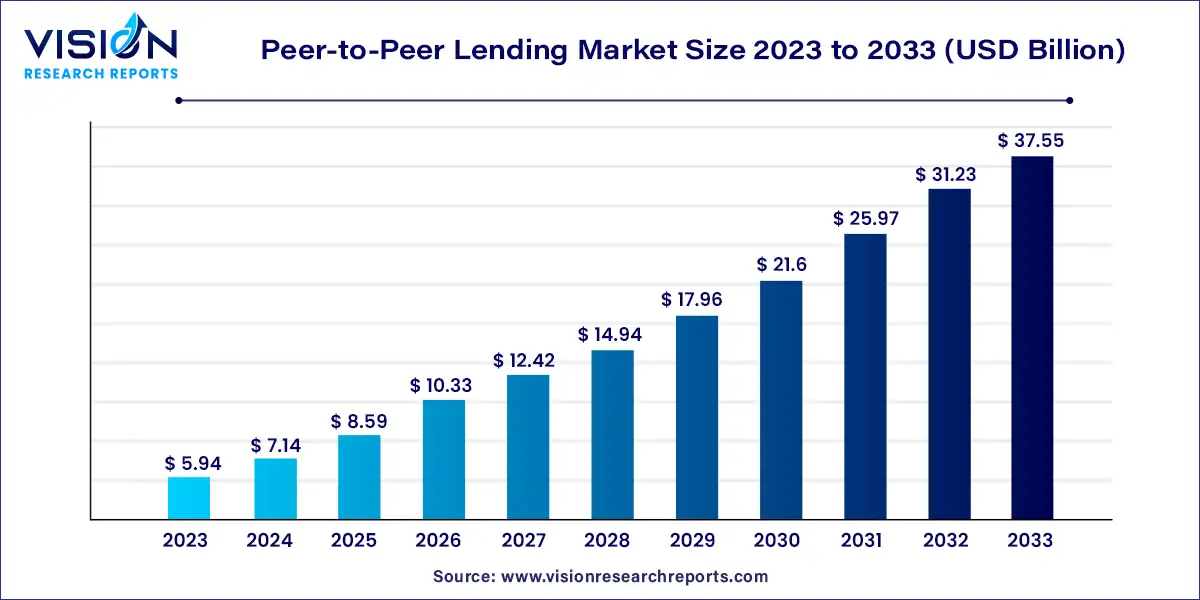

The global peer-to-peer lending market size was estimated at around USD 5.94 billion in 2023 and it is projected to hit around USD 37.55 billion by 2033, growing at a CAGR of 20.25% from 2024 to 2033.

The Peer-to-Peer (P2P) lending market has emerged as a dynamic segment within the broader financial landscape, offering a decentralized platform for individuals and businesses to lend and borrow funds directly from one another without the traditional intermediaries like banks. This disruptive model has gained significant traction globally, driven by factors such as technological advancements, increasing internet penetration, and growing demand for alternative financing options.

At its core, P2P lending platforms serve as matchmakers, connecting borrowers seeking funding for various purposes, ranging from personal loans to small business expansion, with investors looking for attractive returns on their capital. By leveraging sophisticated algorithms and robust risk assessment mechanisms, these platforms facilitate efficient loan origination, underwriting, and servicing processes, mitigating risks for both lenders and borrowers.

The growth of the Peer-to-Peer (P2P) lending market is driven by the technological advancements have enabled the development of sophisticated platforms that facilitate seamless lending and borrowing transactions. Additionally, increasing internet penetration and smartphone adoption have expanded the reach of P2P lending, making it more accessible to a broader audience. Moreover, the growing demand for alternative financing options, coupled with the flexibility and convenience offered by P2P lending platforms, has contributed to their popularity among both borrowers and investors. Furthermore, regulatory developments aimed at fostering innovation and ensuring investor protection have provided a conducive environment for the growth of the P2P lending market.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 32% |

| CAGR of Asia Pacific from 2024 to 2033 | 23.07% |

| Revenue Forecast by 2033 | USD 37.55 billion |

| Growth Rate from 2024 to 2033 | CAGR of 20.25% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The consumer lending segment dominated the market in 2023 with a revenue share of more than 61%. One of the significant benefits of P2P lending is the ability for borrowers to secure loans at lower interest rates compared to traditional banks or credit unions. This advantage stems from the fact that P2P lenders operate with lower overhead costs, enabling them to offer loans at more competitive rates. Moreover, P2P lending platforms typically have a more efficient underwriting process, contributing to lower lending costs and making P2P lending an attractive option for consumers seeking affordable borrowing opportunities.

The business lending segment is anticipated to register the fastest CAGR of 22.55% over the forecast period. P2P lending for businesses is becoming prevalent as this form of lending is exempt from prolonged checking procedures and other complicated processes that pester conventional bank loans. The digital nature of this form of loan results in an easy and swift application process that small businesses tend to appreciate. In addition, P2P loans are most popular among startups and small businesses as they typically have lower limits on the available funding amount.

The unsecured segment dominated the market in 2023 with a revenue share of more than 67%. Unsecured loans do not require borrowers to provide collateral, simplifying the application process and making it more accessible for a larger pool of borrowers. This eliminates the need for time-consuming and cumbersome asset evaluation procedures. In addition, the absence of collateral requirements makes unsecured P2P lending attractive to borrowers who may not have significant assets to pledge as security.

The secured segment is anticipated to register the fastest CAGR of 22.14% during the forecast period. Secured loans offer lenders a higher level of protection by requiring borrowers to provide collateral, such as real estate, vehicles, or other valuable assets. This collateral acts as security for the loan and reduces the risk of default. Therefore, lenders are more willing to provide larger loan amounts and offer lower interest rates, attracting borrowers seeking larger funds or better loan terms.

The non business loans segment dominated the market in 2023 with a revenue share of over 77%. Personal loans cater to a wide range of individual financial needs, such as debt consolidation, home improvement, medical expenses, education, and other personal expenses. This broad applicability attracts a large pool of borrowers, contributing to the dominance of non-business loans. Moreover, P2P lending platforms offer flexibility in loan amounts and repayment terms, which are attractive to individuals seeking smaller loan amounts with shorter repayment periods.

The business loans segment is anticipated to register the fastest CAGR of 22.36% over the forecast period. Small and medium-sized enterprises often encounter challenges accessing traditional bank loans, particularly in the early stages of their business or periods of financial instability. P2P lending platforms provide an alternative financing option that caters specifically to the needs of these businesses, enabling them to obtain the necessary capital for growth and expansion. Moreover, P2P lending offers faster and more streamlined loan application processes compared to traditional financial institutions. This appeals to businesses that require quick access to funding to seize opportunities or address urgent financial needs.

The repaying bank debt segment dominated the market in 2023 with a global revenue share of over 35%. Many borrowers use P2P lending to consolidate and refinance their bank debt. By taking out a P2P loan, borrowers can potentially secure more favorable terms, such as lower interest rates or longer repayment periods, compared to their existing bank loans. This enables them to manage their debt better and reduce their overall financial burden.

The home renovation segment is anticipated to register the fastest CAGR of 22.37% over the forecast period. Banks generally prioritize home loans over smaller home improvement loans due to the larger ticket size and potential for higher returns. This preference creates an opportunity for P2P lending platforms to cater to borrowers seeking funds for home renovation projects. P2P lending platforms offer streamlined processes, competitive rates, and flexibility, enabling borrowers to access smaller loans tailored for home improvements.

North America dominated the peer-to-peer lending market in 2023 with a revenue share of more than 32%. The North America region has a highly developed financial ecosystem with a strong emphasis on innovation and technological advancements. This environment has nurtured the growth of P2P lending platforms and attracted both borrowers and investors. In addition, North America has a large population of tech-savvy individuals who are comfortable with online transactions and digital platforms, making them more receptive to P2P lending. Furthermore, the regulatory framework in North America has been relatively supportive of P2P lending, providing a conducive environment for platform growth.

The Asia Pacific regional market is anticipated to register the fastest CAGR of 23.07% over the forecast period. The Asia Pacific region has a large population, including many unbanked or underbanked individuals with limited access to traditional financial services. P2P lending platforms provide an alternative source of funding for these individuals, driving the demand for P2P lending in the region. In addition, Asia Pacific is experiencing rapid economic growth, leading to increased entrepreneurial activities and small business development. P2P lending platforms serve as a vital source of capital for these businesses, fueling the growth of the region.

By Type

By Loan Type

By End-user

By Purpose Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Peer-to-Peer Lending Market

5.1. COVID-19 Landscape: Peer-to-Peer Lending Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Peer-to-Peer Lending Market, By Type

8.1. Peer-to-Peer Lending Market, by Type, 2024-2033

8.1.1. Consumer Lending

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Business Lending

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Peer-to-Peer Lending Market, By Loan Type

9.1. Peer-to-Peer Lending Market, by Loan Type, 2024-2033

9.1.1. Secured

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Unsecured

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Peer-to-Peer Lending Market, By End-user

10.1. Peer-to-Peer Lending Market, by End-user, 2024-2033

10.1.1. Non Business Loans

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Business Loans

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Peer-to-Peer Lending Market, By Purpose Type

11.1. Peer-to-Peer Lending Market, by Purpose Type, 2024-2033

11.1.1. Repaying Bank Debt

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Credit Card Recycling

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Education

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Home Renovation

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Buying

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Family Celebration

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Peer-to-Peer Lending Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.1.3. Market Revenue and Forecast, by End-user (2021-2033)

12.1.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.2.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.3.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.4.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.5.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Loan Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Purpose Type (2021-2033)

Chapter 13. Company Profiles

13.1. LendingClub Bank

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Lendermarket

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Prosper Funding LLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Proplend

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. PeerBerry

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Upstart Network, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. RateSetter

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. StreetShares, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Bondora Capital OÜ

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. AS Mintos Marketplace

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others