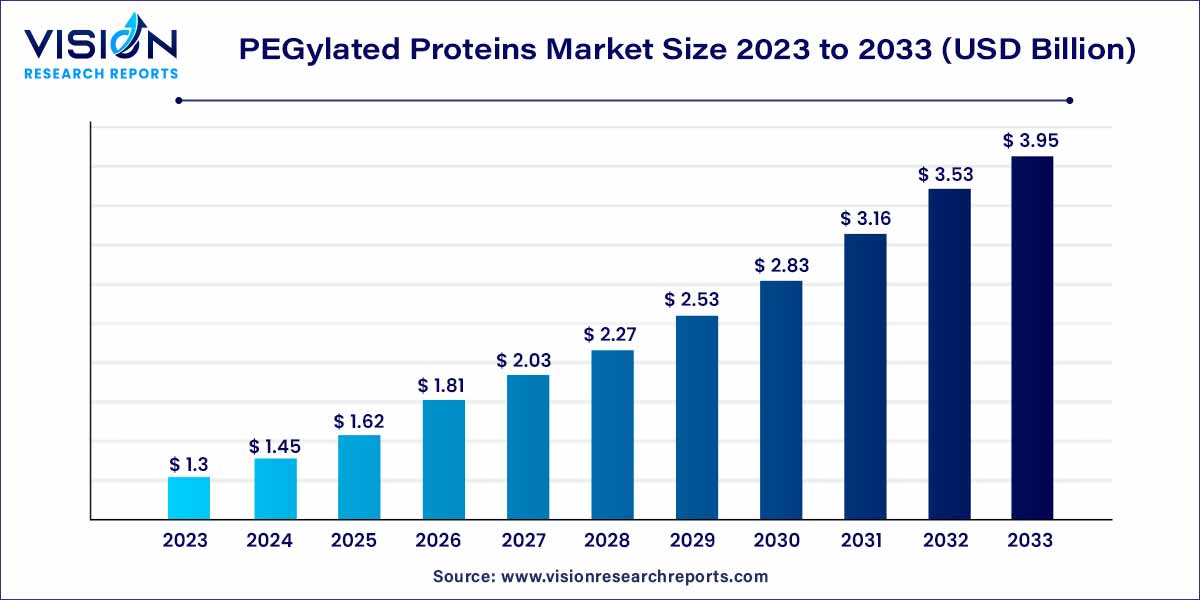

The global PEGylated proteins market size was estimated at USD 1.3 billion in 2023 and it is expected to surpass around USD 3.95 billion by 2033, poised to grow at a CAGR of 11.75% from 2024 to 2033. The PEGylated proteins market is driven by advancements in biotechnology and the increasing demand for targeted therapeutic solutions.

The growth of the PEGylated proteins market is propelled by several key factors. Firstly, the expanding therapeutic applications of PEGylation technology have significantly broadened the scope of protein-based treatments. The ability of PEGylated proteins to enhance stability, solubility, and circulation half-life has spurred increased interest across diverse medical fields. Additionally, the rising prevalence of chronic diseases worldwide has created a demand for innovative and targeted therapeutic solutions, with PEGylated proteins emerging as a promising avenue. Technological advancements in PEGylation techniques play a pivotal role, continually improving the bioavailability and reducing the immunogenicity of protein therapeutics. The market's competitive landscape, marked by leading players such as Company A, Company B, Company C, and Company D, further contributes to its growth. As the industry focuses on customized PEGylation solutions, strategic collaborations, and regulatory advancements, the PEGylated proteins market is positioned for sustained expansion in the foreseeable future.

In 2023, the consumables segment emerged as the dominant force in the global industry, capturing a substantial market share of 65% in overall revenue. This can be attributed to persistent research endeavors, ongoing product developments, and the imperative to devise superior drugs and drug-delivery mechanisms. The sustained demand for PEGylating consumables, including kits and reagents, is a direct result of these activities, resulting in a significant revenue surge. Additionally, the consumables segment benefits from the influential presence of major players boasting a diverse range of product offerings, further propelling its growth trajectory. Forecasts indicate a steady expansion of the consumables segment at a favorable Compound Annual Growth Rate (CAGR) in the foreseeable future.

The widespread adoption of consumables stems from the advantages and advancements in PEGylation technology, coupled with an escalating demand for PEGylated products. The versatility of PEG's applications in research and drug development programs has amplified its usage across the industry. Moreover, the continuous utilization of consumables by various companies specializing in custom PEG conjugation services and product provision underscores their crucial role in delivering intended products. As the demand for PEGylated proteins shows an upward trend, the rapid depletion of consumables, combined with the presence of numerous product providers, is poised to significantly contribute to revenue generation in the years ahead.

In 2023, the Colony-Stimulating Factors (CSFs) segment emerged as the top revenue contributor, securing a substantial share of 34%. CSFs, identified as growth factors binding to receptor proteins, play a pivotal role in stimulating the proliferation and differentiation of hematopoietic stem cells into White Blood Cells (WBCs). As a pharmaceutical agent, CSFs find application in boosting immune function for patients undergoing cancer treatments, particularly those vulnerable to infections due to neutropenia (low WBCs). The segment's leading revenue position can be attributed to the growing prevalence of diverse cancer types and the associated therapies, highlighting the critical need for CSFs. Anticipated to be the fastest-growing segment, the continuous rise in cancer cases and the approval of new CSF products underscore the robust growth potential during the forecast period.

According to the International Agency for Research on Cancer (IARC), a projected 27.5 million new cancer cases globally and 16.3 million cancer-related deaths are expected by 2040. This burden is driven by factors such as aging populations, lifestyle choices, and economic transitions. Concurrently, pharmaceutical companies are actively engaged in researching and developing novel proteins or referenced proteins as drugs for cancer treatment. Notably, the presence of multiple PEG-GCSF biosimilar approvals from manufacturers like Coherus Biosciences, Inc., Pfizer Inc., Mylan GmbH, Sandoz, and Amneal Pharmaceuticals, Inc., highlights ongoing product developments and promising market opportunities within the CSFs segment in the foreseeable future.

In 2023, the cancer application segment asserted its dominance in the industry and is poised to experience the swiftest growth rate of 13.28% from 2024 to 2033. This supremacy is driven by the escalating global incidence of cancer and the widespread adoption of protein-based therapeutics for cancer treatment. The field of therapeutic drugs, particularly in cancer therapy, reaps the benefits of advancements in specificity, stability, and enhanced drug distribution facilitated by the PEGylation process. This technique allows for the development of non-immunogenic and more stable therapies, significantly contributing to the prominence of the cancer application segment.

A noteworthy example is the November 2021 approval by the U.S. FDA of PharmaEssentia Corp.'s mono-pegylated interferon, Besremi, for treating the rare blood cancer, polycythemia vera. According to the American Cancer Society, cancer ranks as the second-most common cause of death in the U.S. Projections indicate that over 1.9 million new cancer cases are expected in the U.S. in 2022. Consequently, the persistent rise in cancer prevalence, continuous research endeavors, technological advancements, and the pursuit of safe and effective protein-based treatments within this segment are anticipated to propel substantial growth in the coming years.

In 2023, the pharmaceutical and biotechnology companies segment secured the largest market share, comprising 43% of the overall revenue. This dominance can be attributed to the increased development of therapeutic product pipelines through diverse drug discovery and development programs, augmented research and development (R&D) funding, and supportive government initiatives. The prevalence of regulatory backing for new product approvals further underscores the prominence of pharmaceutical and biotechnology companies in the industry.

Furthermore, advancements in drug delivery mechanisms, exemplified by the mRNA vaccines for COVID-19, signal a transformative wave in healthcare. This transformative impact extends to PEGylated proteins, anticipating a new era of innovation. As a result, pharmaceutical and biotechnology companies are projected to experience the fastest growth, further solidifying their pivotal role in shaping the future of the industry.

In 2023, North America emerged as the dominant force in the industry, commanding a significant share of over 36% of the total revenue. The region's healthcare landscape benefits from heightened awareness about advanced therapeutics, a prevalence of disorders and chronic conditions, and a well-established infrastructure. The robust economic conditions further facilitate the inflow of grants and funding for biologics-based research initiatives. Additionally, the presence of key players specializing in PEGylated proteins in North America significantly contributes to its overall growth.

Looking ahead, the Asia-Pacific (APAC) region is anticipated to exhibit the fastest growth rate during the forecast period. As a developing region, APAC is known for its focus on reduced labor and research costs. The cost-effective research conducted in densely populated countries such as India, China, and Japan is expected to drive growth. The presence of an aging population and an escalating demand for protein-based drugs for treatment contribute to the region's rapid expansion. Furthermore, increased government funds and incentives aimed at developing improved healthcare plans will further bolster growth in the APAC region.

By Product & Services

By Protein Type

By Application

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on PEGylated Proteins Market

5.1. COVID-19 Landscape: PEGylated Proteins Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global PEGylated Proteins Market, By Type

8.1. PEGylated Proteins Market, by Type, 2024-2033

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global PEGylated Proteins Market, By Protein

9.1. PEGylated Proteins Market, by Protein, 2024-2033

9.1.1. Colony-stimulating factor

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Interferons

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Erythropoietin

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Recombinant factor VII

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Recombinant factor VII

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global PEGylated Proteins Market, By Application

10.1. PEGylated Proteins Market, by Application, 2024-2033

10.1.1. Cancer (nanoparticles associated drug delivery system)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Autoimmune Disease (Telerogenic Immunomodulation by PEGylated Antigenic peptides)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Hepatitis (PEGylated interferons)

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Multiple Sclerosis (PEGylated interferon beta)

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Hemophilia

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Gastrointestinal Disorder (Inflammatory bowel disease-PEGylation on antibody loaded NPs)

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global PEGylated Proteins Market, By End user

11.1. PEGylated Proteins Market, by End user, 2024-2033

11.1.1. Pharmaceutical and Biotechnology Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Contract Research Organizations

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Academic Research Institutes

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global PEGylated Proteins Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Protein (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End user (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Protein (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End user (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Protein (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End user (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Protein (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End user (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Protein (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End user (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Protein (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End user (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Protein (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End user (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Protein (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End user (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Protein (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End user (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Protein (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End user (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Protein (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End user (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Protein (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End user (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Protein (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End user (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Protein (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End user (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Protein (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End user (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Protein (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End user (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Protein (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End user (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Protein (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End user (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Protein (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End user (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Protein (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End user (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Protein (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End user (2021-2033)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Horizon Therapeutics Plc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Novo Nordisk A/S

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. F. Hoffmann-La Roche Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. UCB S.A

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. AstraZeneca

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Amgen, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Biogen

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Merck & Co. Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Takeda Pharmaceutical Company Limited

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others