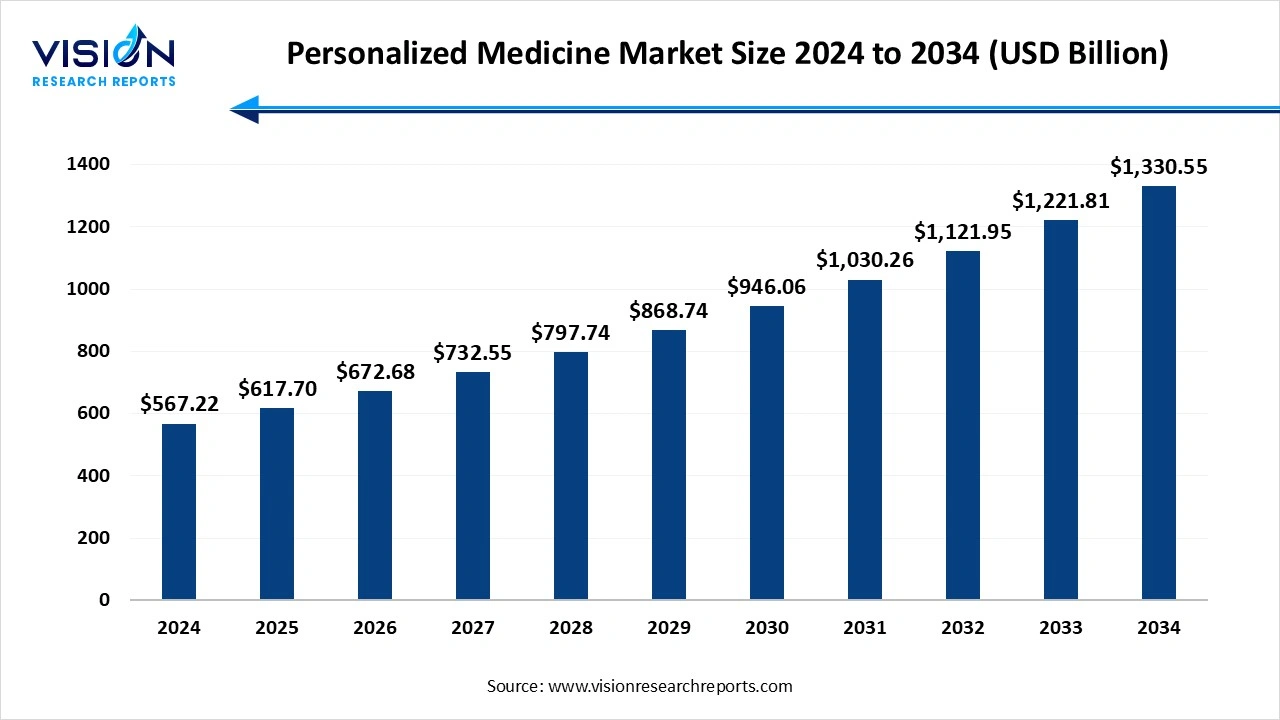

The global Personalized Medicine market size stood at USD 567.22 billion in 2024 and is estimated to reach USD 617.70 billion in 2025, It is projected to hit USD 1,330.55 billion by 2034, growing at a CAGR of 8.9%. The personalized medicine market is growing rapidly due to advancements in genomics, increasing use of targeted therapies, and rising demand for precision diagnostics. Higher prevalence of chronic diseases and expanding applications of AI in healthcare are further accelerating adoption. Growing investments in genetic research and the rise of direct-to-consumer testing also contribute to strong market expansion.

The personalized medicine market is rapidly expanding as healthcare systems shift toward tailored treatment strategies driven by advanced diagnostics, genomic insights, and data-driven care. Growing adoption of targeted therapies, increased demand for precision diagnostics, and rising integration of artificial intelligence are transforming how diseases are detected, prevented, and managed. As pharmaceutical companies invest heavily in biomarker research and companion diagnostics, personalized medicine continues to move from a niche approach to a mainstream healthcare model, promising improved patient outcomes, reduced adverse effects, and more efficient treatment pathways across multiple disease areas.

The personalized medicine market is experiencing robust growth fueled an advancements in genomics and biotechnology are central to this expansion. The completion of the Human Genome Project and ongoing innovations in genetic sequencing technologies have revolutionized the ability to analyze individual genetic profiles, leading to more precise diagnoses and tailored treatment plans. Additionally, the increasing incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders has heightened the demand for personalized treatments that offer improved efficacy and reduced side effects compared to traditional approaches. Technological advancements in data analytics and biomarker discovery further support this trend, enabling more accurate and individualized medical interventions. Moreover, growing investments from both governmental and private sectors are accelerating research and development in personalized medicine, making cutting-edge therapies more accessible.

Report Scope of the xxx Market

| Report Coverage | Details |

| Market Size in 2024 | USD 567.22 Billion |

| Revenue Forecast by 2034 | USD 1,330.55 Billion |

| Growth rate from 2025 to 2034 | CAGR of 8.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | GE Healthcare, Illumina, Inc., ASURAGEN, INC., Abbott, Dako A/S, Exact Sciences Corporation, Danaher Corporation (Cepheid, Inc.), Decode Genetics, Inc., QIAGEN, Exagen Inc., Precision Biologics, Celera Diagnostics LLC, Biogen, Genelex, International Business Machines Corporation (IBM), Genentech, Inc., and 23andMe, Inc. |

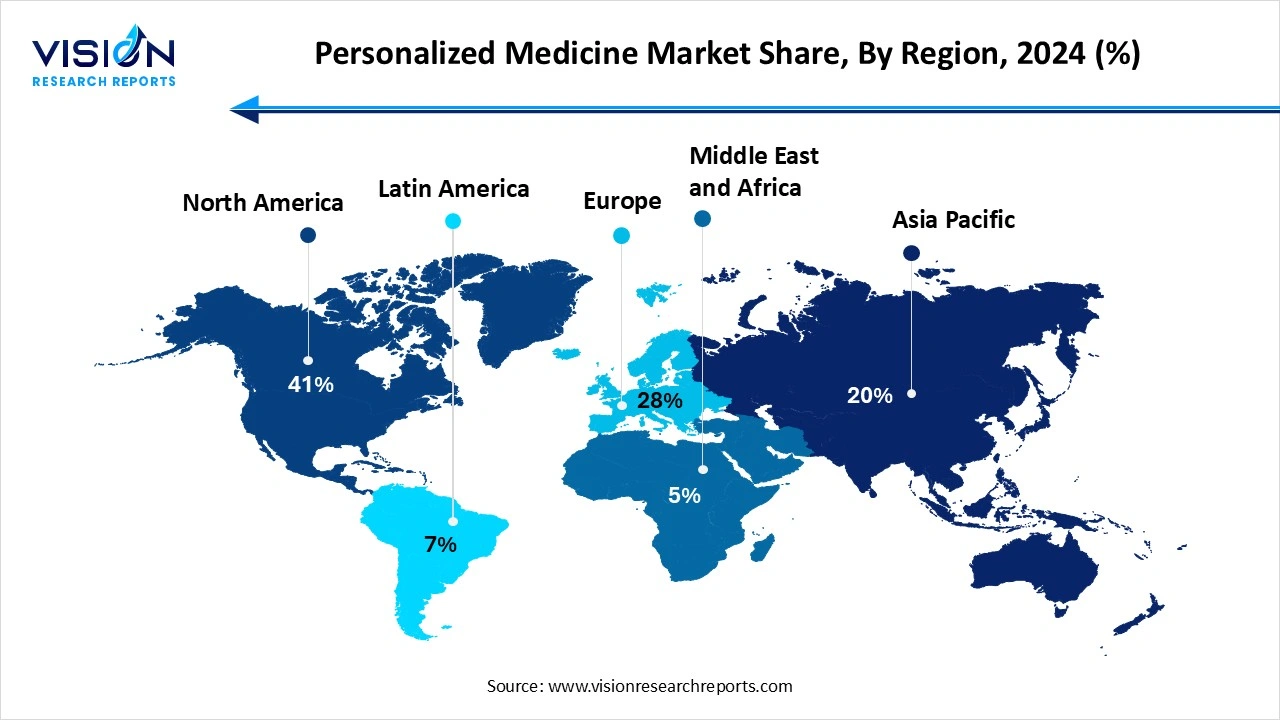

In 2023, North America accounted for the largest share of the personalized medicine market, at 41%. This dominance is due to strong support from research institutions and major pharmaceutical companies. Personalized medicine is increasingly utilized across various diseases and drug discovery processes in the region. Significant advancements in precision diagnostics are emerging, such as Illumina, Inc.’s development of the TruSight Oncology 500 (TSO 500) assay in January 2021. This assay analyzes nucleic acids from tumor samples to identify up to 523 cancer biomarkers.

The Asia Pacific personalized medicine market is expected to grow at the fastest CAGR from 2024 to 2033. The region’s expanding healthcare infrastructure and increasing healthcare expenditures are key factors driving this rapid growth. Several major players are entering the Asia Pacific market, further boosting growth prospects. For instance, in June 2022, MGI and MiRXES partnered to enhance access to advanced spatial multiomics research in the region, which is anticipated to broaden the companies' impact and market reach.

In 2024, the personalized nutrition and wellness segment held a dominant revenue share of 33%, driven by high consumption rates and market penetration. This segment benefits from the popularity of over-the-counter (OTC) nutrition products, which face fewer regulatory hurdles. For example, in November 2023, Viome Life Sciences acquired Naring Health, including its DiscernDX platform. DiscernDX is known for its capabilities in regular health monitoring, early disease detection, and personalized care. This acquisition strengthens Viome’s position in personalized health solutions, enhancing its ability to offer precise food and supplement recommendations. This move marks a significant advancement in personalized nutrition, providing customers with detailed insights into their health and tailored strategies to address underlying issues.

The personalized medicine therapeutics segment is anticipated to experience the fastest compound annual growth rate (CAGR) from 2024 to 2033. The key driver behind this growth is next-generation sequencing technology. The development of high-capacity rapid sequencing platforms is expected to significantly lower the cost of sequencing the entire human genome, leading to greater adoption and utilization of precision medical therapies.

In 2024, the hospital sector led the market with the largest revenue share. Hospitals are crucial players in the personalized medicine market, serving both as end-users and influencers. There is a growing trend towards integrating genomic diagnostics and targeted therapies within hospital settings, reflecting a shift towards personalized medicine. Hospitals are leveraging genetic insights to customize treatments for patients, driving advancements in diagnostic tools and therapeutic methods. This embrace of genomics helps hospitals contribute to market growth by fostering innovation, enhancing patient outcomes, and leading transformative healthcare practices.

By Product

By End-use

By Region

Personalized Medicine Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Personalized Medicine Market

5.1. COVID-19 Landscape: Personalized Medicine r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Personalized Medicine Market, By Product

8.1. Personalized Medicine Market, by Product,

8.1.1. Personalized Medicine Diagnostics

8.1.1.1. Market Revenue and Forecast

8.1.2. Personalized Medicine Therapeutics

8.1.2.1. Market Revenue and Forecast

8.1.3. Personalized Medical Care

8.1.3.1. Market Revenue and Forecast

8.1.4. Personalized Nutrition & Wellness

8.1.4.1. Market Revenue and Forecast

Chapter 9. Personalized Medicine Market, By End-use

9.1. Personalized Medicine Market, by End-use,

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast

9.1.2. Diagnostic Centers

9.1.2.1. Market Revenue and Forecast

9.1.3. Research & Academic Institutes

9.1.3.1. Market Revenue and Forecast

9.1.4 Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by End-use

Chapter 11. Company Profiles

11.1. GE Healthcare

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Illumina, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ASURAGEN, INC.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Abbott

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Dako A/S

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Exact Sciences Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Danaher Corporation (Cepheid, Inc.)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Decode Genetics, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. QIAGEN

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Precision Biologics

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others