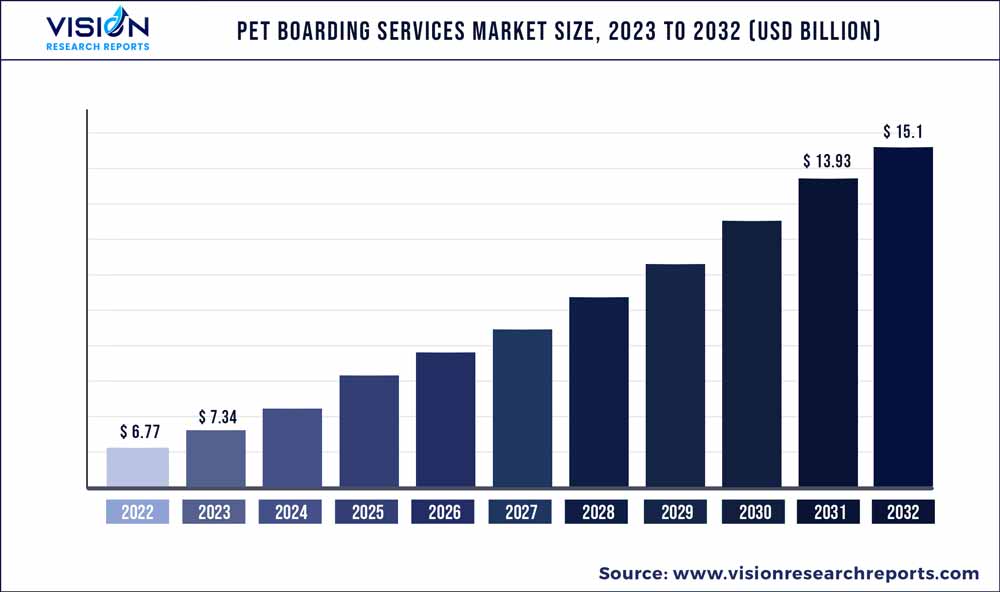

The global pet boarding services market size was estimated at around USD 6.77 billion in 2022 and it is projected to hit around USD 15.1 billion by 2032, growing at a CAGR of 8.35% from 2023 to 2032. The pet boarding services market in the United States was accounted for USD 2.4 billion in 2022.

Key Pointers

Report Scope of the Pet Boarding Services Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 36% |

| CAGR of Asia Pacific from 2023 to 2032 | 9.54% |

| Revenue Forecast by 2032 | USD 15.1 billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | A Place for Rover, Inc.; Holidog.com; Fetch! Pet Care; Swifto Inc.; Camp Bow Wow; PetSmart LLC; PARADISE 4 PAWS.; PetBacker; We Love Pets; Anvis Inc.; Dogtopia Enterprises |

The market growth is largely propelled by factors, such as the rising popularity of pet boarding or daycare services, growing pet ownership & animal humanization trends, and increasing pet care expenditure in developed and developing countries. In addition, the strategies implemented by key players are further boosting market growth. For instance, Rover partnered with the Petco Health and Wellness Company, Inc., in February 2022, to offer Petco customers access to pet boarding and other pet care services. This enabled Rover to reach around 130,000 subscribed pet parents from Petco’s Vital Care.

During the year 2020, the COVID-19 pandemic had a negative impact on the market. This was owing to the stringent government restrictions with nationwide lockdowns and social distancing norms, closure of pet service centers, and reduced appointments in boarding homes. For instance, a survey report published by Anicom, a Japanese pet insurance company, states that the expenditure on pet hotels or boarding centers decreased notably during the year 2020. Every market player encountered challenges during the pandemic owing to restricted access to services. However, the growth quickly recovered the following year with increased pet adoption and ownership rates worldwide.

For instance, according to the American Society for the Prevention of Cruelty to Animals (ASPCA), over 23 million American households adopted a new pet during the COVID-19 pandemic. Rover, for instance, reported that the company registered its largest pet services booking ever in July 2021, with approximately 421,000 bookings. The company also stated that the number of new bookings is the all-time largest in the same month, with approximately 99,000, which was a 31% growth compared to July 2019. Pet parents are increasingly opting for these services instead of relying on friends, family, and neighbors.

As per a July 2020 survey report published by Rover, 67% of its users (pet owners) previously relied on family, friends, and neighbors for pet boarding and daycare. Since its establishment in 2011, over two million pet parents have booked the services, and more than 42 million services across the U.S., Canada, the UK, and Europe, have been delivered by Rover. In addition, the growing expenditure for non-medical veterinary services in developed countries such as the U.S. is further contributing to market growth. According to American Pet Products Association (APPA), the expenditure on pet services such as boarding, was around USD 11.4 billion in 2022, which is projected to reach USD 11.8 Billion in 2023.

Pet Type Insights

The dog pet type segment dominated the market with the largest revenue share of over 81% in 2022. This is attributed to the large adoption of these services for canine breeds, coupled with their growing population in developed countries. The U.S., for example, was estimated to have about 90 million pet dogs in 2022, as per the American Veterinary Medical Association (AVMA), APPA, and internal GVR estimates. By 2030, this number is projected to exceed 100 million. The increasing population of pet dogs in several key countries is expected to contribute to the demand for short-term & long-term boarding services for dogs.

The cats pet type segment is estimated to register the fastest CAGR of about 9.04% over the forecast period owing to the growing adoption of cats and their increasing ownership rates. For instance, the World Animal Foundation estimated that between 2016 and 2020, cat ownership increased from 25% to 26%, reaching 29% in 2022. A total of 25.4% of U.S. households have cats. During the forecast period, the demand for feline boarding services was high. However, the very territorial nature of the feline population might cause stress and behavioral changes among them, which hesitates many cat owners to board their animals. This factor is expected to hamper the segment growth.

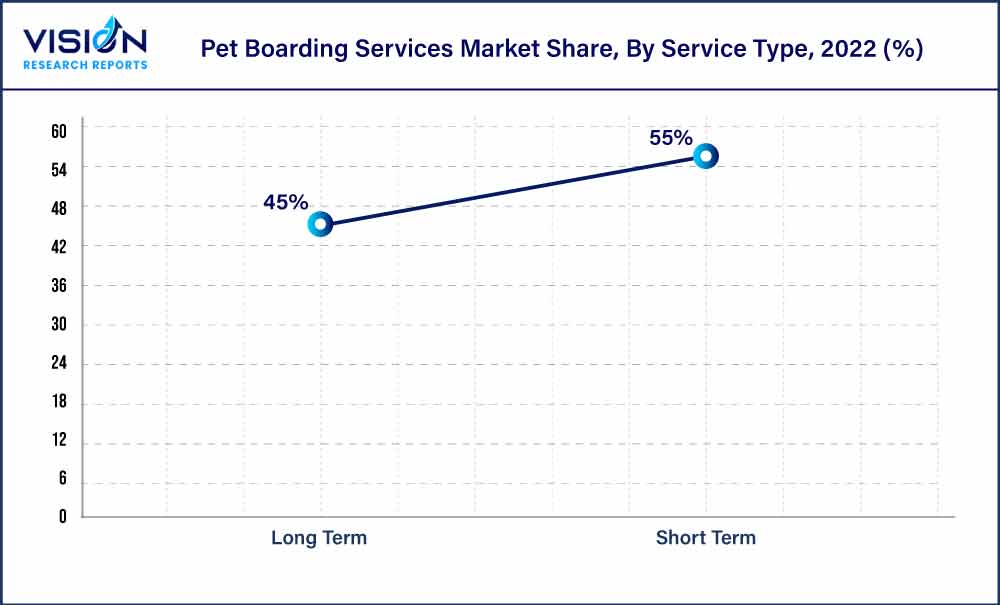

Service Type Insights

Based on the type of services, the market is bifurcated into long-term and short-term services. The short-term or daycare segment dominated the market with the largest revenue share of 55% in 2022. Pet short-term boarding services are often the most adopted and preferred option as they are comparatively more in demand and allow the owner to leave their pets under professional care during the day time. In addition, the pet parents returning to the office post-covid measures, and a high proportion of pet parents being among millennials and the Gen Z population increases the demand for short-term boarding centers for pets.

Rover-a leading pet services provider in the U.S. connects pet care boarders to pet parents via its mobile app. The company has a presence in 50 states across the U.S. and covers 96% of the population. Approximately 41% of the company’s pet parent users in 2020 were millennials, 15% were Gen Z, and the rest were Gen X and baby boomers. Most of the company’s customers also come from affluent households with about 45% belonging to households having an income of USD 100,000 and more. These supportive factors are anticipated in contributing to the substantial share of long-term boarding services.

Regional Insights

The North America region dominated the global industry with the largest revenue share of over 36% in 2022. This substantial share is owing to the presence of a large pet population with respectively high expenditure on pet services. For instance, according to the APPA, the U.S. pet industry expenditure increased from USD 90.5 billion in 2018 to USD 136.8 billion in 2022. The report also estimates the projected expenditure to reach USD 143.6 billion by the end of 2023. These factors are contributing to the region’s largest share.

The Asia Pacific region is projected to grow at the fastest CAGR of over 9.54% during the forecast period. The changing consumer lifestyles, rising interest among people in adopting companion animals, and growing disposable income are expanding the region’s pet industry expenditure. In addition, the growing number of local service providers coupled with increased awareness about and popularity of pet boarding processes in the region supports the market growth. Other regions, such as Europe, Latin America, and Middle East & Africa, also have notable shares in the global market owing to their dynamic pet industry.

Pet Boarding Services Market Segmentations:

By Pet Type

By Service Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pet Boarding Services Market

5.1. COVID-19 Landscape: Pet Boarding Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pet Boarding Services Market, By Pet Type

8.1. Pet Boarding Services Market, by Pet Type, 2023-2032

8.1.1. Dogs

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cats

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Pet Boarding Services Market, By Service Type

9.1. Pet Boarding Services Market, by Service Type, 2023-2032

9.1.1. Long Term

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Short Term

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Pet Boarding Services Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

Chapter 11. Company Profiles

11.1. A Place for Rover, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Holidog.com

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Fetch! Pet Care

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Swifto Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Camp Bow Wow

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. PetSmart LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. PARADISE 4 PAWS.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. PetBacker

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. We Love Pets

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Anvis Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others