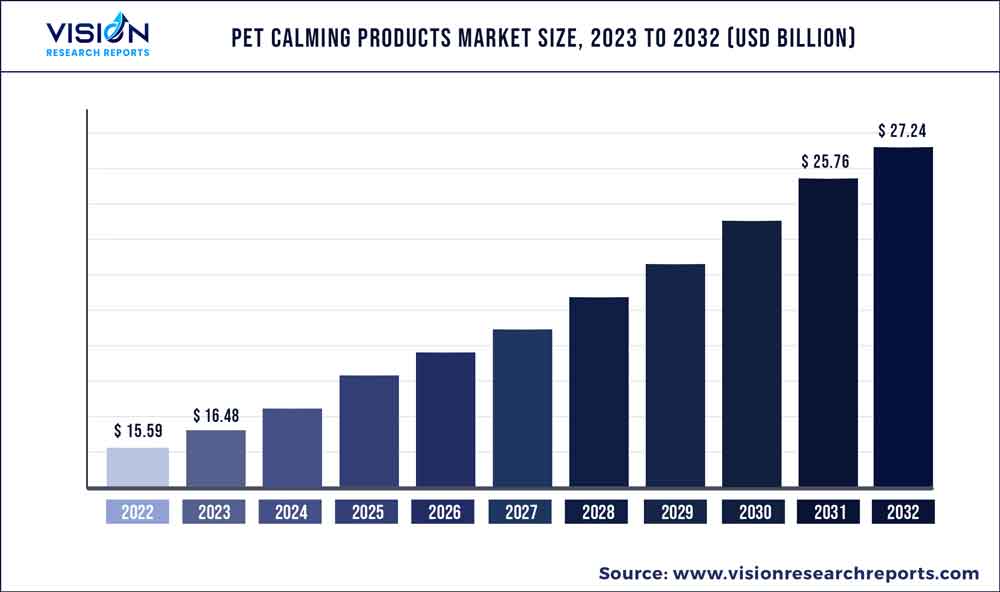

The global pet calming products market size was estimated at around USD 15.59 billion in 2022 and it is projected to hit around USD 27.24 billion by 2032, growing at a CAGR of 5.74% from 2023 to 2032. The pet calming products market in the United States was accounted for USD 5 billion in 2022.

Key Pointers

Report Scope of the Pet Calming Products Market

| Report Coverage | Details |

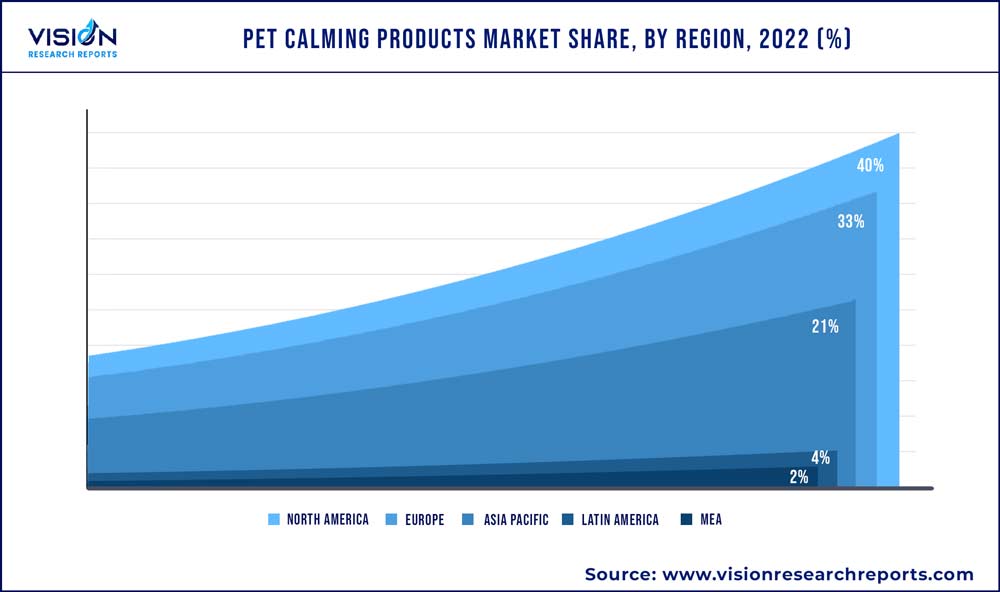

| Revenue Share of North America in 2022 | 40% |

| CAGR of Asia Pacific from 2023 to 2032 | 6.82% |

| Revenue Forecast by 2032 | USD 27.24 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.74% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nestlé Purina Petcare; Virbac; NOW Foods; Zoetis Inc.; PetHonesty; Zesty Paws; THUNDERWORKS; PetIQ, LLC.; CEVA (ADAPTIL); GARMON CORP. (NaturVet) |

Increased awareness that pets, like humans, can experience stress, anxiety, and behavioral issues has led to more pet owners seeking solutions to help their pets manage these conditions. This, in turn, drives growing demand for pet calming products. Lifestyle changes, the humanization of pets, the impact of the COVID-19 pandemic on human-pet relations, and the efficacy of the products are other major factors boosting the market.

The COVID-19 pandemic had a significant impact on the pet calming products industry. With more people working from home and spending increased amounts of time with their pets, many pet owners have reported increased stress and anxiety in their pets. This has led to an increased demand for calming products to help manage these issues. Additionally, the pandemic disrupted the global supply chain, resulting in shortages of certain pet products. This led to some pet owners trying new calming products or turning to online retailers to find the products they need, which also contributed to an increase in demand.

Over the years the trend towards pet ownership is growing, with pets being viewed more as members of the family and as companions. According to Petsecure, the U.S., China, Russia, and France are some nations with the most pet dog and cat populations. Moreover, Americans spend more than USD 50 billion on their pets annually. Changes in lifestyle, such as increased urbanization, long working hours, and decreased outdoor access, have resulted in pets spending more time indoors and often being left alone for extended periods. This can lead to boredom, anxiety, and behavioral issues in pets.

Brands in the pet calming product market have responded to the trends by offering a range of effective and innovative calming solutions that cater to the diverse needs of pet owners and their pets. As more pet owners seek out natural and holistic remedies for their pets, many brands have started to emphasize natural ingredients and formulations in their calming products.

Pet Naturals, a U.S. brand for instance uses fruits, vegetables, oats, seeds, herbs, spices, and champignon mushroom extract as some of the ingredients in its pet calming products. Moreover, it claims to never use benzoic acid, butylated hydroxyanisole, propylene glycol, and parabens in its formulations. The efficacy of pet calming products is crucial for the growth of the market. If pet owners do not see positive results from using calming products, they are less likely to continue using them or recommend them to others. Therefore, the effectiveness of calming products is a key factor in driving demand and growth in the market.

There have been some studies on the effectiveness of pet calming products. A study published in the Journal of Feline Medicine and Surgery found that pheromone-based calming products, such as diffusers and sprays, can be effective in reducing stress and anxiety in cats. Various ingredients such as L-theanine, L-tryptophan, magnolia officinalis, and Phellodendron amurense are commonly found in pet calming products, with research backing their efficacy. For instance, studies have shown both magnolia officinalis and Phellodendron amurense to reduce fear-related signs in dogs during thunderstorms.

Pet Type Insights

The dog segment dominated the market with a share of more than 53% in 2022. According to HealthforAnimals, dogs are the most popular pet worldwide, with a presence in one out of three households. The combination of increased awareness of pet anxiety, growing pet ownership, lifestyle changes, and preference for natural remedies has led to a growing demand for pet calming products for dogs. As people have become busier and more active, they are increasingly taking their dogs with them on the go, whether it be to work, travel, or social events. This can be stressful for some dogs, leading to a greater demand for calming products to help them cope.

The cat segment on the other hand is forecasted to expand at the fastest CAGR of 6.53% in the forecast period. Ownership of cats as a pet is on the rise. According to Lemonade, a pet insurance provider, there are around 110.15 million pet cats in Europe, which makes it the continent with the highest cat ownership. Moreover, American Veterinary Medical Association reports that, between 2016 and 2020, the proportion of homes with at least one cat climbed slightly, from 25% to 26%, before rising to 29% in 2022. Calming sprays, chews containing chamomile and L-tryptophan, diffusers, and supplements are popular calming products widely available for cats.

Product Insights

In terms of product type, the snacks and treats segment dominated the market with a share of over 39% in 2022. These types of products are easy to give to pets and can be incorporated into their regular feeding routine. They don't require any special equipment or training to use and can be given to pets as a reward or as a way to calm them down during stressful situations. Additionally, several pet calming snacks and treats are made with natural ingredients, such as herbs, vitamins, and minerals, with calming properties. This can be appealing to pet owners who prefer natural remedies for their pets.

The gel and ointment segment is posed to register the fastest CAGR of 7.83% during the forecast period. Convenience, targeted application, longer-lasting effects, and use of natural ingredients are factors set to boost the traction of this segment. Gels and ointments are easy to apply and can be quickly absorbed into a pet's skin. This makes them a convenient option for pet owners who want a fast-acting solution to calm their pets during stressful situations. Moreover, such products can be applied directly to the areas where pets are most likely to experience stress and anxiety, such as around the ears or under the chin. This targeted application can make them more effective at calming pets than other products that are ingested or applied more generally.

Type Insights

The over-the-counter segment dominated the market and accounted for the largest revenue share of 64% in the 2022. The rising demand for OTC pet calming products can be attributed to their availability, affordability, and convenience. As investors seek a stake in consumers' growing desire for higher-quality care and more choices for their pets, pet nutrition and other supplies have received a lot of attention. Recent investment moves, especially mergers & acquisitions, have resulted in resource availability to develop new and innovative OTC pet calming products that are safe, effective, and meet the evolving needs of pet owners. For instance, in July 2020, NXMH, a Belgian investment firm, acquired Whitebridge Pet Brands. NXMH focuses on expanding its product portfolio through acquisitions and product development.

The prescription based pet calming products segment is set to rise at a CAGR of around 6.54% in the forecast period. Nowadays, pet owners treat their pets as family members, taking every measure to improve their quality of life. This has led to an increased demand for prescription-based pet calming products. The American Pet Products Association (APPA) 2021-2022 National Pet Owners Survey demonstrated the growing commitment toward pet health. For instance, among all pet owners, owners of birds reported providing their birds with the most vitamins and supplements. Such a scenario bodes well for the growth of this category.

Distribution Channel Insights

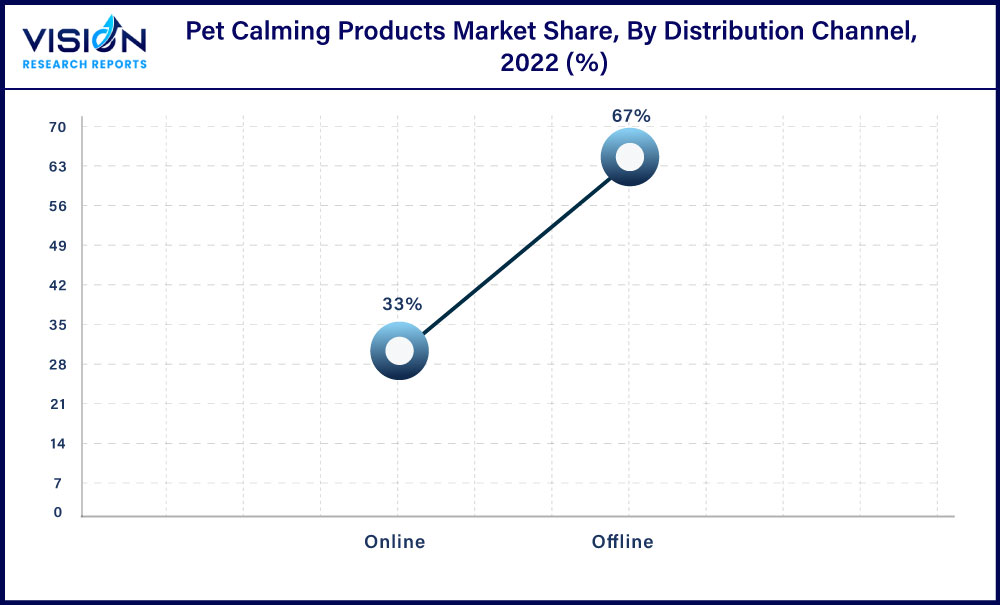

The offline channel segment dominated the market and accounted for revenue share of about 67% in 2022. Offline distribution channels, such as pet stores or veterinary clinics, are often preferred for buying pet calming products for several reasons such as expert advice by present personnel, product testing, immediate availability, and trust worthy sources. In an offline setting, the consumer gets expert advice from trained professionals, such as veterinarians or pet store employees, who can recommend the best calming products for their pet’s specific needs.

The online channel is forecasted to expand at a CAGR of 6.65% during the forecasted period. Online stores offer the convenience of shopping from anywhere, at any time. This is especially important for consumers who live in remote areas or have busy schedules that make it difficult to visit offline stores during business hours. Additionally, factors such as variety, product discounts, price comparisons, and customer reviews will further fuel market growth.

Regional Insights

The North America region dominated the pet calming products industry with a share of over 40% in 2022. With rapid pet ownership trends in the region, the demand for pet-related products is on the rise. A blog by Lemonade suggests that 70% of households in the U.S. owned a pet in 2022. Additionally, pet owners in this country spent approximately USD 9.7 billion on services apart from veterinary needs, including grooming, insurance, boarding, and training. Rising urbanization, and hectic schedules, coupled with awareness and education about pet calming products are major factors propelling the markets in this region.

Asia Pacific region is posed to register the fastest CAGR of about 6.82% during the forecast period. With the younger population delaying marriage and kids, the pet industry in this geography is set to rise rapidly. According to a 2022 article by South China Morning Post, as a result of rising living expenses and the demands of the modern workplace, an increasing number of young Chinese people are choosing to postpone marriage and parenthood or simply give up on both. Many of them choose to raise pets, in turn creating a thriving pet economy. According to China Pet Industry Association, pet dogs and cats in urban areas exceeded 100.8 million in 2020.

Pet Calming Products Market Segmentations:

By Pet Type

By Product

By Distribution Channel

By Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pet Calming Products Market

5.1. COVID-19 Landscape: Pet Calming Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pet Calming Products Market, By Pet Type

8.1. Pet Calming Products Market, by Pet Type, 2023-2032

8.1.1. Dog

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cat

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Pet Calming Products Market, By Product

9.1. Pet Calming Products Market, by Product, 2023-2032

9.1.1. Food and Supplements

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Snacks and Treats

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Gel and Ointment

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Spray and Mist

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Pet Calming Products Market, By Distribution Channel

10.1. Pet Calming Products Market, by Distribution Channel, 2023-2032

10.1.1. Offline

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Online

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Pet Calming Products Market, By Type

11.1. Pet Calming Products Market, by Type, 2023-2032

11.1.1. Prescription

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Over-the-Counter

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Pet Calming Products Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.1.4. Market Revenue and Forecast, by Type (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Type (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Type (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Type (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Type (2020-2032)

Chapter 13. Company Profiles

13.1. Nestlé Purina Petcare

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Virbac

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. NOW Foods

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Zoetis Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. PetHonesty

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Zesty Paws

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. THUNDERWORKS

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. PetIQ, LLC.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. CEVA (ADAPTIL)

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. GARMON CORP. (NaturVet)

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others