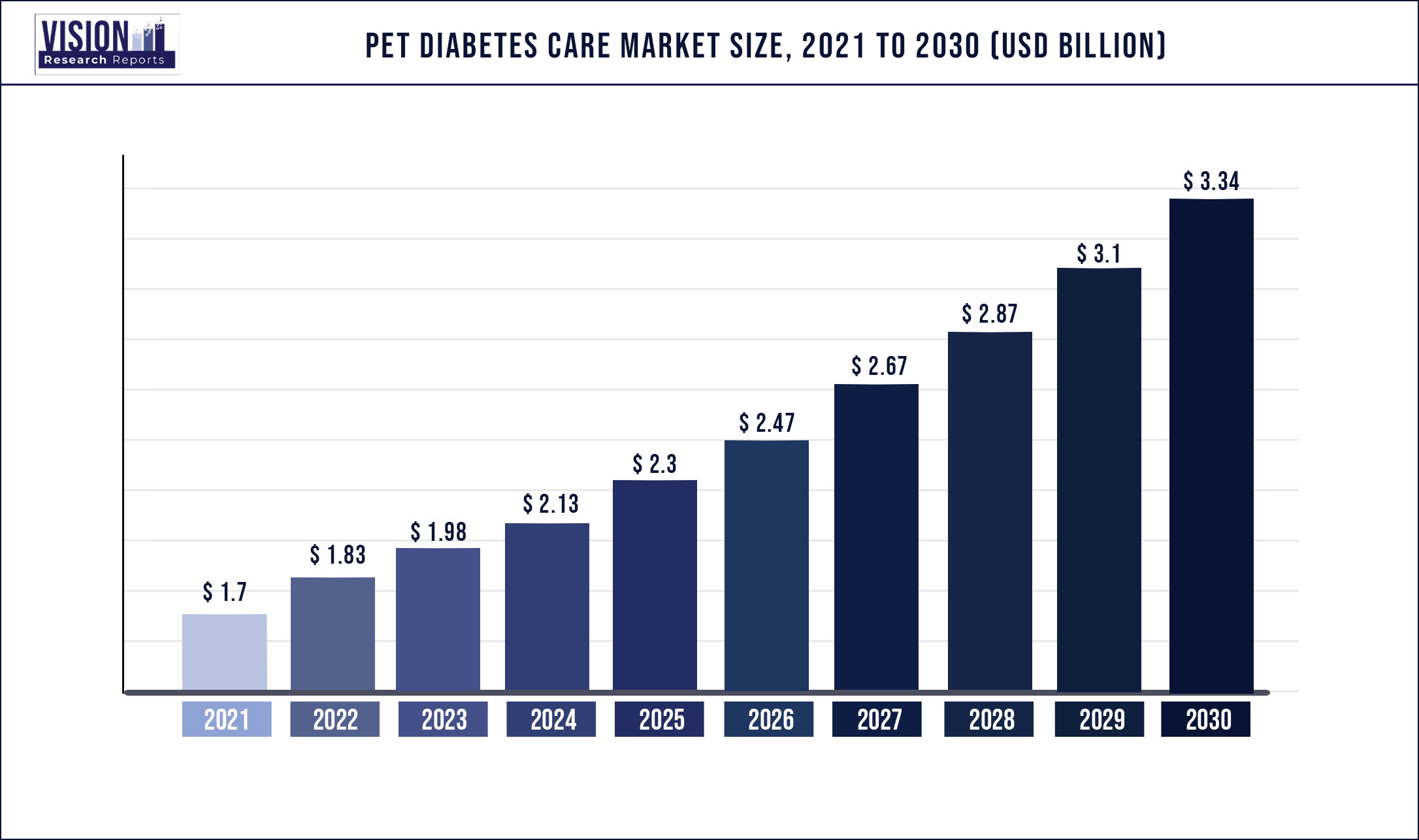

The global pet diabetes care market was valued at USD 1.7 billion in 2021 and it is predicted to surpass around USD 3.34 billion by 2030 with a CAGR of 7.79% from 2022 to 2030.

Report Highlights

By animal type, the North America pet diabetes care market was valued at USD 0.8 billion in 2021 and expected to witness growth at a CAGR of 7.99% from 2022 to 2030.

The key drivers for the market growth are the increasing advancements in pet diabetes care devices, the prevalence of diabetes in pet animals, and the vulnerability of older dogs and cats to develop diabetes. According to the American Veterinary Medical Association, dogs over 7 years old and cats over 6 years old are more prone to be diagnosed with diabetes. In addition, as pets age, obesity arises among them which becomes a significant risk factor for the said condition.

The COVID-19 pandemic created barriers and challenges in the global pet animal health industry that include decreased marketing & sales activities, low veterinary clinic admission, cancellation of routine pet check-ups, and a low number of insulin administration processes performed in veterinary hospitals. However, governments and veterinary organizations of various countries implemented strategies and safety measures to resume veterinary practices during the pandemic. According to the American Veterinary Medical Association, telemedicine services were widely incorporated in veterinary clinics and hospitals to curb the impact of lockdowns and the pet parents were given digital training to inject insulin.

The increasing pet care expenditure in both developing and developed economies is a significant opportunity considered for market growth. According to the American Kennel Club (AKC), pet owners in the U.S. were seen to spend more money on their pet’s wellness and related healthcare products. The American Pet Products Association reported that the overall pet industry sale exceeded USD 100 billion by the end of 2020. The AKC also stated that online veterinary product shopping increased by 86% after the emergence of the pandemic. The trend of owning popular breeds of dogs and cats also enhanced the required routine veterinary and diabetic care services among them. These factors are expected to boost the growth of the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.7 billion |

| Revenue Forecast by 2030 | USD 3.34 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.79% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Animal type, solution, distribution channel, region |

| Companies Covered | Merck & Co., Inc.; Zoetis; BD; Boehringer Ingelheim International GmbH; Trividia Health, Inc.; Allison Medical, Inc.; UltiMed, Inc.; ACON Laboratories Inc.; i-SENS, Inc.; TaiDoc Technology Corporation |

Animal Type Insights

The dogs segment dominated the global pet diabetes care market with a revenue share of over 50.1% in 2021, due to the rising adoption rates of dogs, and the significant disease prevalence. The growing population of dogs is further boosting the growth. According to American Veterinary Medical Association, 45% of American households owned dogs in 2020.

Similarly, as per the European Pet Food Industry, nearly 88 million households in Europe owned a pet, and the dog population was estimated to be 90 million in 2020. In addition, the COVID-19 pandemic has encouraged most people in the world to adopt companion animals for psychological comfort.

The cats segment is anticipated to register a CAGR of over 8% during the forecast period owing to the increasing awareness among pet parents concerning symptoms of diabetes in their cats. The growing prevalence of diabetes in the cat population is another factor boosting the growth.

For instance, according to Boehringer Ingelheim International GmbH, cats are three times more prone to acquire diabetes compared to dogs. In addition, more than half of cats are obese, thereby having a higher risk of developing diabetes. The visual symptoms such as excessive urination, thirst, appetite, and sudden weight loss in diabetic cats are alerting the pet parents in timely diagnosis and following treatments.

Solution Insights

The treatment segment held the largest market share of over 60.12% in 2021. This is owing to the wide availability of major brands of insulin such as Vetsulin and Prozinc. Any dog or cat that is diagnosed to have diabetes is indicated to undergo a lifetime treatment with insulin injection each day.

The veterinarians prefer insulin therapy as a gold standard treatment for diabetes in pet animals, as it aids in transferring glucose from consumed food to other parts of the body. The requirement for insulin delivery devices such as syringes, needles, and delivery pens is high in veterinary hospitals and households, as the needles cannot be reused.

The glucose monitoring devices segment is expected to hold a significant market share over the forecast period owing to the growing diagnosis rate for pets with diabetes and companies launching pet diabetes care devices. As human glucometers are not accurate for animal glucose readings, specific pet glucose monitoring devices have been launched by the key players.

For instance, the AlphaTRAK blood glucose monitoring system by Zoetis is an easy-to-use veterinary kit that helps pet parents to manage their pet’s diabetes condition. In addition, the companies are also providing online application software that can be used with these devices to view reliable vital data on smartphones or tablets. For instance, Zoetis launched PetDialog App which is used along with the AlphaTRAK monitoring device. These factors are supporting the segmental growth of the market.

Distribution Channel Insights

The veterinary hospitals & clinics segment held the largest market share of over 40.2% in 2021. This is owing to a growing number of veterinary hospitals and clinics globally with advanced infrastructures. The veterinary clinics and hospitals are also primary centers of care for pet parents and a major source of acquiring medications for sick pets.

The growing number of veterinary professionals is another factor driving the segment growth in the market. According to the Federation of Veterinarians of Europe, the number of veterinarians was approximately 263 million in Europe in 2019.

The other distribution channels such as retail pharmacies and e-commerce websites are widely contributing to the growth of the market. With an increased number of households owning companion animals, their demand for convenient access to pet glucometers and insulin products is increasing.

There are various brands of glucose monitoring devices and insulin delivery pens available in retail vet pharmacies for diabetes application in pet animals. The online sales of pet diabetic products have grown widely during the COVID-19 pandemic. E-commerce or online stores have become a convenient and easily accessible platform for pet treatment products.

Regional Insights

North America held more than 30% of the revenue share of the market in 2021. The high share of the region is due to the significant presence of key players, the adoption of various strategies initiated by key companies to increase market penetration, rising treatment availability, rising diagnostic rates, and increasing pet population & expenditure.

The growing number of veterinary clinics with licensed and trained veterinarians in the countries is another factor to boost the growth of the market. According to the AVMA, in 2020 nearly 118,624 licensed veterinarians were estimated in the U.S. which majorly catered to pet animal patients.

The Europe region held the second-largest revenue share of the market for pet diabetes care in 2021. This is owing to the presence of major key players such as Boehringer Ingelheim International GmbH and others in the European countries.

Asia Pacific is estimated to register a CAGR of over 9% from 2022 to 2030. This is attributable to the rising animal healthcare expenditure & disposable income in key markets and increasing awareness about the disease in developing countries.The growing demand for the proper and timely diagnosis of pet diabetes, and pet humanization in developing countries like India is further boosting the growth of the market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pet Diabetes Care Market

5.1. COVID-19 Landscape: Pet Diabetes Care Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pet Diabetes Care Market, By Animal Type

8.1. Pet Diabetes Care Market, by Animal Type, 2022-2030

8.1.1 Dogs

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cats

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Pet Diabetes Care Market, By Solution

9.1. Pet Diabetes Care Market, by Solution, 2022-2030

9.1.1. Treatment

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Glucose Monitoring Devices

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Pet Diabetes Care Market, By Distribution Channel

10.1. Pet Diabetes Care Market, by Distribution Channel, 2022-2030

10.1.1. Veterinary Hospitals & Clinics

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Retail Pharmacies

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. E-commerce

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Pet Diabetes Care Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Solution (2017-2030)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

Chapter 12. Company Profiles

12.1. Merck & Co., Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Zoetis

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BD

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Boehringer Ingelheim International GmbH

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Trividia Health, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Allison Medical, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. UltiMed, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. ACON Laboratories Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. i-SENS, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. TaiDoc Technology Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others