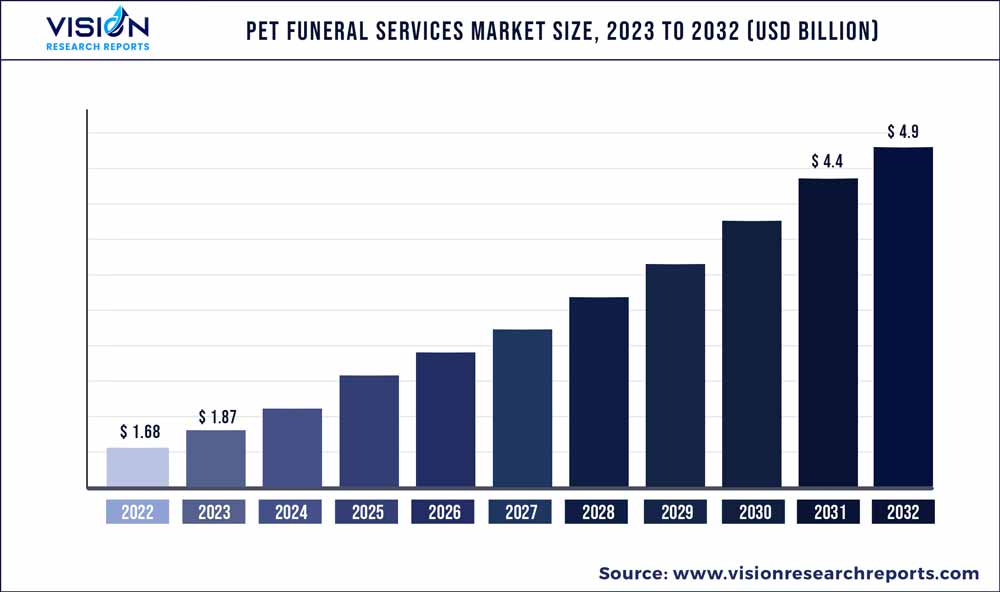

The global pet funeral services market was estimated at USD 1.68 billion in 2022 and it is expected to surpass around USD 4.9 billion by 2032, poised to grow at a CAGR of 11.29% from 2023 to 2032. The pet funeral services market in the United States was accounted for USD 513.3 million in 2022.

Key Pointers

Report Scope of the Pet Funeral Services Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 36% |

| CAGR of Asia Pacific from 2023 to 2032 | 12.55% |

| Revenue Forecast by 2032 | USD 4.9 billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.29% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Veternity; CVS Group; Regency.; Vetspeed Ltd.; Pets in Peace; PRECIOUS PETS CREMATORY.; Constant Companion; Newhaven Funerals; Paws to Heaven Pet Crematory; Pet Cremation Services; Midwest Cremation Service; SARASOTA PET CREMATORY; Okanagan Pet Cremation; Precious Pet Cemetery; Dignity Pet Crematorium; High Peak Pet Funeral Services; Anima Care; Pets At Peace |

The market growth is largely driven by factors such as the rising popularity of pet cremation, growing pet ownership & animal humanization trends, and increasing demand for pet death care services. Moreover, several human funeral homes have expanded their service offerings for deceased pets. For instance, according to an article published by PULVIS in 2019, around 15% of funeral homes in America provide services for pets, while around 12% of funeral homes in the UK do the same. The said percentages are anticipated to have grown significantly in the current year.

During the year 2020, the COVID-19 pandemic negatively impacted the pet funeral services market, like other veterinary services industries. This was owing to the stringent government restrictions with nationwide lockdowns, the closure of pet service centers, reduced appointments in funeral homes, and highly implemented inter-business shift of cremation services to meet human funeral demands (as the death rate of humans owing to COVID was on the rise). However, the growth quickly recovered the following year with increased pet adoption & ownership rates worldwide. For instance, according to the American Society for the Prevention of Cruelty to Animals (ASPCA), over 23 million American households adopted a new pet during the COVID-19 pandemic.

CVS Group, one of our key market players, has reported that its pet crematoria business revenue growth declined by 2.2% during the year 2020, which greatly recovered in the following year, with an 11.1% increase. In addition, the Dulaney Valley Memorial Gardens, U.S., reported that over the years, especially since the COVID-19 pandemic and the respective pet adoption rate expansion, the growth of pet death care services has exponentially increased in their memorial unit. Macroeconomic factors such as slower economic growth, global recession & stubbornly high inflation rates have impacted the market slightly during the years 2022 & 2023. However, the impact is anticipated to recover shortly.

According to the Cremation Association of North America(CANA), pet memorialization and cremation services are among the fastest-growing death care sectors in the U.S. and Canada. To meet the expanding demand for pet funeral services, organizations like CANA are taking initiatives to support and provide information to such businesses. CANA and the International Association of Pet Cemeteries & Crematories (IAOPCC) collaborated several years ago to implement standard guidelines for pet crematories worldwide. The organizations also launched the Certified Pet Crematory Operator Program (CPCO) to ensure that both business owners & employees have been trained for current crematory operations. Such measures initiated by the public and government organizations further boost the market growth.

Pet Type Insights

The dog segment dominated the market of pet funeral services based on pet type, with the largest revenue share of over 51% in 2022. This is attributed to the growing preference for dogs as companion animals in several households around the globe, coupled with their large population in developed countries. The U.S., for example, was estimated to have about 90 million pet dogs in 2022, as per the American Veterinary Medical Association (AVMA), American Pet Product Association (APPA), and internal GVR estimates. By 2030, this number is projected to exceed 100 million. The increasing population of pet dogs in several key countries is expected to contribute to the demand for dog cremation & burial services.

The Better Place Forests, America’s first conservation memorial forest creator, reported that dog cremation is the most performed pet death care process worldwide, followed by cats and horses. The growing popularity of cats and their increasing ownership rates is a significant factor supporting the segment’s fastest growth rate of about 11.7% over the forecast period. For instance, the World Animal Foundation estimated that between 2016 and 2020, cat ownership increased from 25% to 26%, reaching 29% in 2022. 25.4% of U.S. households have cats. During the forecast period, this factor will likely increase the demand for feline funeral services.

Service Type Insights

Based on the type of services, the market for pet funeral services is bifurcated into burial and cremation. The cremation segment dominated the market with the largest revenue share in 2022. Pet cremation services are often the most adopted & preferred option as it is comparatively more affordable and allows the owner to have a decent memorial for their deceased pets. According to a survey report published by Pet Loss Professionals Alliance, around 99% of pet funerals conducted in the U.S. each year involve cremations. The cremation segment is further segmented into communal, partitioned, and private based on how cremation is performed.

The private cremation segment shows the fastest growth of more than 12% during the projected timeline. As per DeJoh Pet Services company, about fifteen years back, only around 1 out of 4 pets were given private cremation as many owners didn’t require back the cremated remains or ash. However, in the current decade, the ratio has flipped to about 70% of pet owners choosing private cremation. The burial segment held a notable share in the market, owing to the limited regulations in a few countries with flexible funeral options. In India, for example, most pet owners prefer burying their companions in their own backyard or empty ground lands. However, in some countries like South Korea and UAE, the burial of pets on private property is strictly prohibited.

Regional Insights

North America region dominated the global market and registered the largest revenue share of over 36% in 2022. This substantial share is owing to the presence of a large pet population with respectively high expenditure on pet services. For instance, according to the American Pet Products Association (APPA), the U.S. pet industry expenditure increased from USD 90.5 billion in 2018 to USD 136.8 billion in 2022. The report also estimates the projected expenditure to reach USD 143.6 billion by the end of 2023. These factors are contributing to the region’s largest share.

The Asia Pacific region is projected to grow at the fastest CAGR of over 12.55% during the forecast period. The changing consumer lifestyles, rising interest among people in adopting companion animals, and growing disposable income expand the region’s pet industry expenditure. In addition, the growing number of local service providers coupled with increased awareness & popularity of pet funeral processes in the region supports the market growth. The other regions, such as Europe, Latin America, and the Middle East & Africa, are also holding notable shares in the market owing to their dynamic pet industry.

Pet Funeral Services Market Segmentations:

By Pet Type

By Service Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pet Funeral Services Market

5.1. COVID-19 Landscape: Pet Funeral Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pet Funeral Services Market, By Pet Type

8.1. Pet Funeral Services Market, by Pet Type, 2023-2032

8.1.1. Dogs

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cats

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Other Animals

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Pet Funeral Services Market, By Service Type

9.1. Pet Funeral Services Market, by Service Type, 2023-2032

9.1.1. Burial

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cremation

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Pet Funeral Services Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Service Type (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Service Type (2020-2032)

Chapter 11. Company Profiles

11.1. Veternity

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. CVS Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Regency

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Vetspeed Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Pets in Peace

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. PRECIOUS PETS CREMATORY.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Constant Companion

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Newhaven Funerals

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Paws to Heaven Pet Crematory

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Pet Cremation Services

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others