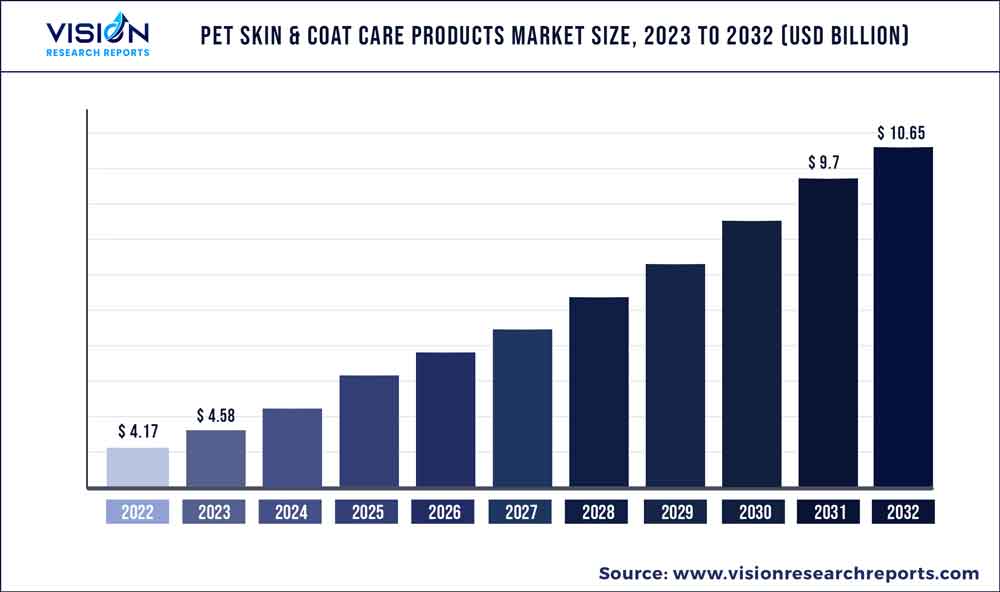

The global pet skin & coat care products market size was estimated at around USD 4.17 billion in 2022 and it is projected to hit around USD 10.65 billion by 2032, growing at a CAGR of 9.83% from 2023 to 2032. The pet skin & coat care products market in the United States was accounted for USD 1.4 billion in 2022.

Key Pointers

Report Scope of the Pet Skin & Coat Care Products Market

| Report Coverage | Details |

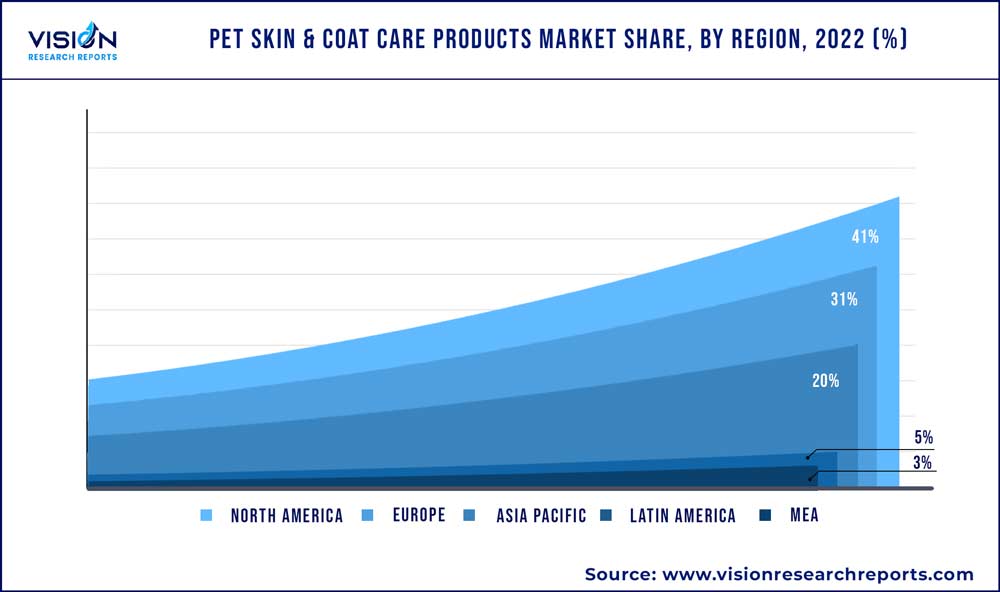

| Revenue Share of North America in 2022 | 41% |

| CAGR of Asia Pacific from 2023 to 2032 | 11.33 % |

| Revenue Forecast by 2032 | USD 10.65 billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.83% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nestlé Purina Petcare; Virbac; Groomer's Choice; SynergyLabs; Zesty Paws; Petco Animal Supplies, Inc.; Logic Product Group LLC; Wahl Clipper Corporation; Earthwhile Endeavors, Inc.; Nutramax Laboratories, Inc. |

The growing middle-class population and pet ownership among millennial households, who typically have smaller families, are boosting the pet population in emerging nations. Additionally, the awareness of the benefits caused by pet ownership on people's health including greater heart health, fewer levels of anxiety and depression, and more is likely favoring the growth of the market. Moreover, the COVID-19 pandemic had a significant impact on the market. According to a Forbes Advisor survey, 78% of pet owners acquired pets during the pandemic. Furthermore, as consumers were locked indoors, they became more attuned to their pet’s health and well-being.

With more people adopting pets during the pandemic, the overall pet care market expanded, leading to a growth in the demand for all types of pet care products, including skin and coat care products. However, the economic impact of the pandemic led to a reduction in heavy spending on non-essential items, including pet care products. As consumers became more price-sensitive, chose lower-priced or generic alternatives rather than premium products.

The trend of pet ownership is increasing over the years, and pets are now being viewed more as members of the family and as companions. The U.S., Russia, China, and France are some of the countries with the largest populations of pet dogs and cats, according to Petsecure. In addition, Americans spend more than USD 50 billion a year on their dogs. As pet owners become more health-conscious themselves, they tend to pay more attention to their pets' health and well-being. This has led to an increased demand for products that promote pet health, including skin and coat care products.

In addition, brands have responded to the trends in the pet skin and coat care market by introducing products that cater to the growing demand for natural and organic ingredients. Such products are known for their soothing and healing properties, making them ideal for use on pets with sensitive skin. 4-Legger for instance is a brand that offers a line of USDA-certified organic pet skin and coat care products, including shampoos and conditioners that are made with natural ingredients like aloe vera, lemongrass, and rosemary.

As disposable incomes rise, pet owners are willing to spend more on their pets' health and well-being, including high-quality pet care products. A 2021-2022 survey by National Pet Owners suggests that total expenditure on pets in the U.S. came up to USD 123.6 billion, a 19% increase from USD 103.6 billion in 2020. Several premium brands have been operating in this market that offers high-quality products formulated with natural and organic ingredients and brands that are free from harsh chemicals. Earthbath for instance is a popular brand in this segment that offers natural pet grooming products. Their skin and coat care products are formulated with natural ingredients, such as oatmeal, aloe vera, and tea tree oil, and are free from harsh chemicals and artificial fragrances.

Furthermore, sustainability has become a significant concern in the pet skin and coat care industry. Consumers are increasingly aware of the environmental impact of pet grooming products and are looking for sustainable alternatives. Kin+kind, a U.S. based company creates natural and organic pet grooming products. They use eco-friendly packaging and source ingredients from sustainable farms. All their products moreover are plant-based, vet-formulated, cruelty-free, USDA organic, and USDA Bio-Based.

Pet Type Insights

Pet skin & coat care product for dogs dominated the market and accounted for the largest revenue share of more than 53% in 2022. In one of three households, dogs are the most common pet around the globe, according to HealthforAnimals. Growing pet ownership, increasing disposable income, humanization of pets, and increased awareness of pet health are some of the major factors propelling the demand for dog-specific skin and coat care products. Additionally, different breeds of dogs have different skin and coat types, and some require more specialized care than others. Pet owners are increasingly seeking out products that are specifically designed for their dog's breed.

Pet skin & coat care product demand for cats is expected to expand at the fastest CAGR of 10.62% during the forecast period. According to HealthforAnimals, approximately a quarter of pet owners have a cat. Fleas, ticks, allergies, aging, and parasites are some common kinds of skin and coat problems that cats face. Shampoos, conditioners, wipes, and supplements are popular kinds of skin and coat care products for cats. Cat conditioners, for instance, help to detangle and soften a cat's fur, making it easier to brush and prevents matting. Some conditioners also contain ingredients that can soothe and moisturize dry or irritated skin.

Product Insights

The shampoo segment dominated the market and accounted for the largest revenue share of more than 43% in 2022. This product is the most preferred by consumers due to its basic need, versatility, availability, cost-effectiveness, ease of use, and variety of options. As pet owners increasingly prioritize their pets' hygiene and grooming, the demand for high-quality pet shampoos is expected to remain strong. In August 2022, Pet Releaf launched its line of plant-based CBD shampoos and conditioners. Veterinarians are using organic chamomile, organic aloe vera extract, and USDA organic full-spectrum hemp extract with naturally occurring CBD, among other plant-based, all-natural components, to formulate the products.

The spray segment is estimated to expand with the fastest CAGR of 10.64% over the forecast period. An increasing number of pet owners prefer high-quality tick and flea sprays to keep their dogs and cats healthy. Sprays can stop the cycle of lice, ticks, and fleas and are suitable for use on dogs' delicate skin. This has been driving the market growth over the last few years. Moreover, manufacturers are focusing on various strategies like product launches, partnerships, mergers, and acquisitions to gain customer traction and increase their market share in this category. For instance, in August 2020, Absorbine Pet Care launched its SaniPet sanitizing spray for pets, which was clinically proven to kill 99.9% of germs carried on paws, skin, and coats.

Application Insights

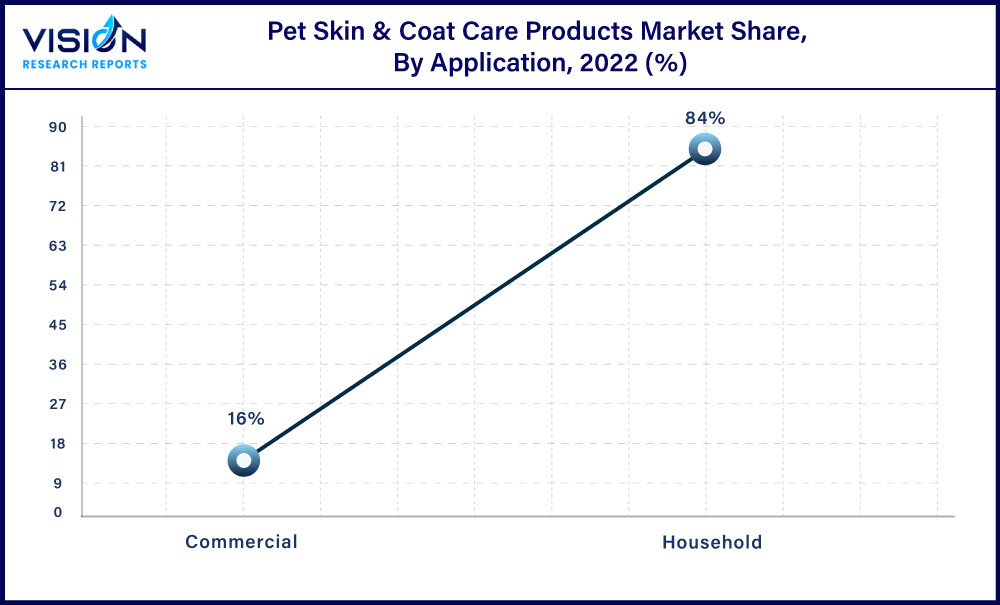

The household pet skin & coat care product segment dominated the market and accounted for the largest revenue share of around 84% in 2022. The annual overview of The European Pet Food Federation of 2021 revealed that almost 88 million households in Europe had a pet. Detailed packaging and labeling, content marketing, and in-store promotions have led pet owners to become more aware of the various kind of pet skin and coat care products. Consequently, consumers use this information to make informed choices about the health of their pets and use these products effectively at their residences. Additionally, by becoming more aware of pet skin and coat health, consumers have learned to identify potential problems early on. This helps to prevent minor issues from becoming more serious and aids to choose the right products to address these issues.

The commercial pet skin & coat care product segment is estimated to expand with a CAGR of 10.83% over the forecast period. This segment’s application of pet skin and coat care products involves using these products in pet grooming businesses and other pet care settings such as pet grooming services, boarding facilities, and, veterinary clinics. For instance, pet boarding places use such products to help keep pets clean and comfortable during their stay. On the other hand, pet grooming businesses use skin and coat care products as part of their grooming services. These products can help to cleanse, condition, and moisturize skin and coats of pets, as well as, address specific skin and coat issues.

Type Insights

The Over the Counter (OTC) type pet skin & coat care product dominated the market and accounted for the largest revenue share of more than 61% in 2022. Pet owners majorly prefer OTC products for their animal companions as these products are less expensive than prescription-based products and offer face-to-face interaction with sales representatives, who can provide guidance and recommendations. In December 2022, Hownd, a plant-based pet care brand in the U.K., released its curated selection of pet shampoos and body mists in selected Whole Foods Market stores in the U.S.

The prescribed type of pet skin & coat care product is estimated to expand with a CAGR of 9.35% over the forecast period. Americans spent almost USD 34.3 billion on veterinary care & product sales, according to the 2021 report by the American Pet Products Association. Veterinarians or other pet care professionals, who have expertise in diagnosing and treating skin and coat conditions in pets, recommend prescribed skin and coat care products. These professionals can help identify specific issues with a pet's skin or coat and recommend products specifically designed to address these issues.

Regional Insights

North America region dominated the pet skin & coat care products market and accounted for the largest revenue share of around 41% in 2022. Increasing pet ownership in the region has had a significant demand for pet skin and coat care products in the region. According to Pet Pedia, 70% of households in the U.S. have at least one pet. Dogs are the most popular pet choice in the country with more than 48 million households having them, according to a 2022 article by Forever Vets. Cats are second on the list with almost 31 million cat owners. A strong pet industry, the premiumization of this business, coupled with increasing disposable income are other factors boosting the demand for pet skin and coat care products in this region.

Asia Pacific is expected to witness a CAGR of about 11.33 % from 2023 to 2032. With the younger generation postponing marriage and having children, the pet industry in this region is expected to grow rapidly. South China Morning Post reported in 2022 that a growing number of young Chinese people are delaying marriage and parenthood or giving up on both due to rising living costs and the demands of the contemporary workplace. A flourishing pet economy is the result of the fact that many of them decide to raise pets. According to The Drum, pet ownership has increased exponentially by 300% since 2013, in China. The country’s emerging demography of pet owners comprises a well-educated, high-income segment of the young population.

Pet Skin & Coat Care Products Market Segmentations:

By Pet Type

By Product

By Application

By Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pet Skin & Coat Care Products Market

5.1. COVID-19 Landscape: Pet Skin & Coat Care Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pet Skin & Coat Care Products Market, By Pet Type

8.1. Pet Skin & Coat Care Products Market, by Pet Type, 2023-2032

8.1.1. Dog

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cat

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Pet Skin & Coat Care Products Market, By Product

9.1. Pet Skin & Coat Care Products Market, by Product, 2023-2032

9.1.1. Spray

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Supplements

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Shampoo

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Conditioner

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Pet Skin & Coat Care Products Market, By Application

10.1. Pet Skin & Coat Care Products Market, by Application, 2023-2032

10.1.1. Household

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Pet Skin & Coat Care Products Market, By Type

11.1. Pet Skin & Coat Care Products Market, by Type, 2023-2032

11.1.1. Prescription

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Over-the-Counter (OTC)

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Pet Skin & Coat Care Products Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.4. Market Revenue and Forecast, by Type (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Type (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Type (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Type (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Type (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Type (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Type (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Type (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Pet Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Type (2020-2032)

Chapter 13. Company Profiles

13.1. Nestlé Purina Petcare

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Virbac

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Groomer's Choice

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. SynergyLabs

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Zesty Paws

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Petco Animal Supplies, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Logic Product Group LLC

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Wahl Clipper Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Earthwhile Endeavors, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Nutramax Laboratories, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others