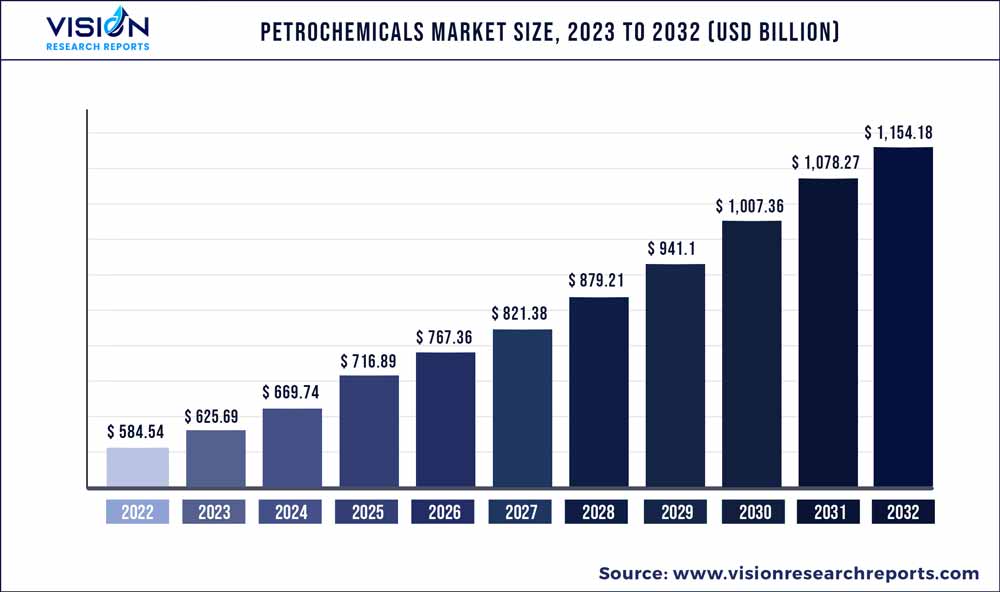

The global petrochemicals market was valued at USD 584.54 billion in 2022 and it is predicted to surpass around USD 1,154.18 billion by 2032 with a CAGR of 7.04% from 2023 to 2032.

Key Pointers

Report Scope of the Petrochemicals Market

| Report Coverage | Details |

| Market Size in 2022 | USD 584.54 billion |

| Revenue Forecast by 2032 | USD 1,154.18 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.04% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | BASF SE; Chevron Corporation; China National Petroleum Corporation (CNPC); China Petrochemical Corporation; ExxonMobil Corporation; INEOS Group Ltd.; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell PLC; SABIC; Dow |

The demand for the product is attributed to an increase in the demand for downstream products from various end-use industries such as construction, pharmaceuticals, and automotive, which is a major factor driving the growth. Petrochemical is a vital component for many industrial processes and hence forms the backbone of an industrial economy. Some of the products derived from petrochemicals include tires, industrial oil, detergents, plastics, etc. Basic plastic derived from the product act as a building block in the manufacturing of consumer goods.

End-use industries evaluate the quality of products supplied from time to time and establish procurement agreements with suppliers to purchase petrochemical derivatives in bulk and ensure their stable and seasonal supply. An increasing number of product suppliers in the market has resulted in the high bargaining power of the buyers.

The industry is significantly affected by the prices of crude oil as it is a basic raw material used for the manufacturing of the product. The volatility in the prices and supply of crude oil has affected the production cost of petrochemicals, which, in turn, makes their production process costly. Factors such as the growing inclination of consumers in developed and developing regions toward environment-friendly products and the volatile prices of raw materials of petrochemicals are likely to hamper the market growth in the coming years.

The steam cracking process is one of the most commonly used processes for manufacturing petrochemicals from natural gas or crude oil. In this process, ethane, a derivative of natural gas or naphtha that is predominantly derived from crude oil, is used for the manufacturing of olefins. A steam cracker has equipment operating at pressure from near-vacuum to 100 atm and operating at temperatures from 100 K to 1400 K.

Moreover, the demand for petrochemicals and their derivatives for use in various applications such as tires, pharmaceuticals, high-tech materials, and paints across the U.S. is led by unprecedented success in the exploration and production of shale gas. The country is a major exporter of petrochemical products to Europe, as well as to countries such as China and India. There has been a significant resurgence in investments and petrochemical capacity expansions in the U.S. since 2014 owing to the reduction in feedstock prices and high demand for petrochemicals in aforementioned applications in the country.

Regional Insights

Asia Pacific region dominated with a market share of 49.12% in 2022. This is attributed to the flourishing chemicals industry and the increase in polymer consumption. Companies in the region are shifting toward natural gas liquids and other non-oil feedstock to cater to the rising demand for the product, along with strategizing cost-effective methods to increase sales of the products.

The growing shale gas exploration activities in the U.S. and Canada are expected to fuel the growth of the North America petrochemicals industry. Europe is anticipated to witness a CAGR of 6.45% over the forecasted period. This is attributed due to the ongoing recovery of the overall manufacturing sector from the global pandemic in Europe coupled with the addition to oil & gas capacity in the region is anticipated to drive the industry’s growth.

Petrochemicals Market Segmentations:

By Product

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others