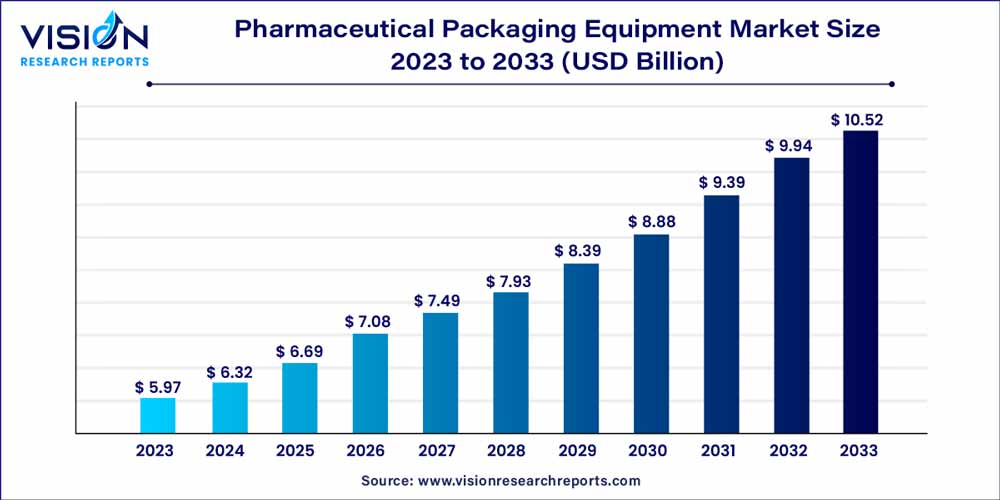

The global pharmaceutical packaging equipment market size was estimated at around USD 5.97 billion in 2023 and it is projected to hit around USD 10.52 billion by 2033, growing at a CAGR of 5.83% from 2024 to 2033. The pharmaceutical packaging equipment market is driven by the increasing global consumption of pharmaceuticals, product safety and integrity, and technological advancements.

The pharmaceutical packaging equipment market plays a pivotal role in ensuring the safety, efficiency, and compliance of pharmaceutical products throughout the supply chain. As the pharmaceutical industry continues to evolve, the demand for advanced packaging solutions has intensified. This overview delves into the key aspects shaping the pharmaceutical packaging equipment market, providing insights into its current landscape and future prospects.

The growth of the pharmaceutical packaging equipment market is propelled by several key factors. Firstly, the stringent regulatory landscape governing the pharmaceutical industry necessitates the adoption of advanced packaging solutions to ensure compliance and product integrity. The continuous evolution of technology is another significant driver, with innovations such as automation, serialization, and smart packaging enhancing the efficiency and reliability of packaging processes. Furthermore, the increasing global consumption of pharmaceuticals, driven by a growing population and aging demographics, fuels the demand for scalable and efficient packaging equipment. As pharmaceutical companies strive to meet higher production volumes while maintaining product quality, the market for pharmaceutical packaging equipment is expected to witness sustained growth in the coming years.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.83% |

| Market Revenue by 2033 | USD 10.52 billion |

| Revenue Share of Asia Pacific in 2023 | 41% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The Filling segment held the largest revenue share of 36% in 2023. Filling machines play a crucial role in the pharmaceutical industry by ensuring precise and sterile dispensing of pharmaceutical products into containers like vials, bottles, and syringes. State-of-the-art technologies such as peristaltic pumps or volumetric fillers are utilized in advanced filling machines, enabling the handling of diverse liquid or powder medications. These machines often feature automated controls and monitoring systems to enhance efficiency, reduce human error, and ensure compliance with pharmaceutical quality standards. Modern filling machines offer flexibility, allowing pharmaceutical companies to accommodate various container sizes and formulations, contributing to streamlined production processes and delivering high-quality, precisely dosed medications to meet the dynamic demands of the pharmaceutical industry.

Wrapping machines are indispensable in the pharmaceutical industry, serving the critical function of securely packaging pharmaceutical products for protection and preservation. Designed to handle various packaging materials, including blister packs, strip packs, and sachets, these machines ensure aseptic and tamper-evident sealing of medicines through advanced technology. With high-speed and precision capabilities, pharmaceutical wrapping machines contribute to the efficient packaging of pharmaceuticals in standardized formats, facilitating convenient distribution and use. The automated features, combined with the ability to incorporate serialization and traceability, make wrapping machines essential in meeting the stringent requirements of the pharmaceutical sector while enhancing packaging efficiency and ensuring product safety.

Asia Pacific dominated the market with the largest market share of 40% in 2023. The region has witnessed a notable upswing in pharmaceutical production, driven by factors such as population growth, escalating healthcare needs, and increased investments in the pharmaceutical sector. This surge in production has, in turn, heightened the demand for advanced and efficient packaging equipment to cope with the expanded manufacturing volumes. Particularly in China, the demand for pharmaceutical packaging equipment has experienced significant growth, propelled by the burgeoning pharmaceutical industry's expansion and the concurrent need for cutting-edge packaging solutions. Given China's pivotal role in pharmaceutical manufacturing, there is a heightened emphasis on enhancing production efficiency, ensuring product safety, and adhering to stringent regulatory standards. The escalating demand for blister packaging machines, vial filling equipment, and track-and-trace systems underscores the pharmaceutical industry's shift towards modern, automated solutions to meet the rising demand for diverse, high-quality pharmaceutical products.

Meanwhile, Europe's packaging equipment market is flourishing, driven by the thriving pharmaceutical industry in the region. Ongoing technological advancements in the pharmaceutical sector and the introduction of new medicines contribute to an increased demand for pharmaceutical packaging equipment, fostering market growth in Europe. This trend is expected to persist over the forecast period. In a noteworthy development in February 2023, Gerresheimer introduced a Clinical Trial Kit tailored to meet the developmental needs of vaccines, novel medications, and biologics. The kit includes sterile Gx RTF vials in a tub, nest, or tray with matching closures, exemplifying the region's commitment to innovation in pharmaceutical packaging solutions.

By Machine Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others