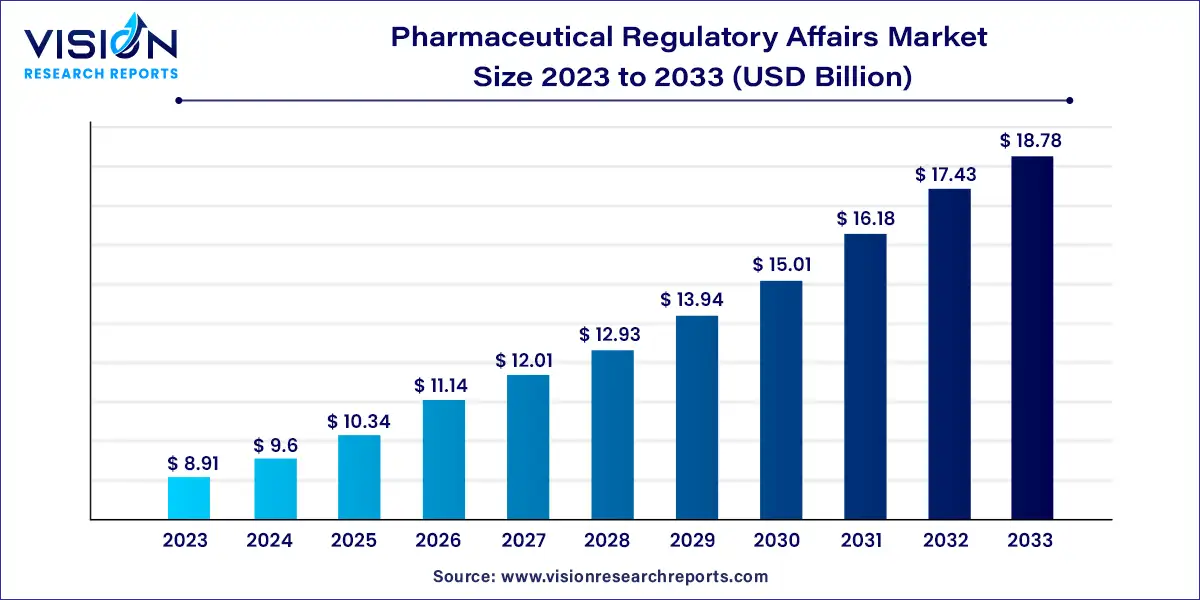

The global pharmaceutical regulatory affairs market size was surpassed at USD 8.91 billion in 2023 and is expected to hit around USD 18.78 billion by 2033, growing at a CAGR of 7.74% from 2024 to 2033.

The pharmaceutical regulatory affairs market plays a pivotal role in ensuring compliance with regulations and standards governing the development, manufacturing, and distribution of pharmaceutical products. As the global pharmaceutical industry continues to evolve and expand, the demand for regulatory affairs professionals and services has grown significantly.

The growth of the pharmaceutical regulatory affairs market is propelled by an increasingly intricate regulatory landscape demands expert navigation to ensure compliance with evolving standards and guidelines. Secondly, globalization has expanded the operations of pharmaceutical companies, necessitating adherence to diverse regulatory frameworks across different regions. Thirdly, technological advancements, such as electronic submission systems and regulatory software solutions, are reshaping regulatory processes and driving demand for specialized expertise. Lastly, stringent quality standards enforced by regulatory agencies underscore the importance of robust regulatory affairs strategies and practices to uphold product safety, efficacy, and quality. These factors collectively drive the growth trajectory of the pharmaceutical regulatory affairs market, emphasizing the critical role of regulatory affairs professionals and services in sustaining industry innovation and safeguarding public health.

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2023 | 39% |

| Revenue Forecast by 2033 | USD 18.78 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.74% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of category, the drug segment held the largest revenue share of over 59% in 2023. Regulatory affairs play a very important role in the entire drug development, manufacturing, and commercialization continuum. This can be attributed to various regulations and related regulatory submissions/documentation at each of the steps involved in the process. A clear understanding of these regulations enables timely and cost-effective product launches in the market and can also help pharmaceutical companies gain the first-mover advantage.

The biologics segment is anticipated to witness the fastest CAGR of 7.87% over the forecast period. Increasing healthcare needs, coupled with increasing investments in healthcare infrastructure and improving regulatory frameworks, are driving the demand for biologics. The increasing middle-class population in Africa and expanding access to healthcare services contribute to the growing demand for advanced and innovative therapies. Furthermore, the prevalence of diseases such as HIV/AIDS, malaria, and noncommunicable diseases, such as diabetes & cancer, highlights the urgent need for effective biologic treatments.

Based on services, the regulatory writing & publishing segment dominated the market in 2023 and held the largest revenue share of 38%. Rigid quality control procedures are used on regulatory papers to ensure consistency, accuracy, and compliance. These high-quality criteria are adhered to by the regulatory writing and publishing section, which is essential for obtaining regulatory clearances. For depth review procedures, adherence to formatting and submission standards, and adherence to guidelines in documentation are a few instances of these services.

Legal representation is anticipated to witness the fastest CAGR of 8.52% over the forecast period. Laws and regulations are growing increasingly complicated due to the changing legal landscape. For people as well as companies to successfully manage these complexities, expert legal advice is required. To maintain compliance, protect rights, and get favorable outcomes in legal disputes, there is an increasing need for legal guidance.

The oncology segment dominated the market in 2023 with the largest revenue share of 35%. This can be attributed to the high prevalence of cancer, which is boosting the need for safe and effective treatment options. Africa is expected to experience the most significant increase in cancer cases and deaths compared to other regions. According to data published by GLOBOCAN, the number of cancer cases is estimated to increase from 1.1 million new cases in 2020 to 2.1 million cases in 2040.

The immunology segment is anticipated to witness the fastest CAGR of 9.29% over the forecast period. Immunological diseases including autoimmune diseases, allergy problems, and immune-mediated disorders are becoming increasingly prevalent. These disorders necessitate efficient therapeutic approaches, increasing the market for pharmaceuticals with an immunological focus.

In terms of product stage, in 2023, the clinical studies segment held the largest market share of 48%. This can be attributed to the rising number of clinical trial registrations over the last few years. The COVID-19 pandemic has increased the number of clinical trials in the region due to the urgency to identify and commercialize an effective cure and/or vaccine for the disease. Furthermore, supportive regulatory actions, such as shortening trial approval time, waiving the waiting period, releasing industry guidance documents, and funding clinical trials undertaken by regulatory authorities, are anticipated to boost this segment in the pharmaceutical regulatory affairs industry.

The preclinical segment is expected to show the fastest CAGR of 8.46% over the forecast period. This can be attributed to the increasing demand for novel disease treatments, such as Zika virus, & Ebola, COVID-19, and the rising prevalence of existing diseases such as cancer, CVDs, & neurological diseases. Preclinical entities are tested in vivo as well as in vitro. Pharmacokinetic (PK) and toxico-kinetic test studies undertaken in this stage are an integral part of Investigational New Drug (IND) applications, while in vivo bioanalytical & DMPK assays are essential for investigating new drugs & conducting clinical trial filings across various regions.

The outsourced regulatory affairs segment held the largest revenue share in 2023 of 58% and is anticipated to witness the fastest CAGR of 9.35% over the forecast period. This can be attributed to the rising popularity of outsourcing services as outsourcing enables companies to reduce costs, reduce staff training time, prioritize strategic projects, and improve overall efficiency, as well as provide greater flexibility. Moreover, factors such as sociocultural factors, language, race, age, ethnicity, genetics, disease prevalence, and intellectual property rights vary according to the country. Outsourcing provides access to local expertise to address these variations and lends clarity on time & cost investments required for bringing the product to the respective market.

On the other hand, the in-house segment holds a significant share of the market. Large healthcare firms have strong in-house teams for regulatory affairs owing to their strong pipelines, varied product portfolios, and the ability to attract skilled & experienced professionals, which makes it a feasible and practical option.

In terms of company size, the medium size companies segment dominated the global market in 2023 and held the maximum revenue share of more than 47%. Medium-sized companies have more resources and capabilities than small companies, enabling them to navigate the complex regulatory landscape more effectively. These companies have a broader product portfolio and a wider geographic presence, allowing them to serve a larger customer base across different countries. They can invest in R&D, clinical trials, and regulatory compliance, ensuring their products meet the necessary standards and regulations.

The large companies segment is expected to rise with the fastest CAGR of 8.08% over the forecast period. Large companies have extensive resources, a global presence, and expertise in navigating complex regulatory frameworks. These companies often have established relationships with regulatory authorities, enabling them to influence policy and shape regulatory standards. Large companies have the financial strength to invest in extensive clinical trials, advanced manufacturing facilities, and robust regulatory compliance systems. Moreover, their strong distribution networks and supply chain capabilities ensure the widespread availability of essential medicines and help address healthcare challenges across the region.

The Asia Pacific region accounted largest revenue share of 39% in 2023. Furthermore, the expansion of established biopharmaceutical companies may increase the demand for regulatory service providers. This is owing to the heterogeneous and complex regulatory environment, fueling the growth of the pharmaceutical regulatory affairs industry. Cost efficiency is a major factor for outsourcing regulatory affairs services, as biopharmaceutical companies face tremendous pressure to reduce the cost of R&D.

North America is also expected to witness significant growth during the forecast period. North America is known to have one of the most stringent regulatory systems globally. In 2021, there was a significant increase in the approval of biologics, accounting for 39.0% of the total new drug approvals. This trend indicates the growing pipeline of biotechnology products. The stringent regulatory environment and increasing R&D expenditure in region are expected to increase the demand for outsourcing regulatory affairs services among leading biopharmaceuticals.

By Services

By Category

By Indication

By Product Stage

By Service Provider

By Company Size

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others