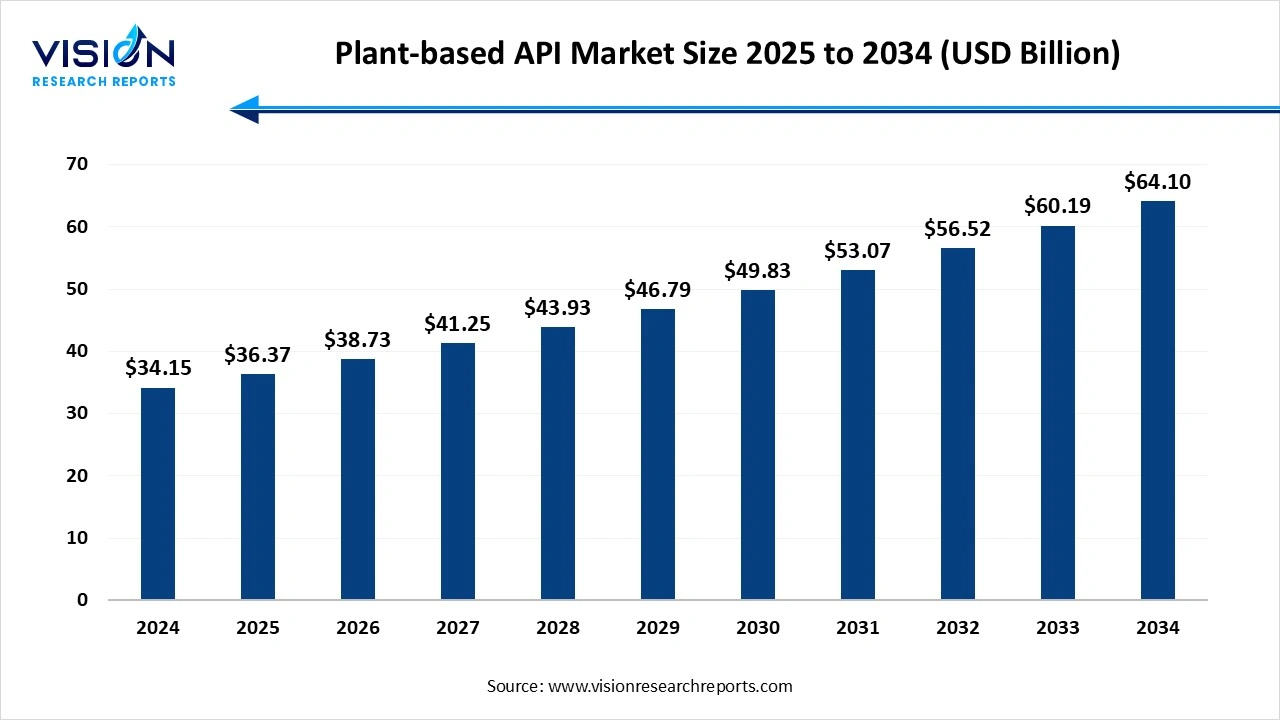

The global plant-based API market size was valued at USD 34.15 billion in 2024 and it is projected to hit around USD 64.10 billion by 2034, growing at a CAGR of 6.5% from 2025 to 2034. The market growth is driven by the rising demand for natural and sustainable healthcare solutions, the plant-based API market is experiencing significant growth.

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 35% |

| Revenue Forecast by 2034 | USD 64.10 billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Roquette Frères; Arboris; Centroflora; BASF SE; Kothari Phytochemicals & Industries Ltd.; Evonik Industries AG; Brains (Brains Bioceutical); Indo Phytochem Pharmaceuticals.; HimPharm.com.; Cargill, Incorporated |

The plant-based active pharmaceutical ingredients (API) market is gaining significant momentum due to the growing demand for safer, more natural therapeutic solutions. Derived from botanical sources, plant-based APIs offer advantages such as reduced side effects, sustainable sourcing, and alignment with the global shift toward eco-conscious healthcare. These natural compounds are widely used in the formulation of medicines for chronic illnesses, cancer, cardiovascular conditions, and infectious diseases. With advancements in extraction technologies and a rising preference for plant-derived drugs in both traditional and modern medicine, the market continues to expand. Additionally, regulatory encouragement and increased research into phytopharmaceuticals are driving innovation, helping the plant-based API market carve out a more prominent role in the pharmaceutical industry.

One of the primary growth factors fueling the plant-based API market is the increasing consumer and industry demand for natural and sustainable pharmaceutical solutions. With rising concerns over the side effects of synthetic drugs, healthcare providers and patients are turning to plant-derived ingredients known for their biocompatibility and therapeutic efficacy. This shift is further supported by the growing popularity of herbal and alternative medicine, especially in emerging economies where traditional medicine systems like Ayurveda and Traditional Chinese Medicine are widely practiced and gaining global attention.

In addition, advances in extraction and purification technologies are making it more efficient and cost-effective to derive high-quality APIs from plants. Regulatory bodies across the globe are also encouraging the use of plant-based ingredients through favorable policies and funding for natural drug research.

One of the major challenges in the plant-based API market is the variability in raw material quality and supply. Unlike synthetic compounds, plant-based ingredients are highly dependent on environmental factors such as soil quality, climate conditions, and agricultural practices. This inconsistency can lead to fluctuations in the concentration of active compounds, affecting the standardization, potency, and reliability of the final API. Additionally, overharvesting of certain medicinal plants poses sustainability issues, leading to resource depletion and increased production costs.

Another significant challenge lies in the complex and time-consuming regulatory approval process. Although there is growing acceptance of plant-based medicines, proving their safety and efficacy through clinical trials remains a rigorous requirement. Pharmaceutical companies must invest heavily in R&D, documentation, and compliance to meet international standards.

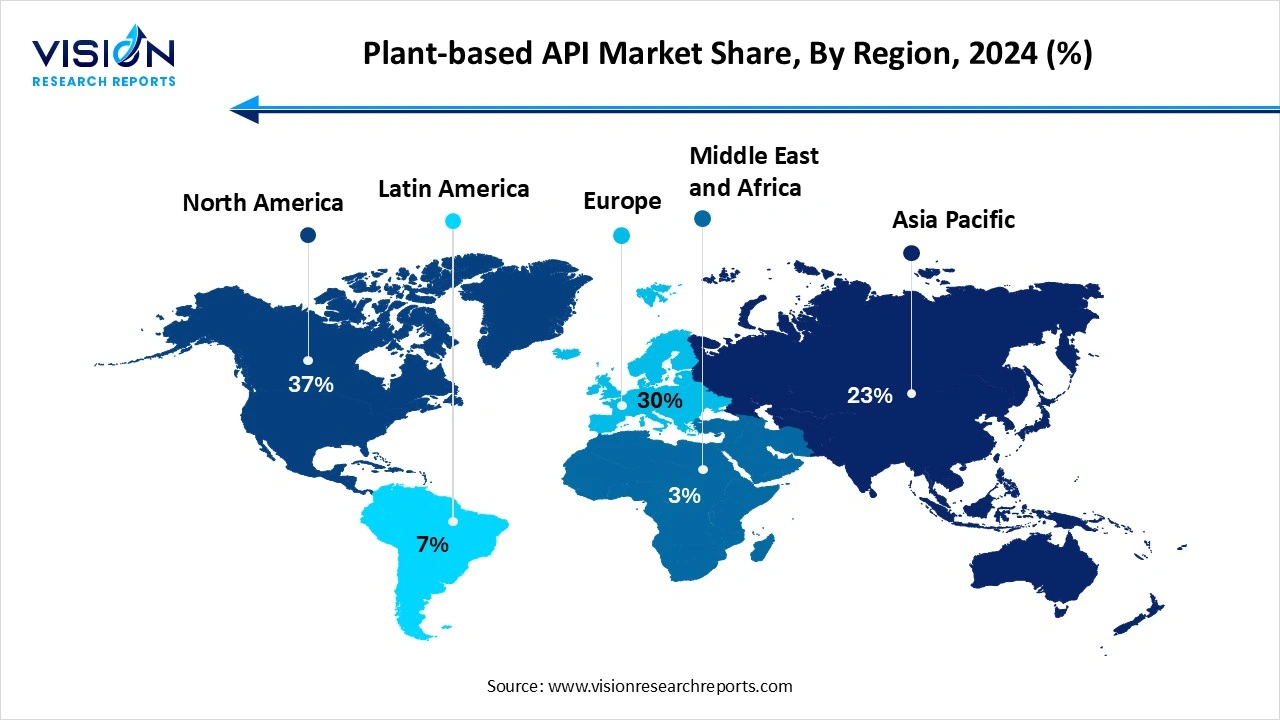

North America accounted for the largest share of 37% in 2024, The plant-based API market. North America holds a significant share of the global plant-based API market, primarily due to its advanced pharmaceutical infrastructure, high healthcare expenditure, and increasing demand for natural and sustainable therapies. The region benefits from strong research capabilities and active collaboration between pharmaceutical companies and botanical research institutions. The United States, in particular, has witnessed a rise in the adoption of plant-based drugs, supported by a growing consumer preference for natural health solutions and increased FDA approvals for phytopharmaceutical products.

The Asia-Pacific region is expected to witness the fastest growth in the plant-based API market, largely due to its rich biodiversity and traditional medicinal practices such as Ayurveda, Traditional Chinese Medicine, and Kampo. Countries like India, China, and Japan are investing heavily in the integration of traditional knowledge with modern pharmaceutical research, creating a robust ecosystem for plant-based drug development. The availability of raw materials, cost-effective manufacturing, and rising healthcare awareness are also contributing to the region's rapid market expansion. Furthermore, increasing government initiatives to standardize and regulate herbal medicines are enhancing the credibility and global competitiveness of plant-based APIs from Asia-Pacific.

The Asia-Pacific region is expected to witness the fastest growth in the plant-based API market, largely due to its rich biodiversity and traditional medicinal practices such as Ayurveda, Traditional Chinese Medicine, and Kampo. Countries like India, China, and Japan are investing heavily in the integration of traditional knowledge with modern pharmaceutical research, creating a robust ecosystem for plant-based drug development. The availability of raw materials, cost-effective manufacturing, and rising healthcare awareness are also contributing to the region's rapid market expansion. Furthermore, increasing government initiatives to standardize and regulate herbal medicines are enhancing the credibility and global competitiveness of plant-based APIs from Asia-Pacific.

The alkaloids segment accounted for the largest market share at 22% in 2024.These nitrogen-containing compounds exhibit powerful pharmacological effects, making them essential components in the treatment of various health conditions such as pain, infections, hypertension, and certain cancers. Well-known alkaloids like morphine, quinine, and atropine have long been used in clinical practice, demonstrating the reliability and efficacy of this molecule class. In recent years, pharmaceutical research has expanded to explore lesser-known alkaloids from diverse plant sources, aiming to uncover novel compounds with improved therapeutic profiles and fewer side effects.

The terpenoids segment is projected to experience a substantial growth rate throughout the forecast period. These naturally occurring organic chemicals are found in a wide range of plants and are known for their diverse biological activities. Terpenoids are widely used in the development of anti-inflammatory, antiviral, anticancer, and antimicrobial drugs, with compounds such as artemisinin and taxol serving as prime examples of their clinical importance. Their structural diversity allows researchers to tailor compounds for specific therapeutic uses, further enhancing their pharmaceutical relevance. With ongoing advances in extraction and synthetic biology, terpenoids are becoming increasingly accessible and cost-effective to produce at scale.

The pharmaceuticals segment accounted for the largest share of 64% in the plant-based API market in 2024. Plant-derived active pharmaceutical ingredients are valued for their therapeutic efficacy, biocompatibility, and lower side-effect profiles compared to synthetic alternatives. They are commonly used in formulations targeting chronic diseases such as cancer, cardiovascular disorders, neurological conditions, and infections. The pharmaceutical industry has shown a strong inclination toward sourcing APIs from botanical origins, especially in response to growing patient preferences for natural and holistic treatments.

The nutraceuticals segment is expected to witness the highest growth rate during the forecast period. Nutraceuticals formulated with natural ingredients are widely sought after for their preventive health benefits and ability to support immune function, digestion, and overall wellness. Plant-based APIs offer an appealing solution for manufacturers looking to develop supplements that are clean-label, vegan, and aligned with sustainable practices. As more consumers shift toward preventive healthcare and functional foods, the demand for high-quality, scientifically supported plant-based ingredients continues to rise.

By Molecule Type

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Plant-based API Market

5.1. COVID-19 Landscape: Plant-based API Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Plant-based API Market, By Molecule Type

8.1. Plant-based API Market, by Molecule Type, 2023-2034

8.1.1. Alkaloids

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Anthocyanin

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Flavonoids

8.1.3.1. Market Revenue and Forecast (2025-2034)

8.1.4. Phenolic Acids

8.1.4.1. Market Revenue and Forecast (2025-2034)

8.1.5. Terpenoids

8.1.5.1. Market Revenue and Forecast (2025-2034)

8.1.6. Lignin & Stilbenes

8.1.6.1. Market Revenue and Forecast (2025-2034)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Plant-based API Market, By End-use

9.1. Plant-based API Market, by End-use, 2023-2034

9.1.1. Pharmaceuticals

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Nutraceuticals

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Herbal Based Industries

9.1.3.1. Market Revenue and Forecast (2025-2034)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Plant-based API Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.1.2. Market Revenue and Forecast, by End-use (2025-2034)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.1.3.2. Market Revenue and Forecast, by End-use (2025-2034)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.1.4.2. Market Revenue and Forecast, by End-use (2025-2034)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.2.2. Market Revenue and Forecast, by End-use (2025-2034)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.2.3.2. Market Revenue and Forecast, by End-use (2025-2034)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.2.4.2. Market Revenue and Forecast, by End-use (2025-2034)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.2.5.2. Market Revenue and Forecast, by End-use (2025-2034)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.2.6.2. Market Revenue and Forecast, by End-use (2025-2034)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.3.2. Market Revenue and Forecast, by End-use (2025-2034)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.3.3.2. Market Revenue and Forecast, by End-use (2025-2034)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.3.4.2. Market Revenue and Forecast, by End-use (2025-2034)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.3.5.2. Market Revenue and Forecast, by End-use (2025-2034)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.3.6.2. Market Revenue and Forecast, by End-use (2025-2034)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.4.2. Market Revenue and Forecast, by End-use (2025-2034)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.4.3.2. Market Revenue and Forecast, by End-use (2025-2034)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.4.4.2. Market Revenue and Forecast, by End-use (2025-2034)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.4.5.2. Market Revenue and Forecast, by End-use (2025-2034)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.4.6.2. Market Revenue and Forecast, by End-use (2025-2034)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.5.2. Market Revenue and Forecast, by End-use (2025-2034)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.5.3.2. Market Revenue and Forecast, by End-use (2025-2034)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

10.5.4.2. Market Revenue and Forecast, by End-use (2025-2034)

Chapter 11. Company Profiles

11.1. Roquette Frères

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Arboris

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Centroflora

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BASF SE

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Kothari Phytochemicals & Industries Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Evonik Industries AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Brains (Brains Bioceutical)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Indo Phytochem Pharmaceuticals.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. HimPharm.com.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Cargill, Incorporated

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others