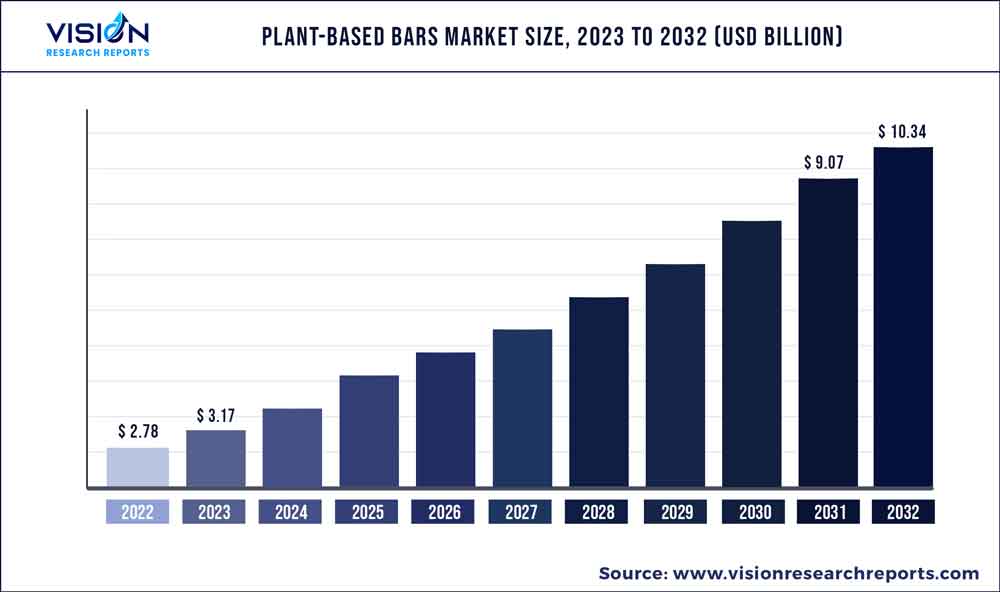

The global plant-based bars market was valued at USD 2.78 billion in 2022 and it is predicted to surpass around USD 10.34 billion by 2032 with a CAGR of 14.04% from 2023 to 2032. The plant-based bars market in the United States was accounted for USD 53.3 million in 2022.

Key Pointers

Report Scope of the Plant-based Bars Market

| Report Coverage | Details |

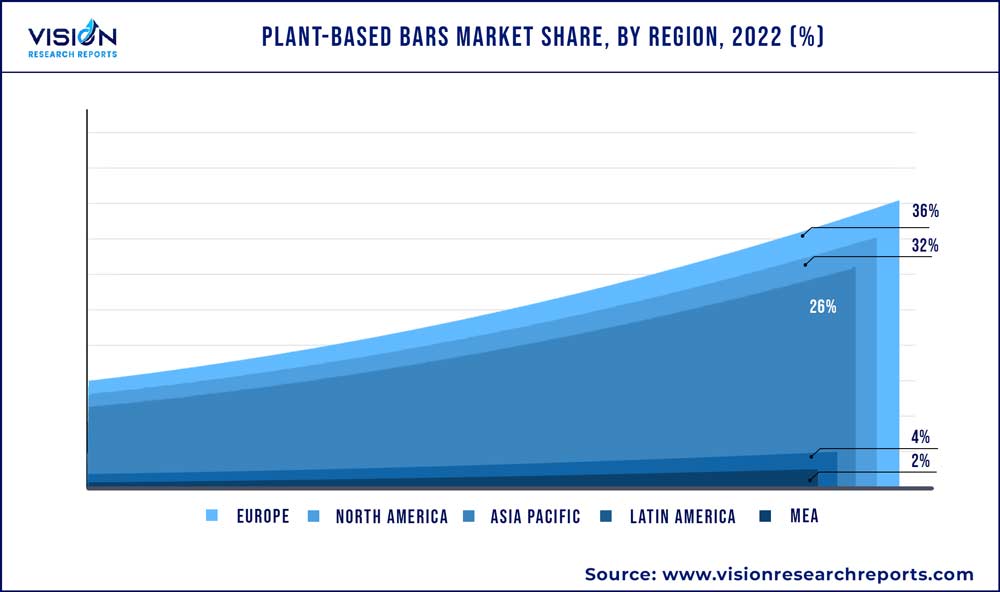

| Revenue Share of Europe in 2022 | 36% |

| CAGR of Asia Pacific from 2023 to 2032 | 16.13% |

| Revenue Forecast by 2032 | USD 10.34 billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.04% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Kellogg's; Greens Gone Wild, LLC.; General Mills Inc.; 88 ACRES; GNC Holdings, LLC; Rise Bar; MadeGood; Växa Bars; Clif Bar & Company; GoMacro, LLC |

One of the primary reasons for the growth of plant-based bars is the increasing emphasis of consumers on health and wellness. With the rise in chronic health conditions such as obesity, diabetes, and heart disease, many people are looking for healthier snack options that can provide them with the nutrients and energy they need to stay healthy. Plant-based bars are a good source of protein, fiber, and healthy fats, and they often contain fewer calories and less sugar than traditional snack bars.

Moreover, plant-based bars are also popular among people with dietary restrictions such as vegans, vegetarians, and those with food allergies or intolerances. These bars are often free from common allergens such as dairy, soy, and gluten, making them a safe and convenient snack option for people with dietary restrictions. For instance, Greens Gone Wild, LLC. is a key company offering vegan and gluten-free protein bars. In addition, plant-based bars are convenient and easy-to-grab on-the-go snacking options. With busy lifestyles, many people do not have time to prepare healthy meals or snacks, and plan-based bars provide a quick and easy solution. They are also portable and can be taken anywhere, making them ideal for people who are always on the move.

The plant-based bars market is further growing owing to the increasing availability of plant-based bars in a variety of flavors. With so many different ingredients and flavors to choose from, people can find a plan-based bar that suits their taste preferences and dietary needs. In addition, the increasing concern over sustainability and the environment are contributing to market growth. Many people are becoming more conscious of the impact their food choices have on the planet and are opting for plant-based options that are more sustainable and eco-friendlier than traditional animal-based products.

Plant-based bars are a good source of protein, which is essential for building and repairing tissues in the body, and for producing enzymes, hormones, and other important molecules. Many plant-based protein sources, such as nuts and seeds, also contain healthy fats, which are important for maintaining healthy skin, hair, and nails, as well as for absorbing fat-soluble vitamins such as vitamins A, D, E, and K. Moreover, Sustainability is a growing concern for many consumers, and the impact of food production on the environment has become a significant issue. Many people are turning to plant-based diets as a way to reduce their carbon footprint and support more sustainable food production practices.

Plant-based bars are often marketed as a more sustainable snack option because they are made with plant-based ingredients. Plant-based agriculture requires less water and land than animal agriculture, making it a more sustainable and eco-friendly food production method. Many plant-based bar manufacturers also use eco-friendly packaging, such as compostable or biodegradable materials, to further reduce their impact on the environment. For instance, GoMacro, LLC. Is a key company that offers its products in sustainable packaging i.e. it has 100% recyclable or compostable packaging.

Furthermore, many plant-based bar manufacturers use social media platforms such as Instagram and Facebook to market their products to a younger demographic. Influencers and celebrities often promote plan-based bars, making them more appealing to younger consumers who are interested in health and wellness. However, the high cost of producing plant-based bars is a significant challenge in the production of plant-based bars, which can make them more expensive than traditional snack bars. This high cost is often due to the use of high-quality, natural ingredients and eco-friendly packaging.

Product Type Insights

Plant-based protein bars accounted for a share of over 36% in 2022. The popularity of plant-based diets has been on the rise in recent years, with many people opting for a more plant-based lifestyle. As a result, there has been an increased demand for plant-based protein sources, including plant-based protein bars. Many manufacturers are now catering to this demand by creating a wide variety of plant-based protein bars that are delicious and packed with nutrition.One of the main reasons why plant-based protein bars were not as popular in the past was due to their taste and texture. However, with advancements in food technology and manufacturing, many plant-based protein bars now taste and feel just as good as traditional snack bars. As a result, more consumers are turning to plant-based protein bars as a tasty and nutritious snack option.

Plant-based energy bars are anticipated to grow at a CAGR of 15.93% over the forecast period from 2023 to 2032. The busy and fast-paced lifestyles of people today often make it difficult for them to find the time to eat nutritious meals. Energy bars provide a convenient and portable source of nutrition that can be eaten at any time, making them a popular choice for people on the go. Moreover, the increasing popularity of sports and fitness activities has also contributed to the growth of the energy bar market. Athletes and fitness enthusiasts often consume energy bars before, during, or after their workouts to provide them with the necessary nutrients and energy to perform at their best.

Nature Insights

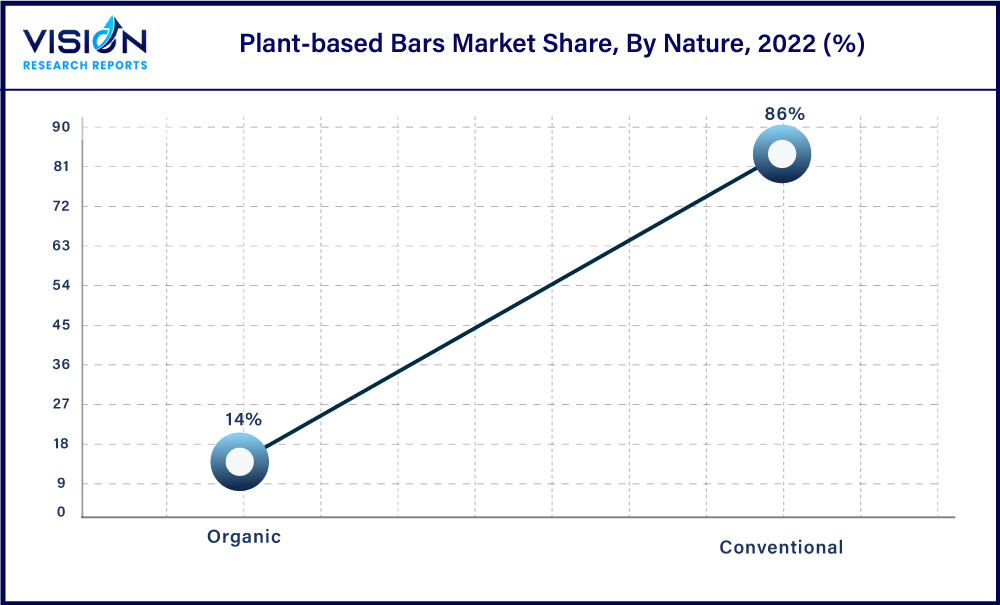

The conventional segment accounted for a share of over 86% in 2022. Conventional plant-based bars are often cheaper and are more affordable for consumers who are on a tight budget. Conventional plant-based are easily available and are often sold in mainstream grocery stores and online retailers, making them more accessible to consumers.Companies that produce these bars often invest heavily in marketing campaigns, which can include television commercials, social media advertising, and influencer partnerships. This exposure makes consumers more familiar with conventional plant-based bars, and they may be more likely to choose these products over others. Thus, the aforementioned factors are contributing to segment growth.

The organic segment is anticipated to grow at a CAGR of 22.44% over the forecast period. The increasing demand for organic products among consumers is a primary factor contributing to the market growth. Organic plant-based bars are often perceived as healthier than conventional options. Organic products are often free from artificial additives and preservatives, which can be found in conventional snack bars. Consumers who are concerned about their health are more likely to choose organic plant-based bars over conventional options. Moreover, the increasing availability of organic plant-based bars is also contributing to their growing popularity. In recent years, organic plant-based bars have become more widely available in grocery stores, health food stores, and online retailers. This increased accessibility has made it easier for consumers to try organic plant-based bars and incorporate them into their diets.

Distribution Channel Insights

The hypermarkets & supermarkets accounted for a share of over 26% of the global revenue in 2022. hypermarkets and supermarkets can offer a wide variety of plant-based products to consumers. These retailers have a large footprint and can stock a diverse range of products to cater to the needs and preferences of their customers. As a result, consumers can easily find plant-based products that suit their dietary preferences and requirements in one location. Moreover, the pricing of plant-based products in hypermarkets and supermarkets is often competitive. As these retailers purchase products in bulk, they can offer them to consumers at lower prices compared to smaller retail settings. This makes plant-based products more affordable and accessible to a wider range of consumers.

The sales through the online channel are projected to grow at a CAGR of 16.05% over the forecast period. The convenience of online shopping has made it easier for consumers to purchase plant-based bars. Online retailers offer a wide range of plant-based bars that can be easily accessed and purchased from the comfort of one's own home. Online retailers often offer a range of products that cater to specific dietary needs, such as gluten-free, dairy-free, or soy-free options. This makes it easier for consumers with dietary restrictions to find plant-based bars that meet their needs. Additionally, online retailers often offer competitive pricing for plant-based bars. This is due to lower overhead costs compared to physical stores, which can result in lower prices for consumers. Online retailers also often offer discounts, promotions, and bulk purchasing options, making plant-based bars more affordable for consumers.

Regional Insights

Europe held a share of over 36% of the global market in 2022. Consumers in the region are choosing to reduce their consumption of animal products and are increasingly turning to plant-based alternatives such as plant-based bars. The availability of plant-based bars in Europe has increased in recent years. Many supermarkets and health food stores now stock a wide variety of plant-based bars, making it easier for consumers to find and purchase these products. This has led to greater consumer awareness and interest in plant-based bars.

Moreover, there is a growing trend towards veganism and vegetarianism in Europe. Many people are choosing to follow a plant-based diet for ethical, environmental, or health reasons. Plant-based bars are a convenient and portable snack option for people following a vegan or vegetarian diet, and this has led to increased consumption of these products. According to an article published by Glanbia plc, Germany, the UK, and France are the top three consumers of plant-based protein ingredients.

The market in Asia Pacific is anticipated to grow at a CAGR of 16.13% over the forecast period. Asia Pacific has a large and growing population of vegetarians and vegans. In many countries in the region such as India, vegetarianism and veganism are linked to religious or cultural practices. As a result, there is a strong demand for plant-based products, including plant-based bars, among these populations. The availability of plant-based bars in the Asia Pacific region has increased in recent years.

Many health food stores and supermarkets now stock a wide variety of plant-based bars, making it easier for consumers to find and purchase these products. Additionally, the region has a large and growing market for healthy and natural food products. Many plant-based bars are made with natural and organic ingredients and are marketed as a healthier snack option. This has led to increased demand for these products among health-conscious consumers in the region.

Furthermore. plant-based foods have been a significant growth driver for U.S. retail food in the long term. This can be attributed to the consumer interest in reducing their meat consumption and increasing their consumption of plant-based foods, including plant-based bars, as a healthier snack option. As a result, the adoption of plant-based foods has increased in the U.S.

Plant-based Bars Market Segmentations:

By Product Type

By Nature

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Plant-based Bars Market

5.1. COVID-19 Landscape: Plant-based Bars Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Plant-based Bars Market, By Product Type

8.1. Plant-based Bars Market, by Product Type, 2023-2032

8.1.1 Protein Bars

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Granola/Cereal Bars

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Energy Bars

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Fruit & Nut Bars

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Plant-based Bars Market, By Nature

9.1. Plant-based Bars Market, by Nature, 2023-2032

9.1.1. Organic

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Conventional

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Plant-based Bars Market, By Distribution Channel

10.1. Plant-based Bars Market, by Distribution Channel, 2023-2032

10.1.1. Hypermarkets & Supermarkets

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Convenience Stores

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Specialty Stores

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Online

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Plant-based Bars Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Nature (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Nature (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Nature (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Nature (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Nature (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Nature (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Nature (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Nature (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Nature (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Nature (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Nature (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Nature (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Nature (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Nature (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Nature (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Nature (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Nature (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Nature (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Nature (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Nature (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Nature (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Kellogg's

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Greens Gone Wild, LLC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. General Mills Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. 88 ACRES

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. GNC Holdings, LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Rise Bar

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. MadeGood

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Växa Bars

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Clif Bar & Company.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. GoMacro, LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others