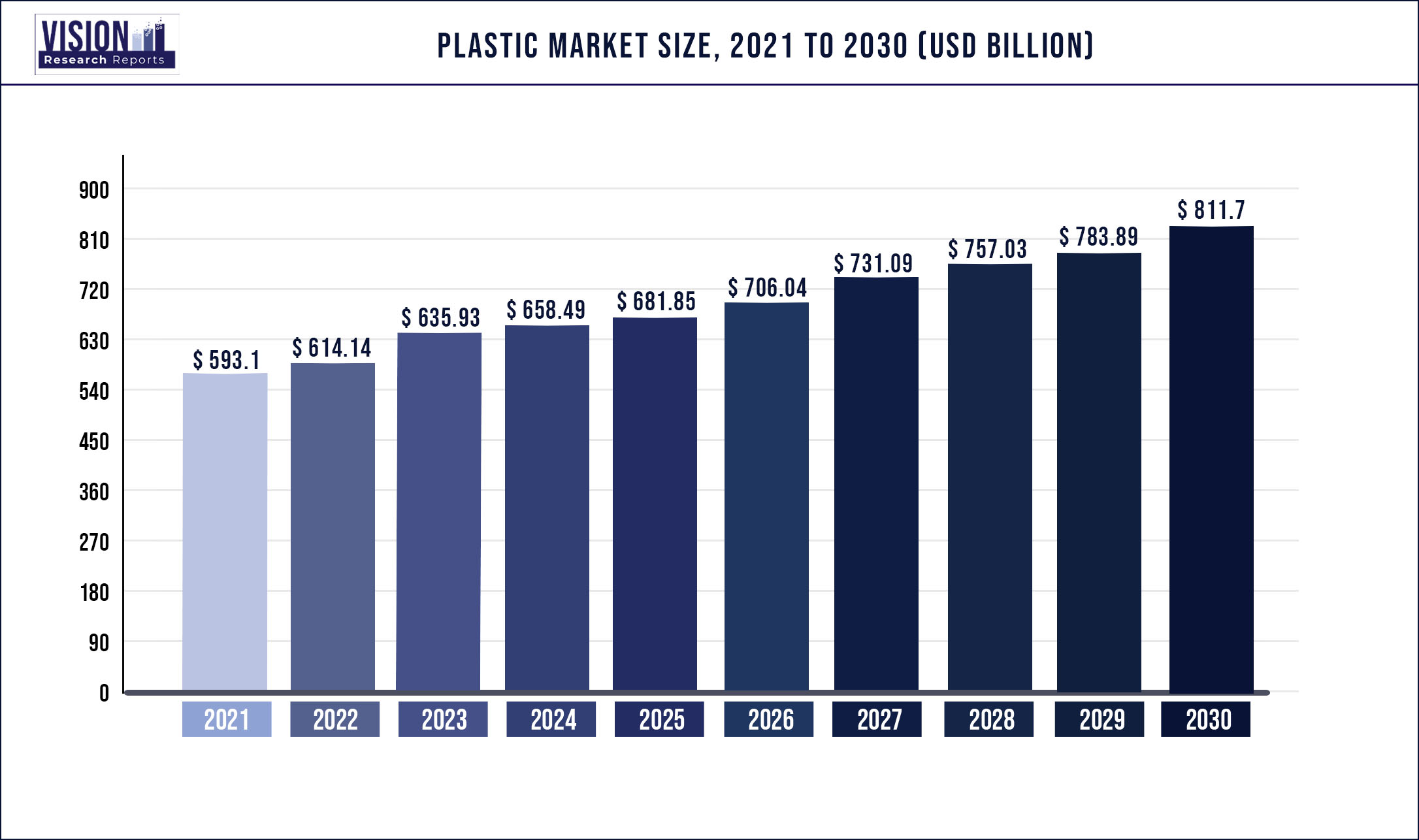

The global plastic market was estimated at USD 593.1 billion in 2021 and it is expected to surpass around USD 811.7 billion by 2030, poised to grow at a CAGR of 3.55% from 2022 to 2030.

The increasing automotive production and subsequent rise in plastic consumption in automotive component fabrication, because of regulatory policies regarding vehicular weight reduction and fuel efficiency, are expected to drive the market during the forecast period.

Plastics facilitate fuel saving in automotive applications, owing to reduced car weight and density, as compared to conventional materials such as metals or rubber. Since the last decade, there has been a substantial demand for these products as a replacement for metals and ferrous alloys across various industries such as consumer goods, automotive, and industrial machinery. The growth of the plastics market mainly depends on factors such as the ever-increasing requirement of end-users in terms of product specification and versatility, influencing consumption dynamics.

Other factors such as the socio-political environment, production process, and feedstock availability events also have a significant impact on the industry trends. Rapidly developing construction and automobile markets in Asia Pacific are expected to increase the demand for plastics in interiors, exteriors, and under the hood components. Its major applications include underhood components in the automotive industry, building interior & exteriors in the construction and infrastructure sectors, and various applications in electronics and durables.

The outbreak of COVID-19 fueled the demand for plastics in the medical end-use industry. Companies are focusing on stepping up their resources and production capabilities to meet the rising demand. For instance, in April 2020, Exxon Mobil Corporation announced an increase in the monthly production of specialized polypropylene by 1,000 tons, to meet the growing need for medical masks and gowns owing to the spread of coronavirus. This surge in the production of polypropylene was aimed to help medical mask and gown manufacturers to produce an additional 20 million gowns or 200 million medical masks.

Extrusion application is anticipated to progress at a substantial growth rate during the forecast period. It is widely used to produce straws, hoses, pipes, and window frames. The increasing demand for these products from the packaging and construction industries is anticipated to create lucrative growth opportunities for the extrusion application segment in the coming years.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 593.1 billion |

| Revenue Forecast by 2030 | USD 811.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 3.55% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, end-use, region |

| Companies Covered | BASF SE; SABIC; Dow Inc; DuPont de Nemours Inc.; Evonik Industries; Sumitomo Chemical Co., Ltd.; Arkema; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Co. LLC; Lotte Chemical Corporation; Exxon Mobil Corporation; Formosa Plastic Corporation; Covestro AG; Toray Industries, Inc.; Mitsui & Co. Plastic Ltd. |

Product Insights

Polyethylene held the largest market revenue share of more than 25.0% of the overall demand in 2021. It is primarily used in the packaging sector, which includes containers and bottles, plastic bags, plastic films, and geomembranes. Based on its molecular weight, there are different types of polymers of PE such as HDPE, LDPE, and LLDPE. For instance, low molecular weight polymers of PE find use in lubricants; medium molecular weight polymers are used as wax, miscible with paraffin; high molecular weight polymers are commonly used in the plastic industry.

Rising demand for packaged food, trays, bottles for milk and fruit juices, crates, caps for food packaging, drums, and other liquid food packaging, to combat the spread of COVID-19 across the world is expected to drive the demand for polyethylene in the coming years.

Acrylonitrile butadiene styrene (ABS) is one of the promising product segments in the plastic market. ABS is widely used in consumer goods and electrical & electronics applications and is gaining popularity owing to its excellent rigidity, high strength, and dimensional stability. It is a tough material and is resistant to corrosive chemicals, physical impact, and heat. Thermoplastics such as ABS liquefy, allowing them to be easily injection molded and recycled. However, ABS is not used in high-heat situations because of its low melting point.

LEGO toys and computer keyboards are also significant application areas for ABS compounds. ABS is also used in manufacturing drain-waste-vent pipe systems, plastic clarinets, golf club heads, musical instruments, enclosures for electrical & electronic assemblies, automotive trim components, and protective headgears, among various other products.

Application Insights

The injection molding application segment held the largest revenue share of over 43.0% of the overall demand in 2021. Injection molding is a common method for producing custom plastic parts. It is a discontinuous process as the plastic parts are produced in molds and are required to be cooled before being removed. This process requires an injection molding machine, molds, and plastic materials. The molten plastic is injected into a mold cavity and then cooled to create the final product. It is generally used in the production of automobile parts, containers, and medical devices among others.

Calendering is one of the potential application segments in the plastics market. It is used to process thermoplastic materials into films and sheeting. It is mainly used for PVC as well as certain other modified thermoplastics. The process consists of five steps - pre-blending, fluxing, calendering, cooling, and winding-up. It allows specialty surface treatments of films or sheets such as enhancing or embossing the physical properties or in-line lamination. The growing packaging industry is driving the demand for films and sheets which, in turn, is further creating the demand for calendering.

End-use Insights

The packaging end-use segment held the largest market revenue share of more than 36.0% of the overall demand in 2021. Packaging is a high-potential end-use segment with moderate penetration. Plastic has been an integral part of the packaging industry. Furthermore, the advent of bio-based plastics has also played a significant role in the food, pharmaceutical, and beverage packaging sectors.

Plastics such as Polyethylene Terephthalate (PET) and Polycarbonates (PC) are increasingly being used in the packaging of beverages, consumer goods, appliances, toys, and apparel. The packaging of appliances is expected to offer lucrative opportunities for market growth. The demand for packaging for healthcare products, groceries, and e-commerce transportation has increased sharply in the post-COVID period, while the demand for luxury, industrial, and some B2B transport packaging declined, owing to the suspension or slowdown of industrial production.

Moreover, the demand for plastic in consumer packaging is expected to shift drastically towards food packaging, owing to the shutdown of restaurants and foodservice outlets during the pandemic. The stockpile and panic purchases of food, groceries, and other homecare necessities are further expected to boost the aforementioned trend.

Regional Insights

Asia Pacific (including China) dominated the plastics market and accounted for over 44.0% share of the global revenue in 2021. The rapidly-growing manufacturing sector is expected to propel the demand for plastic in the automotive, construction, packaging, and electrical & electronics industries. In the recent past, India and China have witnessed a spike in automotive production owing to technology transfer to the sector from the Western markets.

In addition, a well-established manufacturing base for electrical & electronics in Taiwan, China, and South Korea is anticipated to provide further impetus to the plastic industry. India has a strong chemical manufacturing industry base, which serves to strengthen its plastic production. Rapid urbanization, improving economic conditions, and increasing infrastructural activities are the factors supporting the growth of the market for plastics in the Asia Pacific.

China is the largest supplier and producer of plastic components in this region. The growth of the automotive and electronic markets and the subsequent demand for lightweight components to improve the efficiency of vehicles and reduce the weight of electronics components are the major factors contributing to the higher demand for plastic in the country.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Plastic Market

5.1. COVID-19 Landscape: Plastic Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Plastic Market, By Product

8.1. Plastic Market, by Product, 2022-2030

8.1.1 Polyethylene (PE)

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Polypropylene (PP)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Polyurethane (PU)

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Polyvinyl chloride (PVC)

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Polyethylene terephthalate (PET)

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Polystyrene (PS)

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Acrylonitrile butadiene styrene (ABS)

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.8. Polybutylene terephthalate (PBT)

8.1.8.1. Market Revenue and Forecast (2017-2030)

8.1.9. Polyphenylene Oxide (PPO)

8.1.9.1. Market Revenue and Forecast (2017-2030)

8.1.6. Epoxy Polymers

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Liquid Crystal Polymers

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.9. Polyether ether ketone (PEEK)

8.1.9.1. Market Revenue and Forecast (2017-2030)

8.1.10. Polycarbonate (PC)

8.1.10.1. Market Revenue and Forecast (2017-2030)

8.1.11. Polyamide (PA)

8.1.11.1. Market Revenue and Forecast (2017-2030)

8.1.12. Polysulfone (PSU)

8.1.12.1. Market Revenue and Forecast (2017-2030)

8.1.13. Polyphenylsulfone (PPSU)

8.1.13.1. Market Revenue and Forecast (2017-2030)

8.1.14. Others

8.1.14.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Plastic Market, By Application

9.1. Plastic Market, by Application, 2022-2030

9.1.1. Injection Molding

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Blow Molding

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Roto Molding

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Compression Molding

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Thermoforming

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Extrusion

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Calendering

9.1.7.1. Market Revenue and Forecast (2017-2030)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Plastic Market, By End-use

10.1. Plastic Market, by End-use, 2022-2030

10.1.1. Packaging

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Construction

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Electrical & Electronics

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Automotive

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Medical Devices

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Agriculture

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Furniture & Bedding

10.1.7.1. Market Revenue and Forecast (2017-2030)

10.1.8. Consumer Goods

10.1.8.1. Market Revenue and Forecast (2017-2030)

10.1.9. Utility

10.1.9.1. Market Revenue and Forecast (2017-2030)

10.1.10. Others

10.1.10.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Plastic Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. BASF SE

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. SABIC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Dow Inc

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. DuPont de Nemours, Inc

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Evonik Industries

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sumitomo Chemical Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Arkema

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Celanese Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Eastman Chemical Company

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Chevron Phillips Chemical Co., LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others