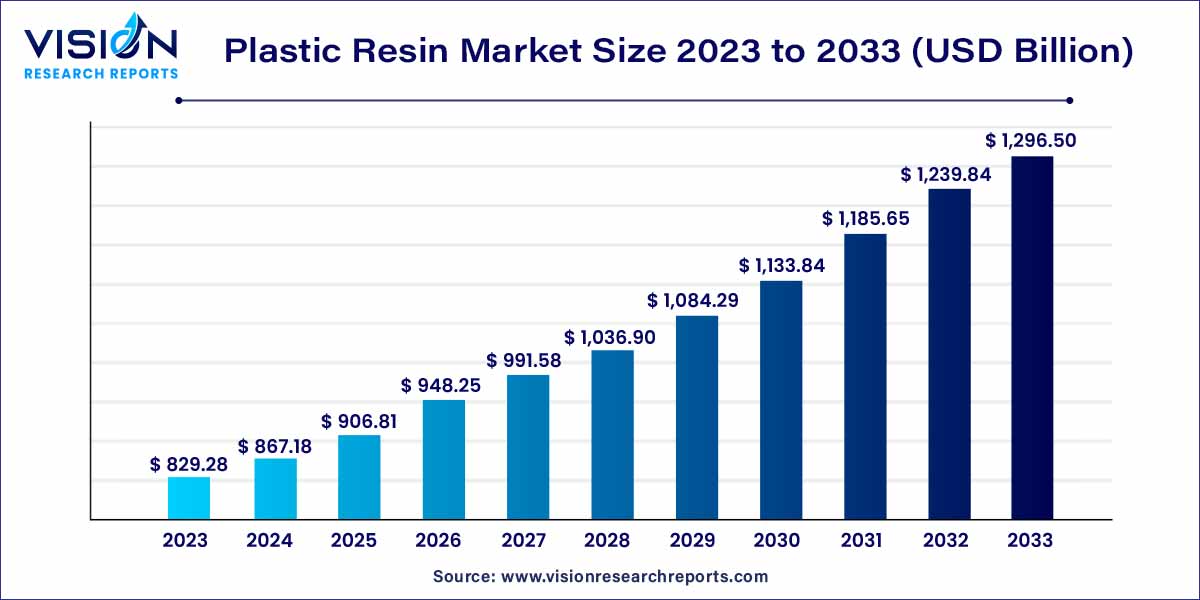

The global plastic resin market was estimated at USD 829.28 billion in 2023 and it is expected to surpass around USD 1,296.5 billion by 2033, poised to grow at a CAGR of 4.57% from 2024 to 2033.

The global plastic resin market has experienced significant growth in recent years, fueled by the ever-expanding demand across various industries. This overview aims to provide insights into the key aspects of the plastic resin market, encompassing its definition, types, applications, and market trends.

The growth of the plastic resin market is underpinned by several key factors. Firstly, increasing demand across diverse industries, including packaging, automotive, and healthcare, fuels the market's expansion. Additionally, the versatility of plastic resins, such as polyethylene, polypropylene, and PVC, allows for their widespread application in various products. Technological advancements in polymer science contribute to the development of innovative and high-performance resin materials, driving market growth. Moreover, a growing emphasis on sustainable practices has led to the adoption of biodegradable and recycled resin options, aligning with environmental concerns. Circular economy initiatives, aimed at promoting recycling and minimizing plastic waste, further propel the market forward. Stringent regulatory frameworks addressing environmental impact also play a crucial role in shaping the plastic resin market, fostering a shift towards more responsible and sustainable practices within the industry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.57% |

| Market Revenue by 2033 | USD 1,296.5 billion |

| Revenue Share of China in 2023 | 41% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The crystalline resin sector held the largest revenue share of 55% share in 2023. The surge in demand for crystalline resins is projected, attributed to their exceptional qualities that thrive in situations involving wear, bearings, and structural loads. Their widespread utilization in packaging is notable, driven by their durability and effective barrier qualities, especially in response to the burgeoning e-commerce sector and the packaging of consumer products.

Characterized by a high melting point and a rigid surface, crystalline resins exhibit resilience against solvent penetration. However, their strength is coupled with a reduction in impact resistance due to their crystalline nature. Three primary types of resins—epoxy resins, polyethylene, and polypropylene—contribute to this sector's diversity. Globally, polyvinyl chloride (PVC) stands out as one of the most extensively used thermoplastic polymers. In its unaltered state, PVC is notably brittle. It finds applications in specific construction activities, clothing fibers, and the healthcare industry. Notably, in the construction sector, PVC serves purposes such as insulation around electrical wires and as an alternative to rubber in specific flooring applications.

In 2023, the packaging segment asserted its dominance in the market, driven by the thriving packaging industry. The surge in demand for packaged foods and beverages is a key driver for the growth of this segment, with the anticipation of continued expansion. Notably, stringent criteria established by various government agencies regarding the safe use of plastic materials in food and beverage applications are expected to further propel the growth of the packaging segment.

The automotive application segment is poised to exhibit the fastest CAGR over the forecast period. This growth is supported by the increased use of plastics in automotive components and the rising production of passenger cars and heavy-duty vehicles, particularly in the Asia Pacific and Central & South America regions. Plastic resins offer enhanced design flexibility, enabling the fabrication of intricate parts and components that can be tailored to meet specific automobile specifications.

In the medical application segment, a significant upsurge in the adoption of plastic resins is anticipated. These resins play a crucial role in the production of medical devices, providing advantages such as improved clarity, cost-effectiveness, and biocompatibility. Various polymers, including Polyethylene (PE) and Polystyrene (PS), are combined to achieve the desired qualities for use in medical devices. The cost-effectiveness of plastic resins compared to alternative materials contributes to the production of affordable medical devices and equipment.

In 2023, China region dominated the market with the largest market share of 41%. This stronghold can be attributed to factors such as rapid urbanization, increased construction activities, and a surge in demand for consumer goods and packaging within the region. As a global manufacturing powerhouse, China plays a pivotal role in driving substantial demand for plastic resins across diverse sectors, including automotive, electronics, packaging, and construction. The market is further fueled by the escalating demand for polyethylene terephthalate (PET) plastic bottles, widely used in packaging bottled water, juices, soft drinks, medications, household cleaners, and personal care products.

Anticipated significant growth is expected in the European plastic resins industry. The European market is characterized by stringent environmental regulations imposed by regulatory bodies such as the European Chemicals Agency (ECHA) and the European Commission. Several European countries, including Denmark, France, Germany, and Austria, have enforced landfill prohibitions for an extended period. The imposition of high landfill tipping fees, dumping taxes, and associated waste management and landfill closure expenses has motivated Europeans to shift towards recycled products. Collaborative initiatives like Zero Waste Europe, working in conjunction with the European Commission, aim to reduce residual waste to zero, further influencing the plastic resins market in the region.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Plastic Resin Market

5.1. COVID-19 Landscape: Plastic Resin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Plastic Resin Market, By Product

8.1. Plastic Resin Market, by Product, 2024-2033

8.1.1. Crystalline Resin

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-crystalline Resin

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Engineering Plastic

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Super Engineering Plastic

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Plastic Resin Market, By Application

9.1. Plastic Resin Market, by Application, 2024-2033

9.1.1. Packaging

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Construction

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Electrical & Electronics

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Logistics

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Consumer Goods

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Textiles & Clothing

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Furniture & Bedding

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Agriculture

9.1.9.1. Market Revenue and Forecast (2021-2033)

9.1.10. Medical Devices

9.1.10.1. Market Revenue and Forecast (2021-2033)

9.1.11. Others

9.1.11.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Plastic Resin Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. SABIC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Dow

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DuPont

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Evonik Industries AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Sumitomo Chemical Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Celanese Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Eastman Chemical Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Chevron Phillips Chemical Co., LLC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. LOTTE Chemical Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others