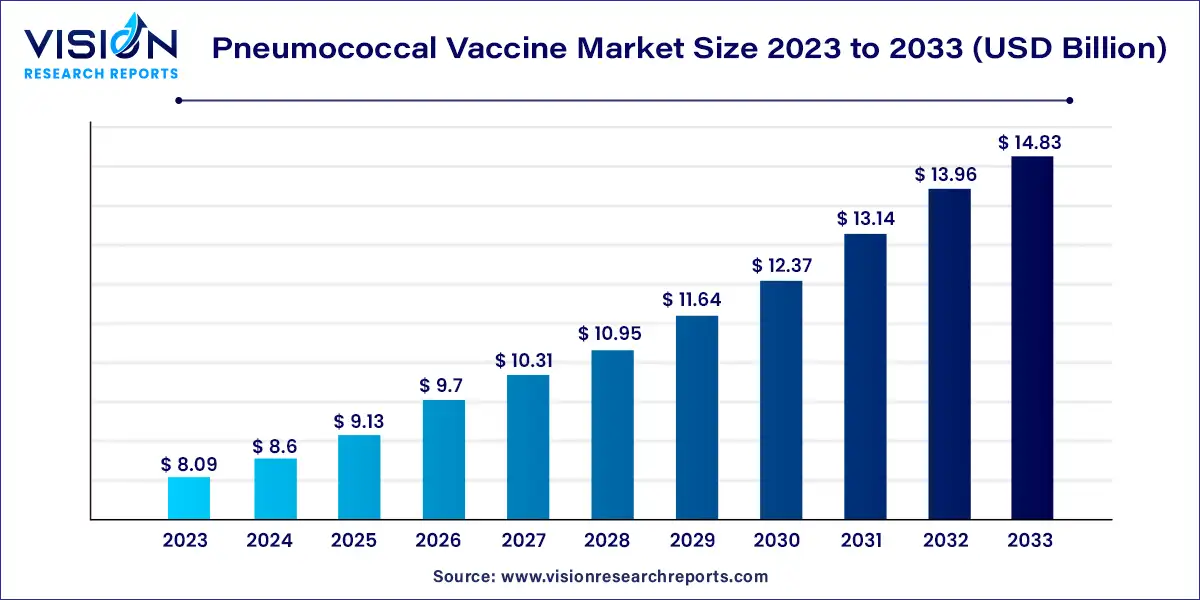

The global pneumococcal vaccine market size was estimated at USD 8.09 billion in 2023 and it is expected to surpass around USD 14.83 billion by 2033, poised to grow at a CAGR of 6.25% from 2024 to 2033.

The pneumococcal vaccine market is witnessing significant growth due to several factors such as the rising prevalence of pneumococcal diseases, increasing awareness about vaccination programs, and government initiatives to promote immunization. Pneumococcal diseases, caused by Streptococcus pneumoniae bacteria, encompass a range of infections including pneumonia, meningitis, and bacteremia. These diseases pose a considerable burden on healthcare systems worldwide, leading to substantial morbidity and mortality.

The growth of the pneumococcal vaccine market is driven by an increasing prevalence of pneumococcal diseases worldwide contributes significantly to the demand for vaccines. As these diseases, including pneumonia, meningitis, and bacteremia, pose significant health risks and economic burdens, there is a growing emphasis on prevention through vaccination programs. Secondly, rising awareness about the importance of immunization, coupled with government initiatives to promote vaccination, drives higher vaccine uptake rates, particularly among vulnerable populations such as infants, young children, and the elderly. Additionally, the introduction of pneumococcal conjugate vaccines (PCVs) has revolutionized disease prevention, offering protection against multiple serotypes of the bacteria. The inclusion of PCVs in national immunization schedules further boosts market growth. Moreover, ongoing research and development efforts aimed at enhancing vaccine efficacy, expanding serotype coverage, and developing novel formulations contribute to market expansion. Overall, these growth factors underscore the increasing importance of pneumococcal vaccination in public health strategies globally.

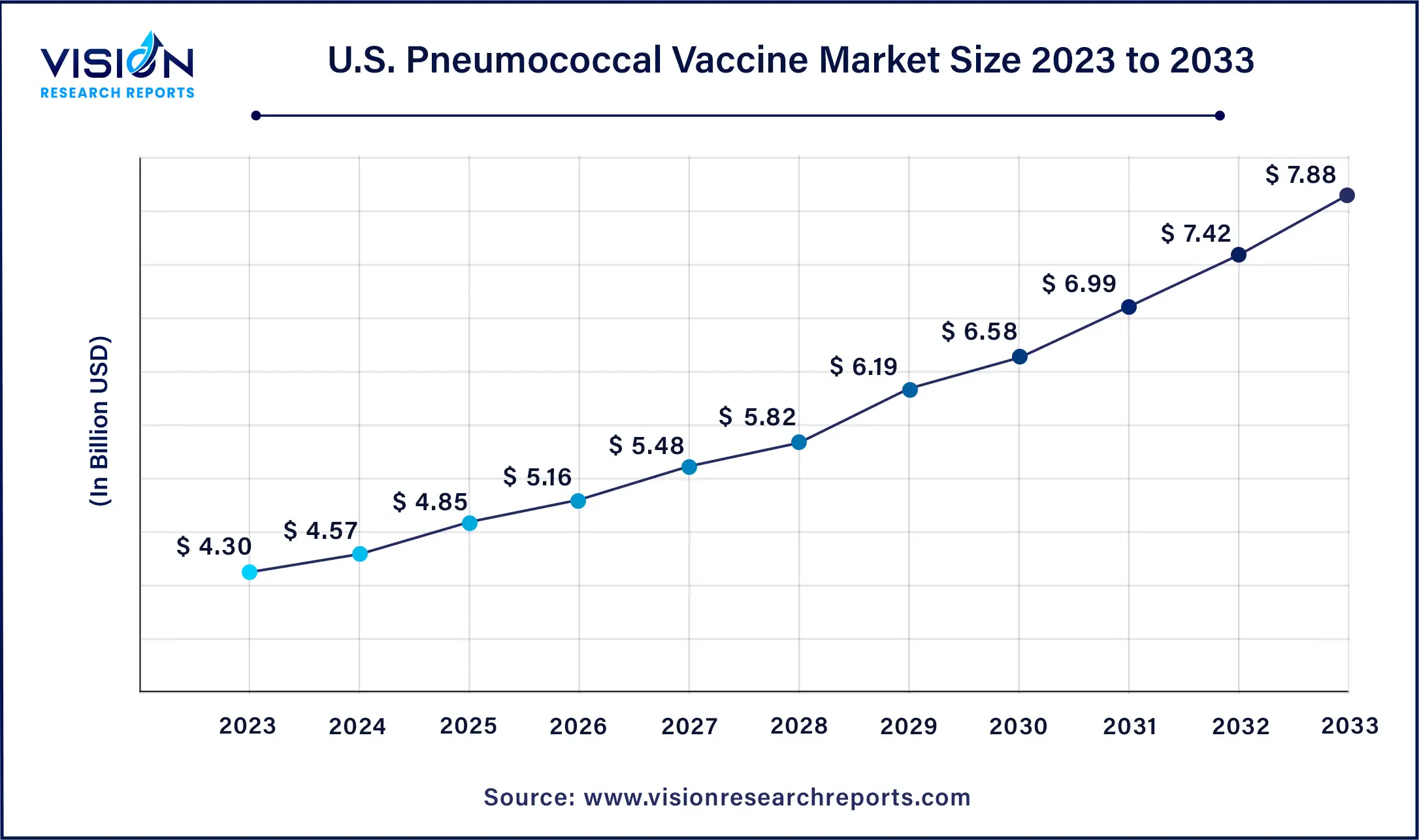

The U.S. pneumococcal vaccine market size was estimated at around USD 4.30 billion in 2023 and it is projected to hit around USD 7.88 billion by 2033, growing at a CAGR of 6.24% from 2024 to 2033.

Forecasts suggest significant growth in the U.S. pneumococcal vaccine market over the coming years. As highlighted by a 2023 report from the National Foundation of Infectious Diseases, pneumococcal meningitis and bloodstream infections, though less prevalent, exhibit higher mortality rates, resulting in over 3,000 deaths annually among U.S. adults and potential lifelong disabilities. This heightened prevalence underscores the urgent need for preventive measures like vaccination, fueling market growth and demand.

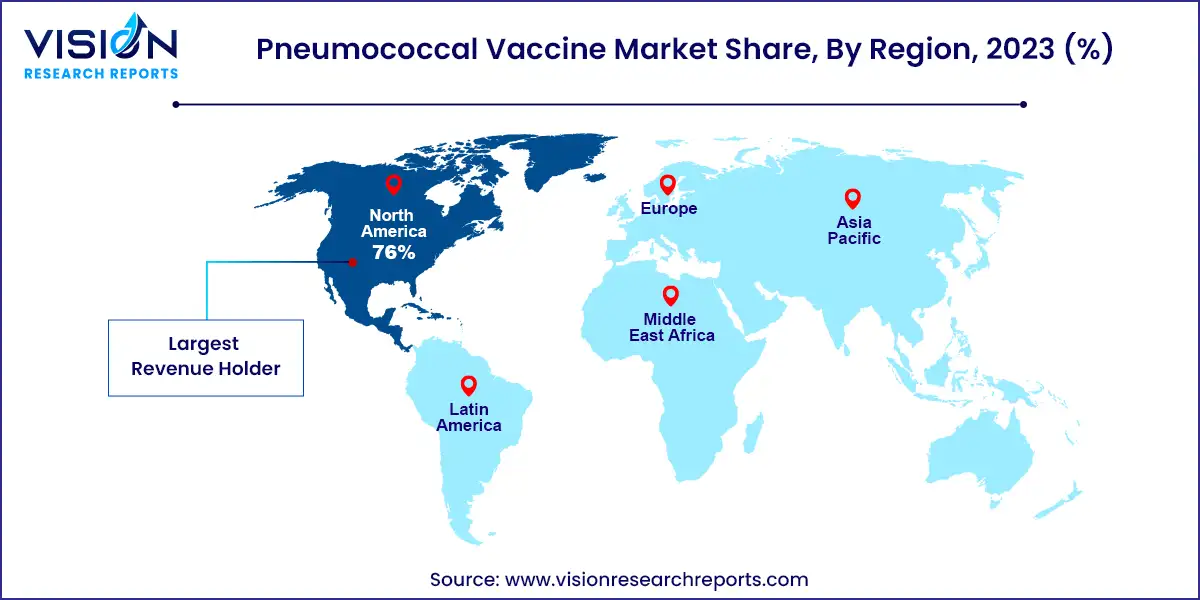

In 2023, the North American pneumococcal vaccine market commanded a significant 76% share of the global market. Governmental health agencies and organizations actively endorse vaccination initiatives to combat pneumococcal infections, propelling market demand. Furthermore, the presence of major pharmaceutical players such as Pfizer Inc. and Merck & Co., Inc. intensifies competition in the region as they strive to develop cutting-edge pneumococcal vaccines. Recent developments, such as Merck & Co., Inc.'s submission of a Biologics License Application (BLA) for its investigational 21-valent PCV and Pfizer Inc.'s approval for PREVNAR 20 in December 2023, underscore the competitive landscape and innovation driving the market forward.

Meanwhile, in the Asia Pacific region, the market is buoyed by escalating awareness regarding the crucial role of vaccination in preventing pneumococcal diseases. Several countries in the region are witnessing a surge in pneumococcal infections, leading to increased vaccine demand. Manufacturers are strategically expanding their footprint in Asia Pacific, capitalizing on this burgeoning industry opportunity. The establishment of local production facilities aims to meet the rising demand for vaccines and reduce reliance on imports.

The pneumococcal conjugate vaccine (PCV) segment dominated the market in 2023, accounting for 94% of global revenue and is expected to exhibit the fastest growth throughout the forecast period. PCVs play a crucial role in safeguarding against pneumococcal disease, a leading cause of mortality among children under 5 years old. These vaccines are engineered to provide protection against the most prevalent serotypes of Streptococcus pneumoniae, the bacterium responsible for pneumonia, meningitis, and various other severe infections. Recent updates from the Advisory Committee on Immunization Practices (ACIP) in the U.S., as highlighted in a CDC article from December 2023, recommend the use of 15-Valent and 20-Valent PCVs for adults. Increasing vaccination rates are imperative in preventing pneumococcal disease, necessitating efforts to address knowledge gaps and barriers to adhering to vaccination guidelines. Resources such as the PneumoRecs VaxAdvisor app, alongside other CDC tools, offer personalized vaccination recommendations to patients, bolstering confidence in vaccines.

On the other hand, the pneumococcal polysaccharide vaccine (PPV) segment is expected to witness steady growth at a compound annual growth rate (CAGR) over the forecast period. PPVs are formulated from the capsular polysaccharide of Streptococcus pneumoniae, the bacterium responsible for pneumonia and related infections. These vaccines stimulate the production of specific antibodies that facilitate the destruction of bacteria through opsonization or phagocytosis, rendering them highly effective against such infections. Notably, Pneumovax 23 (PPSV23) falls within the category of PPVs, comprising purified preparations of pneumococcal capsular polysaccharide and containing polysaccharide antigens from 23 types of pneumococcal bacteria.

In 2023, the public sector emerged as the frontrunner in the market, commanding the highest revenue share. This dominance stems from various factors contributing to the widespread utilization of pneumococcal vaccines within public healthcare settings, encompassing hospitals, clinics, and healthcare facilities. Chief among these factors are the substantial disease burden, governmental initiatives aimed at expanding vaccination coverage, and the cost-effectiveness inherent in public sector vaccination programs when compared to their private sector counterparts. The escalating prevalence of pneumococcal diseases such as pneumonia, sepsis, and meningitis serves as a primary driver behind this trend.

Conversely, the private sector segment is poised for significant growth during the forecast period. Private healthcare providers typically offer a heightened standard of care, characterized by personalized attention and access to advanced diagnostic capabilities. As highlighted in a January 2020 NCBI article, this emphasis on quality care often translates to improved patient outcomes, rendering the private sector an attractive choice for vaccination services. Moreover, private healthcare facilities are frequently more conveniently situated and boast flexible scheduling options, catering to individuals with hectic lifestyles or those who prefer a familiar healthcare environment. Additionally, the private sector exhibits agility in adopting novel vaccines and treatments, including those for pneumococcal diseases. This adaptability arises from the greater autonomy enjoyed by private healthcare providers in selecting the vaccines they offer, positioning them as early adopters of innovative vaccination solutions.

In 2023, Prevnar 13 emerged as the market leader, boasting the highest revenue share. The Prevnar brand encompasses two key vaccines: Prevnar 13 and Prevnar 20, both of which are pneumococcal conjugate vaccines (PCVs) formulated to combat pneumococcal disease. Prevnar 13, a 13-valent PCV, is indicated for active immunization in children aged 6 weeks through 5 years and adults aged 18 years and older against invasive diseases caused by specific Streptococcus pneumoniae serotypes. It also provides protection against otitis media in children within the same age range caused by these serotypes. Approved by the U.S. FDA on August 22, 2017, Prevnar 13's approval history includes updates to its package insert and clinical trial results assessing its use in conjunction with other vaccines. Pfizer Inc. markets the vaccine, which is manufactured by Wyeth Pharmaceuticals Inc., with its patent set to expire in 2026.

The PNEUMOSIL segment is poised for significant growth throughout the forecast period. As outlined in a February 2021 NCBI article, PNEUMOSIL has garnered regulatory approvals and endorsements since December 2018, including Indian Export Notice of Compliance, WHO preapproval, an advance market commitment supply agreement, and Indian Marketing Authorization. Positioned as an option for low- and middle-income countries, PNEUMOSIL aims to address the specific needs of regions such as Africa, Asia, Latin America, and the Caribbean (LAC) by targeting serotypes most likely to cause Invasive Pneumococcal Disease (IPD). This strategic approach endeavors to provide an affordable and efficacious vaccine tailored to the prevalent serotypes in these high-burden areas.

By Vaccine Type

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Vaccine Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pneumococcal Vaccine Market

5.1. COVID-19 Landscape: Pneumococcal Vaccine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pneumococcal Vaccine Market, By Vaccine Type

8.1. Pneumococcal Vaccine Market, by Vaccine Type, 2024-2033

8.1.1 Pneumococcal Conjugate Vaccine

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Pneumococcal Polysaccharide Vaccine

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Pneumococcal Vaccine Market, By Product

9.1. Pneumococcal Vaccine Market, by Product, 2024-2033

9.1.1. Prevnar 13

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Synflorix

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Pneumovax 23

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. VAXNEUVANCE

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. PNEUMOSIL

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Other Products

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Pneumococcal Vaccine Market, By End-use

10.1. Pneumococcal Vaccine Market, by End-use, 2024-2033

10.1.1. Public Sector

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Private Sector

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Pneumococcal Vaccine Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Serum Institute of India Pvt. Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. CSL.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Sanofi.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. GSK plc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Merck & Co., Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Pfizer Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Walvax Biotechnology Co., Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Beijing Minhai Biotechnology Co.,Ltd (Subsidiary of Shenzhen Kangtai Biological Products Co. Ltd.)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others