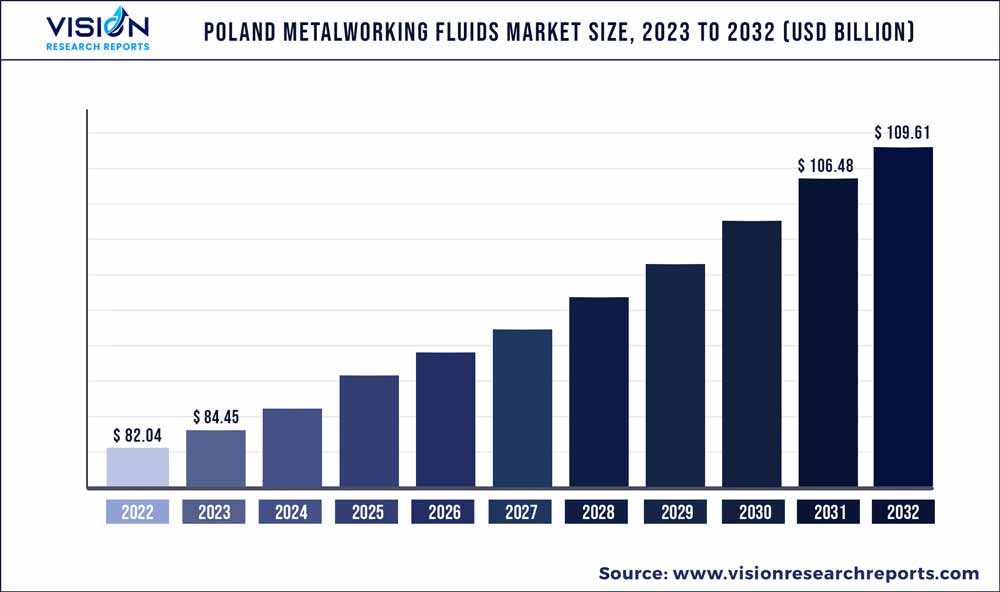

The Poland metalworking fluids (MWFs) market size was estimated at around USD 82.04 million in 2022 and it is projected to hit around USD 109.61 million by 2032, growing at a CAGR of 2.94% from 2023 to 2032.

Key Pointers

Report Scope of the Poland Metalworking Fluids Market

| Report Coverage | Details |

| Market Size in 2022 | USD 82.04 million |

| Revenue Forecast by 2032 | USD 109.61 million |

| Growth rate from 2023 to 2032 | CAGR of 2.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | CIMCOOL EUROPE; Henkel Polska Sp. z o. o; Master Fluid Solutions; Oemeta Inc.; Exxon Mobil Corporation; Blaser Swisslube; Quaker Chemical Corporation; FUCHS; China Petroleum & Chemical Corporation; PCC Group. |

This is attributed to increasing consumer spending and extensive application of MWFs in various industries such as construction, energy, power, and agriculture. In the transportation industry, MWFs are used in the manufacturing of tanks, aircraft, and jets. MWFs assist in operations where heat dissipation is critical for effective machining and helps in the production of high-quality products. Most transportation equipment used in the aerospace and automobile industries use metal treatment fluids in their manufacturing processes. These machines are used in the manufacturing of various components, including transmissions, engines, and suspension systems.

Poland has received U.S. $80.21 billion from Europe's budget for 2021-27, making it the largest net beneficiary of EU funds among all member states. The country intends to allocate the money toward the development of its transportation and energy sectors, resulting in numerous projects aimed at enhancing its road, railway, and waterway infrastructure. This, in turn, is expected to drive the demand for metalworking fluids due to an increase in the use of transportation in the coming years as per the data provided by the International Trade Association.

Poland is focusing on advanced manufacturing technologies such as Industry 4.0 and automation to increase productivity and competitiveness. These technologies require high-performance metalworking fluids to optimize the machining process. This will further pose an opportunity for the metalworking fluids industry to develop specially formulated metalworking fluids for machining processes. For instance, in 2020, Mercedes-Benz began producing engines and batteries in Poland. The new emission-free plant powered by renewable energy exemplifies Industry 4.0 manufacturing.

However, environmental regulations and improper disposal of metalworking fluids may hinder the market growth during the forecast period. As, the, extraction of raw materials, manufacturing processes, and packaging all contribute to the carbon footprint associated with these fluids.

Product Insights

The mineral-based product segment dominated the market with the highest revenue share of 39% in 2022. This is due to their wide usage widely owing to their easy availability and cost efficiency. Mineral-based MWFs in Poland serve aerospace, electricity, rail, and marine industries owing to increasing government spending. Turning, grinding, broaching, drilling, and milling are different machining operations where metalworking fluids are used in these end-use industries.

Manufacturers of mineral-based metalworking fluids in Poland serve a wide range of end-use industries including aerospace, electricity, rail, and marine owing to increasing government spending in these industries. Most small manufacturers prefer mineral-based metalworking fluids due to their low prices.

Synthetic oils are manufactured from synthetic and chemical materials. There are mainly two types of synthetic metalworking fluids: semi-synthetic and fully synthetic. Semi-synthetic metalworking fluids are a blend of synthetic and oil-based components whereas fully synthetic are made entirely from synthetic components. They are mostly preferred, as they are less prone to bacterial growth and can be used for a longer period.

Synthetic metalworking fluids are witnessing a strong demand as they offer superior capabilities such as increased tool life and an excellent surface finish. The fluids are widely used to reduce friction between workpieces, which helps eliminate waste and improve the sump life.

End-use Insights

The machinery end-use segment of MWFs dominated with the highest revenue share of 40% in 2022 owing to its extensive use in machining processes such as milling, drilling, turning, and grinding. These fluids provide lubrication, cooling, chip removal, extended tool life, low friction, and precise and accurate cuts. They also contribute to improved surface finishes on machined components.

Rising demand for manufacturing equipment is expected to drive the growth of the MWFs market. They are used in machining operations to improve the sump life, which eventually leads to a reduction in overhead costs for manufacturers. This advantage has resulted in increasing demand from small-scale manufacturers on account of tight procurement budgets.

Poland has a growing transportation equipment-manufacturing sector, which involves the production of various vehicles and their components. The country has established itself as a significant player in the automotive and aerospace industries, as well as other segments of transportation equipment manufacturing. Thus rising demand for transportation further leads to increasing machinery needs. This further drives the demand for MWFs in Poland.

Industrial End-use Insights

The electricity and power industrial end-use segment of metalworking fluids dominated with the highest revenue share of 26% in 2022 owing to its usage in the manufacturing processes of power generation equipment, such as turbines, generators, transformers, and electrical motors. They help in machining, cutting, forming, and ensuring precision in the production of metal components used in power generation systems. In addition, MWFs are employed in the fabrication of electrical components, including connectors, contacts, and conductors. They assist in machining, stamping, forming, improving cutting performance, reducing heat generation, and enhancing surface finish.

The main application of MWFs is in cooling and heat dissipation applications within power generation systems. They are applied to cool down electrical components, such as transformers and power electronics, to maintain optimal operating temperatures and prevent overheating.

MWFs play a crucial role in the manufacturing of construction and related equipment, offering unique advantages that contribute to their widespread use. These fluids have the remarkable ability to enhance tool strength, deliver exceptional surface finishes on workpieces, improve workpiece efficiency, and facilitate high-quality fabrication. As a result, metalworking fluids have gained significant demand in the construction industry. This industry produces a wide range of equipment, such as excavators, loaders, forklifts, cranes, and dozers.

Applications Insights

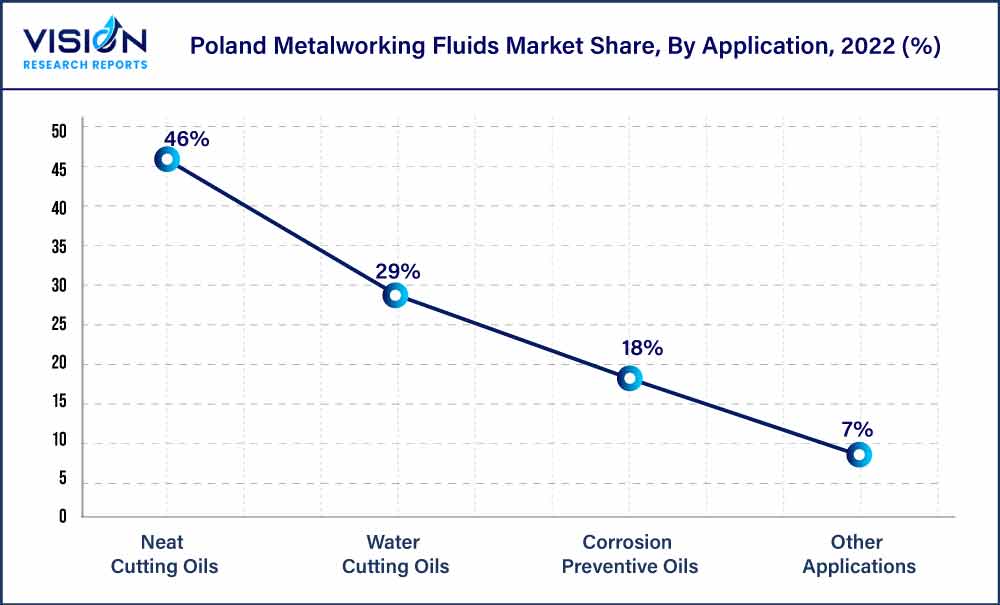

Neat cutting oil application segment of MWFs dominated with the highest revenue share of 46% in 2022 owing to its superior lubricating and cutting performance that prolongs the life of metal equipment and tools by preventing corrosion and rusting. Neat cutting oils also provide outstanding lubrication and cutting performance, enabling high output and performance while maintaining high standards for surface finish and dimensional accuracy. They are simple to use and require little time to maintain cutting oil quality.

The majority of cutting operations and many machining processes use neat cutting oils. Due to their capacity to offer economical solutions, these oils have seen an increase in demand from the high-volume manufacturing sector. These oils are used in many machining processes like drilling, hobbing, turning, honing, and broaching because they improve surface finish and increase the tool life. Furthermore, the demand for neat cutting oils is expected to increase over the forecast period especially to process high-alloy steels in heavy equipment manufacturing.

Water-soluble cutting oils are the most commonly used metalworking fluids in the manufacturing industry. There are three major types of water-cutting oils based on the percentage of mineral oil. Soluble water-cutting oil has 50% to 80% mineral oil content whereas semi-synthetic water-cutting oil contains 30% to 50% mineral oil. Synthetic water-cutting oils contain no mineral oil.

Water-soluble fluids are mixed with water before they are used in the cutting system. Additionally, the fluid prevents corrosion on the workpiece and machine tools by flushing chips and swarf from the cut zone. Most importantly, metalworking fluids boost output, prolong tool life, and demand less energy during the metal treatment.

Corrosion preventive oils are used in machining operations where there is a high risk of tool damage; as a result, these oils help extend sump life, which lowers manufacturing overhead costs. These oils typically contain specialized additives that offer protection against rust and corrosion. The limited financial resources and low production volumes, this has led to a rise in demand from small-scale manufacturers for corrosion preventive oils.

Additionally, an increase in the production of transportation and construction components is anticipated to increase demand for corrosion-preventive oils, which can lower maintenance costs by preventing rust. The demand for corrosion preventive oils is also anticipated to increase due to the expanding manufacturing sector and improved oil performance.

Poland Metalworking Fluids Market Segmentations:

By Product

By Application

By End-use

By Industrial End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Poland Metalworking Fluids Market

5.1. COVID-19 Landscape: Poland Metalworking Fluids Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Poland Metalworking Fluids Market, By Product

8.1. Poland Metalworking Fluids Market, by Product, 2023-2032

8.1.1. Mineral

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Bio-based

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Poland Metalworking Fluids Market, By Application

9.1. Poland Metalworking Fluids Market, by Application, 2023-2032

9.1.1. Neat Cutting Oils

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Water Cutting Oils

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Corrosion Preventive Oils

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Other Applications

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Poland Metalworking Fluids Market, By End-use

10.1. Poland Metalworking Fluids Market, by End-use, 2023-2032

10.1.1. Metal Fabrication

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Transportation Equipment

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Machinery

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Other End-uses

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Poland Metalworking Fluids Market, By Industrial End-use

11.1. Poland Metalworking Fluids Market, by Industrial End-use, 2023-2032

11.1.1. Construction

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Electric & Power

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Agriculture

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Aerospace

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Automobile

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Rail

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Marine

11.1.7.1. Market Revenue and Forecast (2020-2032)

11.1.8. Telecommunication

11.1.8.1. Market Revenue and Forecast (2020-2032)

11.1.9. Healthcare

11.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Poland Metalworking Fluids Market, Regional Estimates and Trend Forecast

12.1. Poland

12.1.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.3. Market Revenue and Forecast, by End-use (2020-2032)

12.1.4. Market Revenue and Forecast, by Industrial End-use (2020-2032)

Chapter 13. Company Profiles

13.1. CIMCOOL EUROPE

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Henkel Polska Sp. z o. o

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Master Fluid Solutions

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Oemeta Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Exxon Mobil Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Blaser Swisslube

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Quaker Chemical Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. FUCHS

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. China Petroleum & Chemical Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. PCC Group.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others