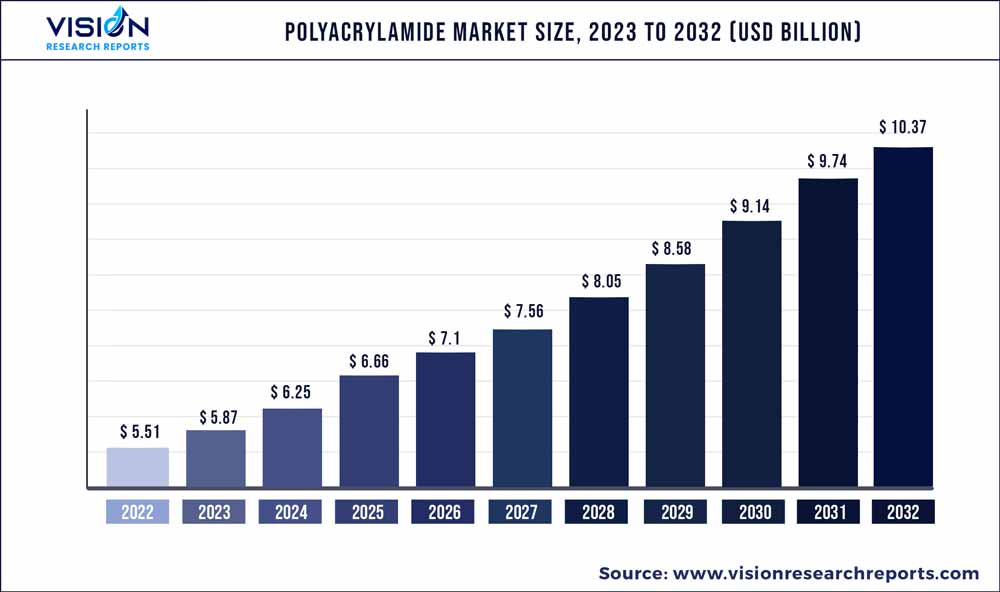

The global polyacrylamide market was surpassed at USD 5.51 billion in 2022 and is expected to hit around USD 10.37 billion by 2032, growing at a CAGR of 6.53% from 2023 to 2032.

Key Pointers

Report Scope of the Polyacrylamide Market

| Report Coverage | Details |

| Market Size in 2022 | USD 5.51 billion |

| Revenue Forecast by 2032 | USD 10.37 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.53% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Anhui Jucheng Fine Chemical Co, Ltd. (CJCC); Ashland Inc.; BASF SE; Kemira; SNF Group; Black Rose Industries Ltd.; Shandong Polymer Bio-chemicals Co., Ltd.; Xitao Polymer Co., Ltd.; ZL EOR Chemicals Ltd.; Dongying Kechuang Biochemical Industrial Co., Ltd. |

Increasing penetration of the product in water purification activities as a flocculating agent is expected to propel the demand for polyacrylamide.

The market is highly influenced by the availability of raw material and fluctuating price trends. The prices of polyacrylamide are likely to grow over the forecast period owing to rising crude oil prices, which are further impacting the acrylamide, acrylic acid, and acrylonitrile prices. As a result, the market players are likely to integrate the value chain to reduce their dependency on the raw material supplier and increase profit margins.

SNF, BASF, and Kemira are few of the top polyacrylamide manufacturers. The multinationals are expanding their production bases and volumes to strengthen their roots in the market. Moreover, the market has numerous small-scale players, selling their products in domestic market. These players are likely to offer competitive pricing to gain market share against these major players.

Key applications of polyacrylamide include water treatment, oil and gas, and paper making. Other application areas include pharmaceuticals, cosmetics, and personal care products. Polyacrylamide is used as a flocculent in waste water treatment of the chemical industry and municipal sewage treatment.

Product Insights

Anionic and cationic polyacrylamide polymers were the dominant product segments, accounting for more than 78.03% of the overall demand in 2022. Anionic polyacrylamide polymers are used in applications including wastewater treatment, pulp and paper industry, aquaculture, food & beverage, coal mining, food & beverage, and oil & gas industries. The anionic polyacrylamide polymers have a high demand for industrial wastewater treatment and municipal sewage treatment as flocculating agents. The increasing impure water discharge from industries, and growing scarcity of potable water, is expected to drive demand for polyacrylamide in water treatment application over the coming years.

Also, the growing product demand in other application areas, such as coal washing, mineral processing, metallurgy, iron & steel, and electronic industries, will support segment expansion. The demand for cationic polymers was significant in 2022 owing to their high usage as retention and drainage aids in papermaking and flocculants in wastewater treatment. These polymers act as stabilizers for emulsion polymerization in cosmetics. The aforementioned factors are expected to open new avenues for market growth over the coming years.

Application Insights

Polyacrylamide demand in water treatment applications dominated the market with a revenue share of more than 38.07% in 2022. The rising demand for polyacrylamide to treat municipal sewage, industrial wastewater, and drinking water purification plants is expected to propel demand. Furthermore, increasing attention to the water treatment industry by government regulatory bodies across various countries is likely to have a positive impact on market growth. The demand for the product from the oil & gas industry for enhancement of oil recovery is expected to grow over the forecasted period as the product improves the oil recovery efficiency.

Also, it is used in drilling mud and fracturing fluid additives. The use of polyacrylamide can adjust the drilling fluidity, carry shale debris, lubricate the drill bit, and control fluid loss. The aforementioned factors are expected to drive product demand in oil & gas applications. In the paper-making industry, it works as a retention agent and improves paper quality. As a result, the demand in paper-making applications will grow significantly over the forecast period. Furthermore, it acts as the dispersing agent and helps in reducing fiber flocculation to improve the paper formation process.

Large-scale paper manufacturing for various applications including educational material and packaging, coupled with rising product adoption in the pulp & paper manufacturing process, will drive the segment growth. It is considered an important variable in the mining process, as it effectively separates the solid mineral from the water or solution and this improves the drilling efficiency. The product is widely used in the coal manufacturing industry for the coal washing process. Rising mining activities, coal washing, metal plating, and dying are expected to drive segment growth over the forecast period.

Regional Insight

In North America, the demand for the product is dominated by the water treatment application, which accounts for over 49.01% of the overall demand in 2022. Stringent regulatory actions against wastewater disposal coupled with the rising environmental concerns in the region are expected to drive water treatment activities, which are likely to have a positive impact on the industry’s growth. Furthermore, developments of polyacrylamide polymers for producing polyacrylamide gel and powder are expected to create new avenues in bio-sciences and pharmaceuticals in the region. Asia Pacific also accounted for a considerable share in 2022. China accounted for the major share of the market and is expected to grow at a significant CAGR over the forecast period.

The robust base of the pharmaceutical and chemical manufacturing industries in the region has resulted in a high volume of wastewater, which will propel the product demand as water treatment chemical. In addition, the region is one of the top pulp & paper manufacturing markets in the world. Thus, the presence of several pulp & paper manufacturers, such as Shandong Pulp & Paper Co., Ltd., will have a positive impact on the industry growth. The product demand in Germany was significant in 2022 and will grow at a lucrative CAGR from 2023 to 2032. The country is the largest EU water technology exporter in Europe. Also, high investments in water recycling and purification technology are expected to drive product demand in water treatment activities.

Polyacrylamide Market Segmentations:

By Product

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Polyacrylamide Market

5.1. COVID-19 Landscape: Polyacrylamide Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Polyacrylamide Market, By Product

8.1. Polyacrylamide Market, by Product, 2023-2032

8.1.1. Anionic

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cationic

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Non-ionic

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Polyacrylamide Market, By Application

9.1. Polyacrylamide Market, by Application, 2023-2032

9.1.1. Water Treatment

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Oil & Gas

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Paper Making

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Polyacrylamide Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Anhui Jucheng Fine Chemical Co, Ltd. (CJCC)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Ashland Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BASF SE

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Kemira

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. SNF Group

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Black Rose Industries Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Shandong Polymer Bio-chemicals Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Xitao Polymer Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. ZL EOR Chemicals Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Dongying Kechuang Biochemical Industrial Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others