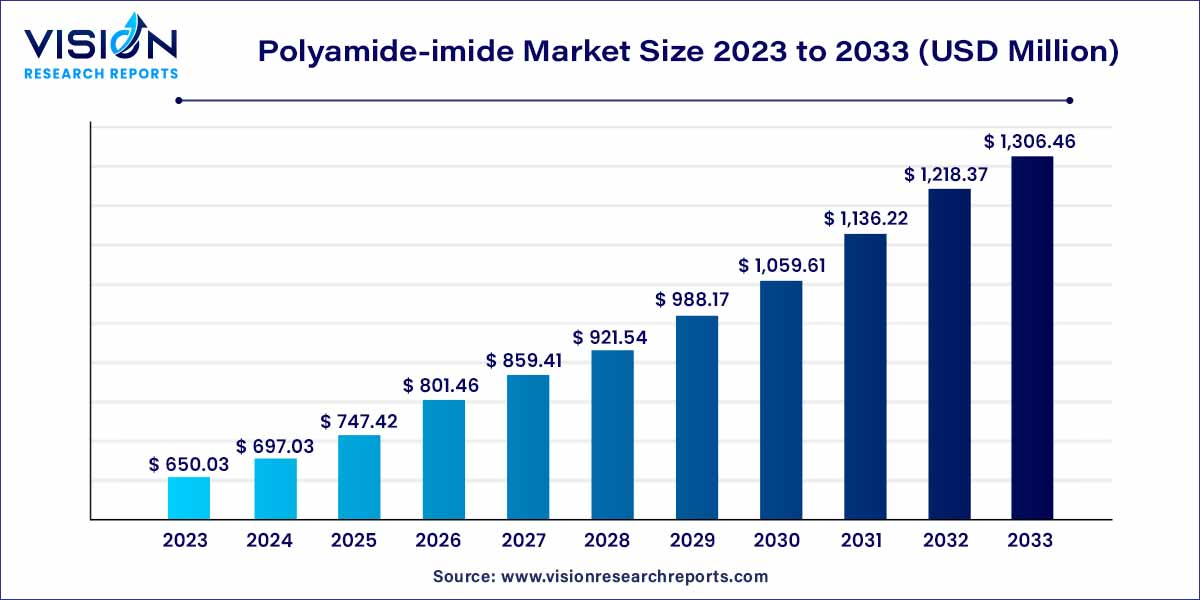

The global polyamide-imide market size was surpassed at USD 650.03 million in 2023 and is expected to hit around USD 1,306.46 million by 2033, growing at a CAGR of 7.23% from 2024 to 2033. The polyamide-imide market is experiencing robust growth and diversification, marked by the rising demand for this versatile polymer across multiple industrial sectors. Polyamide-imide, commonly known as PAI, is a high-performance thermoplastic known for its exceptional heat resistance, mechanical strength, and chemical stability.

The polyamide-imide market is experiencing robust growth driven by several key factors. One of the primary growth drivers is the increasing demand from the automotive and aerospace industries, where polyamide-imide's exceptional heat resistance and mechanical strength make it an ideal choice for critical components. Additionally, the expanding applications in the electronics and electrical sector, owing to its excellent electrical insulating properties, further fuel the market growth. Technological advancements and ongoing research and development initiatives play a pivotal role by enhancing polyamide-imide's properties, expanding its applications, and boosting overall market demand. Furthermore, the industry's focus on environmental sustainability has led to the development of eco-friendly variants, aligning the market with global environmental standards. These factors collectively contribute to the upward trajectory of the polyamide-imide market, making it a promising and evolving sector within the polymer industry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.23% |

| Market Revenue by 2033 | USD 1,306.46 million |

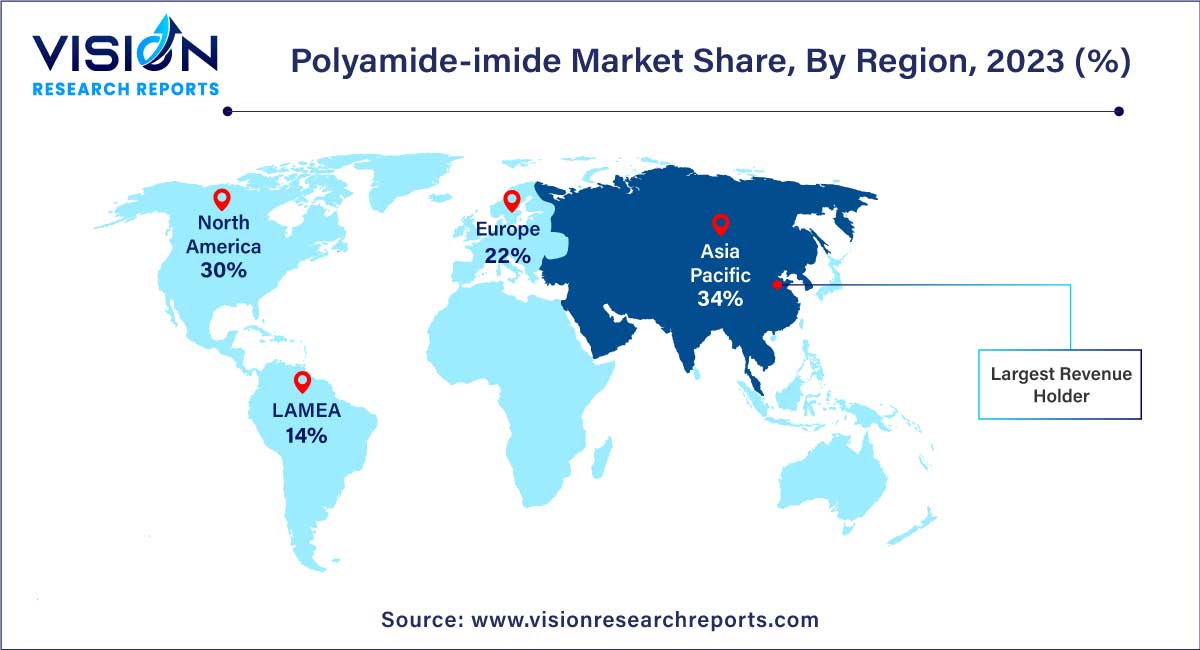

| Revenue Share of Asia Pacific in 2023 | 34% |

| CAGR of North America from 2024 to 2033 | 7.39% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The molding resins segment accounted for the highest revenue share of 76% in 2023. Molding resins made from polyamide-imide are highly regarded for their exceptional thermal stability, mechanical strength, and chemical resistance. These properties make them indispensable in the manufacturing of various components in industries such as automotive, aerospace, and electronics. Polyamide-imide molding resins find extensive use in producing intricate and high-performance parts, including engine components, electrical connectors, and structural elements. The material's ability to withstand extreme temperatures and harsh chemical environments ensures the longevity and reliability of the molded products.

The wire enamels segment is predicted to grow at the fastest CAGR of 7.64% during the forecast period. Wire enamels, polyamide-imide coatings play a crucial role in enhancing the performance and durability of electrical wires and coils. These enamels are known for their superior electrical insulation properties, making them ideal for use in transformers, motors, and generators. Polyamide-imide wire enamels provide excellent adhesion, thermal stability, and resistance to abrasion, ensuring the longevity of electrical components even under demanding operating conditions. As the demand for high-efficiency electrical systems continues to rise, the use of polyamide-imide wire enamels becomes essential, contributing to the seamless functioning of various electrical devices and systems.

Asia Pacific accounted for the largest revenue share of 34% in 2023 and is anticipated to grow at the fastest CAGR of 7.66% during the forecast period. Asia-Pacific emerges as a prominent hub for polyamide-imide production and consumption. Rapid industrialization, particularly in countries like China and India, has resulted in a surge in demand for high-performance polymers across various sectors. The automotive industry, in particular, relies heavily on polyamide-imide for its superior heat resistance and mechanical strength, catering to the growing needs of these emerging markets. Moreover, the region's booming electronics and electrical industry further amplifies the demand for polyamide-imide in applications like circuit boards and electrical connectors.

North America polyamide-imide market is expected to grow at the fastest CAGR of 7.39% over the forecast period. North America stands as a significant market player, driven by the strong presence of the aerospace and automotive industries. The region's robust manufacturing sector and emphasis on technological advancements fuel the demand for polyamide-imide, especially in high-performance applications within these industries. Additionally, stringent environmental regulations in North America have spurred the development of eco-friendly variants of polyamide-imide, aligning with the region's sustainability goals.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Polyamide-imide Market

5.1. COVID-19 Landscape: Polyamide-imide Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Polyamide-imide Market, By Application

8.1.Polyamide-imide Market, by Application Type, 2024-2033

8.1.1. Molding resins

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Wire enamels

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Coating

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Fiber

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Polyamide-imide Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Solvay

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Swicofil AG

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Kermel

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. TOYOBO CO., LTD.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Innotek Technology Limited

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. FUJIFILM Holdings Corporation

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Shanghai Songhan Plastics Technology Co., Ltd

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Ensinger GmbH

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others