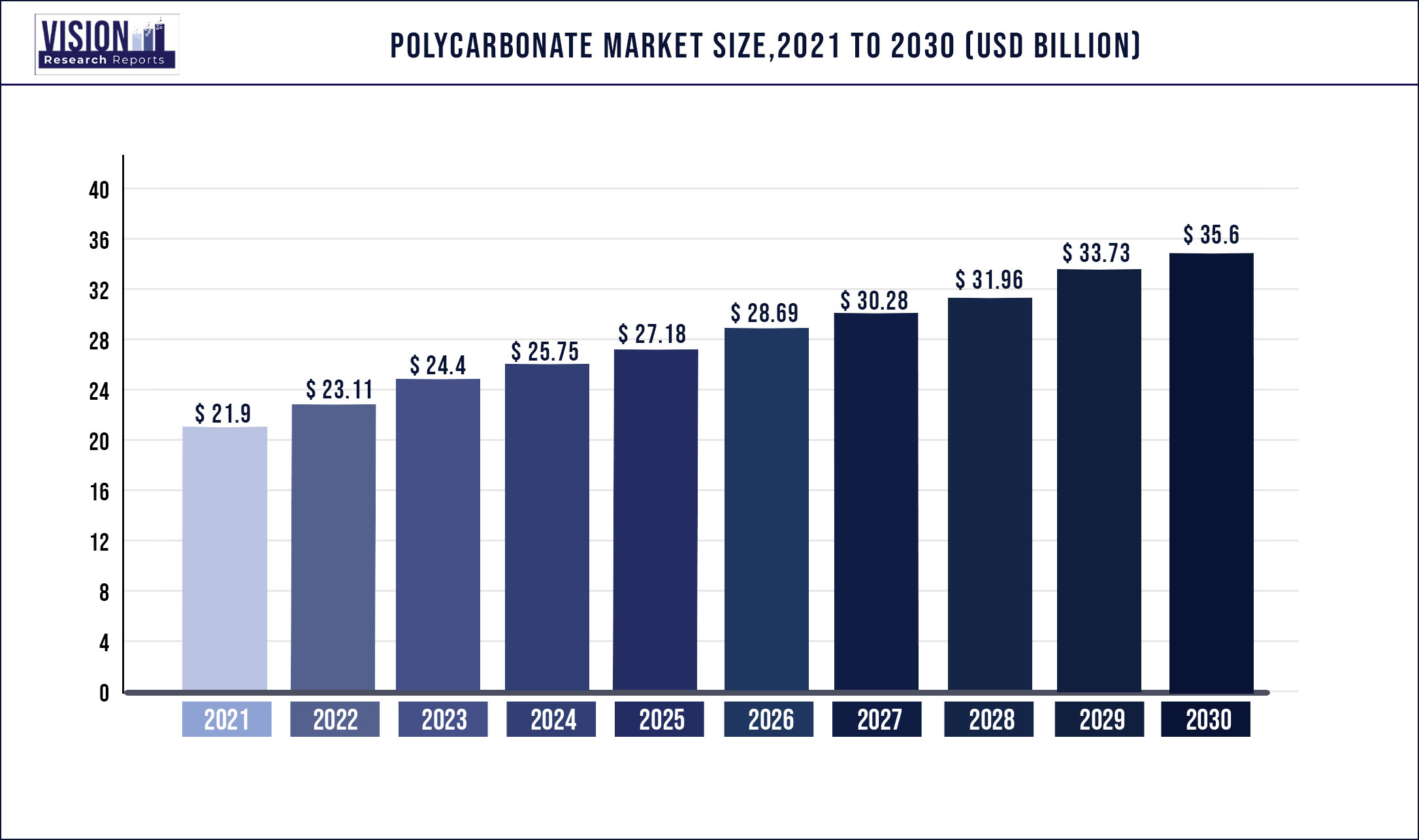

The global polycarbonate market was surpassed at USD 21.9 billion in 2021 and is expected to hit around USD 35.6 billion by 2030, growing at a CAGR of 5.55% from 2022 to 2030.

Regulatory policies are encouraging automotive OEMs to utilize plastics as a means of reducing vehicular weight & improving fuel efficiency. This is anticipated to play a prominent role in driving market growth.

Polycarbonate is a completely recyclable polymer and is therefore favored as a substitute for PVC, particularly in medical devices. In comparison, PC resins offer greater tensile strength & flexural modulus, meaning that they can be easily processed and even blended with other resins such as styrene copolymers and PBT. In the recent past, regulations aimed at reducing plastic wastage highlighted the importance of recycling. PC resins being completely recyclable are expected to benefit from such regulations, and in turn, ease up global supply constraints.

The electrical & electronics segment remained the dominant application area, accounting for more than 24.0% share of the overall consumption in 2021. In the electronics sector, polycarbonate is widely used for producing power housings, connectors, household appliances, and battery boxes. On the other hand, the resin’s optical clarity has led to its increasing usage in headlamps, face shields, laminates, and windshields in the automotive and transportation sector.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 21.9 billion |

| Revenue Forecast by 2030 | USD 35.6 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.55% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, region |

| Companies Covered | Covestro; SABIC; Lotte Chem; Teijin Industries; Mitsubishi Engineering Plastics Corp.; Trinseo; Idemitsu Kosan Co. Ltd.; Lone Star Chemical; Chi Mei Corporation; Entec Polymers; RTP Company; LG Chem |

Application Insights

The electrical & electronics application segment led the market and accounted for more than 24% share of the global revenue in 2021. Polycarbonate resins, blended with other polymers such as PBT and ABS, help to improve the final compound’s impact resistance and high-temperature performance. These compounds are further processed to be used in the fabrication of lighting systems, headlamp lenses, exterior parts, and interior components by automotive OEMs.

Over the recent past, Asian markets that include China, India, Indonesia, Thailand, and Korea have established themselves as regional manufacturing hubs for passenger cars and two-wheelers. High demand for premium passenger vehicles in the region has attracted investments from American and European companies that include Ford, General Motors, Volkswagen.

Polycarbonate demand in electrical and automotive applications has increased tremendously in the recent past. The product is easily moldable and flexible, thus making it ideal for thermoforming applications. Some grades of plastic compounds are tough and strong, whereas others are optically transparent, which makes them easy to be engineered. Furthermore, investments in public infrastructure, particularly in metro-rail projects and greenfield airports, will give rise to the demand for PC resins in construction as well as mass transit systems.

Regional Insights

Asia Pacific dominated the market and accounted for more than 56.0% share of global revenue in 2021. The high share is attributable to the availability of raw materials in abundance and the availability of low-cost labor, which is attracting manufacturers from various industries to set up their production facilities in the Asia Pacific region to derive increased benefits.

In China, the polycarbonate market value in construction is expected to reach USD 1.93 billion by 2024. A non-aggressive monetary stance by the country’s central bank is likely to ease up liquidity, thereby favoring investments in new housing starts.

The Italian construction industry is expected to grow on account of favorable government policies for foreign direct investment (FDI) in the manufacturing sector. Furthermore, government initiatives for investments in energy and residential & commercial construction projects are expected to fuel the demand for polycarbonate during the forecast period. The growth of construction and real estate sectors in the country is likely to augment the demand for furniture, thereby propelling the market growth for polycarbonate during the projection period.

Key Players

Market Segmentation

Chapter 1.Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2.Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3.Executive Summary

3.1.Market Snapshot

Chapter 4.Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Polycarbonate Market

5.1.COVID-19 Landscape: Polycarbonate Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6.Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7.Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8.Global Polycarbonate Market, By Application

8.1.Polycarbonate Market, by Application Type, 2020-2027

8.1.1.Automotive & Transportation

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2.Electrical & Electronics

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3.Construction

8.1.3.1.Market Revenue and Forecast (2016-2027)

8.1.4.Packaging

8.1.4.1.Market Revenue and Forecast (2016-2027)

8.1.5.Consumer Goods

8.1.5.1.Market Revenue and Forecast (2016-2027)

8.1.6.Optical Media

8.1.6.1.Market Revenue and Forecast (2016-2027)

8.1.7.Medical Devices

8.1.7.1.Market Revenue and Forecast (2016-2027)

8.1.8.Others

8.1.8.1.Market Revenue and Forecast (2016-2027)

Chapter 9.Global Polycarbonate Market, Regional Estimates and Trend Forecast

9.1.North America

9.1.1.Market Revenue and Forecast, by Application (2016-2027)

9.1.2.U.S.

9.1.3.Rest of North America

9.1.3.1.Market Revenue and Forecast, by Application (2016-2027)

9.2.Europe

9.2.1.Market Revenue and Forecast, by Application (2016-2027)

9.2.2.UK

9.2.2.1.Market Revenue and Forecast, by Application (2016-2027)

9.2.3.France

9.2.3.1.Market Revenue and Forecast, by Application (2016-2027)

9.2.4.Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Application (2016-2027)

9.3.APAC

9.3.1.Market Revenue and Forecast, by Application (2016-2027)

9.3.2.India

9.3.2.1.Market Revenue and Forecast, by Application (2016-2027)

9.3.3.China

9.3.3.1.Market Revenue and Forecast, by Application (2016-2027)

9.3.4.Japan

9.3.4.1.Market Revenue and Forecast, by Application (2016-2027)

9.3.5.Rest of APAC

9.3.5.1.Market Revenue and Forecast, by Application (2016-2027)

9.4.MEA

9.4.1.Market Revenue and Forecast, by Application (2016-2027)

9.4.2.GCC

9.4.2.1.Market Revenue and Forecast, by Application (2016-2027)

9.4.3.North Africa

9.4.3.1.Market Revenue and Forecast, by Application (2016-2027)

9.4.4.South Africa

9.4.4.1.Market Revenue and Forecast, by Application (2016-2027)

9.4.5.Rest of MEA

9.4.5.1.Market Revenue and Forecast, by Application (2016-2027)

9.5.Latin America

9.5.1.Market Revenue and Forecast, by Application (2016-2027)

9.5.2.Brazil

9.5.2.1.Market Revenue and Forecast, by Application (2016-2027)

9.5.3.Rest of LATAM

9.5.3.1.Market Revenue and Forecast, by Application (2016-2027)

Chapter 10.Company Profiles

10.1.Covestro

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.SABIC

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Lotte Chem

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Teijin Industries

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Mitsubishi Engineering Plastics Corp.

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.Trinseo

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.Idemitsu Kosan Co. Ltd.

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Lone Star Chemical

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.Chi Mei Corporation

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.Entec Polymers

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others