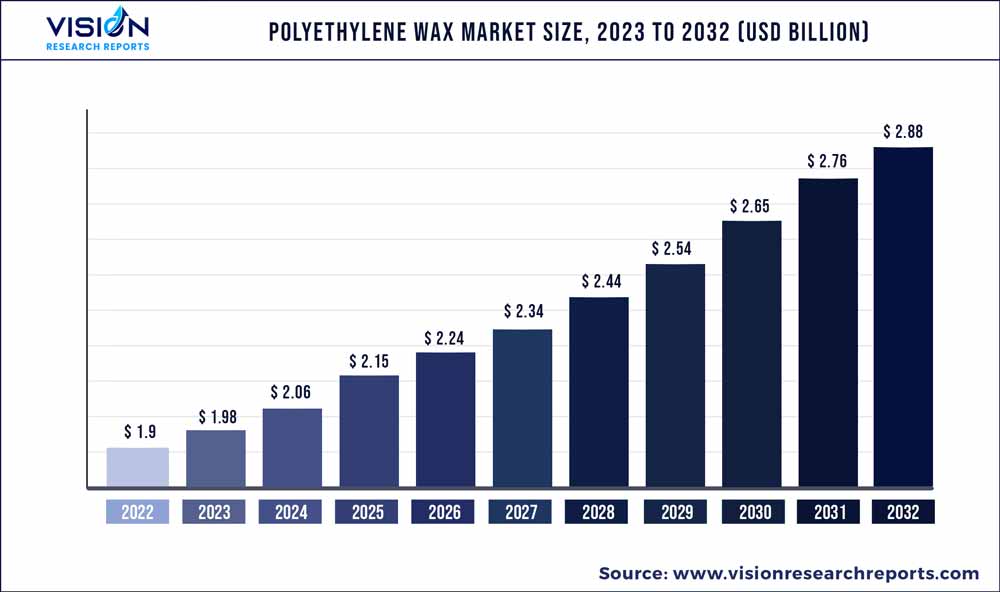

The global polyethylene wax market was surpassed at USD 1.9 billion in 2022 and is expected to hit around USD 2.88 billion by 2032, growing at a CAGR of 4.23% from 2023 to 2032.

Key Pointers

Report Scope of the Polyethylene Wax Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.9 billion |

| Revenue Forecast by 2032 | USD 2.88 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.23% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Baker Hughes; BASF SE; Clariant; Honeywell International Inc.; Mitsui Chemicals; SCG Chemicals Public Company Limited; Zellag, Marcus Oil & Chemicals Private Ltd; Trecora Chemical; Oxidized Polyethylene Innovations |

Polyethylene waxes are synthetic wax type, which is widely used in diversified industries like printing inks, adhesives, masterbatches, plastics, rubber, cosmetics, food packaging, textile, coating, candles and paper production.

Traditionally, Asia Pacific has been the largest polyethylene (PE) wax producer in the world owing to development of end-user industries in China, Vietnam, Japan, and India. China’s well-established polyethylene wax infrastructure coupled with the dominance of the major players will fuel the regional market share over the projected period.

Furthermore, growing initiatives by industry players and regional governments to develop shale gas reserves by 2020 will contribute positively towards affordable ethylene production. Middle East, on account of prevailing strong oil and gas infrastructure is also estimated to experience significant market expansion.

The industry is highly competitive in terms of product variation and pricing. The major industry participants are favored by their well-established consumer base and global footprint in the market. The players are witnessing growing demand from coating, textile, printing inks, polish, food packaging & processing, paints, oil & gas, cosmetics, pharmaceuticals, paper, and leather industries.

The market growth can be attributed to the widespread applications of PE wax. It is used as a lubricant in PVC processing and as a dispersing agent in masterbatch application. HDPPE and LDPPE are produced using polymerization technology. Modification technology is used to manufacture Oxidized, modified, acid-modified products.

Product Insights

Oxidized PE wax was the dominating segment accounting for a revenue share of more than 36.01% owing to increasing application in the coating, plastics, inks, rubber, shoe, leather, lubricants, and masterbatches industries. Asia Pacific oxidized market is expected to witness significant growth due to rapid industrialization and rising R&D activities.

PE wax has gained significant acceptance in the coating industry and is being increasingly used in water-based wax emulsions, nonionic emulsions, and PVC processing in numerous manufacturing sectors such as textile industry, adhesives, packaging, automobiles, and paper coating.

High Density Polymerized PE Wax was the second-largest segment and is predicted to hold significant market share. High density polymerized is the most commonly used PE wax with high density and tensile strength. They are used in diverse application areas as it has high market penetration and is expected to grow at a stable growth rate.

The product has found its wide application in manufacturing industries due to high performance properties like low melt viscosity and compatibility with plasticizers, lubricants, and stabilizers. LDPE and HDPE are obtained through high-density polymerization and are usually used as PVC processing lubricant, hot-melt adhesives modifier, and water-based emulsion additive to improve slip, friction, and scratch resistance.

Technology Insights

Polymerization dominated the market with a revenue share of over 47.1% in 2022. Recently, metallocene, a form of polymerization technology, is used by manufacturers as an enhanced and improved performance solution for the production of HDP and LDP. This is expected to bolster the polymerization technology growth in PE wax market.

Modification technology is used for co-polymer, oxidized, acid- modified, special monomer manufacturing. On account of high growth in acid-modified and oxidized demand, the technology share is also expected to show an increase over the forecast period.

Modification segment demand is proportionately influenced by growing demand for oxidized, special monomer, acid modified, and co-polymer product segment. The market volume is estimated to be driven over the forecast period by growth in the application segment of acid-modified coatings and oxidized in inks, adhesives, and masterbatches.

Application Insights

Candles dominated the application segment with a revenue share of over 29.05% in 2022. Packaging was the second-largest application segment and is predicted to hold a significant market share. Heat sealability and grease & scuff resistance are among the properties of PE wax that are highly preferred in the packaging sector. Wax packaging is expected to witness substantial growth in the Indian market on account of its increasing utilization in coating, treatment, impregnation, and lamination of primary food contact materials such as paper, paperboards, and aluminum.

PE waxes have lubricating properties which support the resin processing. Furthermore, these waxes are extensively used for dispersing colors in plastics and other additives. Increasing demand for PE plastics by food and other packaging industry is likely to boost the segment growth over the forecast period. Besides, westernization in emerging economies is positively impacting the demand for quality products and is expected to surge printing inks sales in the Asia Pacific.

Regional Insights

Asia Pacific held a market share of over 28.02% in global polyethylene wax market in 2022 and is expected to expand at the highest CAGR during the projected period. Based on region the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Central & South America. North America further includes the U.S., and Europe includes Germany.

Rapid industrialization and high polyethylene supplies from India and China have resulted in the growth of PE wax market in the region. China’s well-established polyethylene wax infrastructure along with the presence of significant players in the country fueled the dominance of Asia Pacific in 2018. Owing to the rapid industrial growth in India and Vietnam, the region will experience surged PE wax demand over the forecast period.

Middle East and Africa is also projected to observe a significant gain in its revenue share on account of the prevailing oil & gas infrastructure and low product prices. North American market is anticipated to be driven by the considerable demand for shale gas and crude oil from the U.S. Europe is also expected to witness stable growth owing to the development of end-use industries like coating, printing inks, and adhesives coupled with stringent food regulations by the FDA and REACH.

The U.S. is a booming market space in terms of technological advancements and expanding end-user industries. HDP demand is expected to experience a steady development over the upcoming years due to the saturation product segment and will grow at a stagnant rate for plastic manufacturing. The oxidized product segment is expected to witness remarkable development due to increasing plastic and elastomer applications in this region.

Polyethylene Wax Market Segmentations:

By Product

By Technology

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Polyethylene Wax Market

5.1. COVID-19 Landscape: Polyethylene Wax Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Polyethylene Wax Market, By Product

8.1. Polyethylene Wax Market, by Product, 2023-2032

8.1.1 High Density Polymerized PE Wax

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Low Density Polymerized PE Wax

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Oxidized PE Wax

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Micronized PE Wax

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Polyethylene Wax Market, By Technology

9.1. Polyethylene Wax Market, by Technology, 2023-2032

9.1.1. Polymerization

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Modification

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Thermal Cracking

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Micronization

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Polyethylene Wax Market, By Application

10.1. Polyethylene Wax Market, by Application, 2023-2032

10.1.1. Candles

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Packaging

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Woods & Fire Logs

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Printing Inks

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Cosmetics

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Plastic Additives

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Lubricants

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Rubber

10.1.8.1. Market Revenue and Forecast (2020-2032)

10.1.9. Others

10.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Polyethylene Wax Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Baker Hughes

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BASF SE

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Clariant

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Honeywell International Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Mitsui Chemicals

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. SCG Chemicals Public Company Limited

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Zellag

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Marcus Oil & Chemicals Private Ltd

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Trecora Chemical

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Oxidized Polyethylene Innovations

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others