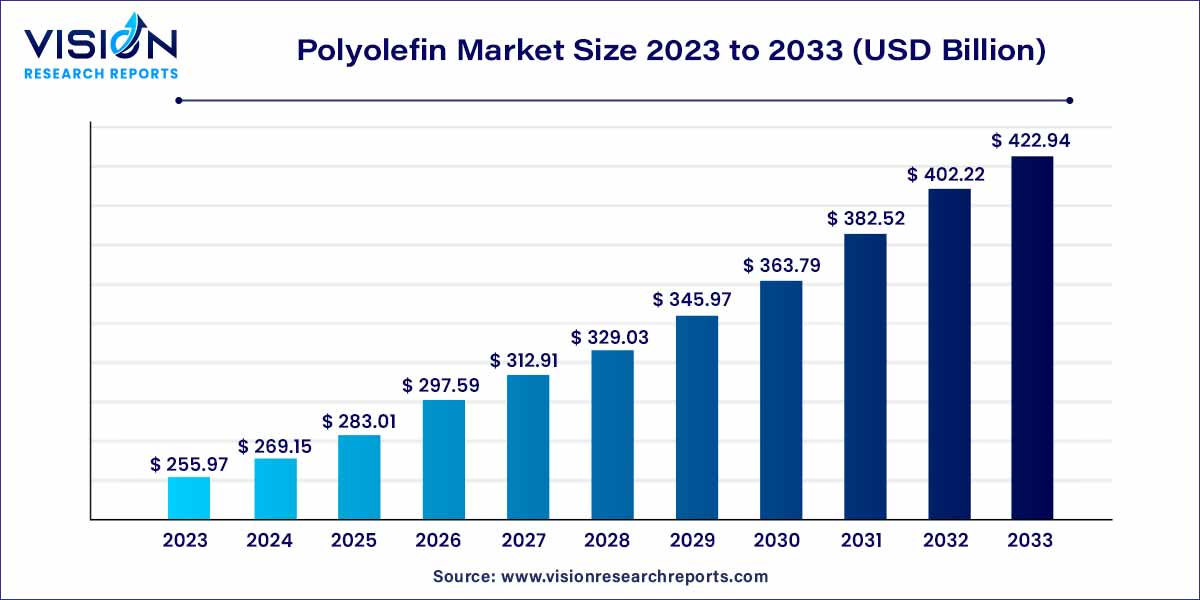

The global polyolefin market size was estimated at around USD 255.97 billion in 2023 and it is projected to hit around USD 422.94 billion by 2033, growing at a CAGR of 5.15% from 2024 to 2033. The polyolefin market is driven by the robust demand within the packaging industry, automotive sector utilization, sustainable practices and innovations, and global infrastructure development.

The polyolefin market stands as a cornerstone in the global polymer industry, showcasing its significance through the widespread use of thermoplastic polymers. Dominated by polyethylene (PE) and polypropylene (PP), polyolefins have become indispensable in various sectors due to their versatility, cost-effectiveness, and impressive chemical resistance.

The growth of the polyolefin market is propelled by several key factors contributing to its sustained expansion. First and foremost, the escalating demand in the packaging industry underscores the market's significance, as polyolefins, particularly polyethylene and polypropylene, prove instrumental in delivering efficient and sustainable packaging solutions. Furthermore, the expanding construction sector plays a pivotal role, with polyolefins finding extensive application in the production of pipes, cables, and insulation materials. The automotive industry also significantly contributes to the market's growth, as polyolefins are integral in the manufacturing of various automotive components. Technological advancements, such as innovations in production processes, particularly metallocene catalysis, enhance the performance of polyolefins, driving their adoption across diverse applications. Additionally, the industry's increasing focus on sustainability, marked by the development of bio-based polyolefins and robust recycling initiatives, aligns with global environmental concerns, further fostering market expansion.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 422.94 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.15% |

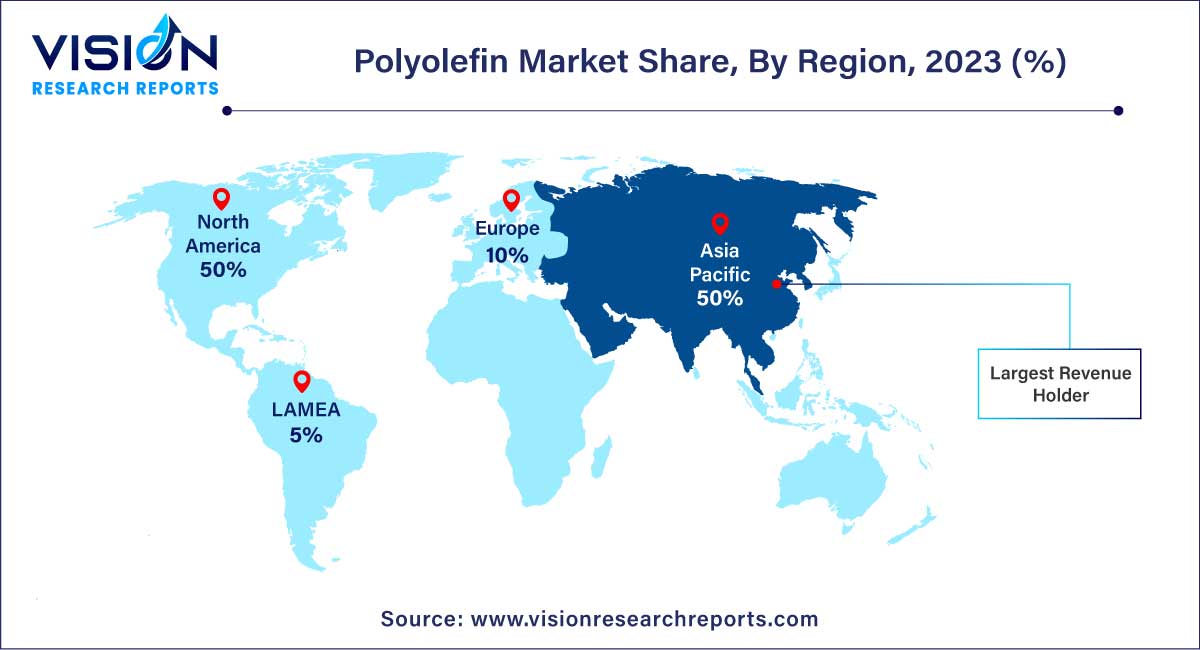

| Revenue Share of Asia Pacific in 2023 | 50% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Polyolefin Market Drivers

Polyolefin Market Restraints

Polyolefin Market Opportunities

The polyethylene (PE) segment dominated the polyolefin market with the revenue share of 39% in 2023. Notably, polyethylene has experienced substantial growth, driven by increased utilization in prototype development using 3D printers and CNC machines.

The Asia Pacific (APAC) region, propelled by heightened industrialization, witnessed China, India, and Japan emerge as key players in the polyethylene market. The expansion of the construction and furniture sectors, coupled with the presence of major automotive industries and a rising demand for advanced infrastructure, serves as crucial factors propelling the polyethylene industry in this region.

Following polyethylene, polypropylene secured a market revenue share surpassing 28.0%. Recognized for its ability to be easily manufactured into living hinges—thin plastics that can bend without breaking—polypropylene, while not commonly used in structural applications, finds extensive use in bottling certain edible products, as well as in items like liquid soaps and shampoos.

Ethylene vinyl acetate (EVA), characterized as a redispersible polymer in free-flowing powder form, shares similarities with low-density polyethylene. Notable for its heightened gloss, softness, and flexibility, EVA performs exceptionally well under low temperatures. Widely employed as a hot-melt adhesive, it finds diverse applications, ranging from soccer cleats to plastic wraps. Additionally, EVA extends its utility to biomedical engineering, serving as parts and components in drug delivery devices for various healthcare applications.

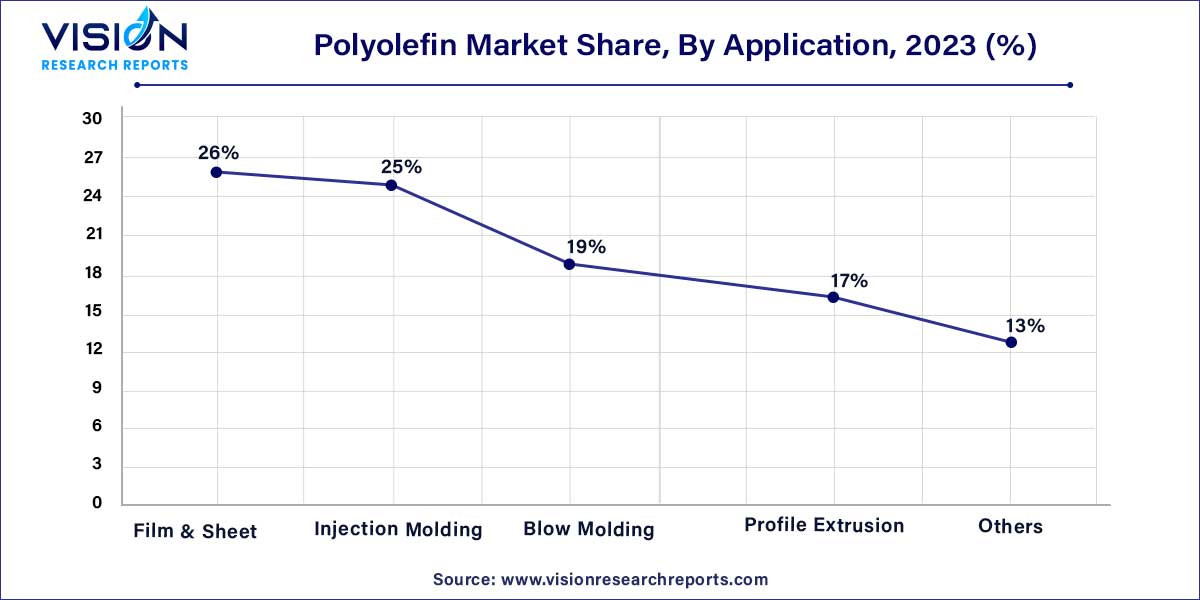

Film and sheet applications held the largest revenue share of 26% in 2023. Polyolefins are particularly valued for their ability to produce high-quality shrink films with enhanced clarity and appearance, making them integral to the consumer goods industry. Offering stronger puncture resistance, FDA approval, chlorine-free composition, and heightened durability, polyolefins, despite being relatively more expensive, are preferred for applications in the film and sheet sector.

The surge in demand for post-consumer recycled plastic resins, propelled by a growing emphasis on sustainability and efforts to reduce the carbon footprint, is noteworthy. Consumer electronics manufacturers, exemplified by companies like Lenovo, are increasingly adopting post-consumer recycled plastic resins in the production of notebooks, desktops, workstations, monitors, and other accessories. This trend is expected to persist and drive market growth over the forecast period.

Injection molding emerges as a vital process for crafting custom polyolefin materials. The method involves the use of molds, and as polyolefin parts are shaped within these molds, a cooling period is necessary before removal. Although the injection molding process is discontinuous, it remains a widely utilized technique, particularly in the production of automobile parts, medical devices, containers, and various other applications.

Asia Pacific dominated the market with the largest market share of 50% in 2023. The region's prominence can be attributed to its abundant pool of skilled labor available at a low cost and the accessibility of land. The strategic shift in production focus towards emerging economies, notably China and India, is anticipated to positively influence market growth throughout the forecast period. Asia Pacific stands as a major hub for rapidly expanding industries such as construction, automotive, and electronics, providing lucrative opportunities for polyolefin manufacturers.

While well-established regions like North America and Europe may experience slower growth, many countries within the Asia Pacific are poised for robust economic expansion in the forecast period. Government initiatives geared towards strengthening domestic manufacturing are expected to boost regional production, reducing dependence on imports and creating favorable prospects for both industrial manufacturers and polyolefin producers.

Sustained economic growth in China, propelled by ongoing infrastructural investments, is anticipated to benefit sectors such as automotive, aerospace, and construction. Reforms, including regulatory changes, policy adjustments, or structural enhancements, are expected to further bolster these industries. However, the outlook for long-term growth in the industrial sector appears less optimistic, potentially impacting the consumption of polyolefin over the forecast period.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Polyolefin Market

5.1. COVID-19 Landscape: Polyolefin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Polyolefin Market, By Product

8.1. Polyolefin Market, by Product, 2024-2033

8.1.1. Polyethylene (PE)

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Polypropylene (PP)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Ethylene-Vinyl Acetate (EVA)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Thermoplastic Polyolefins (TPO)

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Polyoxymethylene (POM)

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Polycarbonate (PC)

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Polymethyl Methacrylate (PMMA)

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Polyolefin Market, By Application

9.1. Polyolefin Market, by Application, 2024-2033

9.1.1. Film & Sheet

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Injection Molding

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Blow Molding

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Profile Extrusion

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Polyolefin Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. China Petrochemical Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. LyondellBasell Industries Holdings B.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. PetroChina Company Limited

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. TotalEnergies

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Chevron Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Repsol

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Dow, Inc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Exxon Mobil Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Braskem

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Borealis AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others