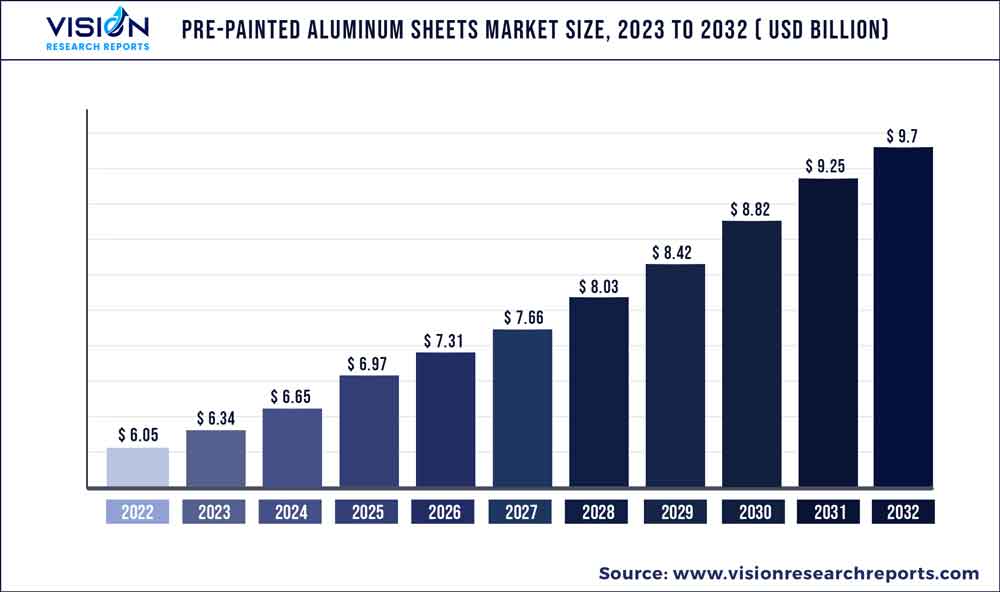

The global pre-painted aluminum sheets market size was estimated at around USD 6.05 billion in 2022 and it is projected to hit around USD 9.7 billion by 2032, growing at a CAGR of 4.83% from 2023 to 2032. The pre-painted aluminum sheets market in the United States was accounted for USD 916.8 billion in 2022.

Key Pointers

Report Scope of the Pre-painted Aluminum Sheets Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 51.05% |

| CAGR of Middle East and Africa from 2023 to 2032 | 4.16% |

| Revenue Forecast by 2032 | USD 9.7 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.83% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Alucosuper New Materials Co., Ltd.; Arconic, Cascadia Metals; Ertegan BV; ITALCOAT S.r.l.; Novelis; Richard Austin Alloys.; Stek Color Aluminium |

The market is projected to be driven by the growing investments in developing the construction sector, hotels & restaurants, along with rising requirements to support the dead wall and enhancement of building aesthetics.

Rising preference for an improved infrastructure with aluminum composite panels (ACPs), and façades have gained importance in recent years. Pre-painted aluminum sheets are widely used owing to their cost effectiveness, high-quality, mechanical properties, and broad applicability. Moreover, with the growing emphasis on decreasing carbon emissions and increasing anti-corrosion properties, strength, and aesthetics, consumption is set to increase in the coming years.

Based on thickness, the market is segmented into below 2.5 mm, 2.5 to 3.0 mm, and above 3.0 mm segments. The pre-painted aluminum sheets with under 2.5mm thickness have a low share and are used for producing ACPs in the construction and industrial sectors. Aluminum has excellent resistance against weather conditions and can withstand extreme hot and cold conditions, which is driving the segment’s growth.

The market growth witnesses restrictions due to certain reasons. One of the factors is geopolitical conflicts like the Russia-Ukraine war. The war has impacted aluminum production and has caused global inflation on account of supply disruptions. This further caused the energy prices to surge. These factors have impacted the construction activities and raw material prices and affected the demand for pre-painted aluminum sheets.

The growth is however expected to be in line in the coming years, which is compelling companies to adopt strategies to expand their presence and capacity. The key players are focusing on R&D to strengthen innovations, technologies, and brand recognition to meet the new demand. For instance, in March 2023, Gulf Aluminium Rolling Mill (GARMCO), announced its plans to invest USD 24.5 million to expand its business into the new aluminum coil line. The company aims to build a technically advanced production line with reduced carbon footprints and increased productivity.

Thickness Insights

Based on thickness, the 2.5mm - 3.0mm segment held the largest revenue share of more than 79.07% in 2022. The thickness of sheets between 2.5 mm to 3.0 mm makes it an excellent option for bending and surface coating purposes. The high corrosion resistance and strength help drive the demand for 2.5 mm-3.0 mm thick pre-painted aluminum sheets.

In the construction industry, the product is mainly used for exterior and interior wall paneling with ACPs and façades. The rising demand for ACPs has compelled key players to take strategic initiatives to manufacture eco-friendly aluminum sheets and provide a sustainable option in a competitive market.

The under 2.5mm thickness segment is anticipated to register a growth rate of 4.13%, in terms of revenue, across the forecast period. The demand is attributed to the rising demand for thinly coated aluminum sheets and coils that find application in the construction & automotive industries where properties such as high strength, corrosion resistance, and ductility are required with lightweight.

Application Insights

Based on application, the aluminum composite panels accounted for a revenue share of over 58.06% in 2022. ACPs are frequently used for façades, signs, and architectural cladding. They are also employed in interior design projects that involve decorative signage, ceiling panels, and wall partitions. Compared to its counterparts, such as timber and tiles, the ACP offers more features. The demand for its applications surged owing to its low cost, high quality, and lightweight properties.

Façade is another vital application of the market, that is expected to grow at a CAGR of 4.94%, in terms of revenue, over the forecast period. Pre-painted aluminum sheets are used for interior and exterior cladding façades. These are used in the development of structures where the performance, decoration, and safety parameters are of the highest priority. One of the most important advantages of aluminum is its high strength-to-weight ratio. Hence, aluminum sheet façades are used in skyscrapers as they can bear the weight of heavy glass spans.

Durability is another key advantage offered by these façades over others. These are renowned for their high corrosion resistance. They are also resistant to weathering and hold up well in both humid and dry regions. In addition, these remain brittle-free in cold temperatures.Thus, their usage in construction applications results in significant cost savings.

Regional Insights

Asia Pacific dominated and accounted for over 51.05% share of global revenue in 2022. Increasing manufacturing activities and surging foreign investments are the key drivers fueling the growth of the market in Asia Pacific. The flourishing end-use industries such as automotive, aerospace, and building & construction in the region are also anticipated to contribute to the increased consumption of pre-painted aluminum sheets in the Asia Pacific from 2023 to 2032.

Growing investments in public infrastructures and construction projects are anticipated to drive the demand for the market in North America. For instance, in April 2022, the Government of Canada allocated USD 4 billion in its 2022 budget to launch the “Housing Accelerator Fund” for building 100,000 affordable homes over the next five years. Pre-painted Aluminum sheets are extensively used in various construction-related applications such as façades, doors, partitions, and windows.

Middle East and Africa are expected to register a growth rate of 4.16%, in terms of revenue, over the forecast period. Countries in the region are developing at a fast pace owing to the ongoing rapid industrialization and urbanization in the region. For instance, in March 2021, the UAE invested USD 81.68 billion for the expansion of its manufacturing industry as a part of its economic diversification plan into non-oil sectors. These factors are accelerating investment in resorts, hotels, artificial islands, and luxury residential projects, thereby leading to the growth of the market.

Pre-painted Aluminum Sheets Market Segmentations:

By Thickness

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pre-painted Aluminum Sheets Market

5.1. COVID-19 Landscape: Pre-painted Aluminum Sheets Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pre-painted Aluminum Sheets Market, By Thickness

8.1. Pre-painted Aluminum Sheets Market, by Thickness, 2023-2032

8.1.1. Under 2.5mm

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 2.5mm - 3.0mm

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Pre-painted Aluminum Sheets Market, By Application

9.1. Pre-painted Aluminum Sheets Market, by Application, 2023-2032

9.1.1. Aluminum Composite Panels

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Signages & Boards

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Facades

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Vehicle Parts

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Pre-painted Aluminum Sheets Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Thickness (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Alucosuper New Materials Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Arconic, Cascadia Metals

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Ertegan BV

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. ITALCOAT S.r.l.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Novelis

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Richard Austin Alloys.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Stek Color Aluminium

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others