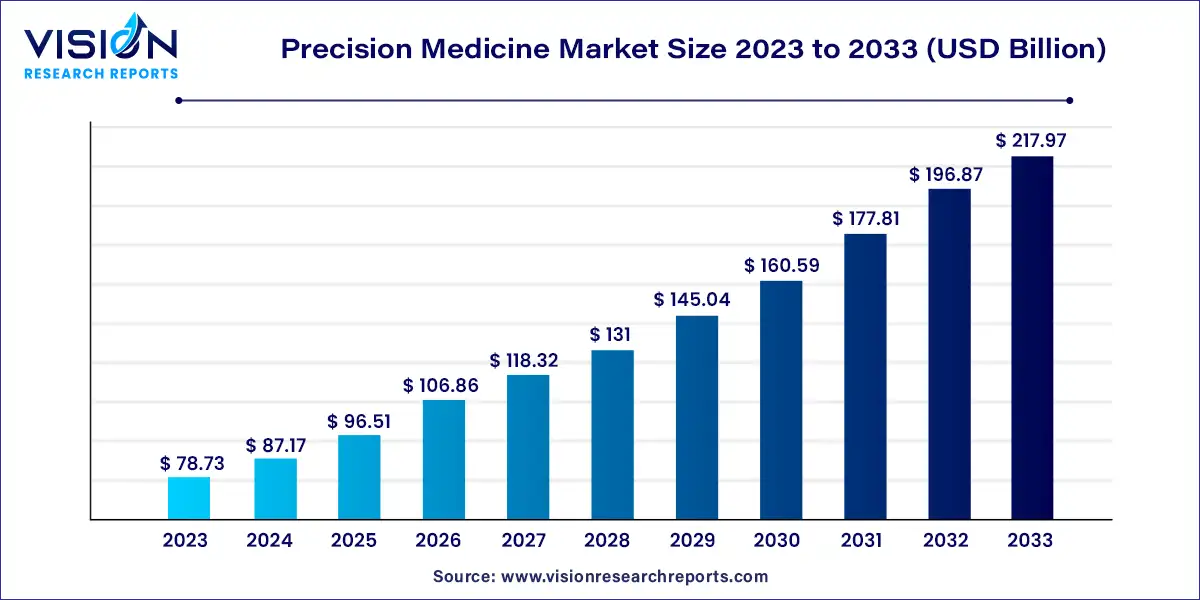

The global precision medicine market size was estimated at around USD 78.73 billion in 2023 and it is projected to hit around USD 217.97 billion by 2033, growing at a CAGR of 10.72% from 2024 to 2033.

Precision medicine represents a transformative approach in healthcare, offering tailored medical treatments based on individual variability in genes, environment, and lifestyle. In recent years, the precision medicine market has witnessed significant growth, fueled by advancements in genomics, bioinformatics, and targeted therapies. This article provides a comprehensive overview of the precision medicine market, highlighting key trends, drivers, challenges, and opportunities shaping its trajectory.

The growth of the precision medicine market is driven by an advancement in genomics, increasing adoption of personalized therapies, and the emphasis on biomarker discovery. Technological breakthroughs, such as next-generation sequencing and gene editing tools, have accelerated the understanding of genetic mechanisms underlying diseases, driving the development of targeted treatments. Moreover, the shift towards personalized therapies tailored to individuals' genetic profiles has led to greater efficacy and reduced adverse effects, contributing to market expansion. Additionally, the identification and validation of biomarkers enable precise patient stratification, facilitating the development of companion diagnostics and enhancing the efficiency of clinical trials.

Advancements in Genomic Technologies:

Rise of Personalized Therapies:

Focus on Biomarker Discovery:

Integration of Big Data and AI:

Expansion of Precision Diagnostics:

Data Integration and Privacy Concerns:

Regulatory and Reimbursement Hurdles:

Cost and Affordability Issues:

The precision medicine market comprises two primary categories: therapeutics and diagnostics. Within therapeutics, there are pharmaceuticals and medical devices, while diagnostics encompass genetic tests, direct-to-consumer tests, esoteric tests, and other specialized assessments.

Oncology dominated the pharmaceutical sector's revenue share in 2023, driven by the rising incidence of cancer and the expanding pipeline of drug candidates in clinical trials. Notably, the National Institutes of Health (NIH) is poised to invest around USD 70 billion in precision oncology, stimulating further market growth. Moreover, respiratory and genetic diseases segments are expected to experience substantial growth. In October 2023, GE Healthcare introduced an all-digital PET-CT system, enabling 35 patient scans in 9.5 hours and reducing medication doses by 40%, showcasing its efficacy in delivering precision medicines.

Within diagnostics, genetic tests are witnessing the fastest growth rate over the forecast period. The demand for novel tools and techniques, such as biomarkers and companion diagnostics, is anticipated to rise alongside the expansion of precision diagnostics and therapeutics, facilitating more effective patient treatment.

Market growth drivers include the increasing prevalence of rare diseases, neurological disorders, and cancers, alongside the growing demand for precision drug therapies. Pressure to mitigate healthcare expenditure and the aging population further bolster market expansion. Additionally, heightened strategic collaborations leading to increased clinical trial activities, coupled with government support and initiatives for advancing treatment options, are anticipated to propel market growth in the forthcoming years.

The precision medicine market is categorized by end use into home care, hospitals, and clinical laboratories. Currently, clinical laboratories and hospitals collectively hold a significant share of 46% in precision diagnostics and medicines. However, the home care segment is poised to witness the highest growth, with a projected CAGR of 11.83% during the forecast period.

Increasing acceptance and favorable outcomes of precision therapies in treating various diseases among patients have contributed to market growth. Moreover, the market is expected to benefit from the expansion of personal healthcare equipment and devices, along with the integration of smart technologies into diverse healthcare systems.

Nevertheless, the market faces challenges due to the high costs associated with precision diagnostic tests and medicines. Additionally, concerns about potential device or software failures and the security of patient data pose significant constraints to market expansion. To address these issues, stringent government regulations and standards are being developed and implemented to ensure compliance and safeguard patient privacy.

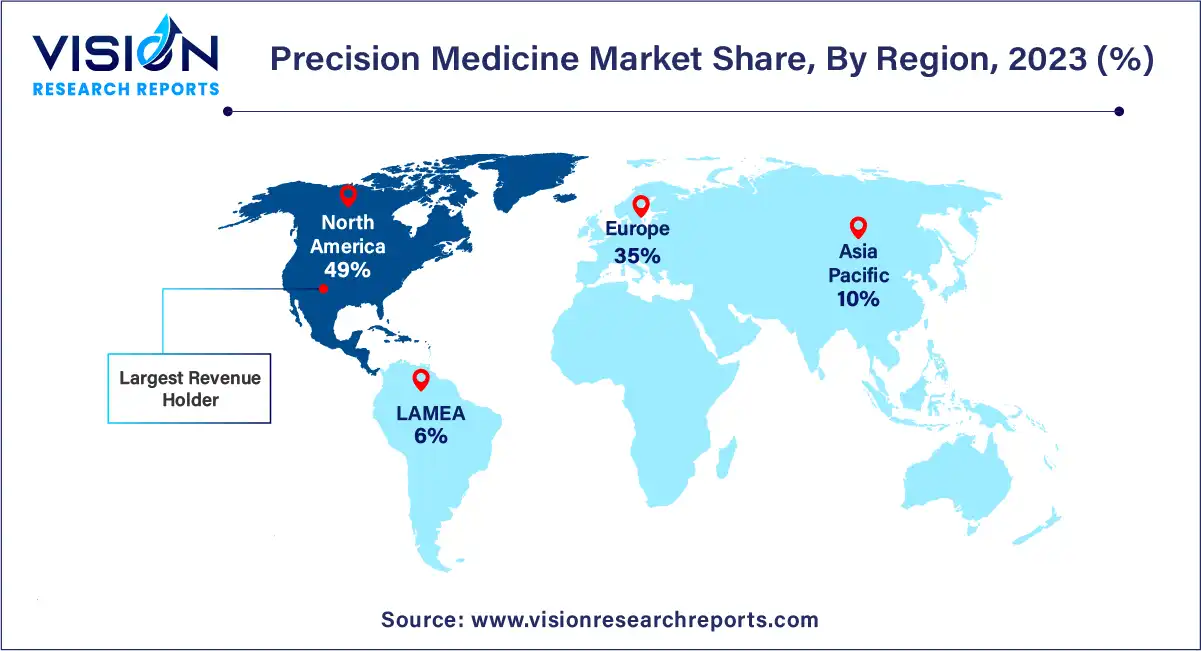

In 2023, North America held the largest share of the global market at 49%, primarily attributed to the presence of numerous leading pharmaceutical and biotech companies, along with a well-established healthcare infrastructure. Government support and higher investments in research and development further bolster these regional markets. Notably, in 2015, the U.S. government launched the Precision Medicine Initiative to advance research and development in this domain.

The precision medicine therapeutics market in Asia Pacific is poised for robust growth, with a projected CAGR of 11.85%. This growth is driven by increasing awareness among the population regarding the importance of precision medicine in treating various diseases, as well as rising income and healthcare expenditure. Government initiatives aimed at enhancing infrastructure and patient care also contribute to market expansion. For instance, inspired by the U.S. initiative, the Chinese government launched the Precision Medicine Initiative in 2016, a 15-year project focused on developing innovative treatment approaches. Additionally, in September 2023, Siemens Healthineers introduced the ARTIS icono angiography system in India, enabling higher-quality patient treatment and expanding the scope of precision medicine in advanced therapy.

By Application

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others