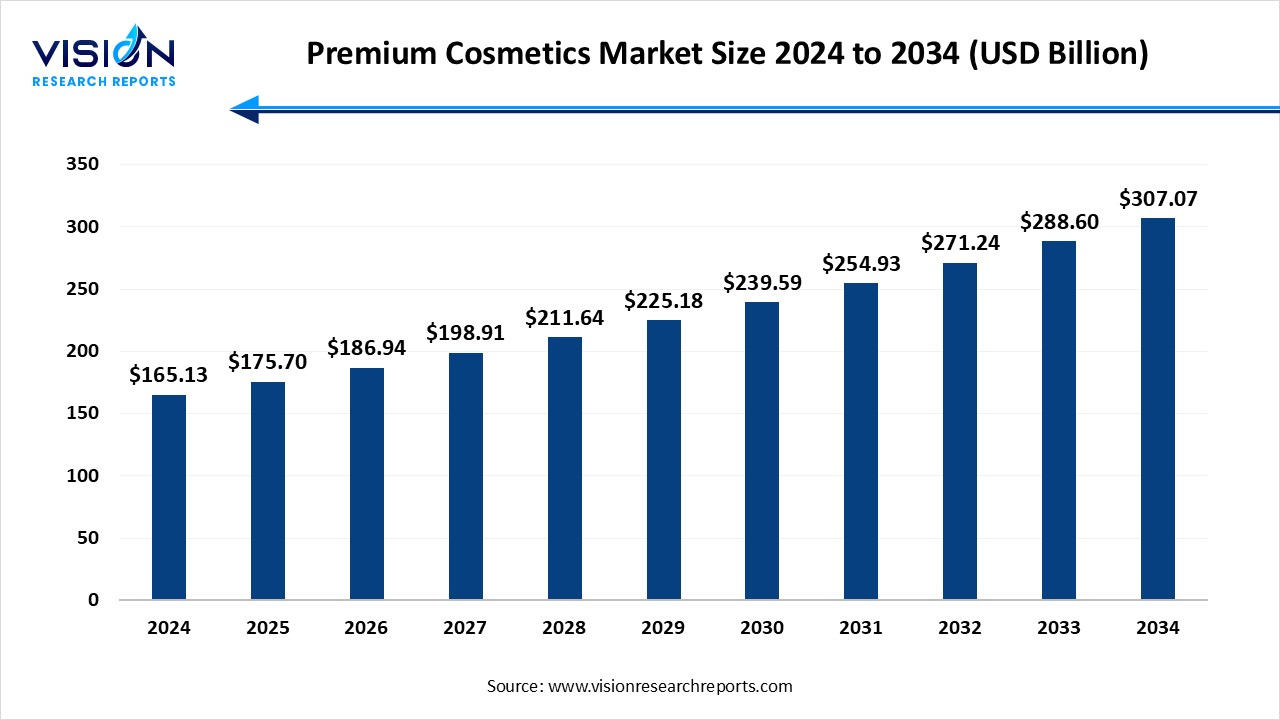

The global premium cosmetics market size was estimated at around USD 165.13 billion in 2024 and it is projected to hit around USD 307.07 billion by 2034, growing at a CAGR of 6.40% from 2025 to 2034.

The global premium cosmetics market is a dynamic and rapidly expanding sector of the beauty industry, characterized by high-quality products, exclusive formulations, and prestigious branding. Driven by increasing consumer demand for luxury skincare, makeup, fragrances, and personal care products, the market is fueled by factors such as rising disposable incomes, growing awareness of skincare benefits, and the influence of social media and celebrity endorsements. Key players in this market continually innovate with natural, organic, and sustainable product lines, catering to a discerning customer base that values quality, efficacy, and brand reputation.

The growth of the premium cosmetics market is primarily driven by increasing consumer demand for high-quality, innovative, and personalized beauty products. As disposable incomes rise, especially in emerging economies, consumers are willing to invest in luxury skincare, makeup, and fragrances that promise superior results and unique experiences. The influence of social media, beauty influencers, and celebrity endorsements has further fueled consumer interest, creating a desire for premium brands that are associated with status, sophistication, and self-expression.

Another critical growth factor is the rapid expansion of e-commerce and digital marketing, which has transformed how premium cosmetics are marketed and distributed. Luxury brands are leveraging digital platforms to reach a global audience, offering personalized online shopping experiences, virtual try-ons, and direct-to-consumer (DTC) sales. Strategic collaborations with beauty influencers and the adoption of omnichannel retail strategies have enabled brands to engage consumers effectively.

Asia Pacific held the largest revenue share, representing 40% in 2024. E-commerce and social media platforms are pivotal in driving sales, with beauty influencers and live-streaming sessions playing a significant role in product promotion. Premium cosmetics brands in this region are also embracing local ingredients and traditional beauty rituals, creating a unique blend of luxury and cultural relevance.

North America stands as a leading market, driven by high consumer spending, widespread awareness of premium skincare and makeup products, and a strong presence of established luxury beauty brands. The United States, in particular, is a major contributor, where consumers prioritize high-quality, science-backed formulations and clean beauty options. The region's robust e-commerce infrastructure further enhances market growth, allowing premium brands to reach a vast audience through online platforms and digital marketing.

Skin care products led the market, capturing a revenue share of 42% in 2024. Premium skincare products, including serums, moisturizers, face masks, and cleansers, are formulated with high-quality, clinically tested ingredients that promise visible results. These products are often enriched with advanced active compounds, such as peptides, hyaluronic acid, retinol, and plant-based extracts, offering targeted benefits for various skin concerns.

Color cosmetics made a significant contribution to the market revenue in 2024. This segment encompasses a wide range of products, including foundations, lipsticks, eyeshadows, mascaras, and blushes, all of which are formulated using superior pigments, innovative textures, and skin-friendly ingredients. Premium color cosmetics brands are constantly innovating with long-lasting, smudge-proof, and multi-functional formulations that enhance convenience for users.

Women end-users led the premium cosmetics market, accounting for 80% of the revenue share in 2024. As the primary consumers of skincare, makeup, fragrances, and haircare products, women’s preferences and purchasing behaviors are pivotal to market growth. The increasing focus on self-care, wellness, and anti-aging solutions has led to a surge in demand for high-quality skincare products that promise visible results. Premium brands cater to women with diverse product ranges, including age-specific formulations, clean beauty options, and personalized skincare solutions.

Despite a clear inclination towards premium cosmetics, the market also faces evolving consumer expectations driven by growing awareness of sustainability, ingredient transparency, and ethical practices. Women are becoming more discerning, preferring brands that align with their values, such as cruelty-free testing, eco-friendly packaging, and the use of natural ingredients. This shift has prompted premium cosmetics brands to innovate with clean beauty formulations and responsible sourcing practices.

Supermarkets and hypermarkets led the market, capturing a revenue share of 36% in 2024. These large retail outlets provide a diverse selection of premium skincare, makeup, fragrances, and personal care products from renowned brands, allowing consumers to explore, test, and compare options before making a purchase. Strategic product placement, attractive in-store displays, and exclusive promotional offers further enhance the shopping experience, making premium cosmetics more accessible to a broad consumer base.

The rise of online channels and e-commerce has revolutionized the premium cosmetics market, offering unparalleled convenience and accessibility for consumers. Premium beauty brands have rapidly adopted digital platforms, creating sophisticated websites and collaborating with e-commerce giants to reach a global audience. Online channels enable consumers to explore an extensive range of premium products, read reviews, access expert recommendations, and benefit from personalized skincare consultations through virtual tools.

By Product

By End Use

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Premium Cosmetics Market

5.1. COVID-19 Landscape: Premium Cosmetics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Premium Cosmetics Market, By Product

8.1. Premium Cosmetics Market, by Product

8.1.1 Skin Care

8.1.1.1. Market Revenue and Forecast

8.1.2. Hair Care

8.1.2.1. Market Revenue and Forecast

8.1.3. Color Cosmetics

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Premium Cosmetics Market, By End Use

9.1. Premium Cosmetics Market, by End Use

9.1.1. Men

9.1.1.1. Market Revenue and Forecast

9.1.2. Women

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Premium Cosmetics Market, By Distribution Channel

10.1. Premium Cosmetics Market, by Distribution Channel

10.1.1. Supermarkets & Hypermarkets

10.1.1.1. Market Revenue and Forecast

10.1.2. Specialty Beauty Stores

10.1.2.1. Market Revenue and Forecast

10.1.3. Pharmacies and Drugstores

10.1.3.1. Market Revenue and Forecast

10.1.4. Online/E-commerce

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Premium Cosmetics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by End Use

11.1.3. Market Revenue and Forecast, by Distribution Channel

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by End Use

11.1.4.3. Market Revenue and Forecast, by Distribution Channel

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by End Use

11.1.5.3. Market Revenue and Forecast, by Distribution Channel

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by End Use

11.2.3. Market Revenue and Forecast, by Distribution Channel

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by End Use

11.2.4.3. Market Revenue and Forecast, by Distribution Channel

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by End Use

11.2.5.3. Market Revenue and Forecast, by Distribution Channel

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by End Use

11.2.6.3. Market Revenue and Forecast, by Distribution Channel

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by End Use

11.2.7.3. Market Revenue and Forecast, by Distribution Channel

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by End Use

11.3.3. Market Revenue and Forecast, by Distribution Channel

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by End Use

11.3.4.3. Market Revenue and Forecast, by Distribution Channel

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by End Use

11.3.5.3. Market Revenue and Forecast, by Distribution Channel

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by End Use

11.3.6.3. Market Revenue and Forecast, by Distribution Channel

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by End Use

11.3.7.3. Market Revenue and Forecast, by Distribution Channel

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by End Use

11.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by End Use

11.4.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by End Use

11.4.5.3. Market Revenue and Forecast, by Distribution Channel

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by End Use

11.4.6.3. Market Revenue and Forecast, by Distribution Channel

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by End Use

11.4.7.3. Market Revenue and Forecast, by Distribution Channel

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by End Use

11.5.3. Market Revenue and Forecast, by Distribution Channel

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by End Use

11.5.4.3. Market Revenue and Forecast, by Distribution Channel

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by End Use

11.5.5.3. Market Revenue and Forecast, by Distribution Channel

Chapter 12. Company Profiles

12.1. L'Oréal Group.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Estée Lauder Companies.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Chanel.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Shiseido Company, Limited.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Coty Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Amorepacific Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Elizabeth Arden, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others