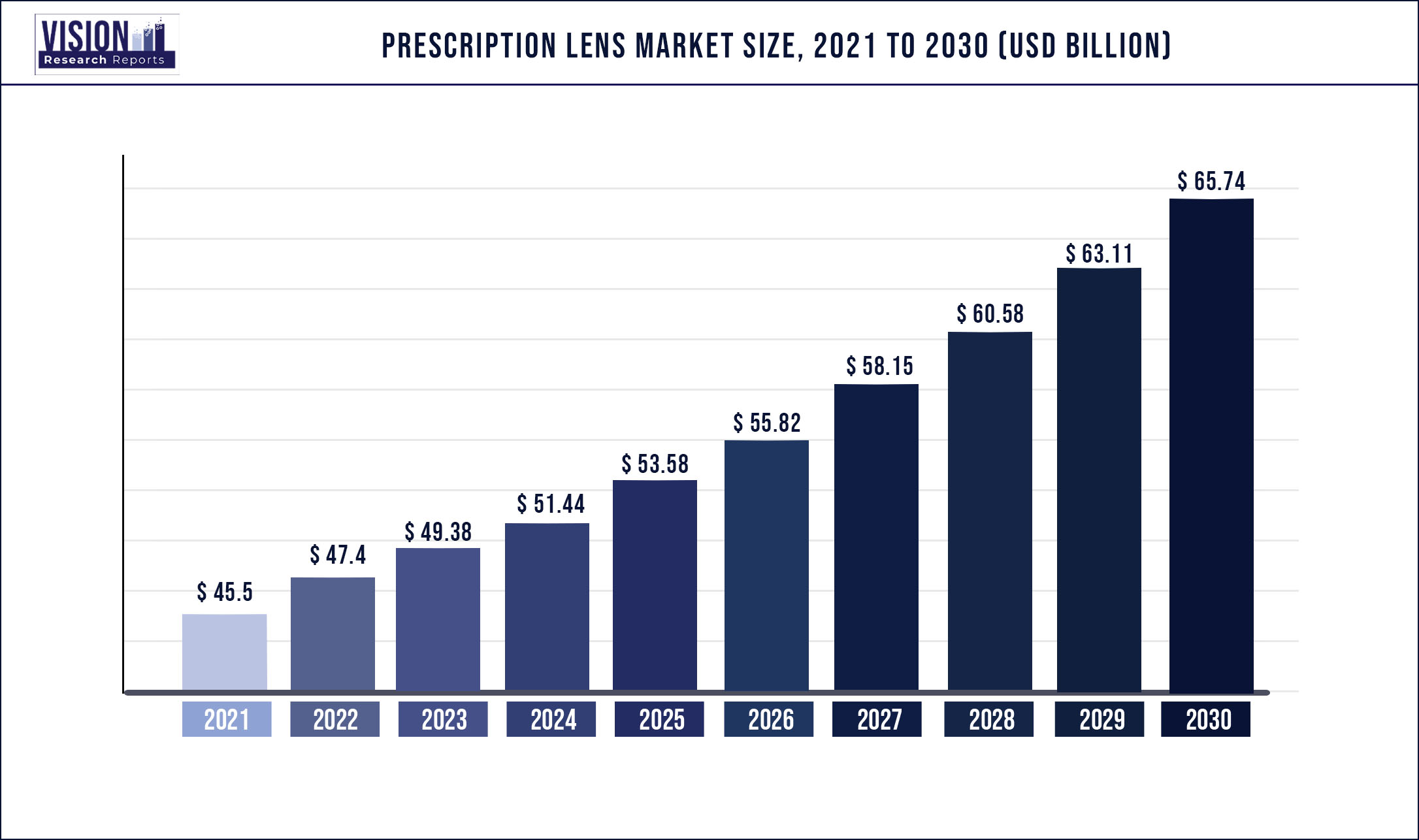

The global prescription lens market was estimated at USD 45.5 billion in 2021 and it is expected to surpass around USD 65.74 billion by 2030, poised to grow at a CAGR of 4.17% from 2022 to 2030

Report Highlights

Uncorrected refractive error cases are majorly contributing to the rapidly growing cases of visual impairment. Therefore, various organizations are focusing on increasing awareness regarding the conditions related to refractive errors and their corrective options. These organizations are also incorporating services to treat refractive errors. Initiatives taken to enhance vision care, identify cases at an early stage, and provide efficient lenses for treating different vision problems are expected to boost the market growth.

Myopia and astigmatism are the two refractive errors with the highest prevalence. Therefore, to provide better treatment for these refractive errors, market players are coming up with different types of prescription lenses with advanced coating options. Furthermore, to increase the reach of these advanced prescription lenses, companies are being developed to enhance the accessibility of vision tests through online platforms. These online vision tests will enhance the early diagnosis of refractive errors and hence are expected to impact the adoption of prescription lenses.

Prescription lenses are available with various coating options to provide patients with enhanced vision in a different environment. Anti-reflective coating prescription lenses are widely preferred due to their advantage of eliminating reflection and reducing contrast. UV coating prescription lenses are witnessing growth mainly due to their growing demand to avoid penetration of harmful UV radiations. These UV radiations later can result in various eye-related disorders, thus increasing the demand for UV-coated prescription lenses.

Market players are focusing on forming alliances to expand the reach of their products. For instance, in April 2022, Carl Zeiss launched the ZEISS Supreme Prime 15, which is a wide-angle lens added to the successful family of supreme prime lenses. Similarly, non-profit organizations are initiating programs focusing on resolving visual impairment due to refractive errors.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 45.5 billion |

| Revenue Forecast by 2030 | USD 65.74 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.17% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, coating, Region |

| Companies Covered | Essilor; ZEISS International; HOYA VISION CARE COMPANY; VISION EASE; SEIKO OPTICAL PRODUCTS; PRIVÉ REVAUX; Vision Rx Lab |

Type Insights

Single vision prescription lenses led the market and accounted for over 25.04% share of the global revenue in 2021. Market players focus on developing single-vision prescription lenses for correcting refractive errors. People aged above 40 years mainly prefer single vision prescription lenses over bifocal, trifocal, and progressive lenses.

Single vision prescription lenses are preferred as an effective option for reading and computer work as they help in maintaining the posture during work, thus avoiding the chance of developing computer vision syndrome. Additionally, single vision lenses help in enhancing peripheral vision, which can be a problem with bifocal, trifocal, and progressive lenses. However, the development of advanced and efficient progressive lenses with a wider field of view and better clarity can impact the segment growth during the forecast period.

Progressive lenses are expected to grow at the fastest rate during the forecast period. Progressive lenses are also termed no-line bifocal lenses due to the absence of a visible bifocal line. Its youthful appearance and effective functionality make it one of the most preferred prescription lenses. Additionally, people with myopia, hyperopia, astigmatism, and/or presbyopia opt for progressive lenses. Furthermore, progressive lenses provide enhanced image quality as it eliminates the image jump observed with bifocals and trifocals lenses.

Workspace progressive lenses are expected to witness significant growth during the forecast period. The working population is growing tremendously, and its long exposure to various devices such as computers, tablets, laptops, and other electronic devices may strain the eyes and hence may lead to some sort of vision problems. Thus, to avoid such vision problems and make work more efficient and comfortable, market players have come up with workspace progressives. These workspace progressives offer a large field of vision from near to an intermediate distance. ZEISS provides four versions of workspace progressive or office progressive lenses, which are near office lens, room office lens, NEW - book office lens, and the individual office lens. Therefore, awareness regarding the usage of office progressive lenses to avoid refractive errors is expected to drive the adoption of these lenses.

Application Insights

Myopia held the largest revenue share of over 30.22% in 2021 and is expected to grow at a significant rate during the forecast period. The global prevalence of myopia is high and it is expected to grow during the forecast period. As per a WHO study, the prevalence of myopia in 2020 was 33% globally, which is expected to grow to 52% by 2050. The highest prevalence of the disease is observed in East Asia under which China, the Republic of Korea, Japan, and Singapore held around 50% of the regional share. Institutes are being developed to control the rise of myopia by increasing awareness regarding its preventive measures.

The rising prevalence of myopia is projected to fuel market growth over the forecast period. For instance, according to the Investigative Ophthalmology and Visual Science journal, around 1.9 billion people were suffering from myopia and about 70 million had severe myopia in 2019 across the globe. Hence, rising cases of myopia are expected to surge the demand for prescription lenses.

Presbyopia is expected to grow at the fastest rate during the forecast period. Presbyopia develops with an increase in age and blurs the vision. The growing aging population is one of the major factors fueling the growth of this segment. Companies such as Essilor and ZEISS are developing advanced prescription lenses for treating presbyopia. Essilor has come up with VARILUX progressive lens by incorporating various advanced features and technologies such as SynchronEyes, Wavefront Advanced Vision Enhancement, 4D Technology, and Nanoptix for treating refractive errors such as presbyopia.

Hyperopia is expected to grow at a significant rate during the forecast period. Hyperopia is mainly prevalent among young children. As per an article published by EyeWiki, in 2015, around 14 million people in the U.S. suffered from hyperopia. Early detection and treatment of hyperopia are important as moderate and high degrees of this disorder may lead to other visual impairment disorders. Hence, market players are developing prescription lenses for treating hyperopia. Convex lenses are among the most preferred solutions for restoring vision problems. Furthermore, convex lenses with anti-reflective coating are among the best set of prescription lenses to be used by a person having hyperopia.

Coating Insights

Anti-reflective (AR) coating held the largest revenue share of over 30.11% in 2021 owing to the growing demand for anti-reflective prescription lenses. Anti-reflective coating lenses are mainly preferred due to various advantages associated with them such as protection from harmful rays from electronic display screens. AR coating helps in eliminating the reflections, reduces contrast, and enhances clarity. Thus, AR coating lenses are largely preferred during nighttime. In addition, these lenses are nearly invisible, which helps in avoiding any distractions through lenses. ZEISS has come up with DuraVision Premium lens coatings, which incorporate ion technology and many advanced features, which makes the lens surface tougher and resistant to damage and light reflections.

The Ultraviolet (UV) treatment lens is expected to grow at the fastest rate during the forecast period. Exposure to UV radiation has led to various eye disorders such as cataracts and macular degeneration. Therefore, people prefer UV-coated lenses to avoid visual impairment disorders. Polycarbonate and the high-index plastics used for making these UV treatment lenses absorb the radiation and protect the eye from harmful radiations. Some UV lenses come along with photochromic treatment. This darkens the lenses when exposed to UV radiations and high-energy visible (HEV) light rays and becomes clearer when indoors. Market players are focusing on developing UV protection prescription lenses for enhanced vision. Essilor’s Crizal range of products comes with UV protection coating to enhance single vision and progressive lens. The company has developed Eye-Sun Protection Factor (E-SPF) for certifying UV protection to the eye and skin surrounding it.

Scratch-resistant coating is expected to grow at a significant rate during the forecast period owing to the growing demand for clear and scratch-free lenses. The materials or plastic used for making advanced prescription lenses are prone to scratches. Hence, these lenses require coatings, which can protect these lenses from scratches. Scratch-resistant coated prescription glasses provide clearer vision for a long duration and thus have a prolonged lifespan. People with an active lifestyle such as sports or are engaged in various outdoor activities largely prefer prescription lenses with this coating.

Regional Insights

Asia Pacific held the largest revenue share of over 25.08% in 2021 and is expected to grow at the fastest rate during the forecast period. Countries such as China, Japan, Singapore, and the Republic of Korea account for a 50% share of myopia prevalence worldwide. The growing prevalence of refractive errors in the region is increasing the number of patients, and hence is creating demand for prescription lenses for its treatment. Market players located in the region are undergoing strategic alliances to expand their prescription lens business. In October 2021, Hoya announced a partnership with Orbis International, which is a global organization that provides mentorship and training and inspires local eye care professionals to save sight in their communities.

North America held the second-largest revenue share in 2021 owing to the increasing prevalence of myopia and presbyopia in countries such as the U.S. and Canada. Furthermore, major market players are present in the region and are launching prescription lenses with advanced features. In October 2018, Privé Revaux launched prescription lenses at an affordable cost. The company has also expanded its reach to the patient pool by providing online vision tests through its partnership with Opternative, a technology company. The adoption of advanced technology and products is high in the region, thus contributing to the overall market growth.

Europe is expected to grow at a considerable rate during the forecast period. The presence of organizations and societies for preventing visual impairment is expected to drive the market in Europe. The International Agency for the Prevention of Blindness (IAPB) along with the WHO has initiated a joint program- VISION 2020: The Right to Sight, for eliminating blindness by focusing on the diseases, which mainly cause vision impairment such as refractive errors. Therefore, growing awareness in the region and the adoption of treatment options such as prescription lenses for refractive errors are expected to propel the market growth in Europe.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Prescription Lens Market

5.1. COVID-19 Landscape: Prescription Lens Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Prescription Lens Market, By Type

8.1. Prescription Lens Market, by Type, 2022-2030

8.1.1 Single Vision

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Bifocal

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Trifocal

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Progressive

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Workspace Progressives

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Prescription Lens Market, By Application

9.1. Prescription Lens Market, by Application, 2022-2030

9.1.1. Myopia

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Hyperopia/Hypermetropia

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Astigmatism

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Presbyopia

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

Chapter 10. Global Prescription Lens Market, By Coating

10.1. Prescription Lens Market, by Coating, 2022-2030

10.1.1. Anti-reflective

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Scratch Resistant Coating

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Anti-fog Coating

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Ultraviolet Treatment

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Prescription Lens Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by Coating (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Coating (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Coating (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by Coating (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Coating (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Coating (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Coating (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Coating (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by Coating (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Coating (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Coating (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Coating (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Coating (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by Coating (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Coating (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Coating (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Coating (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Coating (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by Coating (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Coating (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Coating (2017-2030)

Chapter 12. Company Profiles

12.1. Essilor

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. ZEISS International

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. HOYA VISION CARE COMPANY

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. VISION EASE

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. SEIKO OPTICAL PRODUCTS CO., LTD.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PRIVÉ REVAUX

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Vision Rx Lab

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others