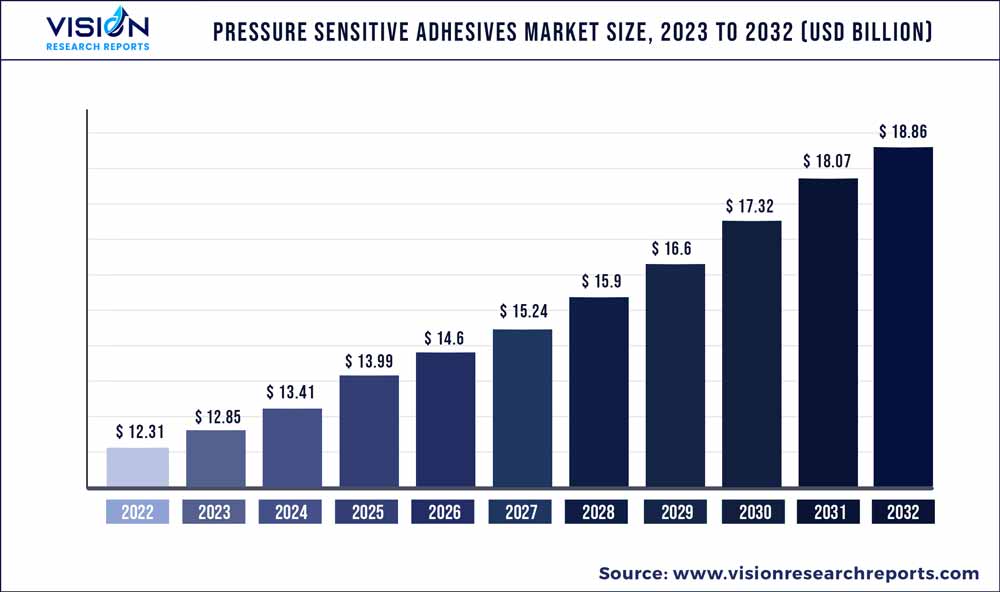

The global pressure sensitive adhesives market was estimated at USD 12.31 billion in 2022 and it is expected to surpass around USD 18.86 billion by 2032, poised to grow at a CAGR of 4.36% from 2023 to 2032.

Key Pointers

Report Scope of the Pressure Sensitive Adhesives Market

| Report Coverage | Details |

| Market Size in 2022 | USD 12.31 billion |

| Revenue Forecast by 2032 | USD 18.86 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.36% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Henkel AG & Co. KGaA; 3M Company; H.B. Fuller; Sika AG; Ashland Inc.; Bostik S.A.; Pidilite Industries Ltd.; Jubilant Industries Ltd.; AkzoNobel N.V.; Franklin Adhesives & Polymers.; DowDuPont Inc. |

Rising demand from packaging industry is predicted to drive the Pressure Sensitive Adhesive (PSA) market growth. Water-based PSAs, also known as emulsion PSA, led the market in 2022. The environmentally friendly nature of these PSAs coupled with compliance with government regulatory bodies, such as Environmental Protection Agency (EPA), is the crucial factor supporting the segment growth.

Radiation cured PSAs are estimated to witness the fastest CAGR over the forecast period. They are typically based on acrylic formulations and provide an ideal solution combining balanced performance, good weather resistance, and advantageous processing. New product launches along with extensive R&D in radiation cured technology are expected to propel the segment growth over the forecast period. Packaging industry, especially food packaging, is one of the most significant end-use industries. PSA labels and tapes help maintain the brand image of the packaged product and are compatible with numerous substrates and coatings.

They offer significant advantages, such as instant bonding and user-friendly application. In the automotive industry, labels play an important role in the supply chain of a car. Majority of the total automotive labels are applied on the automotive parts before car assembly in the supply chain. Several numbers are stamped on pieces of metals and parts to aid in automotive assembly. Apart from labeling, these tapes are used in the assembly of interior vehicle components like dashboards, glass, mirrors, fabric, and carpet.

In the construction industry, higher bonding speed, longer durability, extreme weather resistance, and user-friendly features of acrylic tapes play a crucial role. Acrylic construction tapes are an eco-friendly option as they produce minimal off-gases and fumes. With stringent environmental codes and regulations in the construction industry, PSA high-performing tapes are expected to emerge as the ideal choice for architects and builders.

Technology Insights

The water borne technology dominated the market with a revenue share of more than 40.62% in 2022. This is attributed to its environment-friendly nature and its significant adoption in the manufacturing of tapes and labels. Water-based PSAs are extensively used on paper and are preferred over other technologies for food & beverage labels. Moreover, they are used in the production of general purpose permanent labels, removable labels, and pharmaceutical labels.

Solvent-based technology is generally acrylic or rubber-based polymer formulations dissolved in solvent. Major advantages of solvent-based technology include a wide range of adhesion with quick curing, high bond strength, and high heat and chemical resistance. Solvent-based segment is driven by the utilization of this technology in durable, demanding, and long-term End-uses.

The demand for hot melt technology is expected to grow owing to lower costs as compared to other technologies. Hot melt PSAs allow the converters to use higher coat weight. Also, the flexibility offered by hot melts to bond on both smooth and rough surfaces is a significant factor in facilitating the faster growth of this segment.

In terms of revenue, radiation-cured PSAs are expected to register the fastest CAGR of 5.51% over the forecast period. The technology is designed to meet a variety of end-use requirements including the tapes and labels in different end-use industries, such as food packaging, automotive, and Electronics. They have similar advantages as that of solvent-based acrylic including resistance to cleaners and solvents. Moreover, they do not require special ovens to dry and have no appreciable VOC emissions.

Product Insights

The tapes dominated the market and accounted for 69.91% of the global volume in 2022. This is attributed to extensive utilization of tapes for carton sealing in packaging sector. Moreover, they are used in various assembly End-uses, such as automotive and electronic assembly. The eco-friendly nature, ease of use, and lighter weight of the product as compared to other joining and fastening methods are expected to drive the demand in assembly End-uses.

Demand in labels is driven by increasing utilization of food labels, clear labels, packing lists, envelopes, general purpose permanent labels, fabric labels, tire labels, removable labels, specialty labels, and durable labels. Self-adhesive labels derived from acrylic emulsions are extensively utilized in labeling industry owing to their superior characteristics. They allow wider webs, faster speeds, and overall better uptime during converting as compared to other labels.

Pressure sensitive adhesives are used in graphic films across numerous End-uses including road traffic signage, branding graphics, advertising graphics, large format weather-resistant graphics, home décor, point-of-purchase promotions, outdoor advertising, and vehicle graphics. Branding and advertising graphics are gaining more emphasis in corporate strategies of multinational companies as a brand logo and advertising play a crucial role in influencing the consumer demand.

Adhesive Chemistry Insights

Acrylics dominated the market with a revenue share of more than 58.02% in 2022. This is attributed to extensive usage of Acrylic-based PSAs owing to their oxidation and UV resistance. They are formulated by reacting suitable acrylic monomers, which are later cross-linked to form the required polymer. They are generally used on paper and polar surfaces like steel, glass, aluminum, zinc, polycarbonate, tin, and Polyvinyl Chloride (PVC).

Rubber-based products are typically based on hot melt and solvent-based systems. The adoption of rubber-based products in tapes is driven by their ability to provide quick adhesion on rough and smooth surfaces alike. As opposed to acrylic, rubber-based products are extensively utilized on non-polar, low-energy surfaces. Moreover, they offer a more economical choice for tapes manufacturers.

In terms of revenue, silicone-based products are estimated to witness the fastest CAGR of 5.61% over the forecast period. The use of this formulation is driven by their ability to provide adhesion to silicon and other Technology that are difficult to adhere. In addition, silicone formulations are characterized by extreme weather resistance and have longer durability as compared to acrylics and rubber. However, the large scale adoption of silicone-based PSAs is restricted by their significantly higher cost as compared to acrylics and rubber.

End-use Insights

The packaging segment dominated the end-use segment with a revenue share of over 29.03% in 2022. Tapes find various End-uses in packaging industry ranging from containers, boxes, and envelopes to bank bags and pouches. Self-adhesive labels are extensively utilized for packaged food & beverages, beauty products, warehouse boxes, jars, pharmaceutical and packaging among others. The user-friendly nature and instant bonding speed offered by tapes and self-adhesive labels are the major factors driving the product demand in the packaging industry.

PSAs are also used in building & construction industry for End-uses, such as Automotive, vapor barriers, roofing linings, masking, insulation, and interior design. Companies are undertaking numerous strategies to identify and explore the opportunities for specialty tapes in the construction industry. For instance, The Pressure Sensitive Tape Council (PSTC) conducted an event pertaining to the use of PSAs in building & construction industry in May 2019 in Baltimore.

In automotive industry, pressure sensitive adhesives provide a cost-effective solution to car manufacturers for improving the speed and efficiency of assembly operations. Furthermore, they improve productivity in complex assembly operations. PSAs contribute to ensuring the light weight of cars, thereby improving crash performance and providing an ideal counterbalance. Furthermore, eco-friendly and efficient electric cars are expected to replace combustion engines and redefine the requirements for vehicle manufacturing. This is expected to benefit the market over the coming years.

Regional Insights

Asia Pacific dominated the market with a revenue share of 40.01% in 2022. In terms of revenue, Asia Pacific is also estimated to be the fastest-growing regional market over the forecast period. Rapidly expanding manufacturing sector and increasing foreign investments in the region are expected to play a key role in regional market growth. With increased corporate emphasis and government spending on emerging technologies, innovation, novel materials, and sustainability, PSAs based on UV/EB technology are anticipated to expand at a rapid pace in North America.

As compared to other regions, Europe witnessed a stronger demand for construction tapes in 2018. The market is characterized by the presence of stringent REACH regulations that have slowed down the market growth in the region. Germany, France, and U.K. led the European market, in terms of product consumption, in 2018. Brazil, Argentina, and Chile are the major countries in CSA. Installations of ancillary printers and presses are expected to increase owing to the abolishment of import restrictions in Argentina. Recovery of industrial production in Brazil after a period of recession is anticipated to boost the market growth in the country.

Pressure Sensitive Adhesives Market Segmentations:

By Technology

By Adhesive Chemistry

By Product

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pressure Sensitive Adhesives Market

5.1. COVID-19 Landscape: Pressure Sensitive Adhesives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pressure Sensitive Adhesives Market, By Technology

8.1. Pressure Sensitive Adhesives Market, by Technology, 2023-2032

8.1.1. Water-based

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Solvent-based

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Hot Melt

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Radiation-Cured

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Pressure Sensitive Adhesives Market, By Adhesive Chemistry

9.1. Pressure Sensitive Adhesives Market, by Adhesive Chemistry, 2023-2032

9.1.1. Acrylic

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Rubber

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Silicone

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Pressure Sensitive Adhesives Market, By Product

10.1. Pressure Sensitive Adhesives Market, by Product, 2023-2032

10.1.1. Tapes

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Labels

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Graphic Films

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Pressure Sensitive Adhesives Market, By End-use

11.1. Pressure Sensitive Adhesives Market, by End-use, 2023-2032

11.1.1. Automotive

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Electronics

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Consumer Goods

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Packaging

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Construction

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Pressure Sensitive Adhesives Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Technology (2020-2032)

12.1.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.1.3. Market Revenue and Forecast, by Product (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.2.3. Market Revenue and Forecast, by Product (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.3.3. Market Revenue and Forecast, by Product (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.4.3. Market Revenue and Forecast, by Product (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.5.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.5.3. Market Revenue and Forecast, by Product (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Adhesive Chemistry (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Henkel AG & Co. KGaA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. 3M Company

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. H.B. Fuller

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Sika AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Ashland Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Bostik S.A.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Pidilite Industries Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Jubilant Industries Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. AkzoNobel N.V.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Franklin Adhesives & Polymers.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others